Running your own show is great until April rolls around. Or June. Or September. If you’re a freelancer, consultant, or side-hustler, you’ve probably felt that sudden pit in your stomach when you realize the money in your bank account isn't actually all yours. A huge chunk belongs to Uncle Sam. Honestly, the math is a headache. That’s why finding a self-employment tax calculator free of charge isn't just a "nice to have"—it’s a survival tool.

Most people coming from a 9-to-5 are used to the "set it and forget it" lifestyle of W-2 withholding. Your boss pays half your FICA; you pay the other half. Simple. But when you’re the boss? You’re on the hook for both sides. That’s a 15.3% hit right off the top before you even get to federal and state income taxes. It’s brutal.

I’ve seen people thrive for eleven months only to get crushed by a five-figure tax bill they didn't see coming. It happens because the IRS expects you to pay as you go. They don't want to wait until next year. They want their cut every quarter. If you miss those deadlines or underpay, they’ll tack on penalties that make a bad situation worse.

The 15.3% Trap Most Freelancers Fall Into

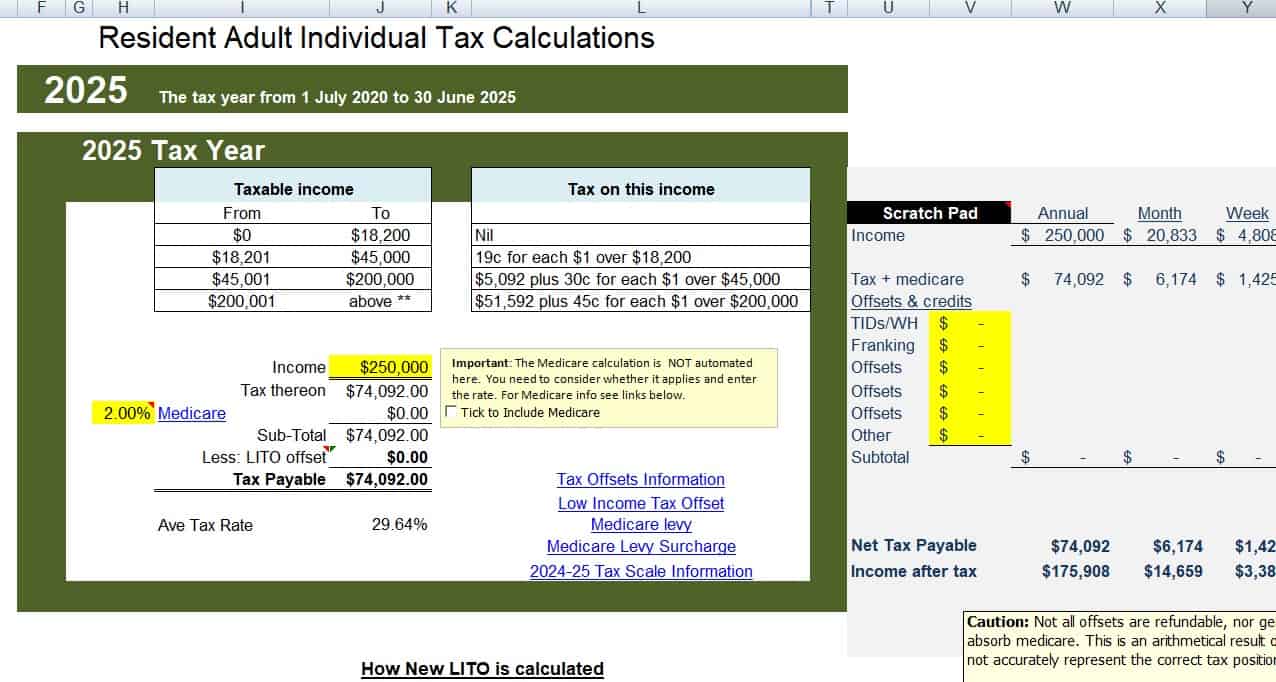

When you use a self-employment tax calculator free tool online, the first number it usually spits out is the SE tax. This covers Social Security and Medicare. For 2024 and 2025, the rate sits at 15.3%.

Wait.

It gets slightly more nuanced. You only pay the Social Security portion (12.4%) on the first $168,600 of your income (for 2024). Anything over that is just the 2.9% Medicare bit. This is where a lot of basic "napkin math" fails. You might think you owe way more than you do, or worse, way less.

💡 You might also like: Cuánto cuesta el dólar en México: Por qué el peso sigue sorprendiendo a todos

Let's talk about the "net" versus "gross" confusion. You don't pay tax on every dollar you invoice. You pay on your profit. If you made $100,000 but spent $20,000 on software, gear, and a home office, you’re taxed on $80,000. Actually, the IRS gives you a little break: you get to deduct 7.65% of your net earnings before calculating the tax. It’s a "tax on a tax" reduction that basically mimics the employer’s share deduction.

Kinda confusing, right?

That’s why these calculators exist. They handle the $0.9235$ multiplier that the IRS uses to determine your taxable self-employment income. Without it, you’re just guessing.

Why You Can't Trust a Generic Income Tax Tool

You'll find plenty of "income tax calculators" out there. Most are built for employees. They ask for your "salary." But as a self-employed person, "salary" is a fluid concept.

A dedicated self-employment tax calculator free version will specifically ask for your business expenses. This is the "Schedule C" magic. If you aren't tracking your mileage, your internet bill, or that fancy ergonomic chair you bought in March, you're literally handing money to the government that you don't owe.

There's also the Qualified Business Income (QBI) deduction. This was part of the 2017 Tax Cuts and Jobs Act. It allows many self-employed individuals to deduct up to 20% of their qualified business income from their taxes. But there are phase-outs. There are "S-Corp" vs "Sole Prop" differences. If your tool doesn't ask about your filing status or business structure, it’s giving you a half-baked estimate.

Real World Example: The $50k Freelancer

Imagine Sarah. Sarah is a graphic designer. She makes $60,000 in gross revenue. She has $10,000 in legitimate business expenses. Her net profit is $50,000.

If Sarah just looked at a standard income tax bracket, she might think she owes roughly 10-12% in federal tax. She forgets the 15.3%.

Her SE tax alone is roughly $7,065.

Then she owes federal income tax on the remaining amount (after deductions).

Then state tax.

Suddenly, her "take home" isn't $50,000. It's closer to $38,000. If she didn't use a calculator to figure this out in January, she’s going to have a very stressful April.

Where to Find the Best Free Tools

You don't need to pay for high-end accounting software just to get an estimate. Several reputable sites offer these calculators for free:

- Kept: Great for a quick, no-nonsense estimate.

- TurboTax/H&R Block: They have free "preview" calculators, though they'll eventually try to sell you the filing software.

- Found or Lili: These are "neobanks" for freelancers that often have these tools baked into their websites.

- The IRS Website: Specifically, look for Form 1040-ES. It’s not "pretty," and it’s definitely not a "calculator" in the modern sense—it’s a worksheet—but it is the ultimate source of truth.

Quarterly Payments: The "Pain-Free" Way

The IRS wants "estimated payments." These are due April 15, June 15, September 15, and January 15.

💡 You might also like: The Savings and Loan Crisis: Why Your Bank Is Still Scared of the 1980s

If you use a self-employment tax calculator free tool every three months, you can stay ahead. Some people prefer to just take 25% or 30% of every check they receive and move it to a high-yield savings account. That’s a solid strategy. It lets you earn a little interest on the "tax money" before you send it off.

But keep in mind: if you expect to owe more than $1,000 in taxes for the year, the IRS requires these payments. If you wait until the end of the year to pay it all, you might get hit with an underpayment penalty. It’s not usually a massive amount—maybe a few hundred bucks depending on the debt—but why give them more money than you have to?

Common Mistakes When Calculating Your Own Taxes

Don't forget the "half-deduction." You can deduct half of your self-employment tax from your adjusted gross income. This doesn't lower the SE tax itself, but it lowers the amount of income subject to regular federal income tax.

Also, watch out for state-specific taxes. A tool that only calculates federal self-employment tax is only doing half the job if you live in a high-tax state like California or New York. Conversely, if you're in Florida or Texas, you're off the hook for state income tax, which changes your "effective" tax rate significantly.

One more thing: Health insurance.

If you’re self-employed and paying for your own health insurance, that’s often an "above-the-line" deduction. It’s a huge win. Most free calculators have a toggle for this. Use it.

Actionable Steps to Take Today

- Gather your YTD (Year-to-Date) numbers. Don't guess. Look at your invoices.

- Estimate your expenses. Even a rough ballpark of $500/month is better than zero.

- Run the numbers. Use a self-employment tax calculator free tool right now to see where you stand for the current quarter.

- Open a separate "Tax" savings account. Set it to a high-yield rate (4% or higher).

- Automate your transfers. Every time a client pays an invoice, move 25-30% into that account immediately.

- Mark your calendar. Set alerts for the 15th of April, June, September, and January.

Tax season doesn't have to be a disaster. It just requires a bit of math and the right tools. By staying proactive and using free resources to double-check your liability, you keep more of what you earn and stay out of the IRS's crosshairs.