Money is weird. We use it every day, but we rarely think about the handful of people in Washington D.C. who basically decide what that money is worth. If you’ve ever wondered why your mortgage rate suddenly spiked or why your savings account is finally earning a bit of interest, you can usually trace it back to a governor of the Federal Reserve.

There are seven of them. Total.

They sit in the Eccles Building, usually wearing gray suits, and they make decisions that ripple through every economy on the planet. Honestly, most people can name the President or maybe a couple of Supreme Court justices, but these governors? They’re the ghosts in the machine. They aren't elected by the public, which feels a bit sketchy to some, but they are appointed by the President and confirmed by the Senate. It’s a long-game role. A full term is 14 years. That is intentional. You want these people thinking about the next decade, not the next election cycle.

What Does a Governor of the Federal Reserve Actually Do?

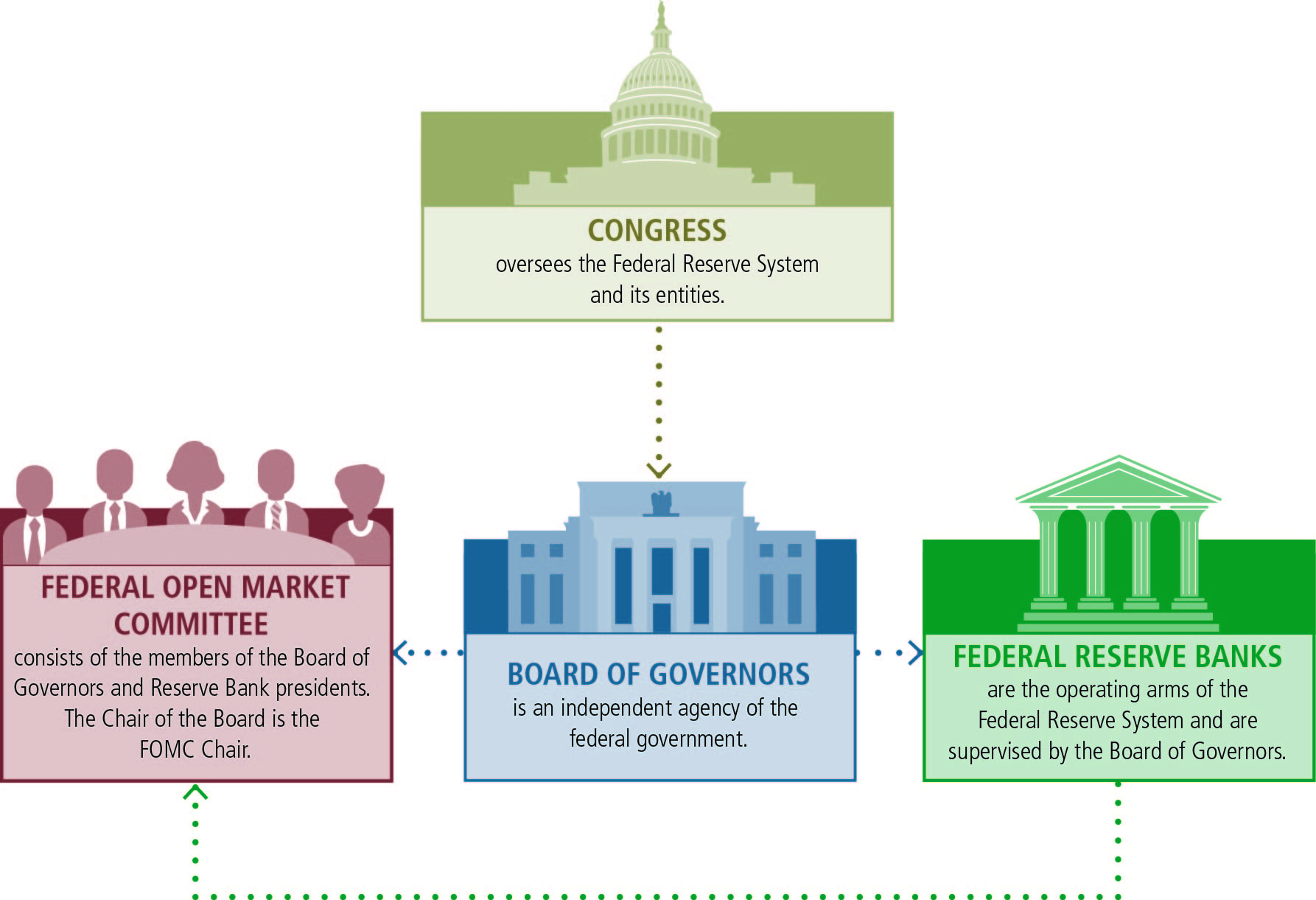

Basically, they run the show. Each governor of the Federal Reserve is a member of the Board of Governors. They don't just "talk" about the economy; they vote on the rules that banks have to follow. They oversee the 12 regional Reserve Banks scattered across the U.S., from San Francisco to Richmond.

🔗 Read more: Cómo sacar el RFC por internet: Lo que nadie te dice sobre el trámite en el SAT

But the "Big One" is the FOMC.

The Federal Open Market Committee is where the magic (or the pain) happens. This is where they decide whether to hike interest rates or cut them. All seven governors have a permanent vote on this committee. While regional bank presidents rotate their voting power, the governors are always at the table. When Christopher Waller or Michelle Bowman gives a speech, the stock market literally moves. Why? Because investors are trying to read the tea leaves of their personal economic philosophies.

It’s not just about rates, though. They handle "supervision and regulation." This is the boring-sounding stuff that actually keeps your bank from collapsing. Remember the Silicon Valley Bank mess in 2023? That put a massive spotlight on the Vice Chair for Supervision—currently Michael Barr. His job is literally to make sure banks aren't gambling with your deposits.

The Seven Seats and the Power Struggle

You’d think they all agree, right? Wrong.

The Board is designed to be a mix of perspectives. You have "hawks" and you have "doves." Hawks, like Governor Michelle Bowman, tend to worry more about inflation. They want to keep rates higher to make sure prices don't spiral out of control. Doves are more worried about unemployment. They want lower rates to keep people working, even if it means prices creep up a bit.

Currently, the board is a fascinating mix of academic heavyweights and practical experts. You have Adriana Kugler, an expert on labor markets, sitting next to Philip Jefferson, the Vice Chair. Then there’s Jerome Powell, the Chair. He’s the face of the Fed, but he’s just one of the seven votes. He can’t just dictate terms; he has to build a consensus.

Why the 14-Year Term is a Big Deal

Politics is messy. The Fed is supposed to be "independent." By giving a governor of the Federal Reserve a 14-year term, the law tries to insulate them from whoever is in the White House. If a President wants to juice the economy right before an election by lowering rates, the governors can—and often do—say no.

Terms are staggered. One expires every two years. This prevents a single President from "packing" the board all at once, though in practice, people rarely stay for the full 14 years. Most serve a few years and then head back to academia or the private sector because, frankly, the pay in the private sector is way better than the government salary.

How Their Votes Hit Your Wallet

Let’s get real. You probably don’t care about the minutes of the last Board meeting. You care about your car loan.

When a governor of the Federal Reserve votes to raise the "federal funds rate," they are making it more expensive for banks to borrow money from each other. The banks aren't just going to eat that cost. They pass it on to you.

- Credit Cards: Most have variable rates tied to the prime rate. If the Fed moves, your interest payment moves. Usually within one or two billing cycles.

- Mortgages: These are a bit more complex because they track the 10-year Treasury yield, but the Fed's "dot plot"—a chart showing where each governor thinks rates are going—massively influences those yields.

- Savings Accounts: This is the one "win." When governors push rates up, your high-yield savings account starts actually paying you something.

It’s a balancing act. If they push too hard, they cause a recession. If they don't push hard enough, your groceries cost 20% more next year.

The "Invisible" Work of the Board

Beyond the interest rate drama, these governors are deep into the plumbing of the financial system. They are currently debating "Basel III Endgame" rules. It sounds like a Marvel movie, but it’s actually a set of capital requirements that determine how much "cushion" banks need to hold.

Governor Lisa Cook, for example, has spent a lot of time looking at how Fed policy impacts different demographics. It’s not just about one giant "US Economy" number. They look at why black unemployment is different from white unemployment, or how rural banks are faring compared to Wall Street giants.

They also manage the "Discount Window." This is the emergency lender of last resort. If the world is ending (like in March 2020), the governors are the ones who decide to flood the system with cash to keep it from seizing up. It is an incredible amount of power for people who aren't household names.

Actionable Insights for Navigating Fed Policy

You can't control what a governor of the Federal Reserve decides, but you can front-run their impact on your life.

Watch the "Fedspeak"

The governors give speeches almost every week. You don't need to read the whole transcript. Look for "hawkish" or "dovish" headlines on financial news sites. If multiple governors start talking about "upside risks to inflation," expect your borrowing costs to stay high or go higher. Stop waiting for a rate cut that isn't coming.

Lock in Debt Early

If the consensus among the governors is that rates are going up, lock in your fixed-rate mortgage or refinance your car loan now. Conversely, if they are hinting at a "pivot" to lower rates, wait a few months before taking out a big loan.

Diversify Your Cash

Don't leave all your money in a big-name bank that pays 0.01% interest. When the Fed raises rates, smaller online banks move their savings rates much faster. If the governors are voting for "higher for longer," you should be shopping for a better APY every single month.

Check the Vice Chair for Supervision's Stance

If you hold bank stocks, pay close attention to Michael Barr's speeches. If he’s pushing for higher capital requirements, banks might have less money for buybacks or dividends. This is a direct lever on your investment portfolio that has nothing to do with the "headline" interest rate.

The Federal Reserve isn't just a building; it's a group of seven people trying to steer a massive, chaotic ship. Understanding who they are and what they value is the closest thing to a crystal ball you’ll find in finance. Keep an eye on the board, because they are definitely keeping an eye on your money.