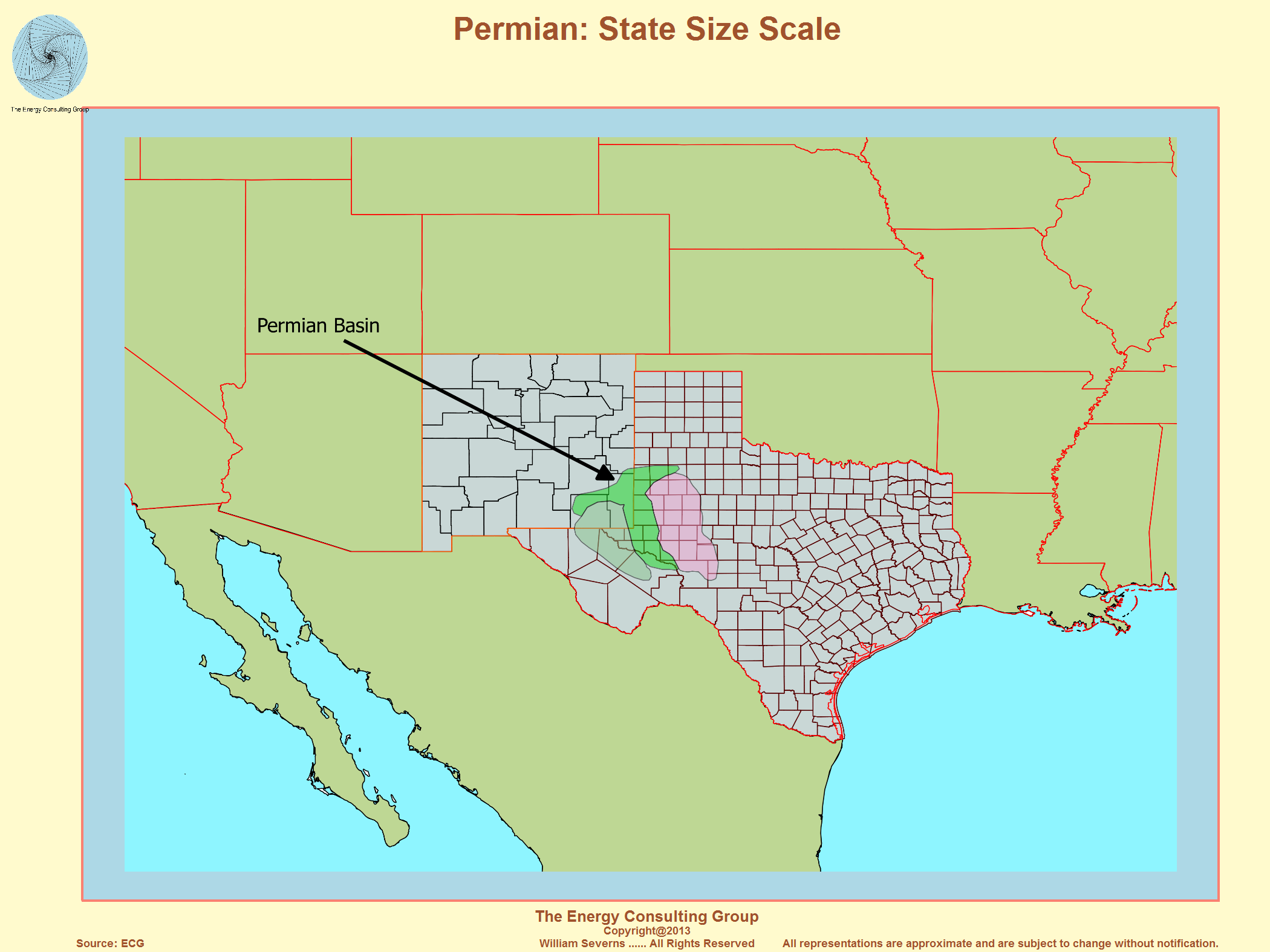

If you look at a map of the Permian Basin, you’re not just looking at a geography lesson; you’re looking at the heartbeat of global energy. It’s messy. It’s huge. Honestly, it’s a bit of a topographical jigsaw puzzle that covers roughly 86,000 square miles across West Texas and Southeastern New Mexico.

People think it’s just one big flat desert. It isn't.

Most folks see a map and assume the lines are set in stone. They aren't. Depending on whether you’re a geologist, a landman, or an ESG investor, those borders shift. You've got the Delaware Basin on the west, the Midland Basin on the east, and the Central Basin Platform stuck right in the middle like a structural spine. It’s a massive sedimentary deposit that’s been stacking layers of organic-rich "pay zones" for about 250 million years.

The Three Big Pieces of the Map

When you pull up a high-resolution map of the Permian Basin, the first thing that jumps out is the verticality. You have to realize this thing is deep—sometimes five miles deep.

The Midland Basin is the old reliable. It’s where the shale revolution really kicked into high gear in the early 2010s. If you’re looking at a map, this is the eastern "lobe," centered around cities like Midland and Odessa. It’s flatter, the geology is slightly more predictable, and the infrastructure is dense. You can’t throw a rock without hitting a pipeline or a salt water disposal well.

Then there’s the Delaware Basin. This is the "wild child" on the western side of the map. It stretches from Pecos, Texas, up into Lea and Eddy Counties in New Mexico. It’s deeper. It’s higher pressure. It’s more expensive to drill. But the production numbers coming out of the Delaware are often staggering compared to the Midland. If you’re tracking a map for investment, this is where the "Tier 1" acreage is currently being fought over.

🔗 Read more: Getting the Heading for Recommendation Letter Right Without Overthinking It

Finally, there’s the Central Basin Platform. Think of it as the elevated ridge between the two deeper basins. This area was the king of the 1970s and 80s. It’s where the "easy" oil was found in shallow, conventional reservoirs. Today, it’s less about the flashy new shale wells and more about Enhanced Oil Recovery (EOR) and carbon sequestration projects.

Why the Borders on Your Map Keep Changing

Maps are political. They're also economic.

The University of Texas Bureau of Economic Geology (BEG) has its own definition of the basin's boundaries. The USGS (U.S. Geological Survey) might have another. Some maps include the Val Verde Basin to the south or the Northwest Shelf.

Why does this matter? Because of the "Permian fringe."

In 2023 and 2024, we saw companies like Diamondback Energy and ExxonMobil (after the Pioneer merger) focusing heavily on the "core of the core." However, as that prime acreage gets drilled up, the map of the Permian Basin starts to expand. Suddenly, areas that were considered "too risky" or "too thin" five years ago are being highlighted on internal corporate maps. Tech has changed what we consider "the basin."

📖 Related: Baskin Robbins Logo History: The 31 Secret and Why It Changed

The New Mexico Factor

If you look at the top-left corner of the map, you’ll see the New Mexico line. This is a huge deal right now. Roughly 90% of the Delaware Basin’s New Mexico side is federal land. That means permits are harder to get, and the regulatory environment is a lot more intense than in Texas.

When you look at a map showing active rig counts, you’ll see a massive cluster right along that state line. Operators are playing a game of chess with federal leases versus private Texas land. It's a logistical nightmare that makes the map look like a cluttered game of Tetris.

Geology vs. Infrastructure: Two Different Maps

You can’t just look at a geological map of the Permian Basin and understand the business. You need the infrastructure map.

Oil is useless if you can't move it. The map is currently a web of "midstream" assets. Huge trunk lines like the Permian Highway Pipeline and the Gulf Coast Express are the only reasons this region hasn't choked on its own success.

There’s also the water issue. For every barrel of oil, you get about 4-6 barrels of "produced water"—nasty, salty stuff from the prehistoric ocean. A modern map of the Permian Basin is now covered in water pipelines and recycling facilities. If you see a map with a bunch of dots in the middle of nowhere, those are likely Salt Water Disposal (SWD) wells. They’re becoming controversial because of "induced seismicity"—basically, small earthquakes caused by pumping water back into the ground.

The Wolfcamp and Beyond: The Vertical Map

If you could slice the basin like a layer cake, you’d see why it’s so valuable. Most oil fields have one or two productive layers. The Permian has dozens.

- The Wolfcamp: The absolute superstar. It’s divided into A, B, C, and D benches.

- The Bone Spring: Popular in the Delaware; it’s a mix of sand and carbonate.

- The Spraberry: The Midland Basin’s bread and butter.

- The Cline Shale: The deeper, tougher layer that people are still trying to figure out.

When an engineer looks at a map of the Permian Basin, they aren't looking at X and Y coordinates. They are looking at the Z-axis. They might be drilling a 10,000-foot lateral in the Wolfcamp A while another company is drilling a lateral right above them in the Jo Mill. It’s a 3D grid of industrial activity.

Common Misconceptions About the Map

People think the Permian is "tapped out."

The data says otherwise. While "Tier 1" inventory is shrinking, the efficiency of how we map the reservoir is skyrocketing. We’re using fiber-optic cables in wells to listen to the rock cracking. We’re using AI to analyze seismic maps to find "sweet spots" that were missed in the first wave of the shale boom.

Another mistake? Thinking the map is just about oil. The Permian is one of the largest producers of natural gas in the country. Often, it’s produced as "associated gas" (gas that comes out with the oil). Because there isn't always enough pipe to move it, you’ll sometimes see "flaring" on satellite maps—the basin literally glows from space.

📖 Related: Why 2024 Bank Holidays USA Still Matter for Your Money Right Now

How to Actually Use a Permian Map for Business

If you’re trying to make sense of this for investment or research, don't just use a static image from a Google search.

- Check the Railroad Commission (RRC) of Texas: Their GIS map is the gold standard for Texas. It’s clunky, it looks like it was designed in 1998, but it’s accurate. You can see every single well ever drilled.

- Look at New Mexico’s OCD (Oil Conservation Division): For the Delaware side, this is your source of truth.

- Overlay Lease Boundaries: A geological map tells you where the oil is; a lease map tells you who owns it. This is where the real money is made or lost.

The map of the Permian Basin is basically a living document. It changes every time a driller hits a new formation or a midstream company lays a new pipe. It’s the most complex industrial site on Earth, hidden under a bunch of mesquite trees and caliche roads.

Actionable Insights for Navigating Permian Data

To truly understand or utilize a map of the Permian Basin, you have to stop looking at it as a static territory and start viewing it as a multi-layered data set.

- Prioritize the Delaware Basin for Growth: If you are looking at where the most aggressive, high-pressure drilling is happening, focus your map research on Reeves, Loving, and Ward counties in Texas, and Lea and Eddy in New Mexico.

- Monitor Induced Seismicity Zones: Use the TexNet Seismic Monitoring Program maps. If you’re involved in land or disposal, you need to know where the RRC has restricted water injection. This directly impacts the cost of doing business in those specific map "hot spots."

- Differentiate by "Bench": Don't just look at surface locations. Use tools like Enverus or TGS to see which "bench" (Wolfcamp A vs B) is being targeted. A map that shows all wells as equal is lying to you.

- Check the Pipeline Interconnects: The most valuable land on the map is often the land closest to a "hub" like Waha. Logistics define the "basis" price—the difference between the price of oil in Midland versus the price in Houston.

- Factor in Federal vs. Private Land: Always overlay the BLM (Bureau of Land Management) layers. In a shifting political climate, the map's "West side" (New Mexico) carries significantly different regulatory risk than the "East side" (Texas).

Stay away from generic PDF maps from 2018. They are functionally useless now. The basin has been re-mapped by the drill bit a thousand times since then. Use real-time GIS layers if you want to see where the industry is actually going, rather than where it's already been.