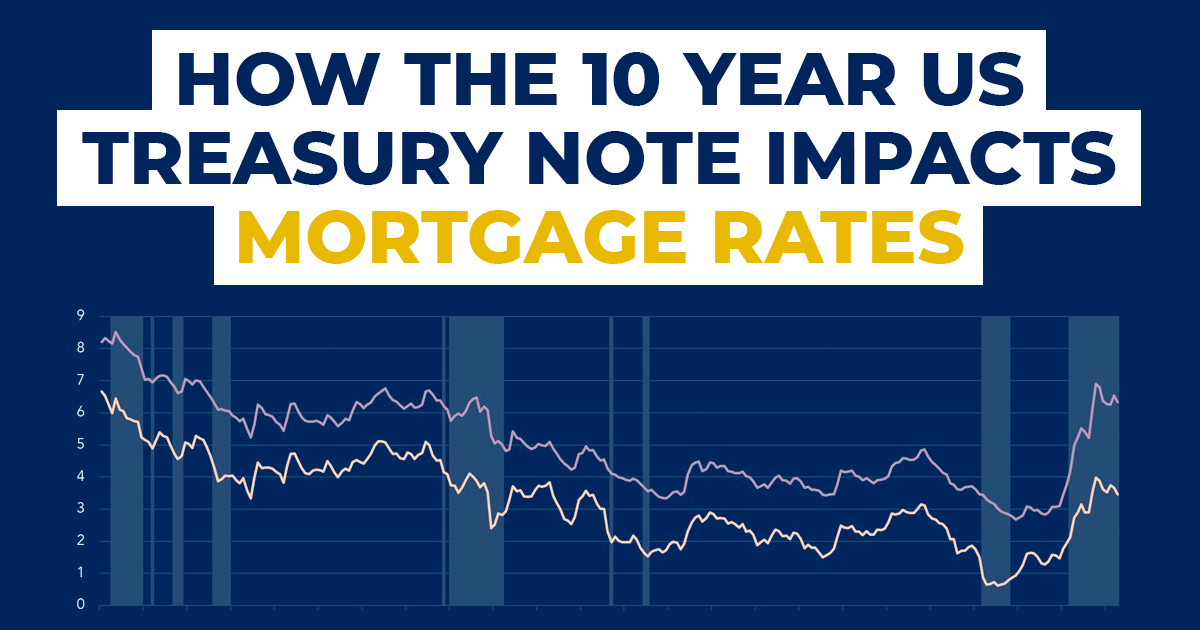

If you’ve ever wondered why your mortgage rate suddenly spiked or why your tech stocks took a nose-dive in a single afternoon, you’re basically looking at the ghost of the Treasury market. It’s the "benchmark." People call it that because it’s the floor. Everything else—your car loan, your credit card APR, the "risk-free" return on a savings account—is built on top of it. Historical 10 year US treasury rates aren't just a bunch of dusty charts for bond geeks in Manhattan. They are the pulse of global capitalism. When the 10-year yield moves, the world flinches.

Honestly, most people ignore these numbers until they try to buy a house. That’s a mistake. Understanding where we’ve been helps you realize that the "normal" rates we see today are actually pretty weird when you look at the long arc of American history.

The Era of the Great Inflation and the 15% Yield

To understand where we are, you have to look back at the early 1980s. It was a nightmare. We’re talking about a time when historical 10 year US treasury rates hit an all-time peak of 15.82% in September 1981. Can you even imagine that? Today, people lose their minds if a mortgage hits 7%. Back then, Paul Volcker, the Fed Chair with the giant cigars, was essentially breaking the back of inflation by cranking interest rates into the stratosphere. He had to. The 1970s had been a decade of stagflation—low growth and high prices—and the market had lost faith in the US dollar.

By pushing the 10-year yield that high, Volcker signaled that the US was serious about price stability. It worked, but it was painful. This period set the stage for a 40-year "bull market" in bonds. See, when interest rates fall, bond prices go up. From 1981 all the way to 2020, we saw a massive, steady decline in yields. It was a golden era for debt. If you borrowed money in 1990, it was cheaper than in 1980. If you borrowed in 2010, it was cheaper than in 2000. We all got used to cheap money. It became the air we breathe.

The Long Slide to Zero

After the 1980s peak, the 10-year rate spent most of the 90s bouncing between 5% and 8%. It was a healthy range. It meant you could actually earn a living just by holding government debt. You didn't have to gamble on crypto or AI startups to beat inflation. But then the 2008 financial crisis changed everything.

The Fed stepped in with something called Quantitative Easing (QE). Basically, they started buying up Treasuries to force rates down. By 2012, the 10-year yield had dropped below 1.5%. Many experts at the time, like Bill Gross—who was once called the "Bond King"—warned that we were hitting the "end of the road" for low rates. He was partly right, but the market stayed lower for much longer than anyone anticipated. We entered a strange twilight zone where the historical average for the 10-year, which is somewhere around 4.5% over the last century, felt like an impossible dream.

Why 2020 Changed the Math Forever

Then came the pandemic. In March 2020, as the world locked down, everyone rushed into the safety of US Treasuries. It was a panic. This drove the 10-year yield down to a shocking, record-low of 0.52% on an intraday basis. Think about that. You were essentially lending the US government money for a decade and getting almost nothing in return. Once you accounted for inflation, you were actually losing purchasing power.

This was the bottom.

Since that 2020 floor, historical 10 year US treasury rates have been on a tear. We’ve seen one of the fastest "repricings" in history. By 2023, the yield had surged back toward 5%. This wasn't just a minor correction. It was a regime change. The 40-year trend of falling rates was officially broken. We are now in a world where "higher for longer" isn't just a slogan; it’s the reality.

✨ Don't miss: Ketcham-Ripley Funeral Home: Why Local Heritage Still Matters in Rockford

The Real-World Impact of the 10-Year Yield

So, why does this matter to you? Well, the 10-year Treasury is used to price almost all long-term debt.

- Mortgages: Banks take the 10-year yield and add a "spread" (usually 1.5% to 3%) to cover their risk. When the 10-year hits 4.5%, your mortgage is likely going to be 7% or higher.

- Stock Valuations: This is the big one. Analysts use the 10-year rate as the "discount rate" in their models. When the rate goes up, the present value of future earnings goes down. This hits growth stocks and tech companies the hardest because their profits are expected way out in the future.

- The Government Deficit: The US has trillions in debt. When historical 10 year US treasury rates rise, the cost to service that debt explodes. We are now spending more on interest payments than on some entire government departments.

It’s a feedback loop. If the government has to pay more interest, it might have to issue more debt, which can push rates even higher. It's a delicate balance that the Treasury Department and the Federal Reserve have to manage every single day.

Misconceptions About the "Inverted Yield Curve"

You’ve probably heard people whispering about the "inverted yield curve" like it’s a prophecy of doom. Usually, the 10-year rate should be higher than the 2-year rate. You’re locking your money up for longer, so you should get paid more, right? That's logical. But sometimes, the 2-year yield goes higher than the 10-year.

This happened significantly in 2022 and 2023.

💡 You might also like: Who is CNN Owned By: What Most People Get Wrong

Historically, an inverted curve has been a very reliable recession indicator. It suggests that investors are pessimistic about the short term and expect the Fed to cut rates in the future to save a failing economy. However, this time around, things stayed inverted for a record-breaking period without a formal recession being declared immediately. It shows that while historical 10 year US treasury rates provide a map, the map isn't always the territory.

What the Experts Say (And Where They Disagree)

Wall Street is split. On one side, you have the "deflationists" like Lacy Hunt of Hoisington Investment Management. He has argued for years that high debt levels eventually kill growth, which forces rates back down. He looks at the aging population and the massive debt overhang and sees a future where the 10-year yield returns to 2% or lower.

On the other side, you have people like Jamie Dimon, the CEO of JPMorgan Chase. Dimon has warned that we could see 10-year rates hit 6% or even 7% due to "green" energy spending, military conflicts, and persistent inflation. He thinks the era of cheap money was an anomaly, and we are returning to a much more expensive historical norm.

Both can't be right.

The truth usually lands somewhere in the middle, dictated by the "R-star"—the neutral interest rate where the economy isn't being stimulated or restricted. The problem is, nobody actually knows exactly where R-star is until we’ve already passed it.

📖 Related: Kristin McIntyre Wellness Connection Maine LinkedIn: What Really Happened Behind the Scenes

How to Use This Data Right Now

Looking at historical 10 year US treasury rates shouldn't just be an academic exercise. It should dictate how you move your money. If you believe we are heading back to the 1980s-style inflation, you want to stay away from long-term bonds. If you think the recent spike was a fluke and we’re going back to 2% yields, then buying 10-year Treasuries now at 4% or 4.5% is basically a gift from the heavens.

You also have to watch the "term premium." This is the extra compensation investors demand for the risk of holding a bond for a decade. For years, the term premium was negative—investors were so desperate for safety they didn't care about the risk. Now, that’s shifting. Investors are getting nervous about the sheer volume of Treasury supply hitting the market.

Practical Steps for Your Portfolio

Don't just stare at the 10-year yield; act on it.

- Audit your debt. If you have a variable-rate loan, you are at the mercy of the 10-year and its shorter-term siblings. If the 10-year looks like it’s forming a "higher low" on the technical charts, it’s time to lock in a fixed rate if you still can.

- Re-evaluate your stock "moat." Companies that rely on constant borrowing to survive (zombie companies) get absolutely crushed when the 10-year Treasury rate stays above 4%. Look for companies with high cash reserves—they actually benefit from higher rates because their cash earns more.

- Diversify your duration. Don't put all your bond exposure into 10-year notes. Use a "barbell" strategy. Keep some money in very short-term T-bills (3 to 6 months) to capture high current yields, and some in longer-dated bonds to lock in rates in case the economy eventually cools off.

- Watch the Fed's dot plot, but trust the 10-year more. The Federal Reserve controls the short-term Fed Funds Rate, but the market controls the 10-year. If the Fed says they will keep rates high, but the 10-year yield starts falling, it means the market doesn't believe them. The market is usually right.

The 10-year Treasury is the ultimate truth-teller. It filters out the noise of political speeches and corporate earnings calls. It is the collective wisdom of every major bank, central bank, and hedge fund on the planet. By keeping an eye on where it’s been and where it’s headed, you aren't just tracking a number; you're tracking the heartbeat of the global economy.

Keep your eye on the 4.2% to 4.5% range. Historically, this has been a "pivot point." If we stay above it, the era of easy money is dead and buried. If we drop below it and stay there, we might just be heading back to the "new normal" of the 2010s. Either way, your wallet will feel it.