Watching NVIDIA (NVDA) these days is like keeping tabs on a high-stakes poker game where the stakes are trillions of dollars and the players are world superpowers. If you checked your portfolio this morning and saw a sea of red next to those four letters, you aren’t alone in wondering what’s going on. Honestly, it’s a bit of a head-scratcher when the company is literally the backbone of the entire AI economy.

Why is NVDA stock down today?

✨ Don't miss: Why is O’Reilly Stock Down Today: What Most People Get Wrong

The short answer isn't just one thing. It's a cocktail of "good news but with strings attached," a little bit of "investor fatigue," and some serious side-eye from international regulators. While NVIDIA ended Tuesday’s session with a very modest gain of about 0.47% to close at $185.81, it spent a significant chunk of the trading day in the red, and many of its high-flying peers were catching some serious wind. If you're looking at the five-day trend, things look even more sluggish.

The China "H200" dilemma

The biggest news hitting the wires right now is the weird, "will-they-won't-they" situation with chip exports to China.

Reuters just reported that the U.S. government finally gave the green light for NVIDIA to export its H200 chips to China. On paper, that sounds like a massive win. We're talking about a potential $40 billion revenue unlock for 2026. But here’s the catch—and it’s a big one. The Chinese government basically clapped back, saying they’ll only allow a specific, select group of local companies to actually buy those chips.

It's a classic case of geopolitical ping-pong.

Investors hate uncertainty. When Washington says "go" but Beijing says "maybe," the market tends to sell first and ask questions later. There’s a lingering fear that even if the tech is available, the demand might be artificially capped by local policy.

Is the "AI Laggard" narrative taking hold?

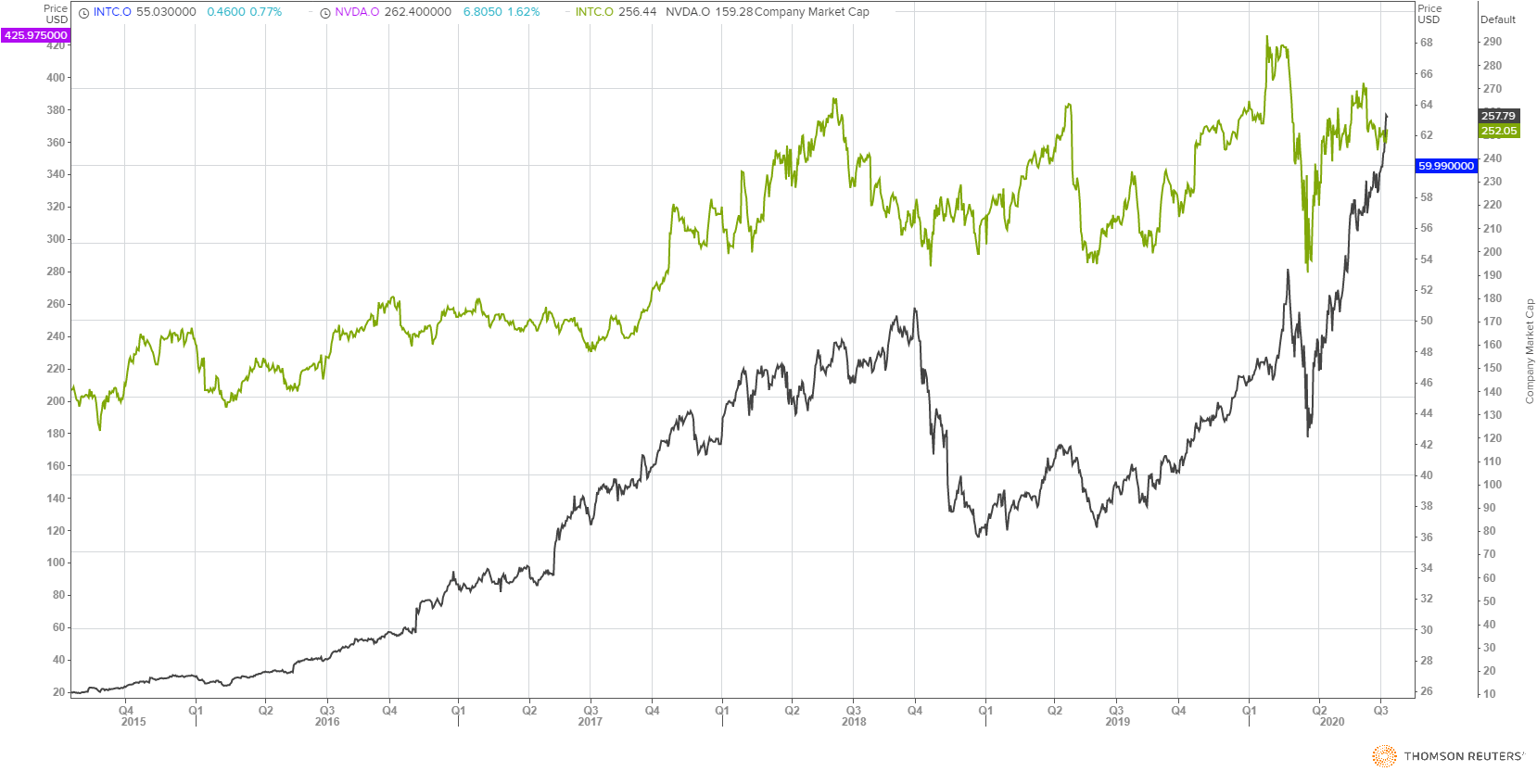

This might sound crazy given that NVIDIA has soared something like 1,000% over the last three years. But lately? It’s kind of been a laggard.

Chris Caso over at Wolfe Research recently pointed out that NVDA is up "only" 36% over the past year. Compare that to Micron Technology (MU), which has been on a total tear, up around 300% since the beginning of 2025.

- Blackwell rollout jitters: The launch of the Blackwell platform was technically "late" by aggressive Wall Street standards.

- Custom chips: Companies like Google, Amazon, and Microsoft are building their own AI processors (ASICs).

- The Rubin hype: Even though Jensen Huang just blew the doors off CES 2026 with the Rubin architecture (promising 5x the performance of Blackwell), some traders are worried we’re hitting a "buy the rumor, sell the news" phase.

The $5 trillion heavy lift

We have to talk about the sheer size of this thing. NVIDIA recently became the first company to ever hit a $5 trillion market cap.

Think about that.

When you’re that big, moving the needle becomes incredibly hard. Every time the stock dips, it’s often just because institutional investors are trimming their positions to lock in gains. It’s not necessarily because the company is "failing." It’s because it’s hard to justify a $6 trillion or $7 trillion valuation without flawless execution every single day.

Currently, the stock is trading at roughly 23 times projected 2026 earnings. That’s actually cheaper than its five-year average of 35x. So while the price is "down" from its October all-time highs, the valuation is actually starting to look... dare I say, reasonable?

What’s actually happening under the hood

Earlier this week, NVIDIA and Eli Lilly announced a $1 billion AI co-innovation lab. They’re trying to use "physical AI" to basically automate drug discovery. It’s cool stuff, but it doesn't pay the bills today.

Today’s price action is really about the "Inference Shift." The market is moving from a world where everyone was just training models to a world where everyone is running them. This requires different memory and networking setups. While NVIDIA's NVLink tech gives them an edge, competitors like AMD (which gained over 6% today) and Intel (up over 7%) are finally starting to look like credible threats in certain niches.

Actionable insights for the "down" days

If you’re holding NVDA and sweating the daily fluctuations, here’s how to look at the landscape:

- Watch the China testing: The U.S. is requiring third-party testing before those H200s ship. Any delay there will cause another dip.

- Mind the PEG: NVIDIA’s PEG ratio is sitting around 0.72. Usually, anything under 1.0 is considered undervalued for a growth stock.

- Focus on the data center: This segment still accounts for about 88% of their revenue. If that number stays strong, the long-term story remains intact regardless of what happens in the gaming or automotive sectors.

The "easy money" phase of the AI boom is probably over. Now we’re in the "show me the revenue" phase. NVIDIA is still the king of the mountain, but as any king knows, the higher you climb, the harder the wind blows.

If you're looking for the next move, keep an eye on the upcoming earnings calls from the "Hyperscalers" (Microsoft and Meta). Their capex spending plans for late 2026 will tell you more about NVIDIA's future than any single day of trading ever could. Look for confirmation that they are still buying every Blackwell chip they can get their hands on.

Total market dominance doesn't happen in a straight line. It's usually a series of two steps forward and one messy, geopolitical step back. Today was just one of those steps back.