You wake up, check your portfolio, and there it is: a splash of red next to the most famous ticker in the world. For a company that basically owns the AI era, seeing NVIDIA in the negative feels... weird. Wrong, even. On January 16, 2026, NVDA closed at $186.23, down about 0.44% on the day. That might seem like a rounding error, but when you're the world's first $4.5 trillion company, even a tiny dip wipes out billions in market value.

So, what gives?

Honestly, it isn't just one thing. It's a messy cocktail of "good news being priced in," a sudden squeeze in the memory chip market, and the fact that everyone is holding their breath for the next big architectural shift.

📖 Related: How much is a lakh in US dollars? Why your calculator might be lying to you

The "Success" Problem and Why is NVDA Stock Down

Wall Street is a fickle place. NVIDIA recently reported revenue of $57 billion for its most recent quarter, which is a staggering 62% jump from the year before. Most companies would kill for those numbers. But for NVIDIA, that’s just a Tuesday.

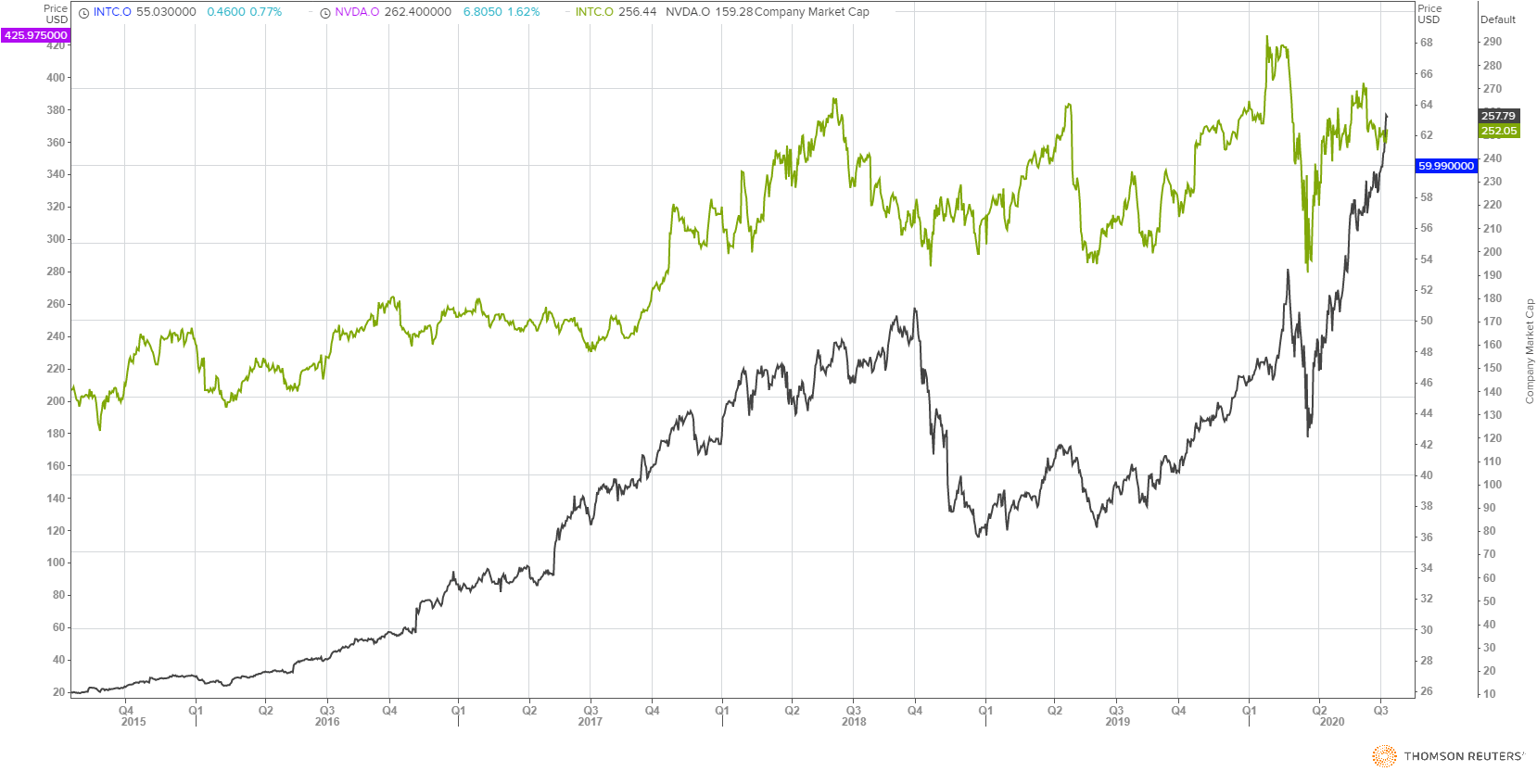

When a stock has run up over 1,000% in three years, "great" isn't good enough anymore. It has to be "miraculous."

Investors are currently wrestling with the valuation trap. Even though the company is printing money, it’s trading at roughly 24 times its projected sales for 2026. That’s actually lower than its historical peaks—some analysts like Chris Caso at Wolfe Research think it’s a steal right now—but the broader market is getting twitchy about "peak AI." Basically, if NVIDIA doesn't beat every estimate by a mile, some traders take it as a sign to bail and lock in their gains.

💡 You might also like: Why 655 Madison Ave NY NY Is Still the Most Interesting Corner of the Plaza District

The Memory Chokepoint Nobody Saw Coming

You can have the fastest GPU in the world, but it’s a paperweight without High Bandwidth Memory (HBM).

Right now, we are in the middle of a massive global memory shortage. In early 2026, companies like Micron and SK Hynix are struggling to keep up. Because AI demand is so "insatiable," as Oxford Economics put it, they are shifting all their production to these high-margin AI chips.

The side effect? It’s cannibalizing the production of standard DRAM. This creates a weird tension. If NVIDIA’s partners can’t get enough memory components to build the full server racks, NVIDIA can't ship as many units. It's a classic supply chain bottleneck, just with higher stakes.

👉 See also: AUD to Philippine Peso: The Move Most People Get Wrong

Why the Rubin Transition Matters

NVIDIA is currently in a "lull" between two massive product cycles.

- Blackwell: This is the current king, and it’s ramping up fast. Jensen Huang mentioned they’ve already booked $500 billion in AI chip orders through 2026.

- Rubin: This is the next-gen architecture named after Vera Rubin. It was the star of the show at CES earlier this month.

The problem? Rubin doesn't start shipping until the second half of 2026. This creates a "wait and see" period. Big cloud providers like AWS, Google Cloud, and Microsoft Azure have already signed up for Rubin, but until those chips actually hit the docks, the stock might just drift. It’s the "iPhone effect"—sometimes people stop buying the current model because they know a much better one is coming in six months.

Competition is Finally Getting Real

For a long time, NVIDIA was the only game in town. Now? Not so much.

AMD is pushing its MI400 full-rack solutions, which are designed to compete directly with NVIDIA’s GB200 systems. At the same time, the "Hyperscalers" (the big tech giants) are tired of paying the "NVIDIA tax." Google, Amazon, and Microsoft are all pouring billions into their own custom AI chips (ASICs).

They aren't going to replace NVIDIA overnight. Not even close. But they are starting to peel away specific workloads to save on electricity and cooling costs. This "Sovereign AI" trend—where nations build their own domestic data centers—is a huge new market, but it also means more hands in the cookie jar.

The Macro Mood Shift

Let's talk about the boring stuff: interest rates and tariffs. Last year, we saw how sensitive chip stocks are to trade policy. Any hint of new import tariffs or export restrictions to China sends the semiconductor index into a tailspin.

Also, the "AI PC" cycle is taking longer than expected to hit the mainstream. While every new laptop has an NPU (Neural Processing Unit) now, the average consumer hasn't found a "must-have" reason to upgrade yet. This has put a bit of a dampener on NVIDIA's gaming and PC segment, which saw a slight dip in the last quarterly report.

Actionable Insights for Investors

If you're staring at the chart wondering whether to buy the dip or run for the hills, consider these specific data points:

- Watch the Forward P/E: Currently, NVDA is trading at about 24x fiscal 2027 earnings estimates. Historically, anything under 30x has been a signal that the stock is "cheap" relative to its growth.

- The $6 Trillion Path: Analysts at The Motley Fool are betting NVIDIA hits a $6 trillion market cap this year. For that to happen, the stock needs to climb to around $250.

- Inventory Check: Keep a close eye on "channel inventories." If supply finally catches up to demand, the massive margins NVIDIA enjoys (currently around 75%) might start to compress.

- The HBM Factor: Follow earnings reports from Micron (MU). If the memory shortage eases, NVIDIA’s path to shipping Rubin becomes much smoother.

The "why" behind the dip isn't a secret—it’s just the reality of being the biggest company on the planet. When you're at the top, the only direction people look is down. But with $150 billion in orders already fulfilled and a whole new architecture launching this summer, this "down" period might just be the quiet before the next storm.

To stay ahead, focus on the upcoming February earnings call. That's where we'll see if the Blackwell ramp is staying on track or if those memory shortages are starting to bite into the bottom line. Check the "Data Center" revenue line specifically; if it stays above 60% year-over-year growth, the long-term thesis remains intact.