If you woke up, checked your brokerage account, and felt that sudden pit in your stomach, you aren't alone. It’s a mess out there. People keep asking why is the S&P 500 down, and honestly, the answer is rarely just one thing you can point a finger at. It’s usually a nasty cocktail of high interest rates, disappointing earnings from the tech giants we all rely on, and a general sense that maybe—just maybe—the market got a little too ahead of itself.

Markets don't move in straight lines. They breathe. Sometimes they gasp.

When the S&P 500 drops, it’s basically a collective "uh-oh" from every major investor on the planet. This index tracks 500 of the biggest companies in the U.S., so when it slides, it’s not just a few stocks acting up. It’s a systemic vibe shift. Right now, we are seeing a massive tug-of-war between the Federal Reserve’s "higher for longer" stance and a bunch of AI-hungry investors who are starting to wonder if the ROI on all those chips is actually going to show up this quarter.

The Interest Rate Hangover and Why is the S&P 500 Down Today

The biggest shadow over the market is the Federal Reserve. Jerome Powell has been pretty blunt. For a long time, money was basically free. You could borrow, spend, and grow without much thought to the cost of capital. Those days are gone.

When interest rates stay high, it hurts the S&P 500 in two very specific ways. First, it makes it more expensive for companies to borrow money to expand. If Apple or Amazon has to pay more on their debt, that’s less profit for shareholders. Simple math. Second, high rates make "safe" investments like Treasury bonds look way more attractive. Why would a massive hedge fund take a risk on a volatile stock if they can get a guaranteed 4% or 5% from the government? They wouldn't. Or at least, they’ll move some of their money out of stocks to play it safe, which pushes the index down.

It’s a gravity thing. Interest rates are the gravity of the financial world. When they go up, everything else finds it harder to fly.

The Magnificent Seven Aren't Feeling So Magnificent

We have to talk about the concentration risk. For the last year, the S&P 500 wasn't really 500 stocks; it was more like seven stocks and 493 passengers. Nvidia, Microsoft, Alphabet, Meta, Apple, Amazon, and Tesla. These guys carried the entire index on their backs.

But what happens when the giants stumble?

Recently, we’ve seen a shift in sentiment. Investors are getting picky. It’s not enough to just mention "AI" in an earnings call anymore. Wall Street wants to see the receipts. When Microsoft or Google spends billions on data centers but the revenue growth doesn't immediately explode to match it, traders get jumpy. They sell. And because these companies make up such a huge percentage of the S&P 500's total value (the "market cap"), a 3% drop in Microsoft moves the needle way more than a 10% gain in a smaller company like Costco or Home Depot.

Inflation Fears Still Haunt the Trading Floor

Everyone thought inflation was dead. It's not. It's just... lingering. Like a guest who won't leave the party.

Every time a new CPI (Consumer Price Index) report comes out and shows that insurance costs or rent are still climbing, the market panics. The fear is that if inflation stays sticky, the Fed won't just keep rates where they are—they might even have to hike them again, though that seems unlikely right now. Even the threat of it is enough to cause a red day.

You’ve also got the "wealth effect" to consider. When people see their portfolios shrinking, they spend less. When they spend less, corporate earnings drop. It’s a feedback loop that the market is constantly trying to price in months before it actually happens. This forward-looking nature of the stock market is why it often feels like the news is bad even when your local economy seems fine. The market is worried about six months from now, not today.

Geopolitical Chaos and Oil Prices

The world is a bit of a powder keg lately. Conflicts in the Middle East and the ongoing war in Ukraine create massive uncertainty. Markets hate uncertainty more than they hate bad news.

👉 See also: 590 West Peachtree Street: What People Get Wrong About Atlanta’s Midtown Transformation

- Oil Spikes: If tensions rise, oil prices usually follow.

- Shipping Issues: Turmoil in the Red Sea messes with global supply chains.

- Energy Costs: High energy prices are a "tax" on every single company in the S&P 500.

If a shipping lane gets blocked or a refinery gets hit, the cost of moving goods goes up. That cost gets passed to the consumer, inflation ticks up, and we are right back to the Fed being grumpy about interest rates. It's all connected.

Valuation Reality Checks: Are We Overvalued?

If you look at the P/E (Price-to-Earnings) ratio of the S&P 500, it’s been hovering well above its historical average. Essentially, people have been paying a premium for stocks because they were afraid of missing out (FOMO).

At some point, the rubber meets the road.

If a company is trading at 30 times its earnings, it better be growing like a weed. If it’s only growing at 5%, that stock is going to get hammered. A lot of the recent downward pressure is just the market "re-rating" these companies. It’s a return to sanity. It’s painful if you bought at the top, but it’s a natural part of the cycle.

The "Carry Trade" Collapse (The Technical Stuff)

Sometimes why is the S&P 500 down has nothing to do with the companies themselves and everything to do with how people are borrowing money. You might have heard about the Yen carry trade. Basically, big investors were borrowing money in Japan (where interest rates were basically zero) and using that cheap money to buy U.S. tech stocks.

When the Japanese yen suddenly gets stronger or their interest rates go up, those investors have to pay back those loans immediately. To get the cash, they sell their most liquid assets. What’s the most liquid asset in the world? Large-cap U.S. stocks. This causes a "forced" selloff that has nothing to do with whether Nvidia is a good company and everything to do with a margin call in Tokyo.

It’s technical, it’s annoying, and it causes massive volatility.

Real-World Impact: What it Means for Your 401(k)

It’s easy to look at a chart and see red lines, but for most people, this is about their retirement. The S&P 500 is the bedrock of most 401(k) plans and IRAs.

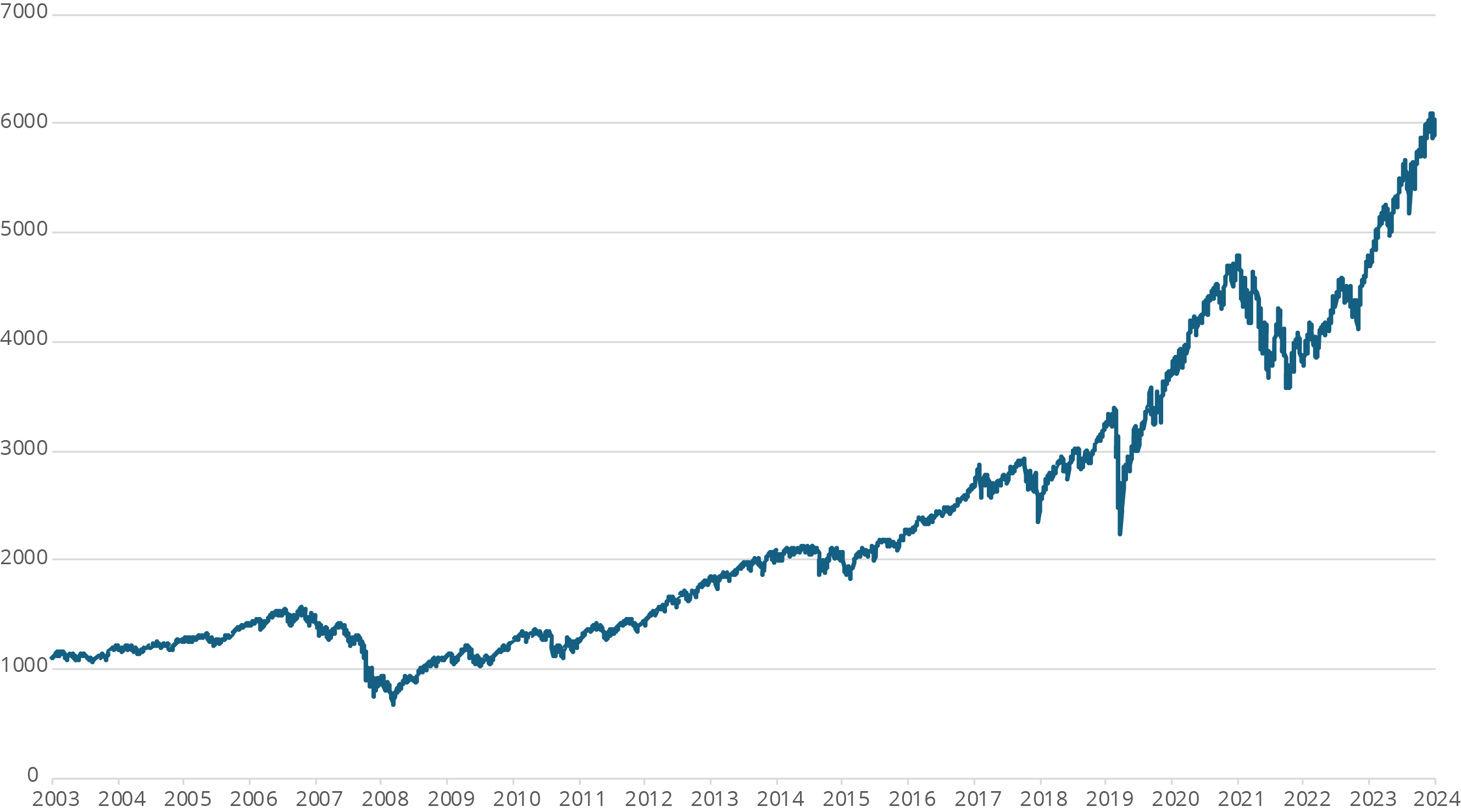

When the index is down 5% or 10%, it feels like money is evaporating. But historically, these "drawdowns" are common. In fact, the S&P 500 has a "correction" (a 10% drop) almost every year on average. It’s the price of admission for the long-term gains. If the market only went up, everyone would be a billionaire and the money wouldn't be worth anything.

The danger isn't the drop itself. The danger is the panic sell at the bottom.

Is a Recession Actually Coming?

This is the million-dollar question. Some indicators, like the Sahm Rule (which tracks unemployment spikes), have started flashing yellow. If the labor market starts to crack and people lose their jobs, then we aren't just looking at a "market correction"—we're looking at a real economic downturn.

Currently, consumer spending is holding up okay, but credit card delinquencies are rising. People are starting to feel the squeeze of those high interest rates we talked about. If the "soft landing" the Fed is aiming for turns into a "hard landing," the S&P 500 could have further to fall before it finds a floor.

Misconceptions About Market Drops

Most people think a down market means the economy is failing. That’s not always true. The stock market is a giant voting machine for future expectations. Sometimes the economy is doing great, but the market is down because it expected it to be spectacular.

Another myth? That you should "wait for the dust to settle" before buying. By the time the dust settles, the recovery has usually already happened. The biggest gains in the S&P 500 often happen on the very days when the news feels the worst.

Actionable Steps for Navigating the Slide

Don't just sit there feeling helpless. There are ways to handle this without losing your mind.

Audit Your Portfolio Weighting

Check how much of your money is actually in those "Magnificent Seven" stocks. You might be surprised to find that through various ETFs, you are way more exposed to tech than you realized. Diversification feels boring when tech is mooning, but it feels like a warm blanket when the S&P 500 is down.

Zoom Out on the Timeline

If you don't need this money for 10 years, stop checking the daily price. The "noise" of the daily news cycle is designed to keep you clicking, not to make you a better investor. Look at a 20-year chart of the S&P 500. This current dip looks like a tiny blip in the grand scheme of things.

Rebalance with Intention

If your stocks have dropped so much that your "safe" assets (like bonds or cash) now make up a bigger percentage of your portfolio than you planned, it might be time to move some money back into stocks. This is the "buy low" part of the "buy low, sell high" mantra that everyone forgets to actually do.

Tax-Loss Harvesting

If you hold individual stocks or ETFs in a taxable brokerage account (not a 401k), you can sell losing positions to offset your capital gains and reduce your tax bill. You can then buy a similar (but not identical) investment to stay in the market. It’s a way to make the market's bad mood work for your IRS bill.

Keep Your Emergency Fund Untouched

The worst thing you can do is be forced to sell your stocks when the S&P 500 is down because you need cash for a car repair or a medical bill. Ensure you have 3–6 months of cash in a high-yield savings account so you can let your investments ride out the storm.

Stay Objective About the News

Remember that headlines are written to trigger an emotional response. When you see a headline about "Trillions Wiped Out," remember that those are "paper" losses. Nothing is actually lost until you hit the sell button.

The S&P 500 has survived world wars, pandemics, the dot-com bubble, and the 2008 housing crisis. It has a 100% track record of eventually hitting new all-time highs. The current volatility is uncomfortable, but it’s rarely a reason to abandon a well-thought-out financial plan. Focus on what you can control: your savings rate, your asset allocation, and your reaction to the red screen.