Money isn't supposed to be this stressful, right? But here we are in January 2026, and if you’ve looked at the DXY—that big index that tracks the greenback against other major players—it’s been a bit of a slide. Honestly, the US dollar has felt like a giant that’s finally decided to take a nap after a decade-long sprint.

It's down about 7% to 10% from its recent peaks. Some folks are calling it a "doomsday" scenario, while others say it's just a healthy correction.

The truth? It's messy.

Why is US dollar weakening right now?

Basically, the "US Exceptionalism" story that dominated the early 2020s is fraying at the edges. For years, the US was the only game in town with high growth and high interest rates. But lately, the gap between the US and the rest of the world is closing.

When the Federal Reserve started trimming interest rates—bringing them down to the current 3.5% to 3.75% range—the "carry trade" lost its luster. If you're an investor, you're not going to park your billions in US Treasuries if the yield is dropping while other countries are holding steady or growing.

🔗 Read more: EU E-Commerce VAT News: Why the 150 Euro Exemption Is Actually Ending

Then there’s the political side of things. It's no secret that the White House has been vocal about wanting a weaker dollar. Why? To make American exports cheaper and hopefully shrink that massive trade deficit. When the president explicitly says the dollar is too strong, markets listen. They sell.

The Fed, Politics, and the Powell Factor

Jerome Powell’s term as Fed Chair is up in May 2026. That’s a huge deal. Markets hate uncertainty, and right now, the air is thick with it. There’s a massive debate about who takes over next—someone like Kevin Hassett, who might be more "dovish" (meaning they like lower rates), or a more traditional central banker.

The recent 43-day government shutdown didn't help either. It messed with the data. For a while, we didn't even know what the real inflation numbers were. Investors hate flying blind. When the numbers finally trickled back in this month, showing inflation stubborn at 2.7%, it confirmed the suspicion that the US economy isn't quite the invincible fortress it was two years ago.

De-dollarization: Real Threat or Ghost Story?

You've probably seen the headlines about "de-dollarization." It sounds scary. But most experts, like George Saravelos at Deutsche Bank, suggest it’s more of a slow drift than a sudden divorce.

- Central Banks are buying gold: They’ve been stuffing their vaults with the yellow metal at record rates.

- Energy trade is shifting: More oil is being priced in non-dollar contracts than we’ve seen in decades.

- The "One Big Beautiful Bill": Massive US fiscal spending has pushed the national debt to nearly $38.5 trillion. That makes people nervous.

If you have a credit card and you keep spending without a plan to pay it back, eventually, your limit gets questioned. The US is finding out that even "exorbitant privilege" has its limits.

The 1995 Mirror

A lot of analysts at Bank of America are looking at 1995 as the blueprint for what’s happening. Back then, the dollar dropped about 4.2% in a year. We're seeing a similar "soft landing" vibe now—tech-driven growth, but with a Fed that is slowly taking its foot off the gas.

👉 See also: GSO Capital Partners LP: How the Credit King Became Blackstone Credit

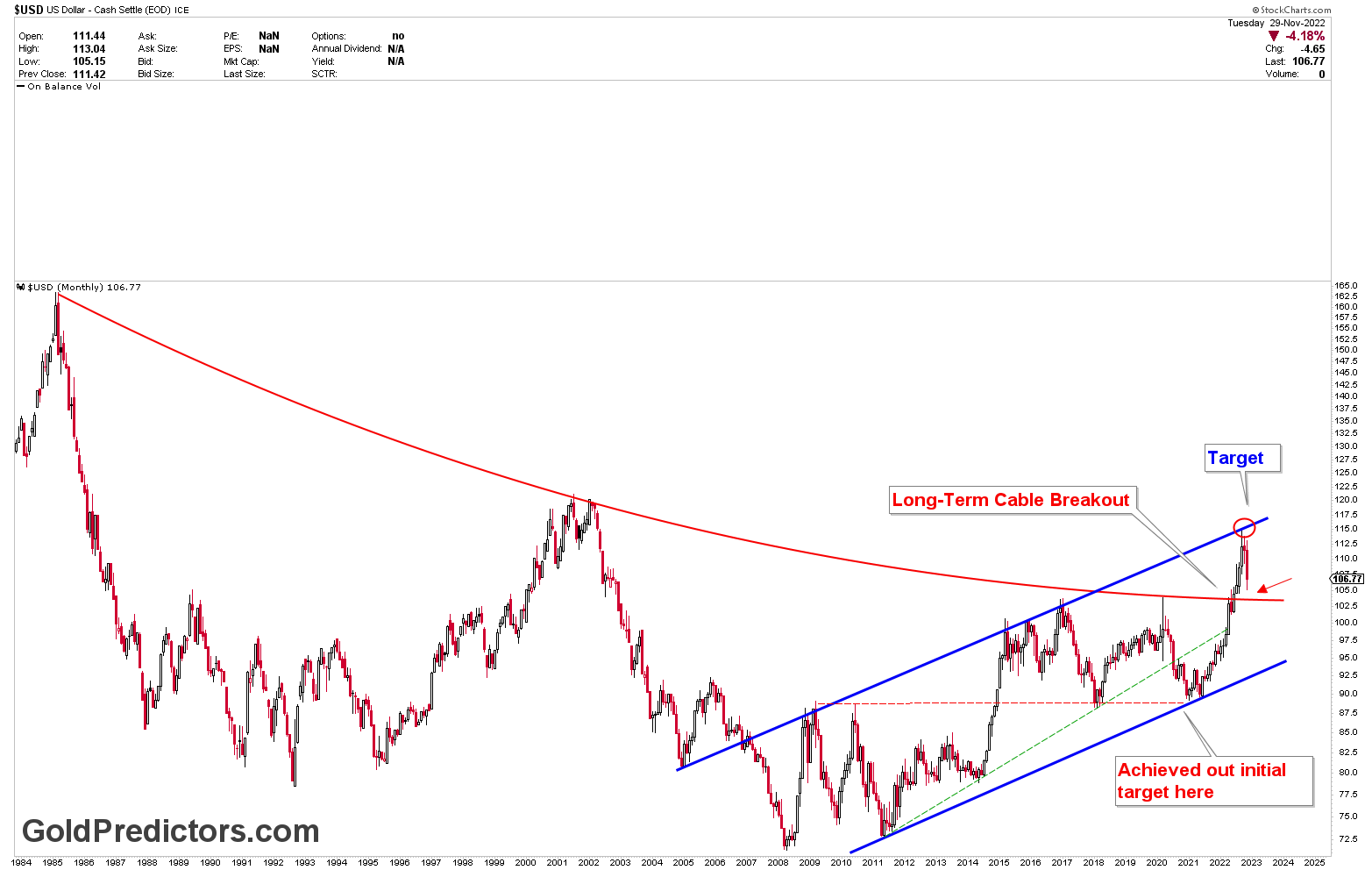

If history repeats, we could see the Dollar Index fall toward the 95 level later this year.

It’s not just about the US being "bad." It’s about the rest of the world getting "better." European and Asian markets are actually outperforming US equities at the start of 2026. Money flows where the growth is, and right now, it's flowing out of New York and into places like Tokyo and Frankfurt.

What this means for your wallet

A weaker dollar is a double-edged sword. If you’re planning a trip to Italy this summer, it’s going to hurt. Your dollars won't buy as many Euros as they did in 2024. On the flip side, if you work for a company that sells software or airplanes to South America or Europe, your boss is probably thrilled. Their products just got a "discount" on the global stage.

Actionable Insights for 2026:

- Hedge your travel: If you have international trips planned, consider locking in exchange rates now or using a credit card with no foreign transaction fees to mitigate the sting.

- Diversify your portfolio: The era of "Only Buy US Tech" is hitting a snag. Look at international ETFs or emerging markets that benefit when the dollar cools off.

- Watch the May Fed appointment: Whoever replaces (or succeeds) Powell will set the tone for the next four years. A political pick could lead to more volatility; a "safe" pick might stabilize the slide.

- Tangible assets: With the dollar's purchasing power drifting, keeping a portion of your savings in commodities or gold has historically been a way to weather the storm.

The dollar isn't "dying," but it is definitely changing. We are moving away from a world where the greenback is the only protagonist and into a more crowded ensemble cast. It’s a transition that requires a bit more agility with your money than we’ve needed in a long time.