You're staring at a $5,000 balance. It feels heavy. You look at that "minimum payment" on your statement—maybe it’s $100—and think, "I can swing that." But here is the thing: that number is a trap designed by mathematical geniuses to keep you in debt for decades. Honestly, if you only pay the minimum, you aren't really paying off the card; you’re just subsidizing the bank's next skyscraper. This is where a credit card payment calculator becomes less of a "math tool" and more of an escape plan.

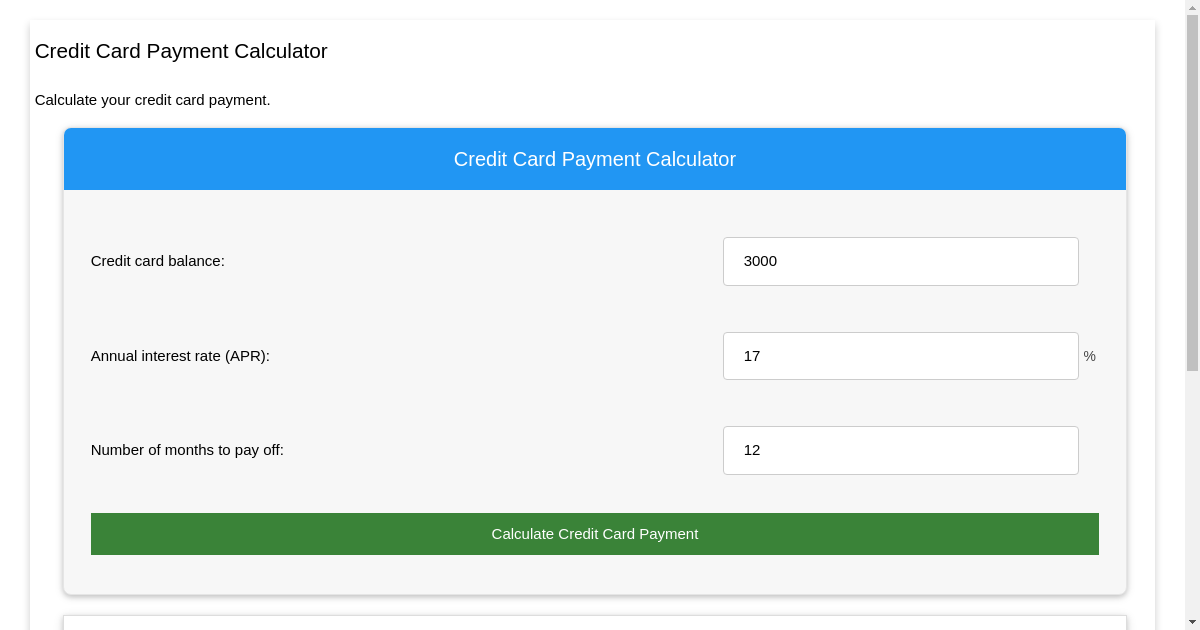

Most people use these calculators all wrong. They plug in their balance, see a scary number of years, and close the tab. They treat it like a digital fortune teller. Bad move. A calculator is a simulator. It's meant for "what if" scenarios that the banks don't want you to run.

The Brutal Math of the Minimum Payment

Banks use a specific formula to calculate your minimum. Usually, it's either 1% or 2% of the total balance plus interest, or a flat $25 or $35—whichever is higher. It sounds reasonable. It’s not. Because interest is calculated daily, your minimum payment barely touches the "principal" (the actual money you spent on that new couch or those plane tickets).

Let’s look at a real-world scenario. Imagine you have a $7,000 balance at a 24% APR. That’s a high interest rate, but it's becoming the norm as the Federal Reserve keeps rates elevated. If you use a credit card payment calculator and stick to the minimums, you’ll be paying that $7,000 off for nearly 30 years. You’ll end up paying back the $7,000 plus an additional $15,000 or more in interest. You’ve basically bought three couches and only get to keep one.

The math is unforgiving.

Credit card interest compounds. That means you are paying interest on the interest that was added to your account last month. It’s the "eighth wonder of the world" in reverse. It’s a wealth-stripping machine. When you see those numbers laid out in a calculator, it should feel like a cold splash of water. It’s supposed to wake you up.

💡 You might also like: Sadera Designs SD3DU Explained: Why This Studio Is Changing How We Think About ADUs

How to Actually Use a Credit Card Payment Calculator for Freedom

Don't just look at the "time to pay off" section. That’s depressing. Instead, focus on the "interest saved" feature. This is the psychological lever that actually changes behavior.

Say you have that $5,000 debt. If you pay the minimum, it might take 15 years. But what if you add just $50 more a month? Plug that into the credit card payment calculator. Suddenly, those 15 years might drop to 5. You just saved yourself a decade of stress and thousands of dollars for the price of a couple of takeout pizzas.

It’s about finding your "break point."

The Snowball vs. The Avalanche

There are two main schools of thought here, and your calculator is the best way to decide which one fits your brain.

- The Debt Avalanche: This is the mathematically "correct" way. You list your cards by interest rate. You take every extra penny you have and throw it at the card with the highest APR—usually a store card or a premium rewards card. You pay the minimums on the others. Once the high-interest beast is dead, you move to the next highest. You save the most money this way.

- The Debt Snowball: Popularized by Dave Ramsey, this is for the people who need a win. You pay off the smallest balance first, regardless of the interest rate. Why? Because crossing a debt off the list feels amazing. It gives you the "dopamine hit" needed to keep going.

Your credit card payment calculator can show you the difference in dollars between these two methods. Usually, the Avalanche saves you a few hundred or thousand dollars, but the Snowball might be the thing that keeps you from quitting. You have to be honest with yourself about your personality. Are you a robot who loves efficiency, or a human who needs encouragement?

The APR Illusion

We need to talk about APR. It stands for Annual Percentage Rate, but as mentioned before, interest is often calculated daily. $Interest = (Balance \times \text{Daily Rate}) \times \text{Days in Billing Cycle}$.

If your APR is 24%, your daily rate is roughly 0.065%. That doesn’t sound like much. But apply that to a $10,000 balance every single day, and the numbers explode. A credit card payment calculator helps you see through the "daily rate" fog.

Also, watch out for "variable rates." Most credit cards are tied to the Prime Rate. When the Fed hikes rates, your credit card gets more expensive almost instantly. If you checked your calculator six months ago, the numbers are probably wrong now. You need to check the "Interest Charge" section on your latest statement and update your inputs.

The Stealth Killers: Fees and Penalty Rates

Most calculators assume you’re a "perfect" borrower—meaning you never miss a payment. But if you're late, your APR can jump to a "penalty rate," which is often 29.99% or higher.

At 30% interest, your debt is doubling roughly every 2.4 years if you aren't making significant progress. That’s a death spiral. If you’ve hit a penalty rate, the credit card payment calculator will show you a terrifying reality: your minimum payment might not even cover the interest. This is called "negative amortization." You’re paying money every month, and your balance is actually going up.

If you see this happening in your calculations, you aren't just in debt; you’re in a financial emergency.

Beyond the Calculator: The Balance Transfer Strategy

If your calculator shows it will take more than three years to pay off your debt, you should look into a 0% APR balance transfer card. These cards usually give you 12 to 21 months of zero interest.

But there’s a catch.

There is usually a 3% to 5% transfer fee. If you’re moving $10,000, you’re paying $300 to $500 upfront. Is it worth it? Use the credit card payment calculator to find out. If the calculator says you’d pay $2,000 in interest over the next year on your current card, then paying a $500 fee to stop that interest is a no-brainer.

However, if you don't pay off the balance before the 0% period ends, the interest rate often snaps back to a very high number. You have to be disciplined. You can’t use the newly cleared card to buy more stuff. That’s how people end up with twice the debt they started with.

Is a Personal Loan Better?

Sometimes the calculator tells you a truth you don't want to hear: you can't afford this debt.

If the monthly payment required to kill the debt in three years is more than you make, you might need a debt consolidation loan. These are personal loans with fixed terms. Instead of a revolving door of debt, you have a clear end date.

Usually, personal loan rates for people with decent credit are between 8% and 15%. Compared to a 25% credit card, that’s a massive win. Use a credit card payment calculator to compare your current trajectory against a fixed personal loan payment. The visual of seeing that "End Date" move from 2045 to 2028 is often the motivation people need to finally pull the trigger on a restructuring plan.

Realities of Credit Scores

Does paying off debt help your score? Yes, but it’s complicated. Your "Credit Utilization" is a huge part of your FICO score. That’s the ratio of how much you owe versus your total limits.

If you have a $10,000 limit and owe $9,000, your score is taking a beating. As you use your credit card payment calculator and start knocking that balance down, your score will start to climb. Once you get under 30% utilization ($3,000 in this case), you’ll likely see a significant jump.

But don't close the card once it’s paid off! Closing an old account can actually hurt your score by lowering your average account age and your total available credit. Pay it off, hide the card in a block of ice in the freezer, but leave the account open.

Actionable Steps to Take Right Now

- Gather your statements. Don't guess. Look at your actual balance and your actual APR for every single card you own.

- Run the "Plus $50" test. Go to a credit card payment calculator and enter your data. Look at the payoff date. Now, add $50 to that monthly payment and see how many years disappear. That's your motivation.

- Call your bank. Seriously. Ask them for a lower APR. If you’ve been a loyal customer and have made on-time payments, they will sometimes drop your rate by 2-3% just because you asked. That’s "free" money that stays in your pocket instead of theirs.

- Identify the "leak." If you pay off $500 but charge $600, no calculator in the world can help you. You have to stop the bleeding before the math can work in your favor.

- Set up Autopay for the minimum. This ensures you never hit that 30% penalty rate. Then, manually pay whatever extra you can afford on top of that.

- Automate the "Found" money. Did you get a tax refund? A bonus? A $20 bill in an old jacket? Don't spend it. Put it toward the highest interest card identified by your calculator immediately.

The goal isn't just to use a tool. The goal is to stop being a profit center for a bank. Every dollar you stop paying in interest is a dollar you can use to actually build a life. Math doesn't have feelings, and it doesn't care about your excuses—but once you understand how the credit card payment calculator works, you can finally make the math work for you instead of against you.