You're sitting there staring at a screen. Your eyes are blurry. You've just spent forty-five minutes trying to figure out the tax implications of a municipal bond swap, and honestly, you feel like your brain is melting. We’ve all been there. The FINRA Series 7 Top-Off Exam is the gatekeeper for anyone who wants to be a general securities representative, and it’s notoriously brutal. But here is the thing: most people fail before they even get to the testing center because they’re using the wrong series 7 example test questions.

It’s not just about memorizing facts. You can't just "flashcard" your way through the Suitability section. FINRA loves to wrap a simple concept in a three-paragraph narrative about a 65-year-old grandmother named Martha who wants to preserve capital but also "kind of" wants to see her portfolio grow so she can leave something for her grandkids. If you don't know how to pick apart those distractors, you're cooked.

The Suitability Trap: Why Practice Questions Feel Like Riddles

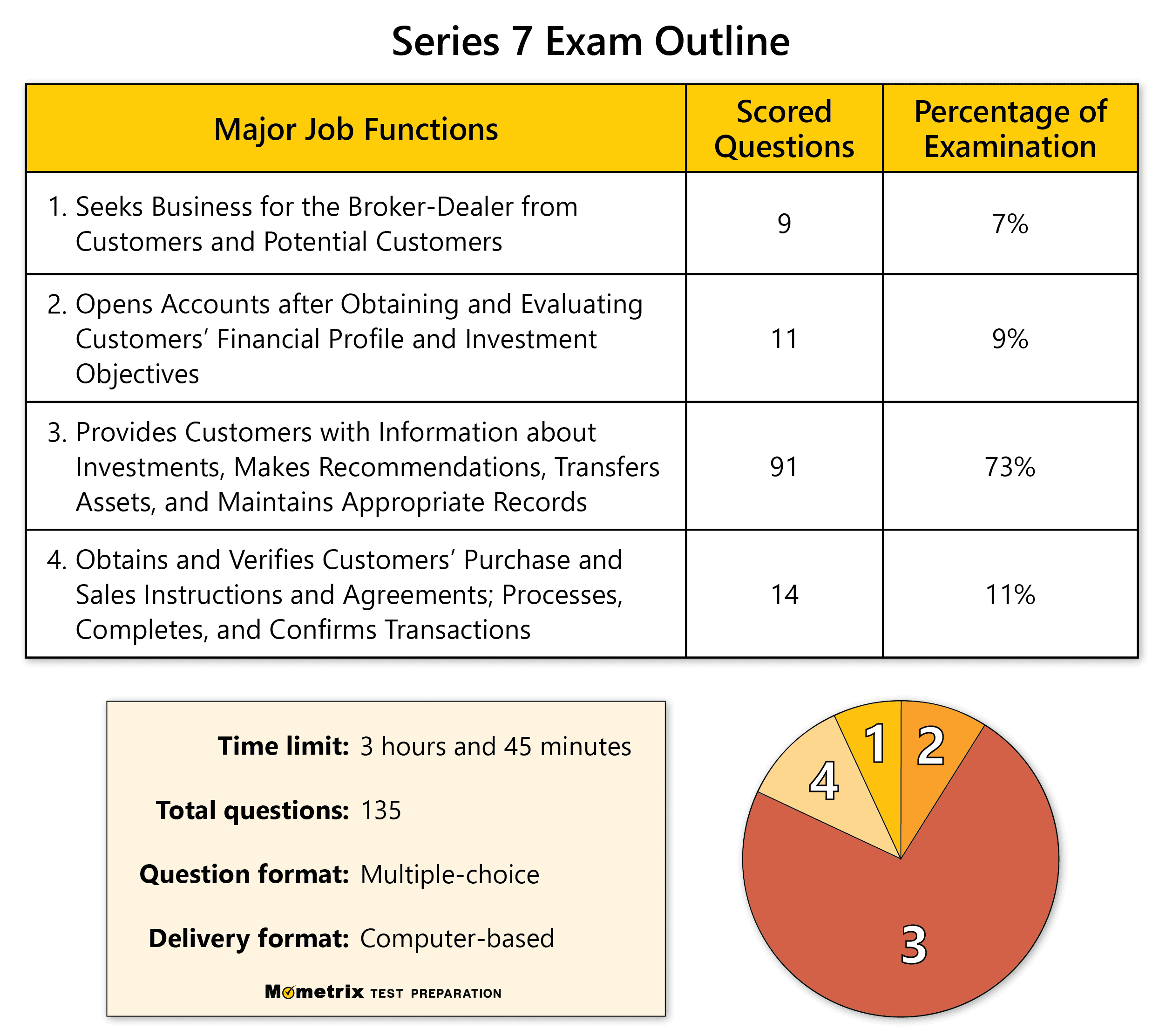

If you look at most series 7 example test questions from providers like Kaplan, STC, or Knopman Marks, you’ll notice a pattern. They focus heavily on Suitability (Function 3). This part of the exam accounts for roughly 91 questions out of the 125 scored items. That is a massive chunk.

Basically, the exam wants to know if you're going to lose a client's life savings on a risky margin play. Let's look at an illustrative example. Imagine a question asks about a high-net-worth individual in the 37% tax bracket who needs tax-free income. The answer is almost always municipal bonds. But wait. What if the question mentions the client is subject to the Alternative Minimum Tax (AMT)? Suddenly, those "tax-free" private activity bonds aren't so attractive.

You have to be a detective. You’re looking for keywords like "liquidity," "time horizon," and "risk tolerance."

If a practice question tells you a client needs "immediate access to funds," and you pick a Limited Partnership or a Variable Annuity with a seven-year surrender period, you just failed that question. It doesn't matter how high the internal rate of return is. If Martha can't get her cash to pay for her hip surgery, the investment is wrong. Period.

Options: The Math Everyone Dreads

Let's talk about the elephant in the room. Options.

People freak out over options. They see "Bull Call Spread" or "Short Straddle" and start sweating. But honestly? The math on the Series 7 isn't that hard. It’s mostly addition and subtraction. The real struggle is the vocabulary and the "directionality" of the trades.

When you're grinding through series 7 example test questions, you’ll see lots of "What is the maximum gain?" or "What is the breakeven?" questions.

For a simple long call, the breakeven is the strike price plus the premium. Easy.

But then they throw a curveball. They'll ask about a "covered call." You own 100 shares of XYZ at $50 and you sell a July 55 call for $3. What’s your breakeven? It’s $47. Why? Because that $3 premium you collected lowers your "cost basis" on the stock.

- Long stock: Bullish.

- Short call: Bearish/Neutral.

- Covered call: Slightly bullish or neutral (income producing).

See? It’s logic, not just math. If you can draw a T-chart—putting money out on one side and money in on the other—you can solve almost any options question FINRA throws at you. Don't let the jargon intimidate you.

Municipal Bonds and the "Tax-Equivalent" Headache

Muni bonds are a huge part of the Series 7. You’ll see questions about General Obligation (GO) bonds versus Revenue bonds.

A GO bond is backed by the "full faith and credit" (and taxing power) of the municipality. Think schools or parks. A Revenue bond is backed by the money a project makes, like a toll bridge or a stadium. If people stop driving on the bridge, the bondholders might not get paid. That makes Revenue bonds riskier, which usually means they have higher yields.

One of the most common series 7 example test questions involves the Tax-Equivalent Yield.

$Tax-Equivalent Yield = \frac{Municipal Yield}{100% - Tax Bracket}$

If a muni bond pays 4% and you’re in the 25% tax bracket, you do 4 divided by 0.75. That gives you 5.33%. This means a corporate bond would have to pay you more than 5.33% to be better than that 4% muni bond. If you see this on a practice test, don't overthink it. Just run the formula.

The "Except" and "Not" Phrasing

FINRA is sneaky. They love negative phrasing.

"All of the following are true regarding Open-End Mutual Funds EXCEPT..."

You read the first option, it’s true, and you click it. Boom. Wrong. You forgot the "EXCEPT."

🔗 Read more: PG\&E Customer Service: How to Actually Reach a Human and Get Results

This is where "human-quality" prep comes in. You need to train your brain to highlight those negative words. In a 125-question exam that lasts nearly four hours, fatigue is your biggest enemy. By question 90, your brain is looking for the quickest exit. That is when you miss the "Except."

Communication and Rules: The Boring (But Vital) Stuff

You also have to deal with the "Conduct Rules." These are the questions about what you can and cannot say to a client.

Can you guarantee a profit? No.

Can you share in a client's profits? Only with written permission and in proportion to your capital contribution.

Can you borrow money from a client? Generally, no, unless they’re a bank or an immediate family member (and even then, there are firm-specific rules).

A lot of series 7 example test questions focus on communications with the public. You need to know the difference between "Correspondence" (25 or fewer retail investors) and "Retail Communication" (more than 25). One needs principal approval before use; the other just needs "post-review" or internal supervision.

It feels like trivia. It is trivia. But it’s the difference between a 68% and a 72% (the passing score).

Why Practice Tests Can Be Deceptive

Here is a secret: Some prep providers make their practice questions harder than the actual exam. They do this so you over-study.

If you're scoring 65% on some of these third-party tests, you might actually be in good shape for the real thing. But don't get complacent. The actual Series 7 uses "proprietary" wording that you won't see anywhere else.

The best way to use series 7 example test questions is to focus on the explanations. Don't just look at whether you got it right or wrong. Read the "why." If you got a question right by guessing, you actually got it wrong in terms of preparation.

Actionable Strategy for Your Final Week

Stop trying to learn new things two days before the test. It won't stick. Instead, focus on these specific steps:

- Master the "Dump Sheet": Practice writing down your formulas, the options "clock," and the bond see-saw on a blank piece of paper. You get a scratchpad or whiteboard at the testing center. The second you sit down, dump your brain onto that paper.

- Focus on Function 3: Since Suitability is the biggest part of the grade, spend 50% of your time there. If you don't understand why a REIT is better for one person and a Treasury bond is better for another, you aren't ready.

- Take Full-Length Exams: You need to build "test stamina." Sitting for 3 hours and 45 minutes is a physical challenge. Do at least three full-length simulations in one sitting without your phone or snacks.

- Ignore the "Expert" Jargon: If a question uses a word you’ve never seen, it might be a distractor. Stick to the core concepts: risk, return, time, and taxes.

The Series 7 isn't an IQ test. It’s a test of your ability to navigate a very specific, very regulated world. Use the practice questions as a map, not just a score. If you can explain why the three wrong answers are wrong, you've already won.