Tax documents are usually forgettable. You file them, you pay the man, and you move on with your life. But honestly, the 2016 1099 MISC form was a bit of a turning point for the IRS and the way independent contractors get tracked. If you're digging through a dusty filing cabinet or a legacy digital folder and found one of these, you might be wondering why it looks different or if the rules even apply anymore.

It matters.

Back in 2016, the gig economy was exploding. Uber was everywhere, Airbnb was the new normal, and thousands of people were suddenly getting these forms for the first time. The IRS was trying to keep up with a massive shift in how Americans earned money. If you have a 2016 form sitting around, you're looking at a piece of the bridge between the old way of doing taxes and the modern, high-tech enforcement era we live in now.

The Big Shift: Box 7 and the 2016 1099 MISC Form

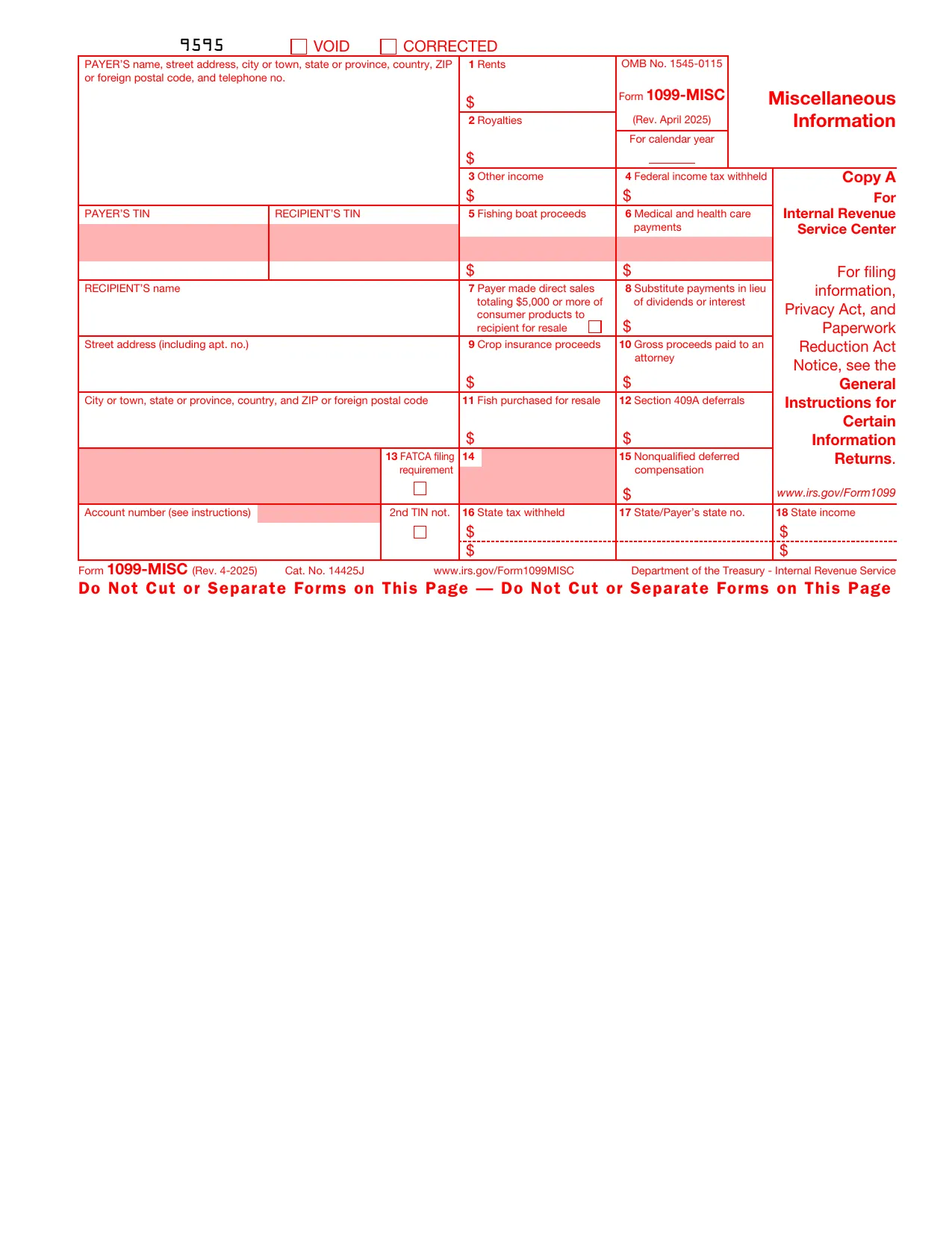

If you look at a copy of the 2016 1099 MISC form, the most important part is Box 7. This was labeled "Nonemployee Compensation." Today, that has its own form (the 1099-NEC), but back then, everything was crammed onto the MISC. This created a huge headache for the IRS and for small business owners because it mixed together two very different types of money: actual business income and "miscellaneous" stuff like prizes or legal settlements.

The 2016 tax year was one of the last years where this "all-in-one" approach really held sway before the feds realized they couldn't track fraud effectively without separating independent contractor pay.

You’ve gotta remember that the PATH Act—the Protecting Americans from Tax Hikes Act of 2015—really kicked in for the 2016 filing season. It moved the deadline for filing these forms up to January 31. Before that, businesses had more time. This change was specifically designed to stop people from claiming huge refunds based on fake 1099 data before the IRS even had the documents to verify them. It was a chaotic year for payroll departments.

Why You Might Still Care About a Document From a Decade Ago

You might think a document from 2016 is ancient history. Normally, the IRS has a three-year statute of limitations for audits. However, if they think you "substantially" understated your income—meaning you left off 25% or more of what you actually made—that window stretches to six years. And if they suspect actual fraud? There is no limit. They can come knocking whenever they want.

Let's say you were a freelance graphic designer or a consultant in 2016. If you received a 2016 1099 MISC form and never reported it, that data is still in the IRS's Information Returns Master File (IRMF). Their computers are remarkably good at matching what a company said they paid you versus what you put on your Form 1040. If you’re applying for a mortgage today or going through a high-level background check for a government job, these old discrepancies can suddenly bubble up to the surface like a bad penny.

It's not just about audits. Sometimes you need to prove your income for Social Security credits. If the SSA doesn't have a record of your self-employment income from that year, your future checks might be smaller. That little piece of paper—or the data on it—is the only proof you have that you actually worked and paid into the system.

Breaking Down the Boxes: What They Actually Meant

The 2016 1099 MISC form was a bit of a kitchen sink.

- Box 1: Rents. If you were a landlord, this is where your property manager reported the rent they collected for you.

- Box 2: Royalties. Writers, musicians, or people with oil and gas leases saw their earnings here.

- Box 3: Other Income. This was the "catch-all." It was for things like jury duty pay, prizes, or winnings that weren't part of your actual job.

- Box 7: Nonemployee Compensation. This was the heavy hitter. If you were an independent contractor, this is where your gross earnings lived.

There were also boxes for fishing boat proceeds (Box 5) and medical and health care payments (Box 6). It’s kind of wild how much they tried to fit onto one page. By 2020, the IRS finally gave up and moved Box 7 to its own form, the 1099-NEC. But in 2016, Box 7 was the king of the form.

Common Errors That Still Trip People Up

A lot of people got confused by the $600 threshold. It’s a common myth that if you made $599, you don't have to report it. Wrong. The company doesn't have to send a form if they paid you less than $600, but you are still legally required to report every single cent to the IRS.

Another weird thing about the 2016 tax year was how it handled back-up withholding. If you didn't provide your TIN (Taxpayer Identification Number) to the payer, they were supposed to take 28% off the top and send it to the IRS. If you see an amount in Box 4, that’s money that was already taken out of your check. If you didn't file your taxes that year, you basically gave that money to the government for free.

Digital Archeology: How to Find Your Old 2016 Data

If you’ve lost your copy of the 2016 1099 MISC form, you aren't totally out of luck. You can request a "Wage and Income Transcript" from the IRS. This is basically a computer printout that shows all the 1099s, W-2s, and other documents the IRS received under your Social Security number for a specific year.

You can get these for up to ten years back. Since we're currently in 2026, 2016 is right on the edge of falling off the digital map for easy retrieval. If you need this info for a legal case or to fix a Social Security discrepancy, you should grab it now before it gets archived into deep storage.

It's also worth checking with the company that issued it. Even though many small businesses have folded or changed names since then, larger corporations are required to keep these records for quite a while.

The Paperwork Trail

- Go to the IRS "Get Transcript" tool online.

- Select the "Wage and Income Transcript" for the year 2016.

- Check the "Payer's Name" and "Recipient's TIN."

- Cross-reference this with your bank statements from that era.

Sometimes, a company might have issued a 1099 by mistake, or they might have used the wrong Social Security number. Fixing these "zombie" tax issues requires having the original data in hand.

Real-World Impact: The "Hidden" 2016 Audit

I once saw a case where a consultant was hit with a massive tax bill in 2022 for work done back in 2016. Why? Because the company they worked for got audited. When the IRS looks at a business's books, they look at all the 1099s that business issued. If the IRS sees that the business claimed a deduction for paying "Contractor X" $50,000, but "Contractor X" never filed a return, the IRS computer triggers a flag.

Even if you think you're safe because a decade has passed, if the business that paid you is ever audited, your 2016 1099 MISC form becomes a very relevant document very quickly. It's the paper trail that never truly disappears.

The nuances of the 2016 form are specific. For instance, payments to corporations generally didn't require a 1099-MISC, but payments to attorneys did—even if the attorney was incorporated. This is a classic "gotcha" that tripped up many small business owners who thought they were following the rules.

💡 You might also like: West Coast Fulfillment Services: Why You’re Probably Overpaying for Shipping Right Now

Moving Forward With Your Records

If you're sitting on a pile of old tax documents, don't just toss them. The general rule is to keep records for seven years, but for something as foundational as the 2016 1099 MISC form, keeping a digital scan is just smart. You never know when you'll need to prove your "cost of goods sold" or a business expense that was tied to that specific income.

If you find an error on an old form now, it’s usually too late to get the company to issue a "corrected" version (1099-MISC-C). Instead, you'll have to explain the discrepancy to the IRS with other evidence, like bank deposits or a signed contract.

Actionable Steps for Handling 2016 Records:

- Verify Your Social Security Earnings: Log into the Social Security Administration website (SSA.gov) and make sure your 2016 earnings match what you actually made. If it's $0, you might lose out on future benefits.

- Download Your Transcripts: If you haven't already, pull your 2016 Wage and Income Transcript from the IRS website before it’s purged from the ten-year active window.

- Audit Your Own Files: Ensure any 1099-MISC from that year is paired with the expenses you claimed against it. If you ever need to defend those deductions, you’ll need the receipts, not just the income form.

- Check for Unclaimed Withholding: If Box 4 shows a value and you didn't file that year, you might have a credit sitting with the IRS, though the statute of limitations for a refund has likely passed (it's usually three years). However, it can still be used to offset other debts in some cases.

The 2016 tax year represents the end of the "wild west" for the gig economy. Understanding that old 2016 1099 MISC form isn't just about nostalgia; it's about making sure your financial history is accurate and protected against future scrutiny. Keep those scans, check your SSA credits, and make sure your digital trail is clean.