Banking used to be a chore. You’d drive to a branch, wait in a line that smelled like stale coffee and old carpet, and hope the teller didn't have a bad day. Now? I’m sitting on my couch in my pajamas, and I just moved five grand between accounts while half-watching a Netflix documentary. It’s wild. The Bank of America mobile banking app has basically become the command center for my financial life, and honestly, it’s a lot more sophisticated than most people realize.

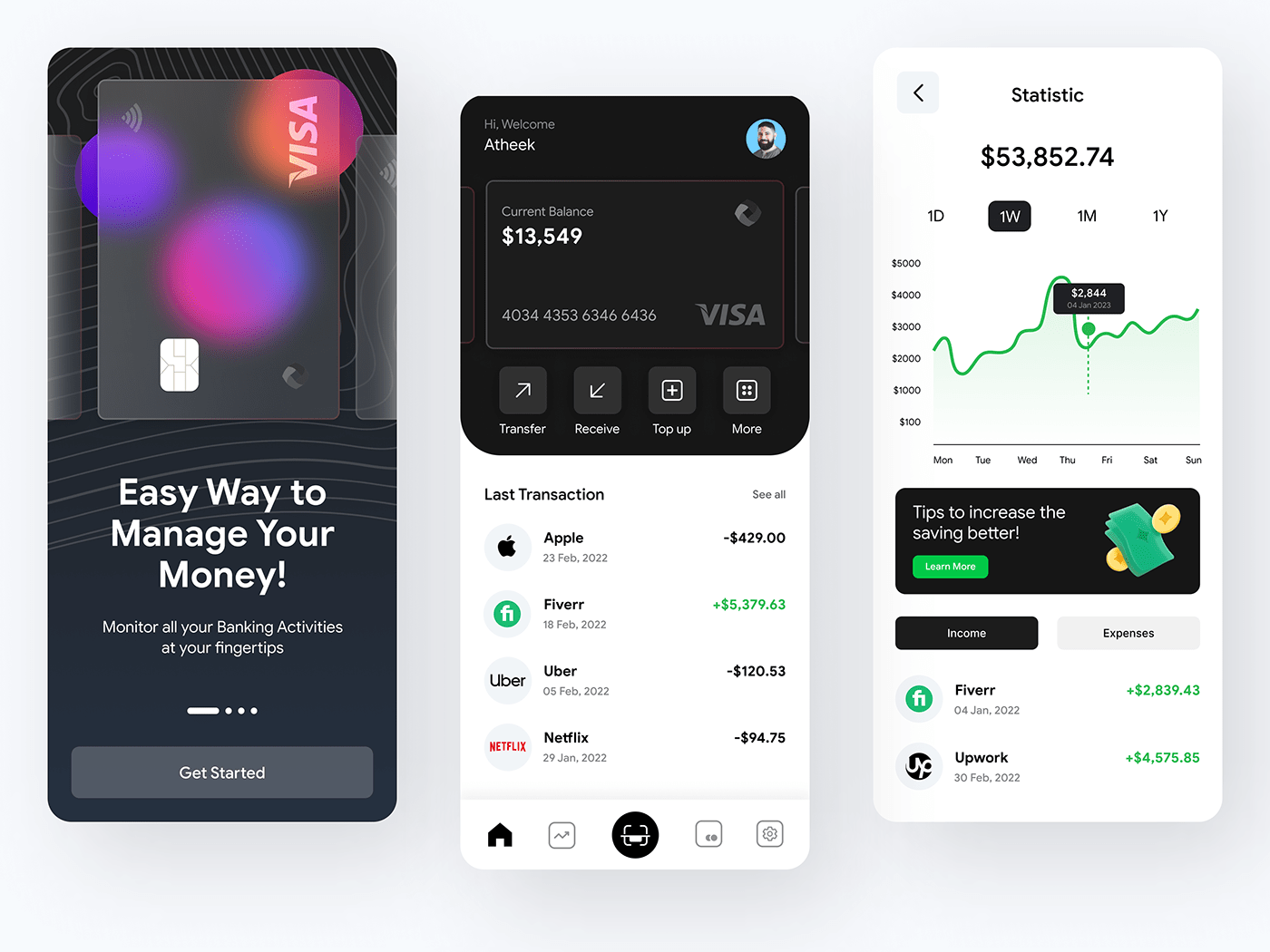

Most banking apps are just glorified balance checkers. They show you a number, maybe let you deposit a check, and that’s about it. But BofA has spent billions—literally billions—on their tech stack. It shows. Whether you're trying to figure out why your spending spiked in October or you need to lock a lost debit card at 2 AM, the app handles it without making you want to throw your phone across the room.

What the Bank of America Mobile Banking App Gets Right

Security is usually the boring part of the conversation, but it's the most important. If someone hacks your account, nothing else matters. The Bank of America mobile banking app uses FIDO2 compliance for biometric authentication. That sounds fancy, but it basically means it’s way harder for hackers to spoof your login than it was five years ago. You’ve got FaceID, TouchID, and that sweet, sweet peace of mind.

Then there’s Erica.

Erica is their AI assistant. Usually, I hate AI chatbots. They're usually useless and just loop you back to a FAQ page that doesn't answer your question. Erica is different. You can ask her, "How much did I spend at Starbucks last year?" and she actually pulls the number. She'll warn you if a subscription price went up or if you have a duplicate charge. It’s like having a tiny, very organized accountant living in your pocket who doesn't charge by the hour.

The Zelle Integration is a Lifesaver

We’ve all been there. You’re at dinner, one person covers the bill, and then comes the awkward dance of "I'll Venmo you." With the BofA app, Zelle is baked right in. It’s fast. Like, dangerously fast. Since it's bank-to-bank, you don't have to wait three days for the money to "land" in your actual spending account. It’s just there.

I’ve used it to pay rent, split pizza bills, and send birthday money to my niece. The limits are generally higher than what you get on third-party apps, too. Because it’s integrated into the Bank of America mobile banking app, you aren't constantly jumping between different interfaces. It feels cohesive.

Life Managed: Beyond Just Checking Balances

People overlook the "Life Plan" feature. It’s a bit buried, but it’s powerful. You tell the app what you’re aiming for—maybe a new car, a house, or just a solid emergency fund—and it tracks your progress. It isn't just a progress bar. It actually looks at your spending patterns and tells you if your goal is realistic based on how much you spend on DoorDash. It’s a reality check that most of us probably need but don't want to admit.

Managing Your Credit Score

You get a free FICO score monthly. This isn't the "VantageScore" fluff that some other apps give you; it’s the actual FICO Score 8 that lenders often use. Keeping an eye on this within the Bank of America mobile banking app helps you spot identity theft early. If that number suddenly drops 40 points and you haven't done anything differently, you know something is wrong.

- Check your FICO score once a month.

- Set up alerts for any transactions over a certain dollar amount.

- Use the "Lock Card" feature immediately if you misplace your wallet.

- Review your recurring subscriptions through Erica to find "zombie" charges.

The Reality of the User Interface

Look, no app is perfect. The BofA interface can feel a bit crowded. There is a lot going on. Between the accounts, the rewards, the investing side (Merrill), and the mortgage tracking, it can be overwhelming for a first-time user.

But once you customize your dashboard, it clicks. You can hide the stuff you don't use. If you don't have a Merrill investment account, you don't need to see it every time you log in. The app allows for that level of personalization, which I appreciate. It makes the Bank of America mobile banking app feel like it belongs to you, not just the bank.

Real Talk: The Merrill Integration

If you’re into investing, the way the app bridges the gap between your checking account and your Merrill Edge brokerage account is seamless. You can see your portfolio performance alongside your savings. Moving money to buy stocks is instantaneous. In a volatile market, that speed matters. You aren't waiting for an ACH transfer to clear while the stock you want to buy climbs 5% higher.

The research tools available are surprisingly deep. You aren't just getting a ticker symbol and a price. You're getting BofA Global Research reports. These are the same reports that institutional investors pay big money for. Having that level of data inside a consumer app is a massive advantage for anyone trying to take their retirement planning seriously.

How to Actually Secure Your Account

Stop using "Password123." Seriously.

The Bank of America mobile banking app offers some of the best security features in the industry, but they only work if you turn them on.

- Enable 2-Factor Authentication (2FA). Do it now.

- Set up push notifications for every single transaction. This is the fastest way to catch fraud.

- Don't log in on public Wi-Fi at a coffee shop unless you're using a VPN.

- Use a unique password that isn't shared with your email or social media.

Fraud is getting smarter. Deepfakes and sophisticated phishing scams are everywhere. The app has a "Security Center" that walks you through your current setup and gives you a "strength" rating. If your rating is low, fix it. It takes five minutes and could save you months of headaches.

Preferred Rewards: The Secret Sauce

If you keep a decent amount of money with BofA or Merrill, you need to look into the Preferred Rewards program. This is where the Bank of America mobile banking app really starts to pay for itself. Depending on your balance, you get "boosts" on your credit card rewards.

💡 You might also like: Swiss Currency to GBP: What Most People Get Wrong About the Franc

For example, if you're in the Platinum Honors tier, that 1.5% cashback card suddenly becomes a 2.62% cashback card on everything. That’s industry-leading. You also get better rates on savings and discounts on home loans. The app tracks your tier status and tells you exactly how much more you need to deposit to hit the next level. It’s gamified banking, but with actual financial benefits.

What Most People Get Wrong

People think big banks are slow. They think fintech startups like Chime or Revolut are the only ones innovating. That’s just not true anymore. The Bank of America mobile banking app has adopted almost every "cool" feature from the startups—round-up savings, instant transfers, spending analysis—and backed it with the security of a trillion-dollar institution.

You get the innovation of a startup with the "too big to fail" safety net of a major bank. It’s the best of both worlds.

Honestly, the biggest mistake people make is only using the app to check their balance. They miss out on the travel notices, the card replacement features, and the "BankAmeriDeals" which are basically free cash for shopping at places you already go to. I once got $5 back just for buying a burrito because I activated a deal in the app. It's not life-changing money, but it's a free burrito. I'll take it.

Your Next Steps to Financial Mastery

Don't just let the app sit there. Take control. Start by opening the Bank of America mobile banking app and heading straight to the "Security Center." Check your settings. Turn on those notifications.

Next, spend ten minutes talking to Erica. Ask her to show you your spending by category for the last three months. You might be surprised—or horrified—by how much you’re spending on dining out. That’s the first step to fixing your budget.

🔗 Read more: American Airlines Stock Price: Why Most People Get the Current Numbers Wrong

Finally, check your "BankAmeriDeals." Scroll through and see if any of your regular shops or restaurants are on there. Tap "Add to Card" on anything that looks relevant. It costs nothing and pays you back in actual cash. That’s how you turn a simple banking tool into a proactive financial partner.

Start today. Log in, clean up your dashboard, and make the technology work for your wallet, not the other way around.