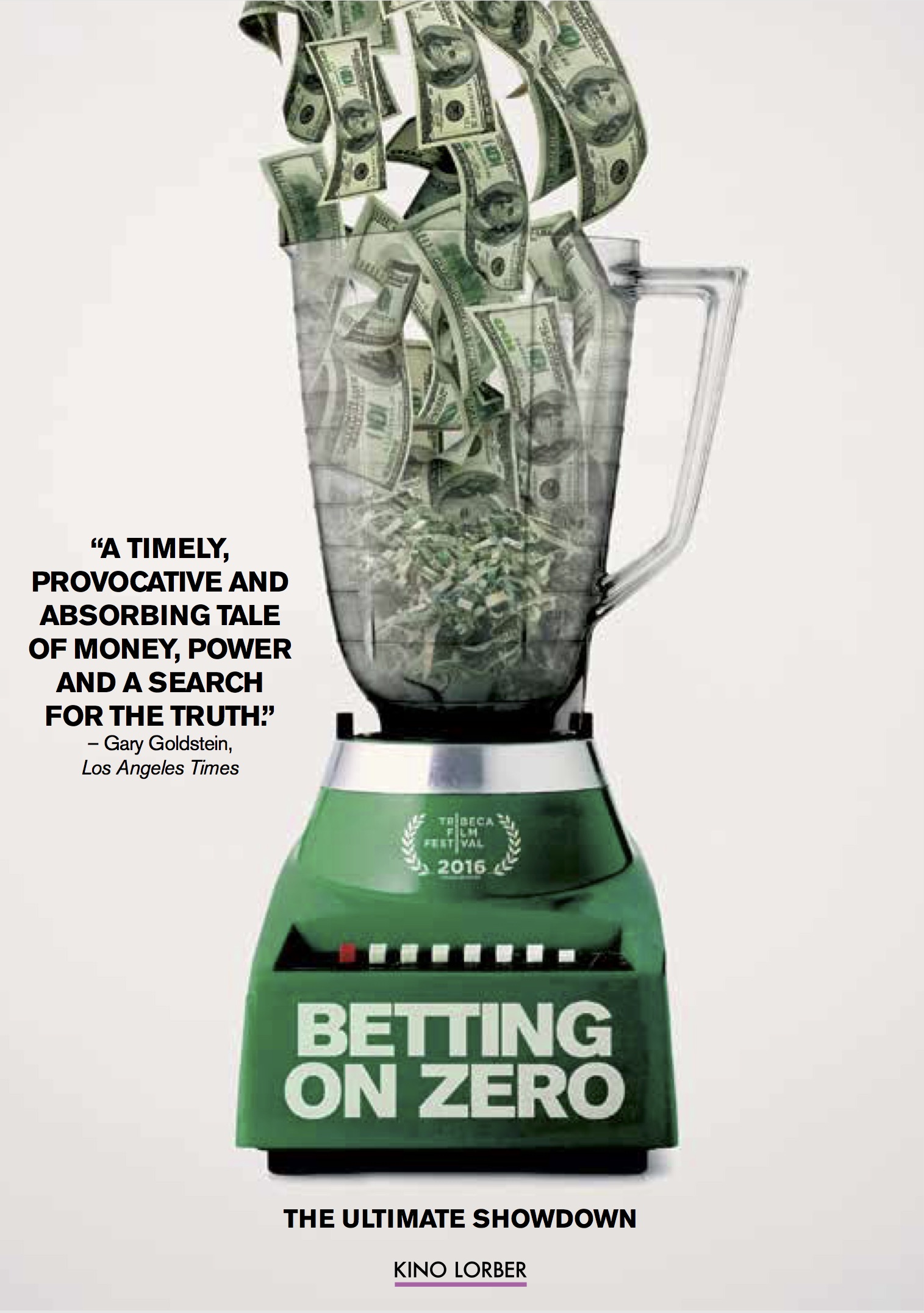

Wall Street usually feels like a math problem. Cold numbers. Stock tickers. But sometimes, it’s a blood sport. That’s exactly what director Ted Braun captured. If you’ve ever wondered why billionaires spend millions of dollars just to ruin each other, the Betting on Zero documentary is basically the best seat in the house you're gonna find. It isn't just a movie about a stock trade; it’s a horror story about the American Dream being sold as a powder in a plastic tub.

Money is weird.

People get obsessed with it. In this film, we see Bill Ackman—the hedge fund titan who looks like he was grown in a lab to manage capital—betting a staggering $1 billion against Herbalife. He wasn't just saying the stock would go down. He was calling it a pyramid scheme. He was trying to burn it to the ground. Honestly, watching him present his case is like watching a prosecutor who hasn't slept in three days. He's convinced he's the hero. But in the world of high-stakes short selling, heroes are hard to find.

The Massive Short and the Herbalife War

Most people don't get how short selling works, and the Betting on Zero documentary does a decent job of explaining the mechanics without being boring. Basically, Ackman bet that Herbalife’s stock price would go to zero. If the company collapsed, he’d make a fortune. If it stayed afloat, he'd lose everything. It's a binary outcome. It’s a heart attack in financial form.

✨ Don't miss: Why Is Zelle Taking So Long? What Most People Get Wrong

But then enters Carl Icahn.

Icahn is the old-school corporate raider who seems to live for spite. He didn't necessarily love Herbalife, but he definitely didn't like Bill Ackman. So, he bought in. He went long. He squeezed Ackman. It became a public, televised feud on CNBC that felt more like a professional wrestling match than a financial discussion. They were yelling. They were trading insults. Meanwhile, thousands of regular people were caught in the middle, wondering if the "business opportunity" they bought into was actually a trap.

The film spends a lot of time in the living rooms of regular people. These aren't billionaires. They're immigrants in suburbs, mostly from the Latino community, who spent their life savings on "nutrition clubs." They were told they were business owners. In reality, many were just the bottom of a very tall, very unstable pyramid. The contrast between Ackman’s sterile glass office and the dusty community centers where people lost $20,000 is jarring. It should be.

Why Everyone Got the Betting on Zero Documentary Wrong

There's this common misconception that the movie is just a hit piece funded by Ackman. Herbalife certainly wanted you to think so. They even set up websites to "debunk" the film before it even hit theaters. But if you actually watch it, Braun doesn't make Ackman look like a saint. He looks like a man possessed. He looks like a man who might be right about the math but wrong about the optics.

The real heart of the film isn't the stock price. It's the regulatory failure.

We see the FTC—the Federal Trade Commission—moving at the speed of a glacier. For years, activists like Julie Contreras pushed for investigations. They had the receipts. They had the victims. Yet, the system seemed rigged to protect the giant corporation over the individual. It’s frustrating. You’ll probably find yourself shouting at the screen at least once.

👉 See also: Avery Dennison Corporation Stock: Why Wall Street Is Still Chasing Labels

One of the most striking things is how Herbalife defended itself. They didn't just talk about products. They talked about "opportunity." They used the language of empowerment to deflect from the reality of their churn rate. Statistics cited in the film and surrounding legal battles suggested that the vast majority of distributors made little to no money. That's not a business; that's a lottery where the house always wins.

The Fallout: Who Actually Won?

If you're looking for a happy ending where the bad guys go to jail and the good guys get their money back, you’re gonna be disappointed. This is real life.

- Bill Ackman: He eventually exited his short position. He lost hundreds of millions of dollars. The market stayed irrational longer than he could stay solvent in that specific trade. He moved on to other things, but the "Betting on Zero" era remains a massive bruise on his reputation.

- Herbalife: They paid a $200 million settlement to the FTC in 2016. They had to restructure how they did business in the U.S. But they’re still here. The stock didn't go to zero. They just kept going, albeit with more oversight.

- The Victims: This is the part that sucks. Many of the people featured in the documentary never saw a dime of that settlement. $200 million sounds like a lot, but when split among hundreds of thousands of people, it’s a drop in the bucket.

The documentary manages to capture a specific moment in time when the "activist short" became a cultural phenomenon. It wasn't just about profit; it was about using the market as a tool for social justice, or at least pretending to. Whether you believe Ackman was a crusader or just a greedy shark, the film forces you to look at the mechanics of Multi-Level Marketing (MLM) under a microscope.

Practical Takeaways from the Herbalife Saga

If you’re watching the Betting on Zero documentary today, don't just treat it as a history lesson. The tactics haven't changed; they’ve just moved to Instagram and TikTok. MLMs are everywhere. They've rebranded as "social selling" or "influencer partnerships," but the underlying math is often the same.

- Check the Retentions: If a company makes more money from recruiting new members than selling actual products to outside customers, run. That is the definition of a pyramid scheme, legally and practically.

- Verify the Income Disclosure: Every legitimate MLM is required to publish an Income Disclosure Statement. Read it. Look at the "Median Income" for the bottom 90%. It’s usually zero or negative.

- Understand Short Interest: For the investors out there, the film is a masterclass in "crowded trades." Everyone knew Ackman was short. That made him a target. In the market, being right isn't enough; you have to be right at the right time.

- Look for the "Why": When a billionaire starts talking about "saving the world" through a stock trade, check their position. There is always a motive. Ackman might have been right about the harm Herbalife caused, but he also stood to make billions if they failed. Both things can be true at once.

The film is currently available on various streaming platforms, and honestly, it’s aged incredibly well. It’s a tight, tense 90 minutes that feels more relevant now as we deal with crypto scams and "get rich quick" schemes that look suspiciously like the nutrition clubs of 2012.

Watching the Betting on Zero documentary won't make you a Wall Street expert, but it will make you a lot more cynical about anyone promising you a "guaranteed" way to be your own boss. In the end, the only people who truly won in this story were the ones who didn't play the game in the first place.

How to protect yourself going forward

Before you join any "business opportunity" or invest in a company being targeted by activist shorts, do your own due diligence. Don't rely on the marketing materials. Look for independent audits. Look for lawsuits in the Pacer database. Talk to former distributors who quit, not just the ones currently making "six figures" on their Instagram stories. The truth is usually found in the people who left, not the ones who stayed.

If you suspect a company is operating an illegal pyramid scheme, you can report it directly to the FTC at reportfraud.ftc.gov. Your data point might be the one that finally triggers an investigation. Don't wait for a billionaire to do it for you.