Money talks. But the Dow Jones closing rate yells.

It’s 4:00 PM in New York. The bell rings at the New York Stock Exchange. In that split second, a single number flashes across screens from Tokyo to London, telling everyone exactly how "the market" feels today. It’s a pulse check. A heartbeat. If you’ve ever sat in a coffee shop and heard someone grumbling about their 401(k), they’re probably reacting to that final print on the Dow.

💡 You might also like: Why Remote Work Policies Are Actually Breaking Your Productivity

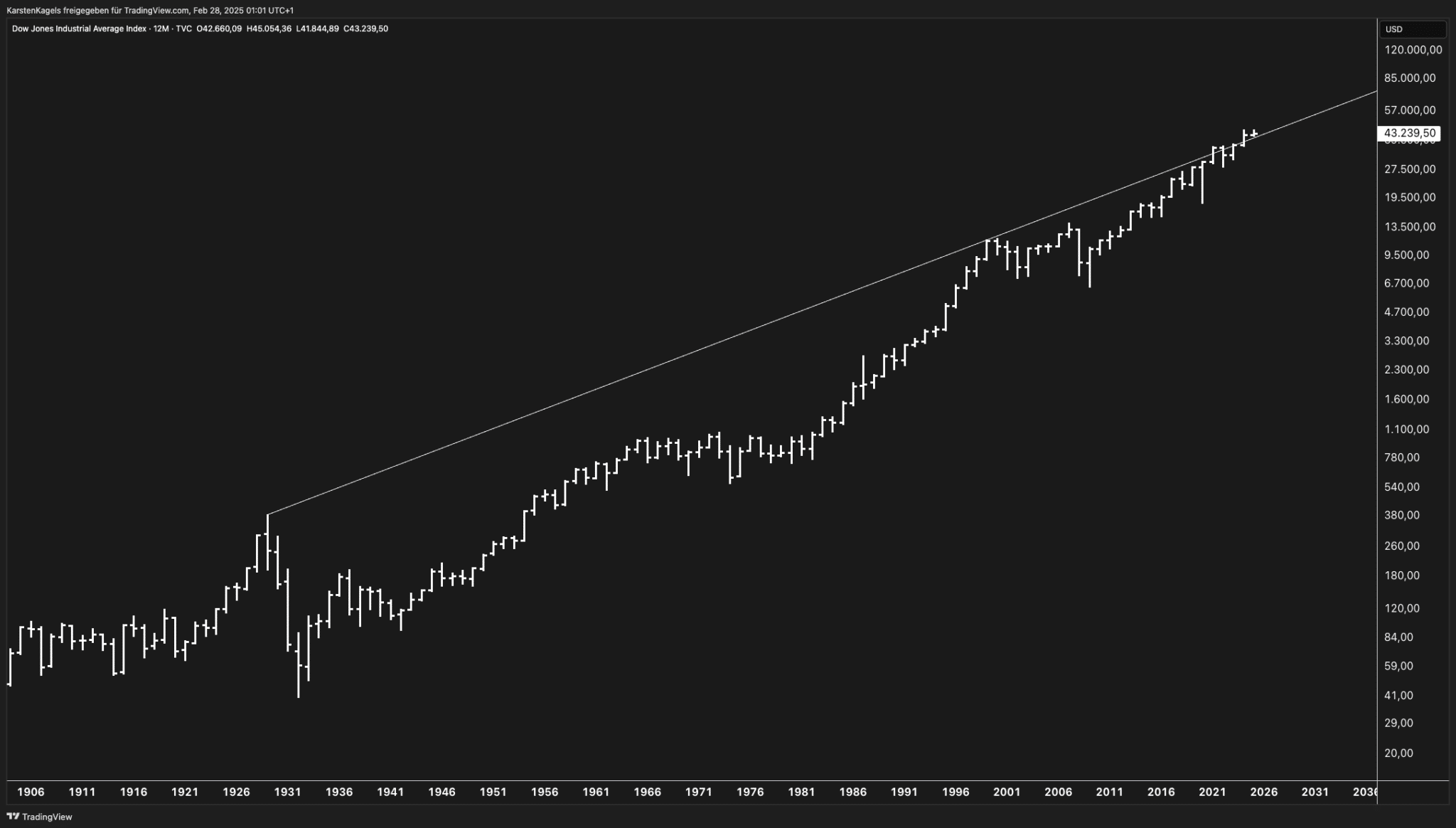

People love to hate the Dow Jones Industrial Average (DJIA). Critics call it an "old man's index" because it only tracks 30 companies. They say it’s price-weighted and weirdly balanced. They’re not entirely wrong. But here’s the thing: despite the rise of the S&P 500 and the tech-heavy Nasdaq, the Dow remains the most cited financial metric in history. It is the shorthand for American prosperity.

What the Dow Jones closing rate actually tells us

Most people think the index is a simple average of stock prices. It’s not. If you just added up the prices of the 30 stocks and divided by 30, you’d get a number that makes no sense every time a company did a stock split or swapped out a member. To fix this, the index uses something called the Dow Divisor.

The divisor is a constantly shifting number—currently a tiny fraction—that ensures the index remains consistent over time. Because the index is price-weighted, a $1 move in a high-priced stock like UnitedHealth Group (UNH) has a much larger impact on the Dow Jones closing rate than a $1 move in a lower-priced stock like Coca-Cola (KO) or Verizon (VZ). This creates a strange reality where the "health" of the Dow depends more on the share price of a company than its actual market capitalization.

Honestly, it’s a bit of a relic. But it’s a relic that works because of its constituents. These aren't startups. We are talking about Apple, Microsoft, Goldman Sachs, and Home Depot. These are the blue chips. When the closing rate drops 500 points, it means the giants of the global economy are having a rough day.

Why the 4:00 PM print is the only one that matters

Day trading is noisy. During the middle of a Tuesday, the index might swing wildly based on a random tweet or a misinterpreted headline. That’s just "noise."

The closing price is different. It represents the "final consensus" of the professional trading world. Institutional investors—the big banks, pension funds, and hedge funds—often execute their largest trades right at the close. This is where the real conviction shows up. When you see a "closing cross" at the NYSE, you're seeing billions of dollars changing hands at a single price point.

If the Dow Jones closing rate finishes at its "high of the day," it suggests that investors are confident enough to hold their positions overnight. If it "fades" into the close, it’s a sign of fear. Traders don't want to be left holding the bag when the sun comes up tomorrow.

The psychology of the Big Round Number

Humans are suckers for milestones. We can’t help it. There is no fundamental economic difference between the Dow being at 39,999 and 40,000. Not one. Yet, when the Dow Jones closing rate crosses a major thousand-point barrier, the headlines go crazy.

This creates a feedback loop.

🔗 Read more: Why 1133 Avenue of the Americas Still Dominates the Midtown Skyline

Retail investors see the "40k" headline and feel a sense of FOMO (fear of missing out). They call their advisors. They log into their apps. They buy. This momentum often pushes the index even higher. Conversely, when the index "fails" to hold a major level at the close, it can trigger a wave of algorithmic selling. The machines are programmed to watch these levels. They don't have emotions, but they respond to the collective emotions of the market participants who set those levels in the first place.

Common misconceptions about the daily rate

I hear this all the time: "The Dow is up today, so the economy is doing great."

Stop.

The stock market is not the economy. The Dow Jones closing rate is a reflection of corporate earnings expectations, interest rate trajectories, and global liquidity. It doesn’t tell you if the average person can afford eggs or if the local hardware store is hiring. In fact, sometimes the Dow goes up because the economy is cooling off, as investors bet that the Federal Reserve will cut interest rates to save the day.

Another big mistake? Comparing the Dow’s percentage moves to the S&P 500 and expecting them to be identical. Because the Dow is only 30 stocks, a single bad earnings report from a heavy-hitter like Boeing (BA) can drag the whole index down, even if the other 470 stocks in the S&P are doing just fine.

How to use the closing rate without losing your mind

If you’re checking the Dow every fifteen minutes, you’re probably stressing yourself out for no reason. Professional wealth managers look at the "closing print" as a data point, not a destiny.

📖 Related: How Much $1 in Indian Rupees Really Costs You Right Now

- Look at the trend, not the tick. One day of the Dow dropping 1% is a headline. Ten days of the Dow dropping 0.1% is a trend. The trend is what affects your retirement account.

- Watch the volume. A high-volume move at the close carries more weight than a low-volume move. If the Dow Jones closing rate spikes on low volume, it might just be a "head fake."

- Compare it to the "Equal Weighted" S&P. If the Dow is soaring but the average stock is flat, the market is "top-heavy." That’s usually a sign of an unhealthy rally led by just a few giant companies.

The Dow isn't perfect. It's quirky, it's old-fashioned, and it's mathematically weird. But it’s also the most famous scoreboard in the world. When you hear that final number tonight, remember that it’s not just a digit—it’s the collective decision of millions of people deciding what the future is worth.

Actionable Next Steps

To get a better handle on what the daily numbers actually mean for your money, start tracking the "Advance-Decline Line" alongside the Dow. This shows you how many stocks are actually rising versus falling. If the Dow is up but more stocks are falling than rising, the "closing rate" is lying to you about the market's true strength. Additionally, check the CBOE Volatility Index (VIX); if the Dow closes down and the VIX is spiking, prepare for a bumpy week. If the Dow closes down but the VIX stays flat, the market is likely just taking a breather.