If you’ve spent any time looking at your brokerage account lately, you’ve probably noticed something a bit lopsided. Your portfolio is likely heavy on the S&P 500. Maybe you've got some Nasdaq 100 in there too. It makes sense. U.S. tech has been on a tear for a decade. But there’s a massive world outside the 50 states that most investors basically ignore until they realize they’re over-concentrated. That’s where the FTSE Global All Cap ex US Index comes in.

It’s a mouthful. Honestly, the name sounds like something a lawyer dreamed up to win a game of Scrabble. But underneath the jargon, it’s one of the most elegant ways to own the entire planet—minus the United States.

👉 See also: S\&P 500: What Most People Get Wrong About the World’s Biggest Index

The index isn't just a list of "big international companies." It’s a massive net. It catches everything. Large caps, mid caps, and even the tiny small-cap companies that most international funds skip over. When you buy a fund that tracks this index, you aren't just betting on Toyota or Nestlé. You’re betting on the economic output of 48 different countries.

What the FTSE Global All Cap ex US Index Actually Tracks

Think of this index as a giant slice of the world economy. It represents about 98% of the investable market capitalization outside the U.S. That is roughly 7,000+ stocks.

Most people think "international" means Europe or Japan. They aren't wrong, but they're missing the full picture. The FTSE Global All Cap ex US Index is split between developed markets and emerging markets. You’re getting the stability of the Swiss franc and the growth potential of Indian tech all in one bucket. It’s balanced by market cap, so the bigger the company, the bigger the slice.

It covers the heavyweights. You’ve got Taiwan Semiconductor (TSMC), which basically runs the global chip industry. You’ve got ASML in the Netherlands. You’ve got Samsung. These aren't "alternative" investments. They are the backbone of modern life. Without them, your iPhone doesn't work and your car doesn't start.

One thing that surprises people is the small-cap exposure. Most international indexes, like the MSCI EAFE, only look at large and mid-sized companies in developed countries. They ignore the small players. They ignore emerging markets. The FTSE version says, "No, we want it all." That "All Cap" part of the name is doing a lot of heavy lifting. It means you’re catching the next big thing before it becomes a household name.

Why Investors Tend to Run Away From International Stocks

Let’s be real. International stocks have been "about to outperform" for like fifteen years. And for fifteen years, the U.S. has mostly kicked their teeth in.

It’s frustrating. You see the S&P 500 up 15% and the FTSE Global All Cap ex US Index up maybe 5% or 7%. It’s easy to ask, "Why bother?"

Home bias is a hell of a drug. We like what we know. We know Apple. We know Amazon. We don’t necessarily know the intricacies of a bank in Toronto or a mining company in Australia. But there's a danger in that comfort. Markets move in cycles. In the 1970s and the 2000s, international stocks absolutely crushed the U.S. market. If you were 100% in U.S. stocks from 2000 to 2009, you basically made zero money. It was the "Lost Decade." Meanwhile, emerging markets were on fire.

💡 You might also like: 20k a year is how much an hour: What Most People Get Wrong

Valuations matter. Right now, U.S. stocks are expensive. They’re priced for perfection. International stocks, by comparison, are sitting in the bargain bin. They have higher dividend yields on average. They have lower price-to-earnings ratios. You're essentially buying more earnings for every dollar you invest compared to the U.S. market. It's a classic "buy low" scenario that most people miss because they're too busy chasing what did well last year.

The Vanguard Connection: VXUS and VEU

You can’t talk about this index without talking about Vanguard. They’re the ones who made it famous. Most retail investors interact with the FTSE Global All Cap ex US Index through the Vanguard Total International Stock ETF, which goes by the ticker VXUS.

VXUS is basically the gold standard for this index. It’s cheap. The expense ratio is usually around 0.08%. That’s nearly free. For 8 cents on every $100, you get a piece of seven thousand companies. It’s absurd when you think about the logistics of buying those stocks individually. Imagine trying to open a brokerage account in Thailand, then another in France, then another in Brazil. You'd lose half your money in fees and paperwork.

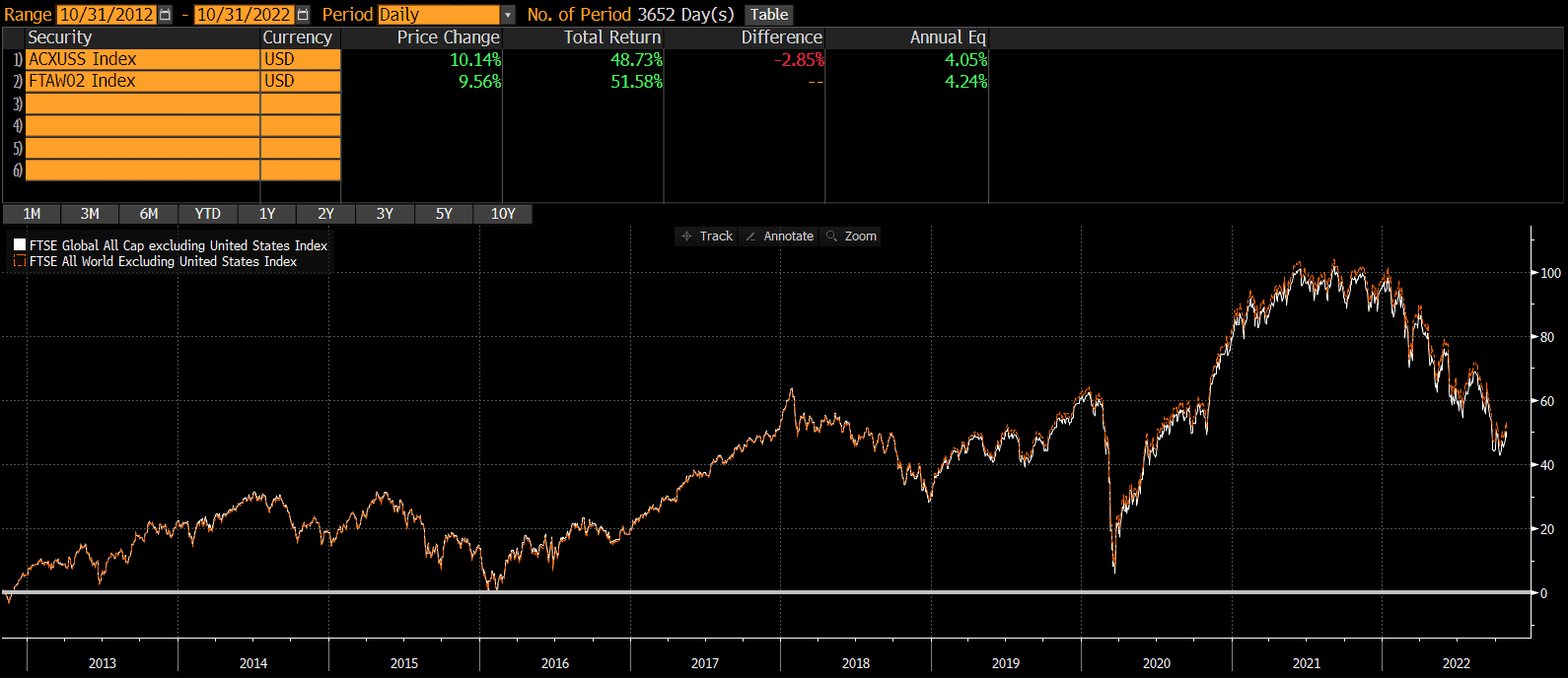

Some people get confused between VXUS and VEU. VEU tracks the FTSE All-World ex-US Index. Spot the difference? VEU misses the small caps. It’s "All-World," not "All Cap." Over long periods, those small caps in the VXUS/All Cap version can add a little extra juice to your returns, though they also bring a bit more volatility. For most people, the All Cap version is the more "complete" meal.

Real Risks: It’s Not All Sunshine and Dividends

I’m not going to sit here and tell you it’s a guaranteed win. There are real reasons why the FTSE Global All Cap ex US Index can feel like a drag on your portfolio.

Currency risk is the big one. When you invest in Toyota, you’re technically investing in Japanese Yen. If the U.S. Dollar gets stronger, your investment in Toyota is worth fewer dollars, even if the stock price in Japan stays the same. The "strong dollar" has been a massive headwind for international investors for years.

Then there’s the sector makeup. The U.S. market is tech-heavy. It’s growth-oriented. The international market is more "old school." You’ve got more banks, more energy companies, and more industrials. If tech is booming, the U.S. wins. If value stocks or commodities are booming, the FTSE Global All Cap ex US Index usually takes the lead.

Geopolitics is the wild card. Emerging markets make up about 25% of this index. That includes China. If there’s a trade war or a regulatory crackdown in Beijing, it’s going to hurt. You have to be okay with that volatility. You have to be okay with owning companies in countries where the rule of law might be a bit... flexible.

💡 You might also like: How Much is Peso to Dollar: What Most People Get Wrong Today

Why the "Ex-US" Strategy Actually Protects You

Diversification isn't about making the most money in a single year. It’s about not going broke when one specific thing fails.

If you only own U.S. stocks, you are making a massive bet on one country, one currency, and one legal system. That's a lot of eggs in one basket, even if that basket is the strongest one in the world right now. The FTSE Global All Cap ex US Index is your insurance policy.

It provides a different "flavor" of return. Because the international index has more exposure to financials and materials, it often reacts differently to inflation or interest rate changes than the S&P 500 does. When the U.S. market is flat, sometimes Europe is up. When China is struggling, maybe the UK is doing well.

The goal is to smooth out the ride. It’s about having a portfolio that doesn't rely on a handful of Silicon Valley companies to do all the work.

Actionable Steps for Your Portfolio

Don't just jump in blindly. Start by looking at your current allocation. Most "target date" funds or robo-advisors usually put about 30% to 40% of your stock allocation into international funds like those tracking the FTSE Global All Cap ex US Index.

- Check your overlap: If you already own a "Total World" fund like VT, you already own this index. Don't buy it again.

- Consider the tax implications: If you hold an international fund like VXUS in a taxable brokerage account, you might be eligible for the Foreign Tax Credit. This helps offset the taxes those foreign companies pay to their home governments. It’s a nice little "tax alpha" you don't get with U.S. stocks.

- Rebalance with discipline: If the U.S. keeps winning, your international slice will shrink. Once a year, sell some of your U.S. winners and buy more of the "ex-US" index. It feels wrong to sell what's working to buy what's "losing," but that is literally the definition of buying low and selling high.

- Don't overthink the "ex-US" part: Some people try to pick specific countries like "just India" or "just Germany." Unless you’re a professional macro-analyst, you’ll probably get the timing wrong. The beauty of the All Cap ex US index is that it makes those decisions for you based on market weight.

Investing in the global economy outside your own borders isn't just a "good idea." It's a fundamental part of a mature investment strategy. The U.S. is currently about 60% of the world's total stock market value. That leaves 40% of the world’s opportunity on the table if you aren't looking outside. The FTSE Global All Cap ex US Index is the simplest, cheapest, and most comprehensive way to grab that 40% and hold onto it for the long haul.

Look at your 401k or your IRA tonight. If you don't see a ticker symbol that represents the world outside the U.S., you've got a hole in your strategy. Fixing it doesn't take much effort, but it might be the thing that saves your retirement if the domestic market ever decides to take a decade-long nap.