You’ve probably seen it. That jagged, often terrifying line crawling across a Bloomberg terminal or a Yahoo Finance page. It looks like a mountain range designed by a caffeinated toddler. But that graph of bond yields is actually the heartbeat of the entire global economy. Honestly, if you want to know why your mortgage is expensive or why your tech stocks are tanking, you look at the yields. Everything else is just noise.

When people talk about "the market," they usually mean the Dow Jones or the S&P 500. That’s a mistake. The bond market is massive—way bigger than the stock market. It’s the "smart money." While stock traders are busy chasing the next AI hype cycle, bond traders are cold, calculating calculators of risk and inflation.

Reading the tea leaves of the Treasury curve

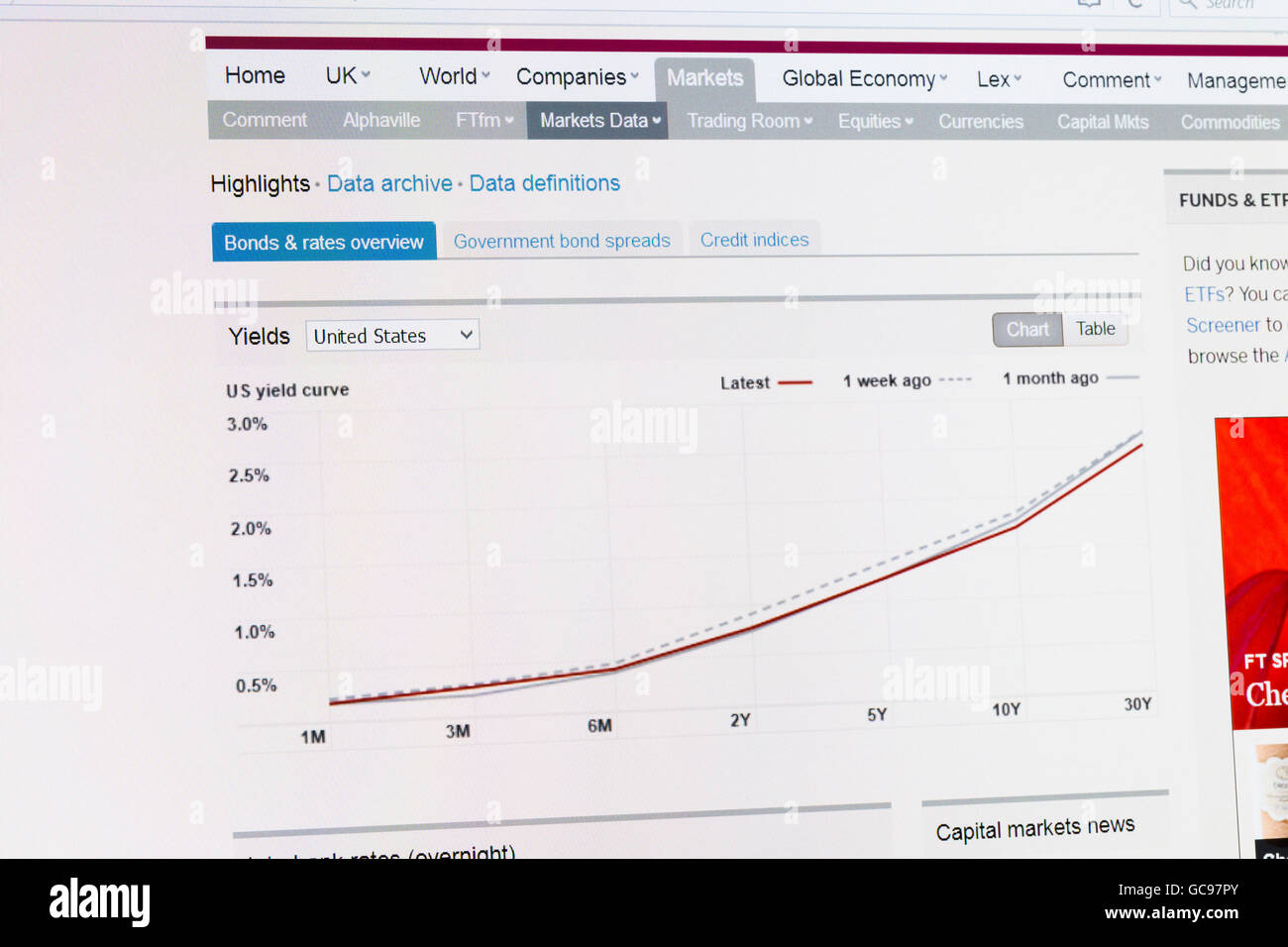

The most famous version of this is the U.S. Treasury yield curve. It’s basically a snapshot of what investors think interest rates will be in two years, ten years, or thirty years. Usually, it slopes upward. Why? Because lending money for thirty years is riskier than lending it for two. You want a higher "reward" for locking your cash away that long. Makes sense, right?

But lately, things have been weird. We’ve spent a lot of time looking at an inverted graph of bond yields. That’s when short-term rates are higher than long-term ones. It’s like the market is screaming that a recession is coming. It’s an omen. Historically, when the 2-year yield crosses above the 10-year yield, a recession follows within about 12 to 18 months. It’s not a perfect crystal ball, but it’s pretty close.

👉 See also: How Do You Say Hyundai: Why We All Got It Wrong For Decades

Think about the psychology there. If investors are willing to accept a lower return for a 10-year commitment than a 2-year one, they’re basically saying, "I’m scared of the near future, so I’ll lock in whatever I can get for the long haul."

The 10-Year Treasury: The world’s benchmark

If the economy has a North Star, it’s the 10-year Treasury yield. This single number dictates the "risk-free rate." Every other investment is measured against it. If you can get 4.5% from the U.S. government—the safest borrower on the planet—why would you buy a risky corporate bond for 5%? You wouldn’t. You’d demand 7% or 8%.

When the graph of bond yields spikes, it’s like a vacuum cleaner sucking liquidity out of the room. Borrowing gets harder. Companies stop hiring. People stop buying houses because their monthly payment just jumped $800.

Why the "Long End" is acting so crazy

We’ve seen some massive swings in the 10-year and 30-year yields recently. Experts like Ed Yardeni have pointed toward the "Bond Vigilantes." These are the guys who sell off bonds when they think the government is spending too much money. When they sell, prices go down, and yields go up.

It’s a tug-of-war. On one side, you have the Federal Reserve trying to control the short-term rates. On the other side, you have the actual market—pension funds, foreign governments, and banks—deciding what the long-term rates should be. Sometimes they don't agree. When they don't, the graph of bond yields starts looking like a heart monitor during a marathon.

The "term premium" is a phrase you’ll hear economists toss around. It’s basically the extra compensation investors want for the "unknown unknowns" of the future. For years, this premium was basically zero or even negative. Now? It’s clawing its way back. People are waking up to the fact that inflation might be stickier than we thought.

Real yields vs. Nominal yields

Don't let the jargon scare you. It's simpler than it sounds. Nominal yield is the number you see on the screen. Real yield is that number minus inflation. If your bond pays 5% but inflation is 6%, you’re actually losing 1% of your purchasing power every year. You're getting poorer, just slowly.

🔗 Read more: Positive work quotes for tuesday: Why they actually help you get more done

Investors watch the graph of bond yields adjusted for inflation (often using TIPS, or Treasury Inflation-Protected Securities) to see if the economy is actually "tight." If real yields are high, it means money is actually expensive. That puts a massive ceiling on how high the stock market can go. High real rates are the ultimate "fun sponge" for Wall Street.

The connection to your mortgage and car loan

Most people don't own bonds. They own houses. But guess what? The 30-year fixed mortgage in the U.S. is pegged almost directly to the 10-year Treasury yield. They move in lockstep.

When the 10-year yield goes up by 1%, your mortgage rate usually follows. That’s why the graph of bond yields matters to regular people. It’s the difference between being able to afford a three-bedroom house or being stuck in a studio apartment.

- Yields Up: Mortgage rates rise, housing market cools, car loans get pricier.

- Yields Down: Refinancing booms, stocks usually rally (unless it's because of a crash), and borrowing feels "easy" again.

What the "Basis Trade" tells us about stability

There’s a darker side to these charts. Hedge funds often use massive amounts of debt (leverage) to bet on tiny differences between the price of a bond and the price of a bond future. It’s called the basis trade.

When the graph of bond yields gets too volatile, these trades can blow up. We saw a version of this in March 2020 when the bond market—the most liquid market in the world—basically froze. The Fed had to step in with trillions of dollars just to keep the pipes from bursting.

It shows how fragile the system is. We treat these graphs as abstract lines, but they represent the plumbing of global civilization. If the plumbing leaks, everyone gets wet.

Looking at the "Big Picture" history

If you look at a graph of bond yields over the last 40 years, it’s been a long, slow slide down. From the double-digit highs of the Paul Volcker era in the early 80s to the "Zero Interest Rate Policy" (ZIRP) era after 2008.

We got used to cheap money. We thought it was permanent.

But the 40-year bull market in bonds is likely over. We’ve hit the floor and bounced. Now, we’re in a regime where "higher for longer" isn't just a catchphrase; it’s a reality. This shift changes everything. It changes how you save for retirement. It changes how governments fund their deficits. It changes the very definition of "value" in the stock market.

Real-world impact: The UK "Mini-Budget" disaster

Remember when Liz Truss was the UK Prime Minister for about five minutes? Her "mini-budget" proposed huge tax cuts without saying how they’d be paid for. The graph of bond yields (Gilts, in the UK) spiked so fast it nearly collapsed their entire pension system.

The market looked at the plan, hated it, and started dumping bonds immediately. It was a brutal reminder that even governments have to answer to the bond market. You can't just print and spend without consequences. The yields will always find the truth.

Practical steps for navigating this volatility

You don't need to be a bond trader to use this information. You just need to be aware of the signals. When you see yields rising sharply, it’s usually a bad time to take on new debt. It might be a good time to look at "Cash equivalents" like Money Market funds, which are finally paying decent interest after a decade of nothing.

Monitor the 10-Year Treasury yield weekly. If it starts breaking above 4.5% or 5%, expect turbulence in the stock market, especially in growth and tech sectors that rely on cheap borrowing.

Check the spread. Look at the difference between the 2-year and 10-year yields. If the 10-year is significantly lower (inversion), keep your emergency fund extra padded. A recession might not be tomorrow, but the market is pricing in trouble.

Diversify with duration in mind. If you think interest rates have peaked, "long-duration" bonds (like the TLT ETF) might gain value because bond prices move opposite to yields. If you think inflation is coming back, stay "short-term" or look at inflation-protected assets.

Stop ignoring the boring stuff. The graph of bond yields might not be as exciting as a crypto pump-and-dump or a new iPhone launch, but it's the foundation of your financial life. Ignore the foundation, and the house eventually falls down. Keep your eyes on the lines; they tell the story before the headlines do.