You’ve seen it. That big "X" on the chalkboard in every intro economics class. It looks simple—maybe too simple. Two lines crossing in a void. But honestly, that supply and demand chart is basically the heartbeat of the world. It’s why your eggs cost six dollars last year and why you can’t find a cheap house in Austin or Nashville right now. It isn't just academic fluff; it's the literal engine of every transaction you've ever made.

Prices don't just "happen."

Companies don't just pick a number out of a hat, though it sometimes feels that way when you're looking at a $12 cocktail. Everything is a constant, vibrating negotiation between the people making stuff and the people buying it.

The Intersection Where Everything Happens

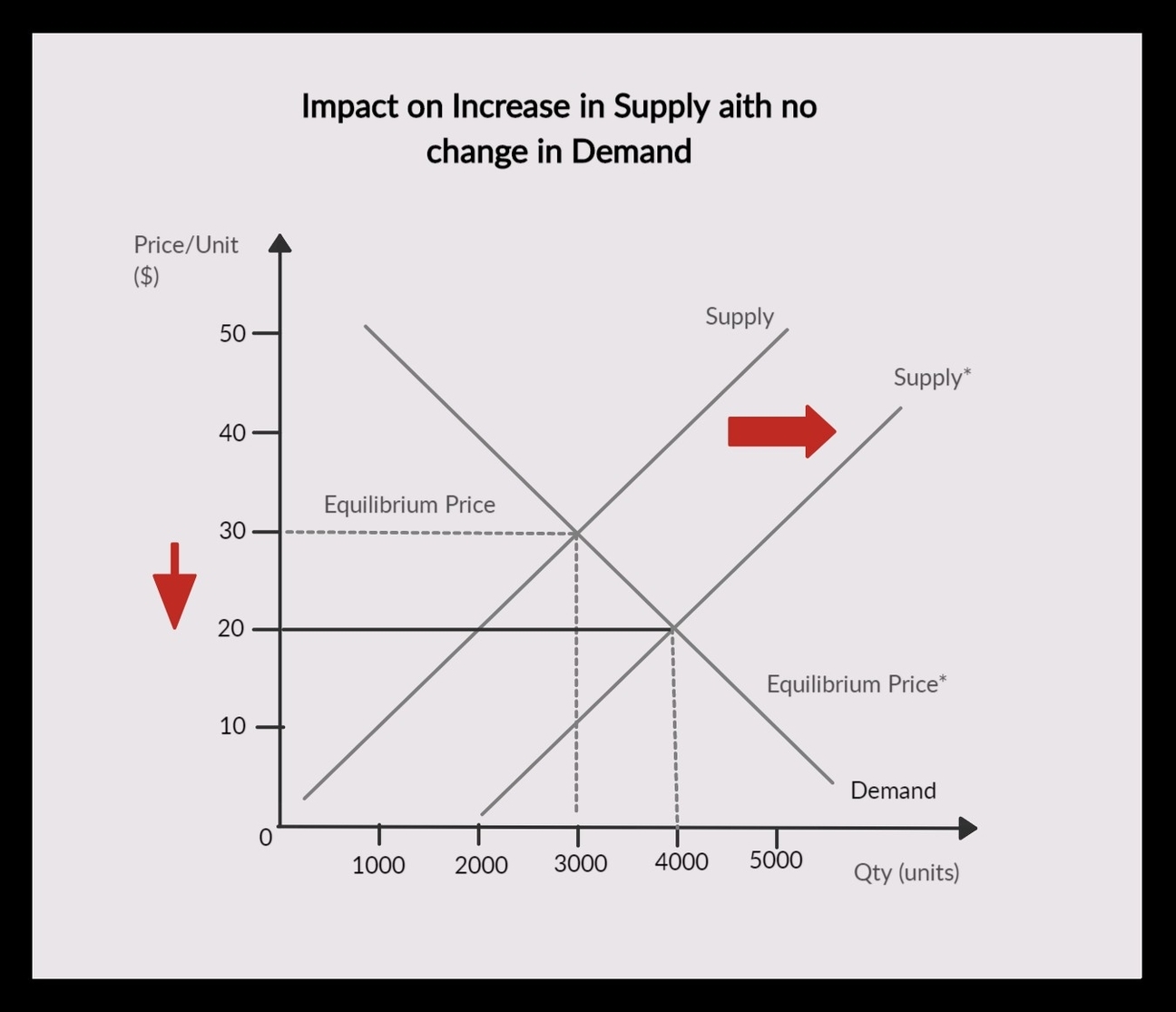

Let’s look at the supply and demand chart for a second. You have the supply curve—that's the one heading up and to the right. It represents the producers. Basically, the higher the price they can get, the more they want to sell. Why wouldn't they? If you're selling lemonade and people are willing to pay $50 a glass, you’re going to be out there squeezing lemons until your hands bleed.

Then you have the demand curve. This one slopes down. It’s the consumer’s point of view. As things get more expensive, we buy less of them. It’s the "forget it, I'll wait for a sale" line.

Where they meet is the equilibrium.

This is the sweet spot. In a perfect world, this is where the amount of stuff producers want to sell exactly matches what buyers want to buy. Economists like Alfred Marshall, who really popularized this graphic in his 1890 book Principles of Economics, saw this as a sort of natural law, almost like gravity. But in the real world? Equilibrium is a moving target. It’s messy.

What Shifts the Lines?

The lines move. All the time. If a celebrity mentions a specific brand of vintage sneakers, the demand curve for those shoes teleports to the right. Suddenly, the price goes vertical. This isn't just theory; we saw it with the "Stanley Cup" craze. A product that sat on shelves for years suddenly became a social necessity. The supply stayed the same (initially), but demand exploded.

Result? Resale prices that make no sense.

On the flip side, supply can crash. Think about the 2021 semiconductor shortage. You couldn't get a new Ford or a PlayStation 5 because a few factories in Taiwan and Korea couldn't get the components they needed. On our supply and demand chart, the supply curve shifted violently to the left. When supply drops and demand stays high, the price point—that intersection—climbs up the Y-axis.

It’s why used cars were suddenly worth more than new ones. It felt like a glitch in the matrix, but it was just the chart doing its thing.

The Myth of the "Rational" Consumer

Most textbooks assume you are a "rational actor." They think you have all the information and make the best choice for your wallet.

They're wrong.

People are weird. We buy things because we're sad, or because we want to impress a neighbor we don't even like. This is where Behavioral Economics comes in. Guys like Richard Thaler (who won a Nobel Prize for this) proved that the supply and demand chart needs a human element. Sometimes, raising the price of a luxury good actually increases demand because it makes the item feel more exclusive. This is called a Veblen good. Think Rolex or Hermès. If a Birkin bag cost $40, nobody would want it.

The chart usually says "price up, demand down." Veblen goods say "hold my champagne."

Real World Friction

There’s also the issue of "sticky prices." In a perfect world, if demand drops, prices should drop instantly. But have you ever noticed that a restaurant rarely lowers its prices just because it's a slow Tuesday? They’d rather have empty tables than deal with the "menu costs" of printing new prices or devaluing their brand.

Information isn't perfect either.

When you’re looking at a supply and demand chart, you're assuming everyone knows what the "fair" price is. But if you’re at a tourist trap in Rome, you might pay 10 Euros for a bottle of water because you don't know there's a grocery store around the corner selling it for 50 cents. That's information asymmetry. It distorts the lines.

🔗 Read more: Official Trump Meme Coin: What Most People Get Wrong

Why Your Rent Is So High

Let’s get into the heavy stuff: Housing. This is the most painful application of the supply and demand chart today. In cities like San Francisco or New York, the supply of housing is what we call "inelastic." It’s a vertical line. You can’t just "make" more land. You can’t build a 50-story apartment complex overnight—it takes years of permits and construction.

So, supply is stuck.

But demand? Demand keeps growing as people move for jobs. When you have a fixed supply and rising demand, the price intersection only goes one way: up. This is why economists like Edward Glaeser argue that the only way to fix the housing crisis is to make the supply curve more "elastic"—meaning we need to make it easier to build so the supply can actually respond when demand goes up.

If you don't build, the chart wins. Every time.

The Role of Elasticity

Elasticity is just a fancy word for "how much do people care about price changes?"

If the price of salt doubles, you’ll probably still buy it. It’s cheap, and you need it. That’s inelastic. If the price of a specific brand of frozen pizza doubles, you’ll just buy a different brand or get a taco. That’s elastic.

When companies look at their supply and demand chart, they are desperately trying to figure out how "stretchy" your demand is. If they can convince you that their product is a necessity (like an iPhone), they can push that price higher without losing too many customers.

Surprising Distortions: Subsidies and Floors

Sometimes the government steps in and puts a thumb on the scale. They might set a "price floor," like the minimum wage. Or a "price ceiling," like rent control.

While these come from a good place, they often create what's called deadweight loss.

If the government sets a price ceiling on milk that is below the equilibrium point, farmers might stop producing it because they can't make a profit. Then you get shortages. You have plenty of demand, but the supply curve has been artificially chopped off.

We saw this in history with the gasoline lines in the 1970s. The price wasn't allowed to rise to meet the scarcity, so instead of paying with money, people paid with their time—sitting in cars for hours hoping to get a few gallons.

The supply and demand chart always finds a way to balance out, even if that balance is "nobody gets anything."

Actionable Insights for the Real World

Understanding this isn't just for passing a test. It’s for surviving the economy.

- Timing the Market: If you see a supply shock (like a frost in Florida affecting oranges), realize that the price hike is coming. Buy your juice now or switch to apple juice for a few months.

- Negotiation Power: If you’re selling a house or a car, you want to create "artificial scarcity." This pulls the supply curve back in the buyer's mind, making your "equilibrium" price higher.

- Career Planning: Your salary is governed by this same chart. If you have a skill that everyone has (high supply), your "price" (wage) stays low. If you learn a niche, difficult skill like AI ethics or specialized underwater welding (low supply) and companies need it (high demand), your personal equilibrium point skyrockets.

- Recognizing Hype: Before buying into a trend, ask if the price is high because of value or just a temporary demand spike. If it’s just a shift in the demand curve due to "social proof," it will eventually shift back. Don't be the one holding the bag when the curve resets.

Price is just a signal. It's a piece of data wrapped in a dollar sign. When you look at a supply and demand chart, you're looking at the collective soul of everyone in the market trying to find a way to agree on what something is worth. It’s never static, and it’s never quite fair, but it’s the most honest map we have for how the world actually works.

🔗 Read more: US Market Open Time: Why 9:30 AM is Only Half the Story

To apply this practically, start tracking the "price signals" in your own life. When you see a sudden jump in the cost of a service you use, don't just get annoyed—look for the shift. Is it a labor shortage (supply)? Or has a new regulation made it harder to operate (shifting the curve)? By identifying the cause, you can predict whether the price is a temporary "blip" or a new permanent reality, allowing you to adjust your budget before the crunch hits.