Money isn't free. Most people realize this when they look at their credit card statement or a mortgage quote, but they rarely look at the source code of the global economy. That source code is the US 2 year bond yield. It’s basically the heartbeat of the market. If it spikes, your car loan gets more expensive. If it craters, something is usually very wrong with the American economy.

The yield on the two-year Treasury note is a weird, sensitive beast. It represents the interest rate the U.S. government pays to borrow money for exactly twenty-four months. Because it’s such a short window, it doesn't care about what might happen in twenty years. It cares about right now. It cares about what Jerome Powell and the Federal Reserve are whispering behind closed doors. Honestly, if you want to know where interest rates are going, stop listening to the talking heads on TV and just look at the two-year.

The Fed's Best Friend (and Worst Enemy)

There is a tight, almost obsessive relationship between the US 2 year bond yield and the federal funds rate. Think of the Fed as the driver of a car and the two-year yield as the person sitting in the passenger seat trying to grab the steering wheel.

When the Fed raises rates to fight inflation, the two-year yield climbs almost immediately. Sometimes it even moves before the Fed makes a move. It's predictive. Traders are constantly betting on what the central bank will do next, and those bets are placed right here. If the market thinks a rate hike is coming in June, you’ll see the two-year yield start creeping up in April or May. It’s a leading indicator that rarely lies.

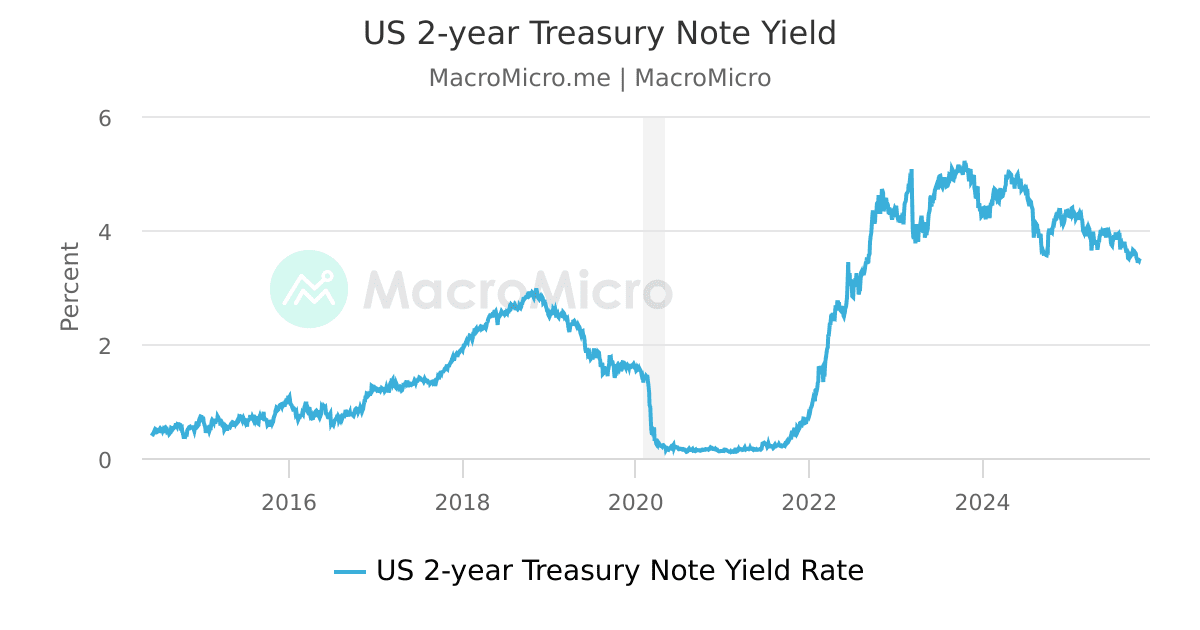

For instance, look at the chaos of 2022 and 2023. As inflation became "sticky," we saw the two-year yield tear through the 4% and then the 5% barrier. It wasn't just a number on a screen. It was a signal that the era of cheap money was officially dead. The yield acts like a giant magnet. When it goes up, it pulls other interest rates—like those for 24-month auto loans or personal lines of credit—up with it.

💡 You might also like: Shark Tank México: Why It Actually Works Differently Than The US Version

Why the two-year matters more than the ten-year right now

You’ve probably heard people drone on about the "benchmark" 10-year Treasury. Sure, it’s important for mortgages. But the 10-year is a long-term play on growth and demographics. The US 2 year bond yield is a play on policy. It's the most sensitive part of the yield curve to what the Federal Reserve is doing.

When the two-year yield is higher than the ten-year yield, you get what's called an inverted yield curve. It’s basically the bond market’s way of screaming, "We think a recession is coming!" This happens because investors are so worried about the near future that they demand more interest to hold debt for two years than they do for ten years. It’s counterintuitive. It’s also one of the most reliable recession predictors in the history of modern finance.

The Mechanics of How the Yield Actually Moves

Yields and prices have an inverse relationship. If you remember nothing else, remember that. When bond prices go down, yields go up.

Imagine you buy a $1,000 bond that pays 2%. If interest rates in the broader economy suddenly jump to 5%, nobody is going to want to buy your 2% bond for the full $1,000. Why would they? They can get 5% elsewhere. So, to sell your bond, you have to drop the price. As the price drops, the fixed interest payment of $20 becomes a larger percentage of the new, lower price. Boom. The yield goes up.

The US 2 year bond yield fluctuates every single day based on:

- CPI Data: If inflation is higher than expected, yields usually jump.

- Jobs Reports: A "hot" jobs market suggests the Fed might need to keep rates high to prevent the economy from overheating.

- Geopolitical Stress: When a war starts or a major bank looks shaky, investors flee to the safety of Treasuries. This "flight to quality" pushes bond prices up and yields down.

It’s a constant tug-of-war.

The 2024-2025 Pivot Point

Recently, we've seen the US 2 year bond yield react violently to the concept of "higher for longer." For a while, the market was convinced the Fed would start slashing rates the moment inflation dipped. They were wrong. The two-year yield stayed stubbornly high because the economy remained surprisingly resilient.

You have to look at the "Real Yield" too. That’s the yield minus inflation. If the two-year is at 4.5% and inflation is at 3%, you’re getting a real return of 1.5%. That’s actually pretty decent for a "risk-free" asset. It’s why so much money has stayed on the sidelines in money market funds instead of flowing back into the stock market or real estate. Why risk your shirt on a tech stock when you can get a guaranteed 4-5% from the US government?

Misconceptions That Could Cost You Money

Most people think a rising US 2 year bond yield is always bad. It's not.

📖 Related: Marc Chaikin AI Stock Pick: The Strategy Nobody Is Talking About

A rising yield can mean the economy is growing so fast that it can handle higher interest rates. It’s a sign of health, sort of. The problem is the speed of the move. If the yield jumps 50 basis points (0.5%) in a week, things start to break. Regional banks, for example, tend to hate rapid yield increases because it lowers the value of the older, lower-interest bonds they hold on their books. Remember Silicon Valley Bank? That was essentially a "yield curve" tragedy.

Another myth is that you can't trade this. You can. While most people don't buy individual Treasury notes, they do buy ETFs like the SHY (iShares 1-3 Year Treasury Bond ETF). If you think rates are going to drop, you buy the ETF. If you think they're going to keep rising, you stay away or look at inverse products.

The Psychology of the 2-Year

There’s a human element here. Traders are people. When the US 2 year bond yield hits a psychological level—like 5.00%—everyone panics or celebrates. It’s a line in the sand.

When we were stuck near 0% for years, the two-year yield was boring. It was a flatline. Now, it’s the most volatile thing in the room. This volatility is a direct reflection of our collective uncertainty about the future of the US dollar and the strength of the American consumer.

Real-World Impact on Your Wallet

You might think, "I don't own bonds, so who cares?"

You do care. You just don't know it yet. The US 2 year bond yield dictates the "risk-free rate of return." This is the foundation upon which all other assets are priced. When this yield goes up, the "discount rate" used to value stocks also goes up. Basically, future earnings from companies like Apple or Nvidia are worth less in today's dollars when yields are high. That’s why the Nasdaq often tanks when the two-year yield spikes.

Then there’s the debt. Most corporate debt is short-term. Companies constantly need to "roll over" their debt. If a company had a loan at 2% and it expires today, they might have to refinance at the current US 2 year bond yield plus a "spread." If that new rate is 6% or 7%, that company’s profits just got nuked. This leads to layoffs. This leads to less R&D. This leads to you.

Tracking the Data Like a Pro

If you want to stay ahead, don't wait for the evening news. Use tools like the CME FedWatch Tool. It shows you the probability of future rate hikes based on where bond traders are putting their money.

Also, watch the "auction" results. Every so often, the Treasury sells new 2-year notes. If the "bid-to-cover" ratio is low, it means there isn't much demand. Low demand means yields have to go up to attract buyers. If the big players—like central banks in Japan or China—stop buying our debt, the US 2 year bond yield will skyrocket, regardless of what the Fed wants.

The Yield Curve Normalization

We spent a record amount of time in an "inverted" state. Eventually, the curve has to "un-invert." Usually, this doesn't happen because the 10-year yield goes up. It happens because the US 2 year bond yield crashes. Why would it crash? Because the Fed sees a recession and starts cutting rates aggressively to save the economy.

Watching the gap between the 2-year and the 10-year is like watching a slow-motion car crash. You know the impact is coming; you just don't know exactly when the metal will crunch.

Summary of Actionable Steps

Don't just stare at the chart. Use the information.

Watch for the "Pivot"

If the US 2 year bond yield starts falling consistently while the Fed is still talking tough, the market is calling their bluff. The market usually wins. This is often a signal to start looking at growth stocks again.

Check Your Cash

If the yield is high, make sure your bank is paying you a high APY on your savings. If the 2-year is at 4.5% and your "high yield" savings account is paying 0.50%, you are being robbed. Move your money into a Money Market Fund or a short-term Treasury ETF.

👉 See also: Eaton Corporation Cooper Industries: How This $11.8 Billion Power Play Changed the Grid Forever

Mind Your Fixed-Income Exposure

If you are nearing retirement, a high US 2 year bond yield is actually a gift. You can lock in "risk-free" returns that we haven't seen in over a decade. But stay short. Don't lock your money away for 30 years if you think inflation might stay high. The two-year is the "sweet spot" for many investors right now.

Monitor Corporate Health

Keep an eye on companies with a lot of short-term debt. If the two-year yield stays elevated, these companies will struggle to refinance. This is especially true for "zombie firms" that only survived because interest rates were near zero for so long.

The yield isn't just a decimal point on a Bloomberg terminal. It is the cost of time. It is the price of risk. In the next few months, as the Fed grapples with a cooling economy and persistent price pressures, the US 2 year bond yield will be the clearest map we have. Ignore the noise. Follow the yield.