You’ve probably seen it sitting there in your retirement account menu. It’s not flashy. It doesn’t make headlines like Nvidia or Bitcoin. Honestly, the Vanguard Total Bond Market II Index Fund is about as exciting as watching paint dry, but that is exactly why it exists.

Most people mistake it for its more famous sibling, BND (the Total Bond Market ETF). They aren’t the same. This one, often referred to by its ticker VTBIX or VTBNX depending on the share class, is a "fund of funds" component or a specific institutional vehicle designed to be the bedrock of a portfolio. It tracks the Bloomberg U.S. Aggregate Float Adjusted Index. That sounds like jargon, but it basically means it buys a little bit of almost every high-quality bond in America.

We’re talking about over 10,000 different bonds.

If you own a Target Date Fund through Vanguard, you already own this. It’s the engine under the hood. While everyone else is arguing about whether the Fed will cut rates by 25 or 50 basis points, this fund just keeps collecting interest payments from the U.S. Treasury and massive corporations. It’s boring. It’s steady. And for most investors, it’s the only bond exposure they actually need.

The Secret Identity of the Vanguard Total Bond Market II Index Fund

Why the "II" in the name? This trips people up. Vanguard created this specific version primarily to serve as a building block for their other funds. If you look at the Vanguard Target Retirement 2045 Fund, for instance, you won't see it buying individual Treasury notes. Instead, it buys a massive chunk of the Vanguard Total Bond Market II Index Fund.

It’s an internal efficiency play.

By using this "II" version, Vanguard can manage the massive inflows and outflows of their target-date series without triggering the same tax consequences or administrative hurdles of the standard Investor or Admiral shares. For you, the individual investor, this usually means you can’t just go out and buy VTBIX with the $500 sitting in your brokerage account. Usually, you need to be a massive pension fund, or you’re getting it through a collective investment trust (CIT) in your employer’s 401k.

Don't feel left out. The underlying "guts" are nearly identical to the VBTIX (Total Bond Market Index Fund). You're getting exposure to U.S. Treasuries, mortgage-backed securities, and investment-grade corporate bonds. It’s the "Aggregate" market.

What Actually Lives Inside This Fund?

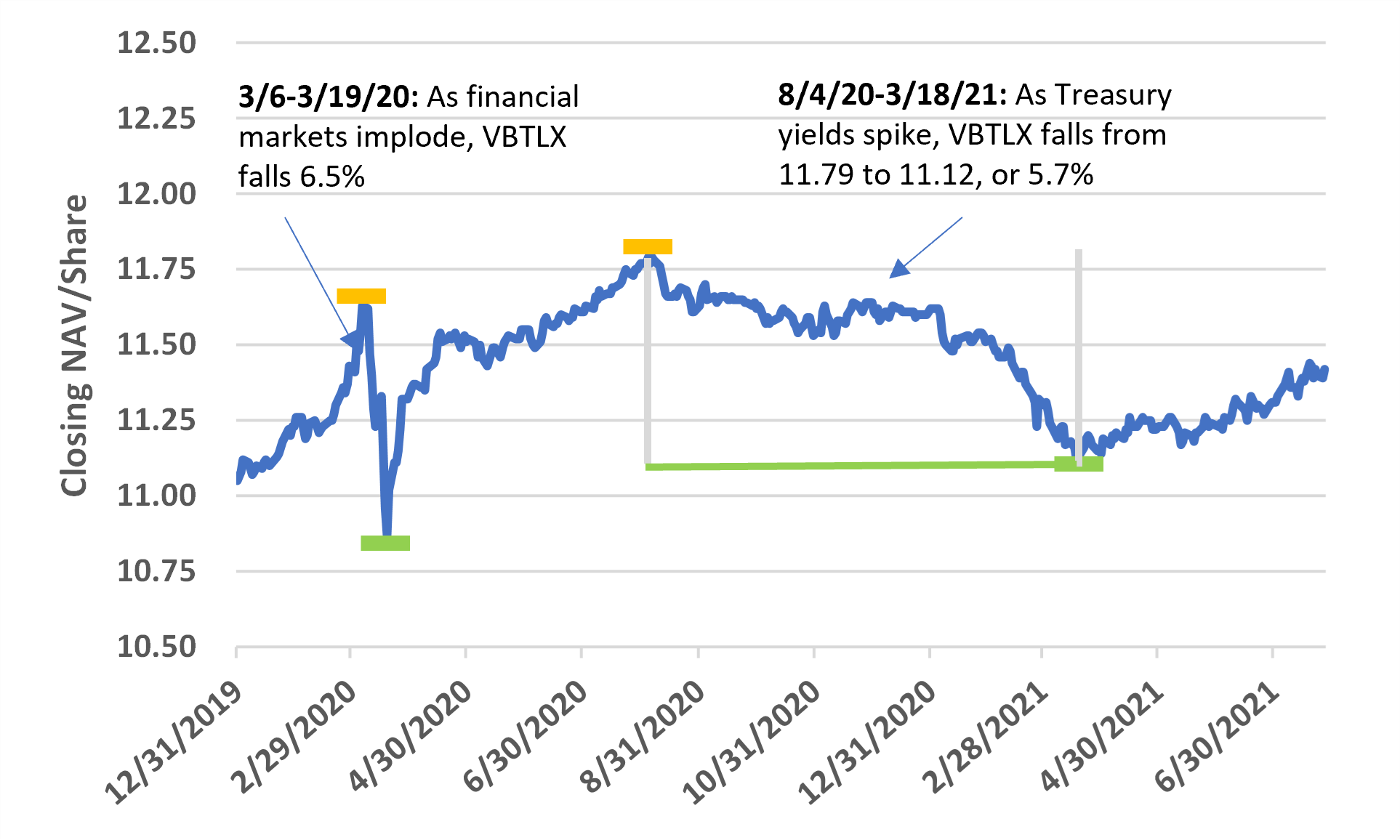

If you cracked open the Vanguard Total Bond Market II Index Fund, you’d see a lot of government debt. About 60% or more of the fund is usually backed by the full faith and credit of the U.S. government. This is your "sleep at night" insurance. When the stock market decides to dive off a cliff—like it did in early 2020 or during the 2008 mess—investors sprint toward Treasuries.

But it’s not just boring government IOUs.

The fund also holds a significant amount of corporate bonds from companies like Apple, Microsoft, and JPMorgan Chase. These are "investment grade." They aren't "junk." They pay a slightly higher interest rate than the government because, let's be real, there’s a slightly higher (though still tiny) chance a bank could struggle compared to the U.S. Treasury.

The third big slice is mortgage-backed securities (MBS). When your neighbor pays their mortgage, a tiny fraction of that interest might eventually flow into this fund. It’s a massive, diversified web of American debt.

Why the 2022-2023 Period Was Brutal

We have to talk about the elephant in the room. For decades, bonds were considered "safe." Then 2022 happened. The Federal Reserve hiked rates faster than almost any time in history.

Bond prices and interest rates have an inverse relationship. It's a see-saw. When rates go up, the price of existing bonds goes down. Because the Vanguard Total Bond Market II Index Fund holds bonds with an average duration of around 6 to 7 years, it got hit hard.

Some investors saw their "safe" bond fund drop 13% or more in a single year. It was a shock to the system.

But here is the nuance: the "Total Bond" strategy is designed for the long haul. Those older, lower-paying bonds eventually mature, and the fund managers replace them with new bonds paying 4%, 5%, or more. The "pain" of 2022 set the stage for much better "gain" in 2025 and 2026. If you're holding this fund today, you're actually earning a real yield for the first time in a long time.

Vanguard Total Bond Market II Index Fund vs. The Competition

You’ll often hear people mention the iShares Core U.S. Aggregate Bond ETF (AGG) or the SPDR Portfolio Aggregate Bond ETF (SPAB). They all do roughly the same thing. They all track the "Agg."

The difference with Vanguard is the structure.

💡 You might also like: How Much Is One Share of NVDA Today: Why Everyone Is Watching $186

Vanguard is client-owned. There are no outside shareholders breathing down their necks for profits. This allows the Vanguard Total Bond Market II Index Fund to keep its expense ratio incredibly low. We are talking about 0.02% or 0.03% in many institutional settings.

At that price, it’s practically free.

Why does a tiny fee matter? Because bonds have lower expected returns than stocks. If a bond fund returns 4% and the management fee is 0.50%, the manager is taking 12.5% of your profit. That’s robbery. With Vanguard, they are taking almost nothing, leaving the interest payments in your pocket.

Is It Risk-Free? (Spoiler: No)

People hear "bond" and think "guaranteed." That’s a dangerous mistake. There are two main risks with the Vanguard Total Bond Market II Index Fund.

- Interest Rate Risk: As we saw recently, if inflation spikes and the Fed raises rates, the value of this fund will drop. If you need your money in six months, this fund might be too volatile for you.

- Inflation Risk: If the fund yields 4% but inflation is 5%, you are technically losing purchasing power. You're getting more dollars back, but those dollars buy fewer tacos.

However, compared to a tech stock or a "high-yield" junk bond fund, the risks here are incredibly muted. It’s the middle-of-the-road option. It’s the vanilla ice cream of the financial world. It’s not exciting, but almost everyone likes it in their bowl.

How to Use This in Your Portfolio

Most financial advisors suggest a classic 60/40 or 70/30 split between stocks and bonds. If you are using the Vanguard Total Bond Market II Index Fund, it should represent the entirety of your "taxable bond" allocation.

You don't need to hunt for individual bonds. You don't need to try and time the market.

If you are 30 years old, maybe this fund is only 10% of your account. You want growth. If you are 65 and retiring next year, maybe it’s 40% or 50%. It acts as the "ballast" on a ship. When the winds of the stock market howl, the ballast keeps the ship from tipping over.

One thing to watch out for: Taxes. Because this fund pays out "ordinary income" in the form of interest, it’s usually best kept in a tax-advantaged account like a 401k or an IRA. If you hold it in a regular brokerage account, Uncle Sam is going to take a bite out of those monthly interest checks every year.

The Role of "Float Adjusted"

You'll see the term "Float Adjusted" in the fund's objective. It sounds like some weird physics term. In reality, it just means the index excludes bonds held by the Federal Reserve or other government entities. It only tracks the bonds actually available for "regular" people and institutions to buy. This makes the fund more representative of the actual market you can participate in. It’s a small detail, but it shows the level of precision Vanguard uses to keep the fund tracking its benchmark perfectly.

Actionable Steps for Investors

If you've realized the Vanguard Total Bond Market II Index Fund is sitting in your retirement plan, here is how to handle it:

💡 You might also like: Social Media and Project Management: Why Your Marketing Team Is Burning Out

- Check your "Duration" exposure. Look at the fund's average duration (currently around 6.1 years). This tells you that if interest rates rise by 1%, the fund's price will likely drop by about 6%. If you can’t stomach that, you might want a "Short-Term" bond fund instead.

- Rebalance annually. If the stock market has a monster year, your 30% bond allocation might shrink to 20%. Sell some stocks and buy more of this bond fund to get back to your target. Buy low, sell high. It's the only free lunch in investing.

- Look at your Target Date Fund. If you own a "Vanguard Target Retirement" fund, don't go out and buy VTBIX separately. You already own it. Adding more might make your portfolio too conservative without you realizing it.

- Don't panic sell. When bonds go down, it's usually because interest rates went up. That means the "yield to maturity" on your fund is now higher. You are being paid more to wait.

The Vanguard Total Bond Market II Index Fund isn't going to make you a millionaire overnight. It isn't going to be the "next big thing." But in a world of crypto scams and volatile "meme stocks," there is something deeply comforting about a fund that just buys the entire American debt market for almost no fee. It’s the foundation. Build the rest of your house on top of it.