Tax season is usually a headache. Honestly, most of us just stare at our W-2s and pray the "refund" number is bigger than the "amount owed" number. But if you’re trying to plan your life—maybe you’re thinking about a raise, a side hustle, or selling some stocks—you need to know how the government actually slices up your pie. That’s where a federal tax brackets 2024 calculator becomes your best friend, or at least a very useful acquaintance.

The IRS adjusted the brackets for 2024 to account for inflation. They do this so "bracket creep" doesn't destroy your soul. Basically, if your wages go up just to keep pace with the price of eggs and gas, the IRS doesn't want to shove you into a higher tax percentage just for staying afloat.

How the Brackets Actually Work (It’s Not What You Think)

A lot of people think that if they "hit" the 24% bracket, the government takes 24% of every single dollar they earned. That is a total myth. It’s wrong.

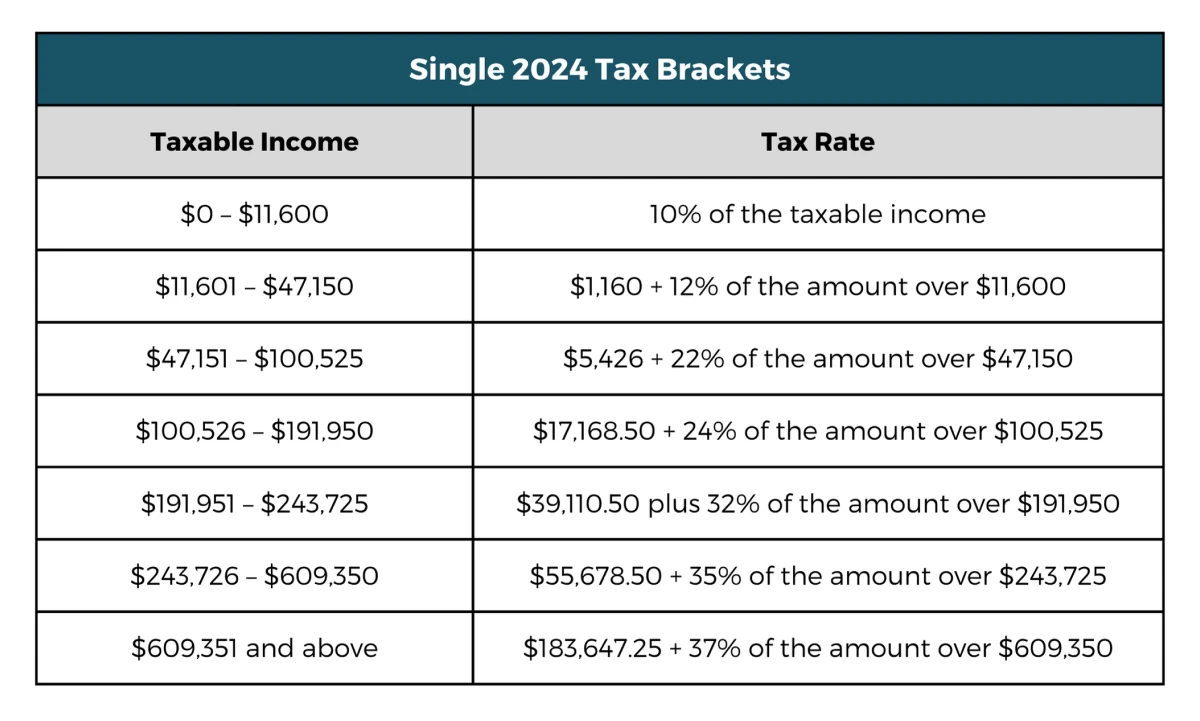

Our system is progressive. Think of it like a series of buckets. Your first $11,600 (if you’re single) goes into the 10% bucket. The next chunk goes into the 12% bucket. Only the money that spills over into the top bucket gets taxed at that highest rate. Using a federal tax brackets 2024 calculator helps you visualize these buckets so you don't panic when you get a $5,000 bonus.

For the 2024 tax year—the ones you’re likely filing right now in early 2025—the top rate remains 37% for individual single filers with income greater than $609,350. For married couples filing jointly, that threshold is $731,200.

Why the Federal Tax Brackets 2024 Calculator Matters Right Now

Inflation was a beast in 2023, which led to a significant 5.4% jump in the tax bracket thresholds for 2024. This is a bigger jump than we usually see. If you’re using an old calculator or just "vibing it" based on last year’s return, you’re going to be off.

The Standard Deduction Game Changer

Most Americans don't itemize. They take the standard deduction. For 2024, that’s $14,600 for singles and $29,200 for married couples filing jointly.

Wait.

📖 Related: 600 Rupees to USD: Why the Exchange Rate Never Tells the Whole Story

Think about that for a second. If you’re married, the first nearly thirty grand you make is essentially "invisible" to the IRS. When you plug your numbers into a federal tax brackets 2024 calculator, make sure it asks for your filing status first. If it doesn't, close the tab. It’s useless.

Capital Gains: The Hidden Tax

We often focus on "ordinary income"—your salary. But if you sold some Nvidia stock or a bit of Bitcoin in 2024, that’s taxed differently. Long-term capital gains (assets held over a year) have their own brackets: 0%, 15%, and 20%.

A good calculator needs to distinguish between your 9-to-5 grind and your "I’m an investor now" income. If your total taxable income is under $47,025 (single), your capital gains rate might actually be 0%. Yeah, zero.

Real World Example: Meet Sarah

Sarah is a freelance graphic designer. She’s single. In 2024, she cleared $85,000 in taxable income after all her business expenses were accounted for.

If she just looked at a chart, she’d see she’s in the 22% bracket. She might freak out and think she owes $18,700.

But a federal tax brackets 2024 calculator shows the truth:

- The first $11,600 is taxed at 10% ($1,160).

- The amount from $11,601 to $47,150 is taxed at 12% ($4,266).

- Only the remaining $37,850 is taxed at 22% ($8,327).

Her total bill is closer to $13,753. That’s an "effective" tax rate of about 16%. See the difference? Understanding the math saves you from unnecessary stress.

Marginal vs. Effective: Know the Difference

Your marginal rate is the "highest" bracket you touch. Your effective rate is the actual percentage of your total income that goes to Uncle Sam. Most people brag or complain about their marginal rate, but your effective rate is what actually dictates your lifestyle.

Common Mistakes When Calculating Your 2024 Taxes

Don't forget the "Above-the-Line" deductions. These happen before the standard deduction even touches your math.

- HSA Contributions: If you have a high-deductible health plan, this money is gone before the IRS sees it.

- Student Loan Interest: You can deduct up to $2,500 of interest even if you don't itemize.

- Traditional IRA Contributions: Depending on your income, this can shave thousands off your taxable total.

If you’re using a federal tax brackets 2024 calculator and it feels too simple, you’re probably missing these nuances. A simple "Income minus Tax" calculation is for middle schoolers. Real life involves the "Adjusted Gross Income" (AGI).

The Alternative Minimum Tax (AMT)

This is the "gotcha" tax designed to make sure wealthy people don't use too many loopholes. For 2024, the AMT exemption amount is $85,700 for singles and $133,300 for married couples. Unless you’re pulling in high six figures or have complex stock options (ISO exercises), you probably don't need to worry about this, but it’s worth noting that even a calculator can sometimes miss this complexity.

State Taxes: The Silent Partner

We’re talking about a federal tax brackets 2024 calculator, but remember that 41 states also want a piece of you. If you live in California, New York, or Oregon, your total tax bite is going to feel way more aggressive than if you’re in Florida or Texas.

Some states have a "flat tax" where everyone pays the same percentage. Others mimic the federal progressive system. When you finish your federal calculation, don't go out and buy a boat. Check your state's Department of Revenue first.

Child Tax Credits and Other Perks

For 2024, the Child Tax Credit is still a big deal. It’s $2,000 per qualifying child. Some of it is refundable, meaning if you owe $0 in taxes, the government might actually send you a check. This is why "taxable income" isn't the final word. Credits are way more powerful than deductions. A deduction lowers the amount of income you’re taxed on; a credit is a straight-up discount on the bill itself.

Strategic Moves for the Rest of the Year

Since we are technically looking back at 2024 while preparing to file, your options to change the past are limited. However, you still have until the April 15, 2025, deadline to contribute to a Traditional IRA or an HSA for the 2024 tax year.

If your federal tax brackets 2024 calculator results show you’re just a few hundred dollars into a higher bracket, a last-minute IRA contribution could potentially drop you back down. It’s one of the few ways to "time travel" in the tax world.

Self-Employment Tax: The Double Whammy

If you’re a 1099 contractor, remember that the federal brackets only cover income tax. You also owe 15.3% for Social Security and Medicare. This is the "Self-Employment Tax." You’re the employer and the employee, so you pay both halves. If a calculator doesn't factor this in for freelancers, it’s giving you a dangerous false sense of security.

Tax Loss Harvesting

Did you sell some "stinkers" in your brokerage account? You can use up to $3,000 of capital losses to offset your regular income. This is a classic move. If your income was $50,000 but you lost $3,000 on a bad stock trade, the IRS only looks at you like you made $47,000.

Actionable Steps for Your 2024 Filings

Stop guessing. Tax law is too dense for gut feelings.

- Gather your documents: Get your W-2s, 1099-NECs, and 1099-INTs (for that high-yield savings account interest) in one folder.

- Find your AGI: Don't just use your gross salary. Subtract your 401k contributions and HSA moves first.

- Run the numbers twice: Use a reputable federal tax brackets 2024 calculator to get a baseline, then compare it to what your tax software (like TurboTax or H&R Block) tells you.

- Check your withholding: If you owed a lot this year, go to your HR portal at work and adjust your W-4 for 2025. You want to aim for as close to zero as possible. Giving the government an interest-free loan (a big refund) isn't actually a "win."

- Look at the 2025 brackets: They’ve already been released. If you’re expecting a big life change in the coming year, start your 2025 planning now.

Understanding these brackets isn't just about paying the bill. It's about knowing how much of your next dollar you actually get to keep. When you realize that moving from the 22% bracket to the 24% bracket is only a 2% difference on that specific "new" money, it makes taking that promotion or starting that business feel a lot less scary.

📖 Related: Andrew Joblon Net Worth: What the Real Estate Mogul Is Actually Worth in 2026

Knowledge is the only thing that makes tax season bearable. Well, knowledge and a good cup of coffee. Or something stronger.