If you’ve ever stared at your bank account on a random Tuesday wondering why the math isn't mathing, you aren’t alone. Payroll is weird. Most of us just expect the money to land when it’s supposed to, but 2025 is throwing some curveballs that could actually make or break your rent payment if you aren't paying attention. We’re talking about the biweekly pay schedule 2025 and why it's technically one of the most predictable yet frustrating ways to get paid.

Budgeting is hard enough. It gets harder when your bills are monthly but your income drops every 14 days.

The Basic Math of Every Two Weeks

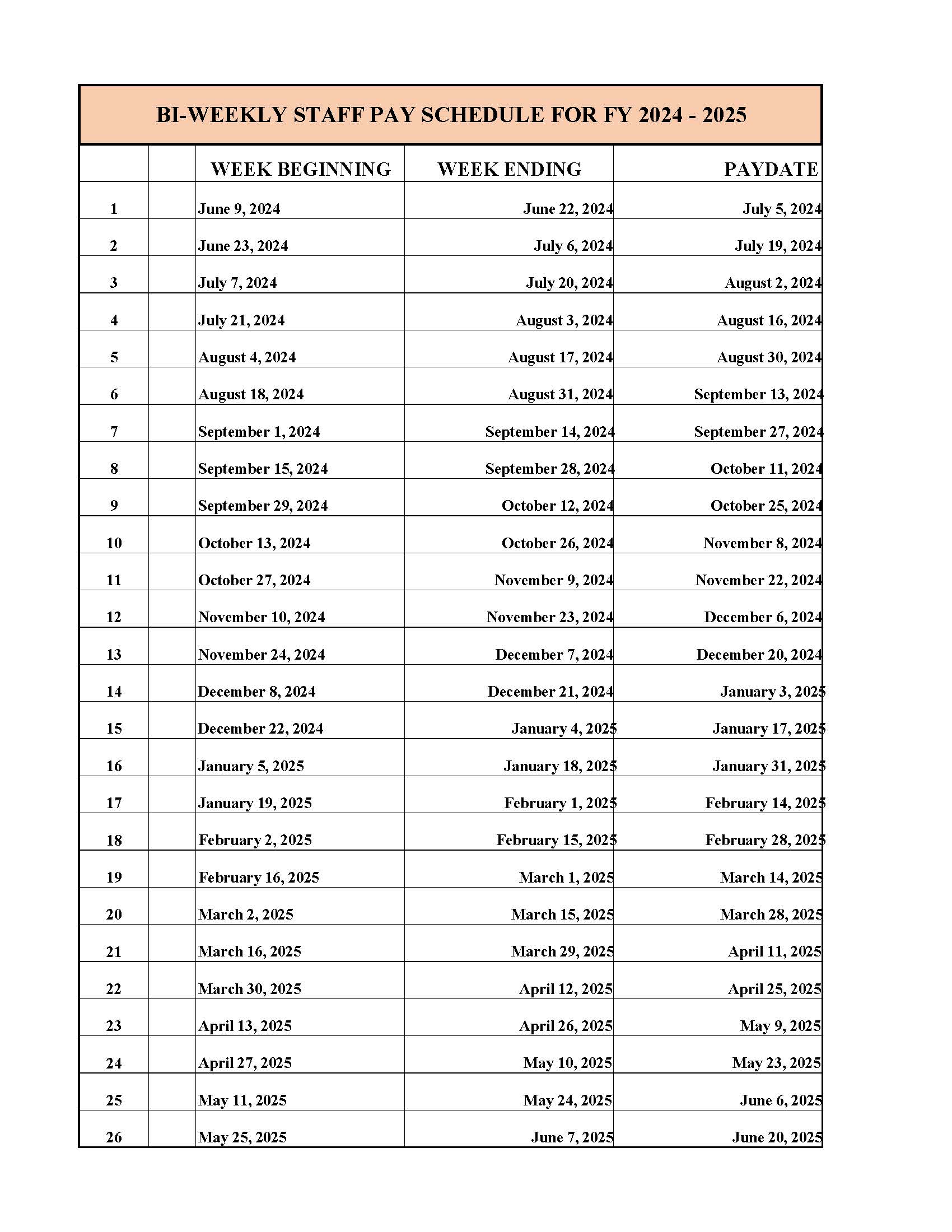

So, how does this actually work? A biweekly setup means you get 26 paychecks a year. Most months, you get two. But because the calendar is a chaotic mess of 30 and 31-day months, two months out of the year, you get a "magic" third paycheck. In 2025, for a huge chunk of American workers, those magic months are likely going to hit in May and October, or perhaps April and October depending on whether your first check of the year was January 3rd or January 10th.

It feels like free money. It isn't.

It’s just your annual salary divided by 26 instead of 24. If you’re used to a semi-monthly schedule—where you get paid on the 1st and 15th—switching to a biweekly pay schedule 2025 can feel like a pay cut at first because each individual check is slightly smaller. You have to wait for those triple-payday months to "catch up" to your total yearly earnings.

When the Checks Actually Drop

Let’s look at the actual days. If your company starts the year with a payday on Friday, January 3, 2025, your rhythm is set. You’ll see money on the 17th and 31st.

Wait.

That’s three checks in January.

If you start the year that way, you’re hitting the ground running with an extra influx of cash, but then you’ve got a long haul through February and March with only two checks each. Most people find that the biweekly pay schedule 2025 creates these little pockets of "wealth" followed by weeks of disciplined grinding.

If your first check isn't until January 10th, your triple-check months shift. You'd likely see that bonus pay in May and October. Honestly, May is a great time for it—right before summer vacations—while October helps cushion the blow of holiday shopping that starts way too early in November.

The Leap Year Hangover

We just came out of 2024, which was a leap year. Leap years sometimes trigger what HR professionals call "The 27th Payday." This happens about every 11 years because 26 paychecks only cover 364 days. That extra day (or two in a leap year) eventually adds up to a full extra pay period.

Most of you won't see that in 2025. We are back to the standard 26-period grind.

But check your specific corporate calendar. Some companies that operate on a fiscal year starting in July might still be feeling the ripple effects of how the 2024 calendar fell. If your HR department is suddenly quiet about the 2025 calendar, it’s probably because they’re busy recalibrating tax withholdings.

The Budgeting Trap Nobody Talks About

Here is the thing.

Most people budget based on two checks a month. They calculate their mortgage, their car note, and their Netflix subscription against those two deposits. Then, when the third check hits in a month like May or August, they treat it like a jackpot. They buy a new TV. They go out for a massive dinner.

That’s a mistake.

A better way to handle a biweekly pay schedule 2025 is to pretend those two extra checks don't exist. If you can live on 24 checks, those extra two can max out an IRA or kill off a credit card balance. According to data from the Bureau of Labor Statistics, biweekly pay is the most common frequency in the US, used by about 43% of private establishments. Yet, financial literacy experts often note that this frequency leads to the highest rate of "accidental spending" because of that perceived surplus.

👉 See also: Victoria Nuland Net Worth: What Most People Get Wrong About the Diplomat's Wealth

Taxes, Benefits, and the "Hidden" Deductions

Your HR person isn't trying to scam you, but the way benefits are pulled from a biweekly pay schedule 2025 can be confusing.

Most insurance premiums (health, dental, vision) are calculated on a monthly basis. Many companies take these deductions out of only 24 paychecks. This means that during your "triple-payday" months, your third check might actually be larger than your normal ones because your health insurance premium has already been covered by the first two.

It’s like a double bonus.

However, 401(k) contributions and taxes don’t take a break. Those are usually a percentage of your gross pay. So, while you might keep your medical premium money, Uncle Sam is still taking his cut of that third check.

Does the Day Matter?

Most companies pay on Fridays. It’s a tradition. But with the rise of digital banking and "early pay" features from banks like Chime or Capital One, the biweekly pay schedule 2025 is becoming more fluid. You might see your "Friday" money on Wednesday afternoon.

If you rely on that early access, be careful. Holidays like Memorial Day (May 26) or Juneteenth (June 19) can shift processing times. If a payday falls on a federal holiday, the law generally requires you be paid the day before, but bank processing can be finicky. Always have a buffer.

Managing the Gap

Sometimes there are five weeks between the start of one month and the end of another. On a biweekly pay schedule 2025, this can mean you pay your rent on the 1st, but your next paycheck doesn't arrive until the 14th.

If you paid your previous rent on the 28th of the prior month, you're looking at a long stretch of "lean" days.

Real experts—people who actually manage payroll for thousands of employees—suggest using a "buffer month" strategy. You save up enough to cover one full month of expenses so that the timing of the 14-day cycle no longer matters. You're always spending last month's money. It sounds impossible if you're living paycheck to paycheck, but using one of those "magic" third checks in 2025 is the fastest way to build that bridge.

What to Do Next

Don't wait until May to figure out where your money is going.

Open your calendar right now. Mark every second Friday starting from your first 2025 payday. Look for the months with three marks. Those are your "wealth" months.

Actionable Steps for Your 2025 Pay Cycle:

- Identify your 3-check months: For most, these will be May and October or January and July. Mark them in red.

- Audit your deductions: Ask HR if your health insurance is deducted 24 or 26 times a year. If it's 24, your 3rd checks will be bigger.

- Automate the "Extra": Set your savings account to automatically grab 50% of any "third" paycheck that hits. You won't miss it if you never see it.

- Coordinate with your landlord: If you have a long gap between checks in a 5-week month, ask if you can split your rent into two smaller payments. Many landlords are cool with this if you ask months in advance.

The biweekly pay schedule 2025 isn't just a list of dates. It's the pulse of your financial life. Understanding the rhythm is the difference between feeling broke on a Thursday and feeling in control of your future.