If you’ve spent any time lately scrolling through real estate listings or staring at a Zillow map with a mix of hope and dread, you’ve probably asked the same question as everyone else: when is the relief coming? Specifically, will mortgage rates go down in 2024?

Honestly, the answer is a bit of a "yes, but." Or maybe a "no, but." It depends on which week you check the news.

Back in early 2024, the vibe was pure optimism. Everyone—from your local loan officer to the big-shot economists at the Federal Reserve—seemed to think we were on a one-way flight to lower rates. We started the year with the 30-year fixed-rate mortgage averaging around 6.6% to 6.7%. There were whispers that we might even see 5% by Christmas. But the economy had other plans. It’s been a total roller coaster, and if you’re waiting for a massive "plunge," you might want to settle in. This is going to be a slow crawl.

Why Everyone Thought Rates Would Crater (and Why They Didn't)

Basically, the Federal Reserve spent the last couple of years trying to break inflation’s back. To do that, they hiked interest rates like crazy. Once inflation started to chill out, the logic was simple: the Fed would lower their benchmark rate, and mortgage rates would follow suit.

But inflation is sticky. It's like that one guest at a party who won't take the hint and leave. Because the job market stayed surprisingly strong and people kept spending money, the Fed didn't feel the rush to cut rates as early as they initially hinted.

The Mid-Year Reality Check

By the time we hit the spring of 2024, things got weird. Instead of dropping, rates actually ticked back up towards 7.2% in May. It was a gut punch for buyers who thought they’d timed the market perfectly. Freddie Mac data showed that the 30-year fixed rate hit a peak for the year around that time, largely because the "higher for longer" narrative took over Wall Street.

- Inflation stayed hotter than expected. The Consumer Price Index (CPI) reports in the first quarter weren't the "all-clear" signal the market wanted.

- The 10-Year Treasury Yield. This is the secret engine behind mortgage rates. When investors get nervous about inflation, they demand higher yields on government bonds, which forces mortgage rates up.

- The "Wait and See" Fed. Jerome Powell, the Fed Chair, basically told everyone to relax and that they weren't in a hurry to cut rates until they were 100% sure inflation was dead.

The Turning Point: What Happened in September?

If you were looking for a sign, September 2024 was it. For the first time in four years, the Federal Reserve actually pulled the trigger and cut the federal funds rate by a jumbo 50 basis points ($0.50%$). This was the moment everyone was waiting for.

Mortgage rates reacted before the announcement even happened. Markets are forward-looking, so by the time the Fed made it official, the 30-year fixed rate had already dipped down into the low 6% range—hitting around 6.1% to 6.2% in some cases.

But here is the catch: mortgage rates don't move in a straight line.

Right after that big September cut, rates actually started to climb again in October and November. It sounds backwards, right? If the Fed cuts rates, mortgages should get cheaper. Not always. Because the economic data came in stronger than expected after the cut, investors started worrying that the Fed might have to slow down their future cuts. By early November 2024, we saw rates jump back up toward 6.8%.

The "Lock-In" Effect Is Real

You’ve probably heard people talk about being "locked in" to their current house. It's a huge problem. Roughly 60% of people with mortgages right now have a rate below 4%. If you're sitting on a 3% rate, moving to a new house with a 6.5% rate feels like a financial disaster.

This has created a massive inventory shortage. Because nobody wants to sell, there aren't enough houses on the market. When there aren't enough houses, prices stay high. So, even if will mortgage rates go down in 2024 becomes a reality, you're still dealing with home prices that refuse to budge.

It's a double-edged sword. Lower rates make your monthly payment more affordable, but they also bring more buyers out of the woodwork. More buyers means more bidding wars. You might save $200 a month on interest but end up paying $30,000 more for the house because you’re competing with ten other people.

What to Expect for the Rest of the Year

As we look at the final stretch of 2024, the consensus among experts like those at Fannie Mae and the Mortgage Bankers Association (MBA) is that we’ll finish the year with rates hovering somewhere between 6.3% and 6.7%.

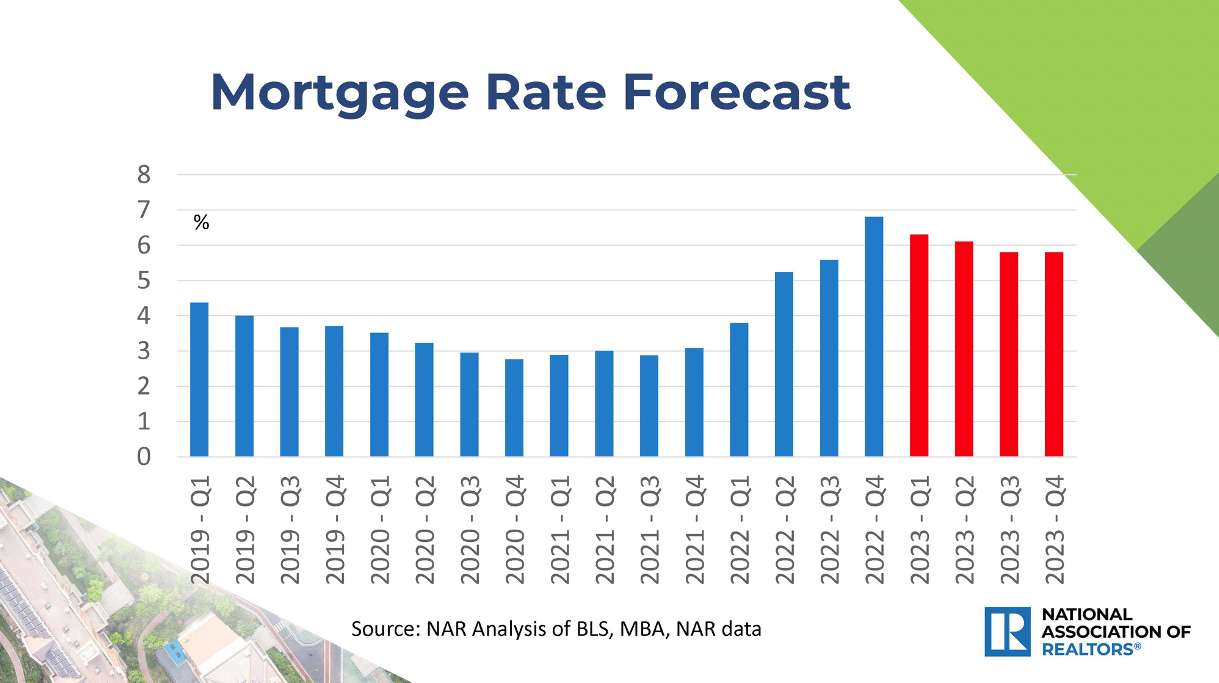

It's not the 5% we dreamed of, but it’s a heck of a lot better than the 8% we saw in late 2023.

The Numbers at a Glance

- Start of 2024: ~6.6%

- Spring Peak: ~7.2%

- Post-Fed Cut Low: ~6.1%

- Late 2024 Projection: ~6.5%

The reality is that "low" is a relative term. If you bought a house in 2021, 6% looks terrifying. If you bought a house in the 1980s, 6% looks like a total steal. We are basically entering a "New Normal" where the era of 3% rates is a historical outlier we probably won't see again for a long time.

Actionable Steps for Borrowers Right Now

Stop trying to time the absolute bottom. You'll miss it. Most people who wait for the "perfect" rate end up missing the "good" rate.

If you are looking to buy or refinance before the year ends, keep these things in mind:

💡 You might also like: Ford Motor Company Forecast and Analysis: Why the EV Reset Changes Everything

Focus on the "Buy-Down." If you find a house you love but the rate is too high, ask the seller for a credit to buy down your rate. A "2-1 buy-down" can lower your rate by 2% in the first year and 1% in the second year, giving you breathing room until you can hopefully refinance later.

Check your credit score today. A difference of 20 points on your credit score can change your interest rate by half a percent. That's thousands of dollars over the life of the loan. Clean up those small errors now so you're ready when the right house pops up.

Shop around—seriously. Don't just go with your primary bank. Get quotes from a credit union, a national lender, and a local mortgage broker. The "spread" between lenders is wider than usual right now, and you could easily find a 0.5% difference just by making three phone calls.

Marry the house, date the rate. It’s a cliché for a reason. You can change your mortgage later, but you can’t change what you paid for the house or where it’s located. If the math works at 6.5%, and you can afford the payment, go for it. If rates drop to 5.5% in 2025 or 2026, you refinance and move on with your life.

The bottom line: will mortgage rates go down in 2024? They already have, compared to the peaks of last year, but the path forward is a jagged line, not a smooth slide. Don't let the headlines paralyze you. If you find a home that fits your life and the payment fits your budget, that’s a win.

Monitor the 10-Year Treasury yield every Tuesday and Thursday. It usually gives you a 48-hour head start on where mortgage rates are headed before the official weekly averages are released. When the yield drops, call your lender immediately.