Everyone is waiting for the big one. You've seen the headlines, the TikTok "doomer" financial gurus, and the frantic dinner party conversations where someone swears their neighbor’s cousin just saw a 20% price cut. There is this visceral, almost desperate expectation for the house market to crash because, let’s be honest, the current prices feel like a glitch in the simulation.

But feelings aren't fundamentals.

If you're sitting on a pile of cash waiting for 2008 to repeat itself, you might be waiting a long time. Or you might be the smartest person in the room. It depends entirely on which specific data points you're willing to ignore.

The "inventory" problem that won't go away

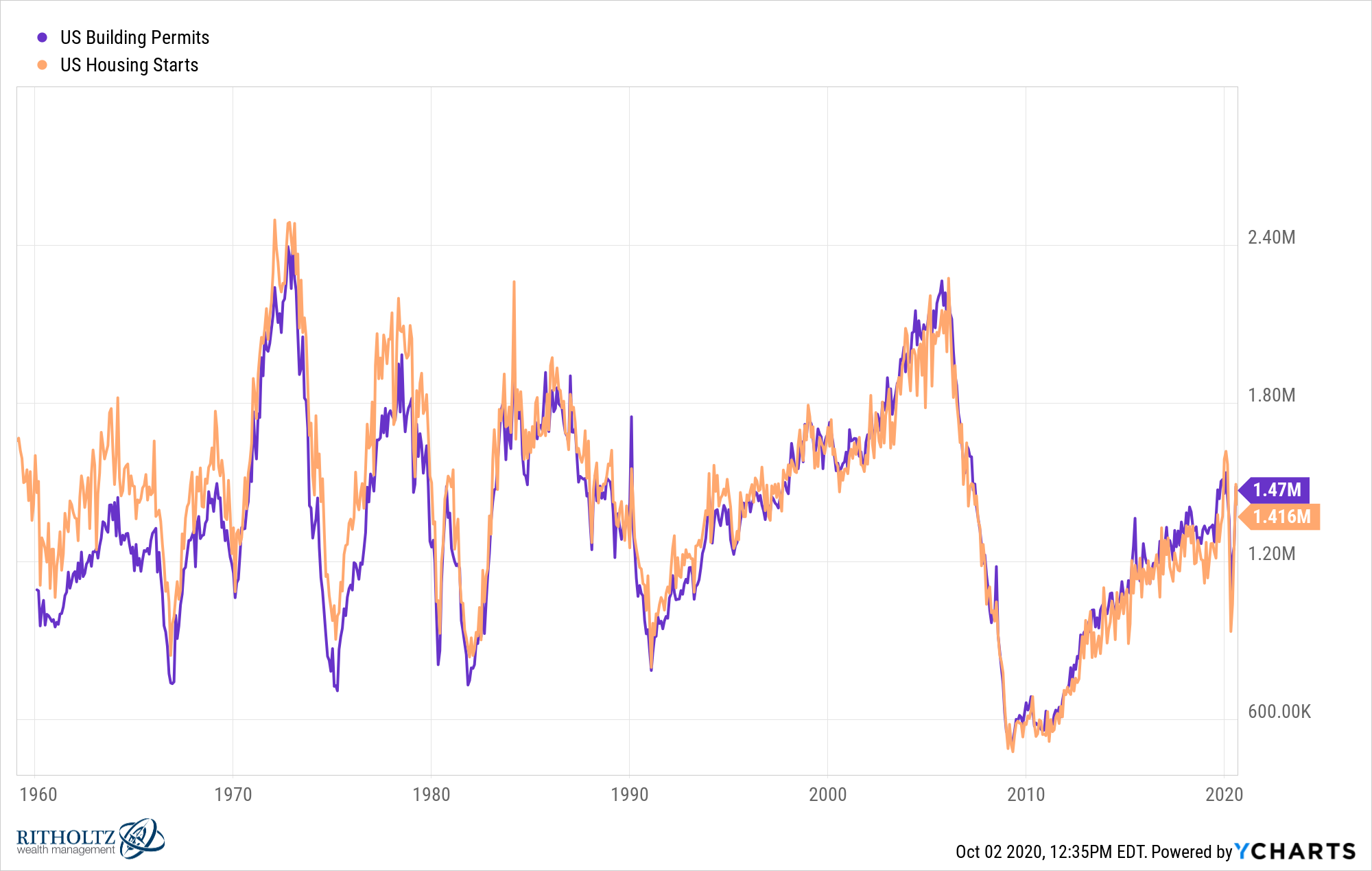

Supply and demand. It’s the first thing they teach you in Econ 101, and it’s the primary reason we haven't seen a total meltdown yet. We are short millions of homes. The National Association of Realtors (NAR) and various housing analysts have pointed to a structural deficit that's been building since the Great Recession. We simply stopped building enough houses for a decade.

Then 2020 happened.

✨ Don't miss: Unemployment Rate in Los Angeles: What Most People Get Wrong

Everyone stayed put. Then interest rates spiked. Now, we have the "golden handcuff" effect. If you bought a house in 2021 with a 3% mortgage rate, are you really going to sell it today to buy a different one at 6.5% or 7%? Probably not. You’re staying. This keeps inventory levels at historic lows, which acts as a floor for prices. For the house market to crash, you need a flood of desperate sellers. Right now, most homeowners aren't desperate; they're sitting on record levels of home equity.

According to CoreLogic, the average homeowner with a mortgage has seen their equity increase significantly over the last few years. We aren't seeing the subprime "ninja" loans (No Income, No Job or Assets) that fueled the 2008 fire. Lending standards are actually quite boring and strict now. That’s a good thing for stability, even if it’s annoying for buyers.

Where the cracks are actually showing

It’s not all sunshine and rising valuations, though. If you look at the Sun Belt—places like Austin, Phoenix, and parts of Florida—the vibe is shifting. These were the "poster children" of the pandemic boom. Everyone moved there, prices went vertical, and now reality is set in.

In some of these metros, inventory is actually climbing. Fast.

Why? Because builders finally caught up in those specific regions. When you have a ton of new construction hitting the market at the same time that high interest rates are squeezing monthly payments, sellers have to blink. We’re seeing price corrections in these pockets. But a "correction" of 10% after a 60% gain isn't exactly the house market to crash scenario people are dreaming of. It’s more like a hangover after a very wild party.

The Commercial Real Estate Shadow

There is one "black swan" everyone is watching: commercial office space. With remote work being... well, just the way things are now, downtown office buildings are in trouble. Banks that hold these loans are feeling the heat. If a major regional bank collapses because of commercial defaults, it could tighten credit for residential mortgages too.

Credit crunches are messy.

When banks get scared, they stop lending. When they stop lending, buyers disappear. When buyers disappear, prices fall. It’s a chain reaction. While the residential market looks sturdy, it is tethered to a broader financial system that has some very visible bruises.

🔗 Read more: Does Fannie Mae Own My Loan? How to Find Out Fast

Why 2026 feels different than 2008

Let’s talk about the "M" word: Mortgages.

In 2008, people had adjustable-rate mortgages (ARMs) that were designed to explode. When the rates reset, the payments became impossible. Today, the vast majority of Americans are on 30-year fixed-rate loans. Their payment is the same today as it was three years ago, regardless of what the Fed does.

Foreclosures are still near historic lows.

To get a real house market to crash, you need "forced selling." Forced selling happens when people lose their jobs or can't afford their payments. As long as the labor market stays relatively tight and unemployment doesn't skyrocket to 8% or 10%, people will fight tooth and nail to keep their homes. They'll cut Netflix, they'll stop eating out, and they'll skip vacations before they let the bank take the house.

The affordability ceiling is real

You can only push prices so high before the math stops working. We are at that point for a lot of people.

When you combine high home prices with high interest rates, the "monthly payment" for a median-priced home has essentially doubled in a very short window. This is the "affordability crisis." It’s a slow-motion car crash for the American Dream.

Does this lead to a crash? Not necessarily. It can also lead to a "lost decade" where prices just move sideways or grow very slowly while incomes (hopefully) catch up. It’s boring. It’s frustrating. But it’s a very real possibility.

Regionality is the new reality

Stop looking at "National" home price indices. They don't matter to you unless you own a home in every state. The "national" market is a myth.

- The Midwest and Northeast: These areas didn't see the insane spikes that Vegas or Boise saw. Consequently, they aren't seeing the same pullbacks. Inventory remains incredibly tight because people just aren't moving.

- The Tech Hubs: San Francisco and Seattle have been through the ringer with tech layoffs and remote work shifts. They’ve already seen some of the "crash" people are looking for, but even there, the bottom hasn't fallen out completely because there’s still a lot of high-earning wealth looking for assets.

- The "Boom" Towns: Florida is the wild card. Between insurance premiums skyrocketing and a massive influx of new condos, some areas are looking a bit shaky. If your insurance goes from $2,000 to $8,000 a year, that affects your ability to pay the mortgage. That is a localized pressure point that could lead to more inventory.

Institutional Investors: The Boogeyman?

You’ve heard the rumors. BlackRock or Blackstone is buying every house on your block.

It’s a bit of an exaggeration, but the presence of institutional investors does change the game. These companies don't "panic sell" the way a family might. They have long time horizons. If prices dip, they might just buy more. This creates a "floor" under the market that didn't exist in previous cycles. However, if they decide the "Single Family Rental" (SFR) model no longer yields a good ROI compared to treasury bonds, they could stop buying, which removes a huge chunk of demand.

What should you actually do?

Stop trying to time the "perfect" bottom. You won't know it’s the bottom until six months after it’s passed. Instead, look at your own "Personal Economy."

✨ Don't miss: Safety Third: Why Mike Rowe Thinks Your Boss Is Lying to You

If you are looking at the house market to crash as your only way into a home, you need a plan that doesn't rely on a global financial disaster.

Actionable Steps for the Current Market

1. Audit your debt-to-income ratio. Lenders are being picky. If you have a high car payment or mounting credit card debt, your "buying power" is crippled regardless of what home prices do. Clean up the balance sheet now so you're "bankable" when a deal actually appears.

2. Watch the "Days on Market" (DOM) in your specific zip code. This is the most honest metric in real estate. If homes in your target neighborhood used to sell in 4 days and are now sitting for 40, the power has shifted. That’s when you can start making "disrespectful" offers. Low-balling works better when a seller is tired and the house is dusty.

3. Explore "Assumable Mortgages." This is a niche trick. Some FHA and VA loans are "assumable," meaning you can take over the seller’s 3% or 4% rate. It’s a paperwork nightmare, but it’s one of the few ways to beat the current interest rate environment.

4. Consider the "Buy the Rate, Not the House" Strategy. Wait, that’s backwards. Usually, people say "Marry the house, date the rate." But honestly? If you find a house that fits your life and you can afford the payment today, the market fluctuations over the next 24 months won't matter if you plan to stay for 10 years.

5. Factor in the "hidden" costs. In 2026, it’s not just the mortgage. It’s the property taxes (which have reset higher) and the insurance (which is getting weird). Run your numbers with a 20% buffer for these line items.

The house market to crash narrative is compelling because it offers hope to those priced out. But the structural reality—low supply, strict lending, and massive home equity—suggests a "grind" rather than a "collapse." Keep your down payment in a high-yield account, keep your credit score pristine, and be ready to move when the individual "micro-opportunities" pop up in your specific city. The "national" crash might never come, but a motivated seller in your preferred school district certainly will.