You’ve seen the flashing red and green numbers on the news. Someone yells that the Dow is up 400 points, and suddenly everyone is acting like they just won the lottery. Or the Nikkei 225 drops 3%, and people start talking about a global meltdown. But if you actually sit down and ask the average person what a world major stock index really represents, you’ll mostly get blank stares or some vague guess about "the economy."

It isn't just one thing. It's a barometer. It’s a messy, weighted, constantly shifting collection of companies that we’ve collectively decided represent the "vibe" of a specific country’s financial health.

If you're trying to grow your wealth or just understand why your 401(k) looks depressed, you have to get past the ticker symbols. Most people think these indices are just lists of the biggest companies. They aren't. Some are weighted by price, some by market cap, and some—frankly—are just weird relics of how we used to calculate math by hand in the 1890s.

👉 See also: Where Was Cook Out Founded? The Real Story Behind the Red Roofs

The Big Three: Why the US Still Rules the Narrative

When we talk about a world major stock index, the conversation usually starts and ends with the S&P 500. Honestly, for most investors, it’s the only one that truly keeps them up at night. The Standard & Poor’s 500 tracks the 500 largest publicly traded companies in the US. It’s market-cap weighted, meaning Apple and Microsoft have way more influence than a company like Campbell Soup.

Then there’s the Dow Jones Industrial Average. It’s famous. It’s historic. It’s also kinda... flawed? The Dow only tracks 30 companies. Because it is price-weighted, a company with a higher stock price has more pull than one with a lower price, regardless of how much the company is actually worth. If Goldman Sachs moves a few dollars, the Dow feels it way more than if a cheaper stock doubles in value. It’s a bit of a dinosaur, yet the media treats it like the holy grail of financial data.

Don’t forget the Nasdaq Composite. This is where the tech giants live. When Nvidia or Alphabet (Google) have a bad day, the Nasdaq bleeds. It’s the high-growth, high-risk child of the American market.

Moving Across the Pond: Europe’s Heavy Hitters

Europe doesn't have one single "S&P 500" equivalent that everyone agrees on, which makes things complicated. You have the FTSE 100 in the UK—often called the "Footsie." It’s heavily skewed toward mining, oil, and banking. If you want to know how the British economy is doing, you look at the FTSE 250 instead, because the 100 is mostly full of global companies that happen to be headquartered in London but make their money elsewhere.

In Germany, the DAX is the king. It recently expanded from 30 to 40 companies. It’s unique because it’s a "total return" index, meaning it assumes all dividends are reinvested back into the stocks. This makes the DAX look like it’s performing better than other indices over long periods, but it’s really just a different way of keeping score.

Then you’ve got the CAC 40 in France. Think luxury. LVMH and Hermès carry massive weight here. When Chinese consumers stop buying $3,000 handbags, the CAC 40 feels the sting immediately. It’s a fascinating window into global consumer spending.

✨ Don't miss: How Do You Become a Home Inspector Without Wasting Your Time

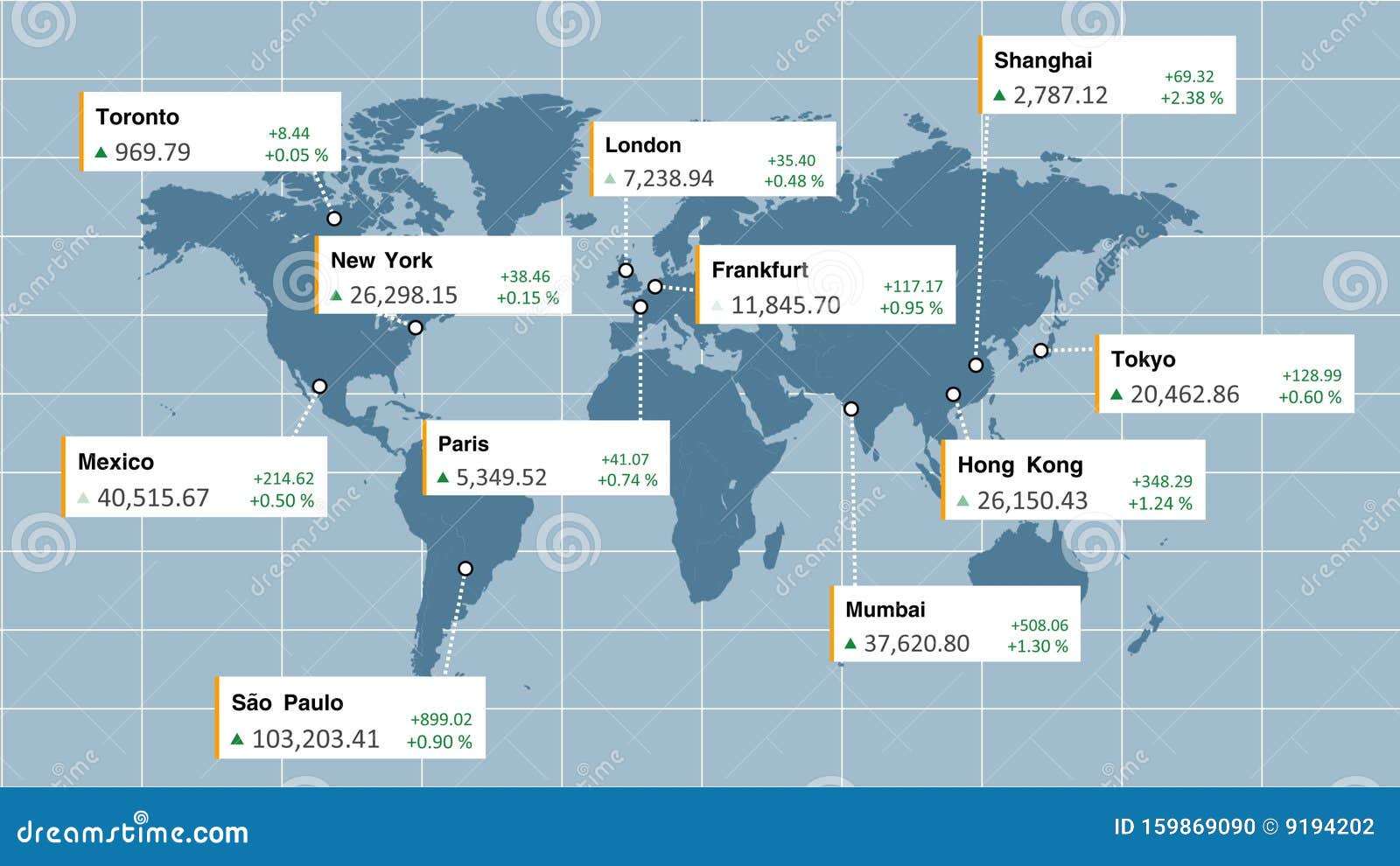

Asia and the 24-Hour Market Cycle

By the time you wake up in New York, the Asian markets have already finished their day. The Nikkei 225 in Japan is the big one there. Like the Dow, it’s price-weighted, which leads to some quirky movements. It spent decades trying to recover from its 1989 peak—a cautionary tale that "stocks always go up" isn't a universal law of physics.

Across the water, the Hang Seng Index in Hong Kong acts as the primary gateway for international investors to touch the Chinese market. It’s been incredibly volatile lately due to regulatory shifts and property market jitters.

Then there’s the MSCI Emerging Markets Index. This isn’t tied to one country. It’s a basket. It includes companies from Brazil, India, South Africa, and China. It’s the "wild card" of a world major stock index portfolio. When the US dollar is strong, these markets usually struggle because their debt becomes more expensive to pay back.

The Math Behind the Madness

How are these things actually built? It’s not just a random pile of stocks.

- Market-Cap Weighting: This is the gold standard. The bigger the company (Price x Number of Shares), the more it moves the index.

- Price-Weighting: The more expensive the "sticker price" of a single share, the more power it has. This is how the Dow and Nikkei work, and most modern mathematicians hate it.

- Equal-Weighting: Every company gets the same vote. If the smallest company in the index goes up 10%, it has the same impact as the biggest company going up 10%.

Why does this matter? Because if you buy an "Index Fund," you are buying into these specific math formulas. If the top five companies in the S&P 500 are overvalued, the whole index is risky, even if the other 495 companies are doing great.

Misconceptions That Cost People Money

A huge mistake people make is thinking a world major stock index is the same thing as "the economy." It isn't. The stock market is about corporate profits and future expectations. The economy is about jobs, wages, and GDP. Sometimes they move together; often they don't.

During the 2020 lockdowns, the S&P 500 hit record highs while unemployment was skyrocketing. Why? Because the index is dominated by tech companies that thrived while we were all stuck at home, and the Fed was pumping liquidity into the system. The "average person" was struggling, but the "average index component" was killing it.

Another thing: survivorship bias. Indices are curated. When a company starts to fail, it gets kicked out of the index and replaced by a rising star. This makes the long-term charts of a world major stock index look like a beautiful, upward-sloping line. It hides the corpses of the companies that didn't make the cut.

The Role of Passive Investing

We are currently living in the era of the "Index Fund." Vanguard and BlackRock have trillions of dollars flowing into these indices automatically every month through people's retirement accounts. This creates a feedback loop. Because money flows into the index, the index has to buy more of the stocks inside it, which pushes those stock prices up, which makes the index look better, which attracts more money.

Some experts, like Michael Burry (the "Big Short" guy), have warned that this might be a bubble. If everyone is buying the index regardless of whether the individual companies are actually good, price discovery breaks. We haven't seen the full fallout of this yet, but it's a nuance most "set it and forget it" investors totally ignore.

How to Actually Use This Information

So, what do you do with this? Don't just watch the numbers change color on your phone.

Look at the "Concentration Risk." Currently, the top 10 companies in the S&P 500 make up a larger percentage of the index than they have in decades. If you own an S&P 500 index fund, you aren't as "diversified" as you think you are. You’re basically betting on Big Tech.

If you want real diversification, you need to look at a world major stock index outside of the US. International indices like the MSCI EAFE (which covers developed markets in Europe, Australasia, and the Far East) often trade at lower valuations than US stocks. They haven't performed as well recently, but markets move in cycles.

Actionable Steps for the Modern Investor

First, check your exposure. Open your brokerage account and look at your "top holdings." If you see the same five tech stocks in every fund you own, you're over-concentrated. You might think you're safe because you own three different funds, but if they all track the same world major stock index, you're just holding the same basket in different colored bags.

Second, pay attention to the "Rebalancing" dates. Every few months, indices like the Nasdaq 100 or the S&P 500 will swap companies out or change their weights. This creates massive buying and selling pressure. You don't need to trade it, but you should know why the market is acting weird on those specific Fridays.

🔗 Read more: Scott Crump Toyota Jasper: What Most People Get Wrong

Third, look at the "Equal Weight" versions of these indices. If the S&P 500 is up but the S&P 500 Equal Weight Index (RSP) is down, it means only the giant companies are carrying the market. That’s a sign of a "thin" market, and it’s usually a warning that a correction is coming. A healthy market is one where the majority of stocks are participating in the rally, not just the ones run by billionaires in Silicon Valley.

Stop treating the index as a scoreboard of "winning" or "losing." Treat it as a map. It shows you where the money is flowing and where the risks are hidden. The market isn't a monolith; it's a collection of stories, math errors, and human emotions all mashed together into a single percentage point. Understanding that is the difference between being a gambler and being an investor.

Diversify across geographies. Don't ignore the "boring" indices in Europe or the volatile ones in Asia. In a globalized world, a ripple in the Nikkei can become a tidal wave in the NYSE within twelve hours. Stay informed, but more importantly, stay skeptical of the headlines. The index tells you what happened, but it rarely tells you why without a little digging.