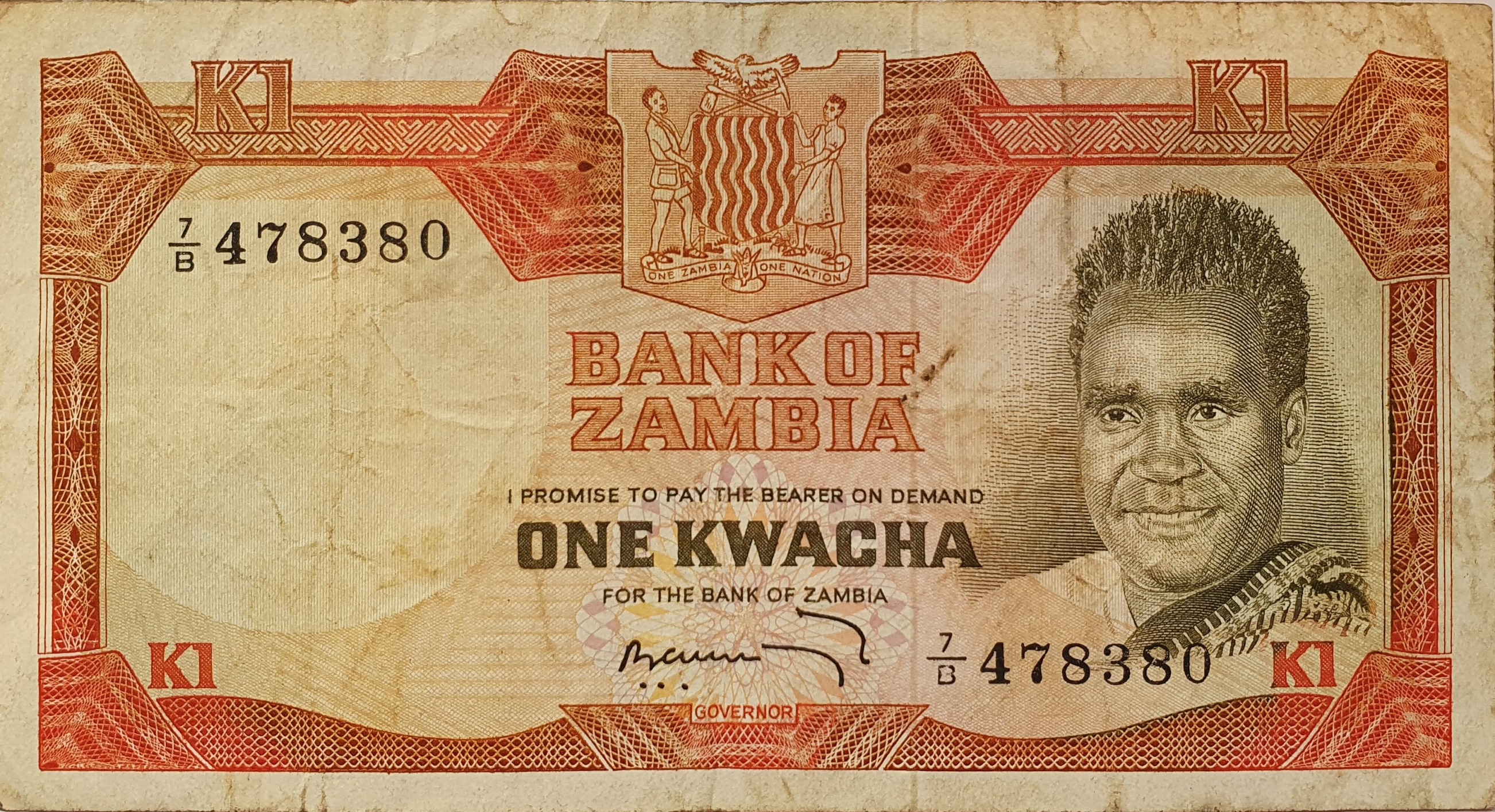

Honestly, if you looked at the Zambian Kwacha a few years ago, you’d probably have written it off. It was a rough ride. But right now, something kinda wild is happening in Lusaka that’s catching everyone off guard.

The Zambian Kwacha to American Dollar exchange rate has turned into one of the most interesting stories in emerging markets. We aren't just talking about a minor fluctuation here. As of mid-January 2026, the Kwacha has been hovering around the 19.70 to 20.00 range per USD. To put that in perspective, this is a currency that was languishing at much weaker levels not that long ago.

You’ve likely noticed the shift if you’re sending money home or trying to price out a mining contract in the Copperbelt. The Kwacha isn't just surviving; it’s basically pushing back against the Greenback in a way few saw coming.

The Copper Engine Is Finally Purring

You can't talk about the Kwacha without talking about copper. It’s the lifeblood. For a long time, production was stagnant, but 2025 changed the game.

Zambia hit a massive milestone, finally pushing toward that one million tonne annual production mark. When you have giants like First Quantum and the revived operations at Mopani and Konkola Copper Mines (KCM) firing on all cylinders, the dollar inflows follow. It’s simple math, really. More copper exported equals more dollars hitting the Zambian banking system, which naturally props up the Kwacha.

Global demand for the "red metal" is basically through the roof because of the world’s obsession with electric vehicles and renewable energy. Since Zambia is the second-largest producer in Africa, it's sitting in a very sweet spot.

What the Bank of Zambia Is Doing Right

The central bank hasn't been sitting on its hands. Dr. Denny Kalyalya and the Monetary Policy Committee (MPC) have been playing a very disciplined game. In late 2025, they actually managed to cut the policy rate to 14.25%.

Why does that matter for the exchange rate?

Well, it shows confidence. They only cut rates when they feel inflation is finally under control. Inflation dropped to around 11.2% by December 2025, which is a huge win compared to the scary double-digits of the past. When a central bank manages to cool down prices without crashing the economy, investors notice. They start moving money back into Kwacha-denominated assets, which adds another layer of support for the currency.

The Debt Shadow Is Lifting

For years, the "debt restructuring" talk felt like a never-ending saga. It was the dark cloud over every conversation about the Zambian Kwacha to American Dollar outlook.

But the news that Zambia has restructured over 92% of its external debt changed the vibe completely. It’s like the country finally got its credit card debt under control and can breathe again. By reaching deals with both bilateral creditors and Eurobond holders (who took a 25% "haircut"), Zambia has significantly lowered its risk profile.

When the risk goes down, the currency goes up. It’s that simple.

Real-World Impact: What This Means for You

If you’re a business owner in Lusaka or a traveler planning a trip to Victoria Falls, these numbers aren't just digits on a screen. They change how you live.

- Importing Goods: If you’re bringing in equipment or retail stock, a stronger Kwacha means your costs are lower. You're getting more "bang for your buck"—or rather, more "goods for your Kwacha."

- Fuel Prices: Since Zambia imports fuel in dollars, the Kwacha’s strength has helped stabilize prices at the pump. This has a massive ripple effect on transportation and food costs.

- Sending Money: For the diaspora in the US, your $100 isn't going quite as far in Kwacha terms as it did two years ago. But on the flip side, the money you do send is being injected into a much more stable economy.

Why It Might Stay This Way (Or Not)

Is this a permanent trend? Look, nobody has a crystal ball.

The Kwacha is still a commodity-linked currency. If global copper prices take a sudden dive because of a slowdown in China or the US, the Kwacha will feel the heat. Also, 2026 is an election year in Zambia. Politics always has a way of making markets a bit jumpy. Investors tend to get cautious when they aren't sure what the next administration’s fiscal policy will look like.

However, the fundamentals are the strongest they've been in a decade. The foreign exchange reserves are sitting at about 4.5 months of import cover, which gives the Bank of Zambia a decent "war chest" to smooth out any sudden volatility.

Making the Most of the Current Rate

If you need to move money between the Zambian Kwacha and American Dollar, timing is everything.

Don't just walk into the first bank you see on Cairo Road. The spreads can be wide. Check the interbank rates first—they’re usually around 19.80 right now—and see how close your provider gets to that. Many people are moving toward digital platforms like Wise or local fintech apps because they often offer better mid-market rates than traditional banks.

If you’re a business, you might want to look into forward contracts. Locking in a rate now for a future payment can save you a lot of sleep if the market gets volatile again during the election cycle.

💡 You might also like: When Will the Fed Cut Rates: What Most People Get Wrong

The big takeaway? The Kwacha has moved out of the "struggling currency" category and into the "recovery success story" lane. It’s been a long road, but the combination of copper booms, debt relief, and smart central banking has actually worked.

Keep an eye on those monthly inflation reports. As long as they stay on a downward path and the mines keep digging, the Kwacha should remain a solid performer against the dollar for the foreseeable future.

To stay ahead of the curve, keep a close watch on the upcoming February 2026 MPC meeting. That’s where the Bank of Zambia will signal its next move. If they hold or cut rates again, it's a green light that they believe the current Kwacha strength is here to stay.