You’ve probably seen the headlines or heard the stories. Zimbabwe has been through the absolute ringer when it comes to money. From the legendary 100 trillion dollar bill that couldn't even buy a loaf of bread to the sudden introduction of gold-backed coins, it’s a lot to keep track of. Honestly, if you’re looking at zimbabwe currency to pkr right now, you might be seeing numbers that look totally different depending on which website you click.

That’s because Zimbabwe just swapped currencies again.

In April 2024, the Reserve Bank of Zimbabwe (RBZ) killed off the old Zimbabwean Dollar (ZWL) and brought in something called the Zimbabwe Gold (ZiG). By the time we hit early 2026, this "ZiG" has become the standard, but people still get confused because old "ZWL" or "ZWD" tickers still pop up on some finance apps. Basically, if you are checking the rate for a business deal or just curious about how far a Pakistani Rupee goes in Harare, you have to make sure you’re looking at the ZiG.

The Reality of the ZiG: Zimbabwe Currency to PKR Today

As of mid-January 2026, the exchange rate is hovering around 1 ZiG to 10.90 PKR.

It’s been a wild ride. When the ZiG first launched, the government basically said, "Trust us, this one is backed by actual gold and foreign cash." For a while, it held steady. But currency markets are fickle. Over the last year, we’ve seen the ZiG fluctuate against the Pakistani Rupee quite a bit. One day you’re getting 10.80 PKR, and the next it might jump to 11.05 PKR based on the latest gold spot price or the State Bank of Pakistan’s own policy shifts.

The interesting part? While the official rate says one thing, the "street rate" in Zimbabwe can be a whole different animal. Even with a gold-backed currency, many vendors in Zimbabwe still prefer the US Dollar. If you’re a Pakistani exporter looking at this market, don't just look at the screen rate. You’ve got to account for the liquidity—which is a fancy way of saying "can I actually get my hands on the cash?"

Why the Rates Keep Jumping

Why does zimbabwe currency to pkr move so much? It’s not just one thing. It's a mix of gold prices, inflation in Islamabad, and the sheer historical trauma of the Zimbabwean economy.

When gold prices go up globally, the ZiG theoretically gets stronger. Since the Pakistani Rupee has its own struggles with inflation and IMF bailouts, the "cross rate" between these two can be pretty volatile. It’s like watching two people on a seesaw during an earthquake. Honestly, it’s a miracle they stay as stable as they do.

Here is a quick look at how the conversion feels in the real world:

- 100 PKR will get you about 9.17 ZiG.

- 1,000 PKR is roughly 91.70 ZiG.

- If you have 100 ZiG, that’s about 1,090 PKR.

These aren't just numbers. For someone sending a remittance or trying to price a shipment of textiles from Karachi to Bulawayo, these decimals matter. A 2% swing in a week—which happens more often than you’d think—can wipe out the profit margin on a small trade deal.

👉 See also: 6000 RMB to USD: What Most People Get Wrong About This Exchange

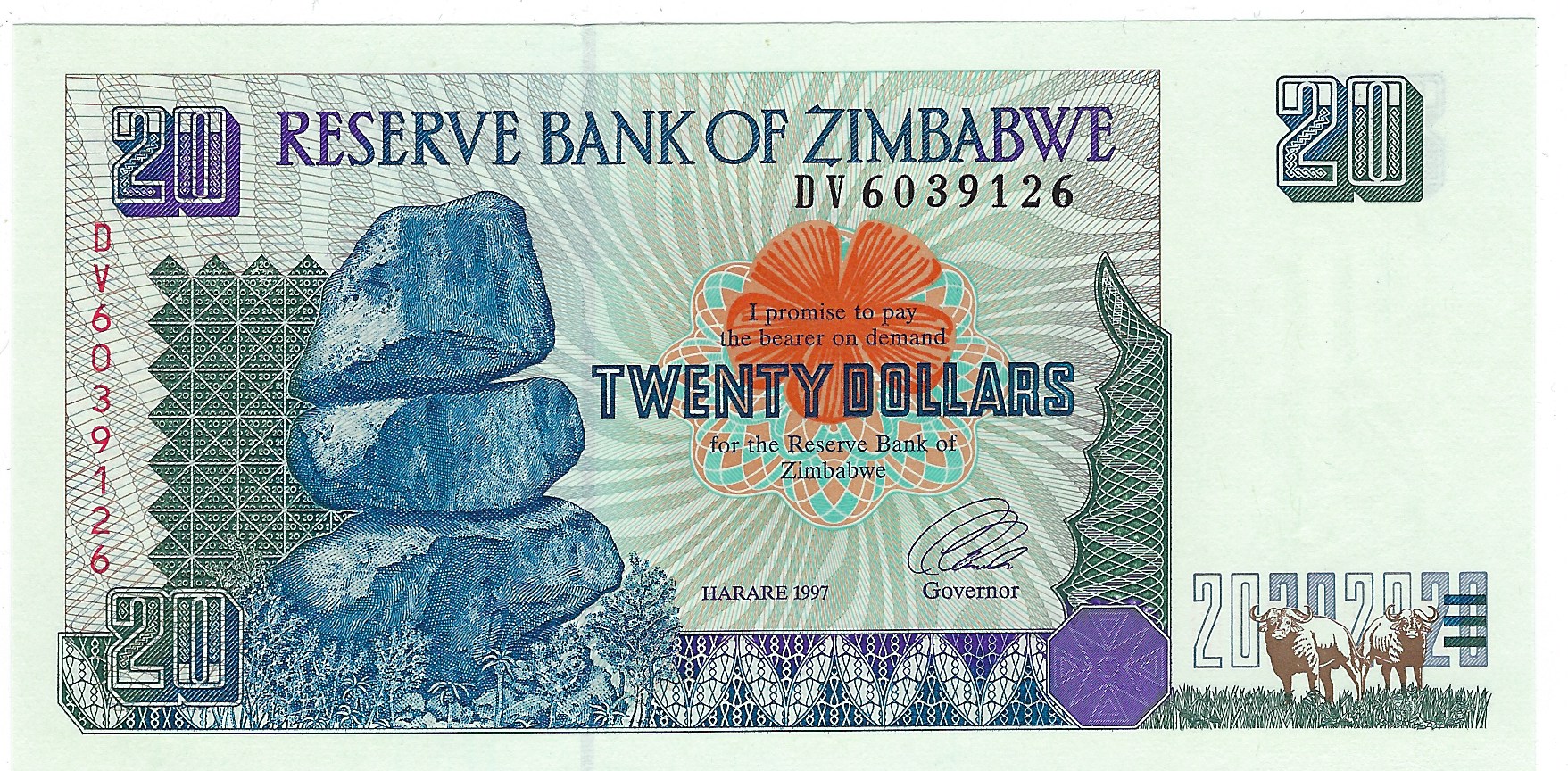

What Happened to the Old Trillions?

You can still find the old 100 trillion dollar notes on eBay as souvenirs. They are worth more as "curiosity items" than they ever were as actual money. The old ZWL was retired officially in late 2024. If you have a box of those old notes in your attic, don't expect to walk into a bank in Lahore and trade them for a stack of Rupees. They are basically wallpaper now.

The transition to the ZiG was supposed to end the hyperinflation era. Has it? Kinda. Inflation isn't at "trillion percent" levels anymore, but the ZiG has still faced some devaluation pressure. In late 2024, the RBZ had to devalue the ZiG by about 40% almost overnight to bridge the gap between the official rate and the black market. That’s the kind of thing that keeps investors awake at night.

The Pakistan Connection

You might wonder why anyone in Pakistan cares about Zimbabwean money. It’s actually a growing corridor. Pakistan and Zimbabwe have a history of trade in agriculture, surgical instruments, and sports goods. When a trader in Sialkot sells footballs to a school in Zimbabwe, they have to navigate this currency maze.

Most of these deals happen in US Dollars (USD) as an intermediary. But the underlying value is always tied back to how many ZiG or PKR that USD can buy. If the ZiG crashes, the Zimbabwean importer can't afford the Pakistani goods anymore. It’s all connected.

Practical Steps for Converting and Trading

If you’re actually dealing with zimbabwe currency to pkr, don’t just trust the first Google result. Those "mid-market" rates are for banks trading millions, not for regular people.

👉 See also: Reciprocal Tariff Chart 2025: What Most Businesses Get Wrong

- Check multiple sources. Use XE or Ria for a baseline, but if you’re actually moving money, check the bank’s "sell rate."

- Watch the Gold Spot Price. Since the ZiG is gold-backed, a sudden drop in gold prices often leads to a drop in the ZiG value against the PKR.

- Use USD as a bridge. Often, it’s cheaper to convert PKR to USD and then USD to ZiG (or vice versa) rather than trying a direct swap, which usually has terrible spreads.

- Confirm the Ticker. Ensure you aren't looking at ZWL (the old currency) or ZWD (the even older one). The code for the current currency is ZWG (Zimbabwe Gold).

The currency situation in Zimbabwe is a lesson in economic resilience. It’s messy, it’s complicated, and it changes fast. For anyone watching the PKR, it’s also a sobering reminder of what happens when a central bank loses the room.

Current Actionable Insight: If you have business interests involving these two currencies, prioritize "Real-Time Gross Settlement" (RTGS) or USD-based contracts. Relying on the ZiG for long-term price holding is still considered a high-risk move by most treasury experts in the region. Always verify the current ZWG/PKR rate on a live trading platform before committing to a transaction, as the 24-hour volatility can exceed 1.5% in either direction.