Money in Harare is a complicated thing. If you're looking at the zimbabwe currency to usd exchange rate today, you aren't just looking at a number on a screen; you’re looking at a survival strategy for an entire nation.

It's 2026. The currency landscape has shifted again. Honestly, if you still think the "Zim Dollar" from the hyperinflation memes of 2008 is what people use, you've missed a lot of history. Today, the game is all about the ZiG—the Zimbabwe Gold.

The ZiG: What Is This New Currency?

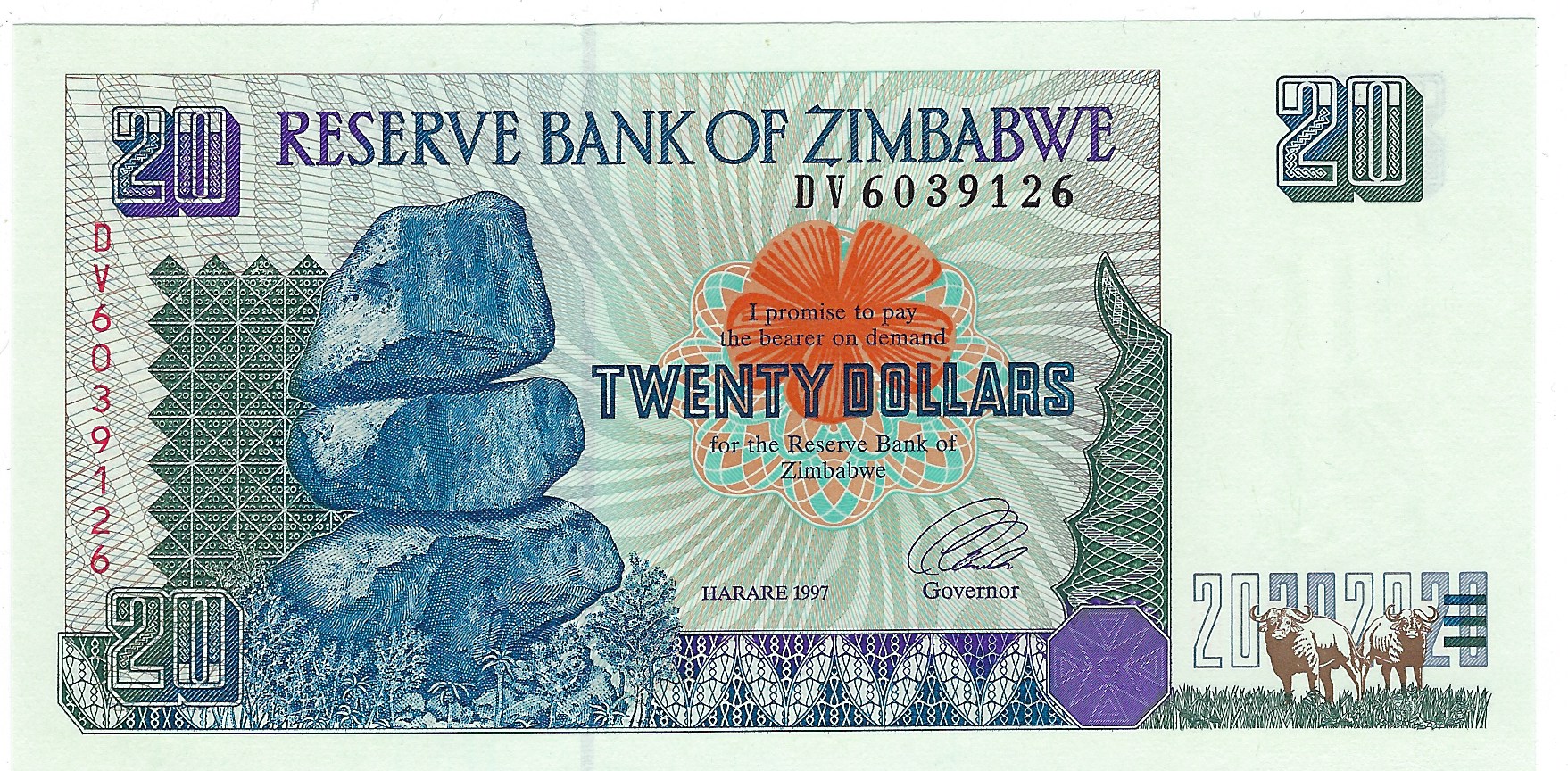

Basically, the ZiG is a "structured currency." It’s backed by actual physical assets. We're talking gold, diamonds, and foreign currency reserves. The Reserve Bank of Zimbabwe (RBZ) launched it in April 2024 to replace the battered RTGS dollar.

As of mid-January 2026, the official zimbabwe currency to usd rate is hovering around 25.72 ZiG to 1 USD.

That sounds stable, right? On paper, maybe. But the reality on the streets of Bulawayo or Mutare is a bit different. While the official interbank rate is what the government uses, the "parallel market" (the street rate) often tells a punchier story.

Why the Rate Moves

The ZiG's value is tied to the price of gold. Since gold has been flirting with record highs—hitting roughly $4,600 per ounce recently—the ZiG has some muscle behind it. But trust is a hard thing to build. Zimbabwe has had six currencies in 15 years. You've gotta understand why people are hesitant to ditch their US dollars.

John Mushayavanhu, the RBZ Governor, has been pushing hard to keep the currency backed. He recently noted that reserves have climbed to over $1.1 billion. That's a huge jump from the $276 million they had at the ZiG’s birth.

The Parallel Market Reality

You can’t talk about the zimbabwe currency to usd rate without mentioning the "street." In 2026, the gap between the bank rate and the street rate is the metric everyone watches.

The government wants that gap below 30%. Sometimes they hit it. Sometimes they don't.

- Official Rate: ~25.72 ZiG per USD

- Street Rate: Can be significantly higher depending on the day

- Payment Preference: Most shops still love the "Greenback" (USD)

If you walk into a grocery store, you might see prices in both ZiG and USD. It’s a multi-currency system, at least for now. The government originally said they’d go back to a single-currency system by 2030, but President Mnangagwa has hinted at moving that deadline up. That kind of talk makes markets nervous.

The Gold Standard Experiment

Zimbabwe is doing something almost no other country is doing right now. They are actually trying to run a gold-backed system in a digital world. Every ZiG in circulation is supposed to be matched by a specific amount of gold or cash in the vault.

It’s an old-school solution to a modern problem.

But here’s the kicker: people still remember 2008. They remember the 100 trillion dollar notes that couldn't even buy a loaf of bread. Because of that trauma, the zimbabwe currency to usd conversion is more about psychology than just economics. If the public doesn't believe the gold is there, the rate slips.

Surviving the 2026 Economy

So, how do people actually handle this?

✨ Don't miss: The Cracker Barrel Decor Change: Why Your Favorite Porch Is Getting a Makeover

Most businesses keep their books in USD. It’s the "anchor." When you get paid in ZiG, you usually try to spend it or convert it as fast as possible. It's a game of hot potato.

However, the 2026 budget has introduced some interesting tweaks. You can pay a portion of your taxes in ZiG. Schools and hospitals are starting to accept it more readily because the "ZiG cards" and mobile money platforms (like EcoCash) are actually working pretty smoothly.

Why It Matters to You

If you’re an investor or just someone sending money home, you need to watch the "Gold PM Fix." Since the ZiG is linked to gold, if the global price of gold drops, the zimbabwe currency to usd rate usually feels the pressure.

Also, watch the inflation numbers. The RBZ is aiming for single-digit inflation this year. If they miss that mark, the ZiG will likely start to slide against the dollar, regardless of how much gold is in the basement.

What to Do Right Now

If you're dealing with the zimbabwe currency to usd market, you need a strategy. Don't just look at one source.

- Check the RBZ Daily Rates: They publish the official "mid-rate" every morning. This is your baseline for legal transactions.

- Monitor Gold Prices: Since the ZiG is a "structured" currency, the London Bullion Market Association (LBMA) prices actually affect the value of money in Zimbabwe.

- Diversify Your Holdings: Even the most optimistic locals keep a "mattress fund" of US dollars. In a country where currency resets happen every few years, cash is still king.

- Use Official Channels for Large Transfers: Using a registered Bureau de Change is safer than the street, especially with 2026's tighter regulations on "unlicensed trading."

The situation is better than it was three years ago, but it's still a high-wire act. The ZiG might be the one that finally sticks, or it might be another chapter in a long book of experiments. Only the gold reserves—and the people's trust—will decide.

Keep a close eye on the monthly inflation reports from the Zimbabwe National Statistics Agency (ZimStat). If you see the "Month-on-Month" inflation creeping above 5%, it's usually a sign that the zimbabwe currency to usd rate is about to get volatile. Stay informed, stay cautious, and always have a backup plan.