You've probably seen the headlines. Another year, another currency "fix" in Zimbabwe. It feels like a movie we've all watched ten times already, but honestly, the 2026 situation has a few weird twists that don't make it onto the nightly news. If you're looking for the Zimbabwe USD exchange rate, you aren't just looking for a number. You're trying to figure out if the money in your pocket—or the price of bread in Harare—is going to make sense tomorrow.

Right now, as of mid-January 2026, the official interbank rate is sitting at approximately 25.67 Zimbabwe Gold (ZiG) to 1 USD.

That sounds stable. On paper, it is. But if you’ve spent five minutes on the streets of Bulawayo or scrolled through WhatsApp groups in Mashonaland, you know the official rate is only half the story. The parallel market—what everyone actually uses to price goods in the tuckshops—is a different beast entirely.

The Reality of the ZiG in 2026

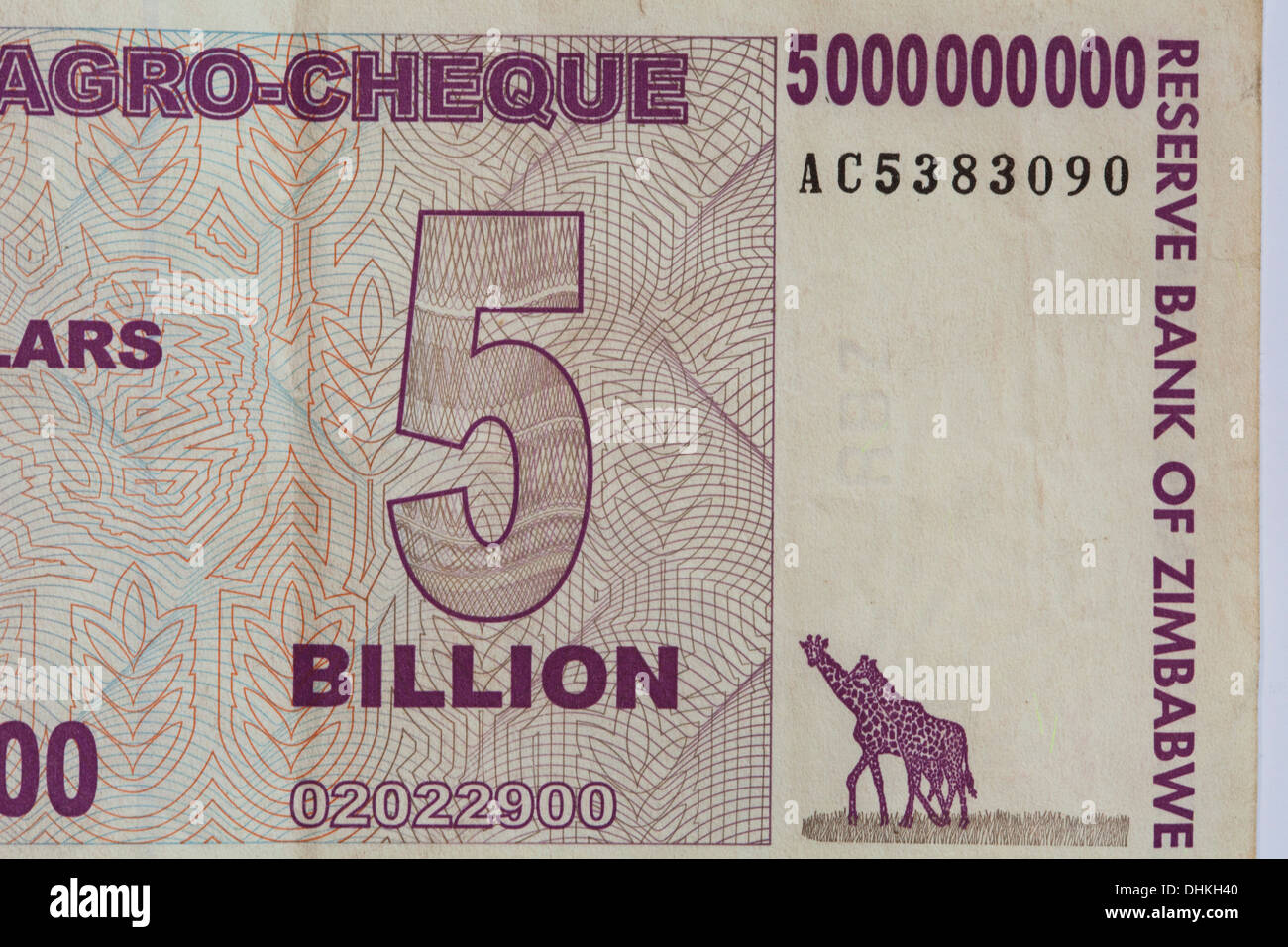

The ZiG was introduced back in April 2024. It was supposed to be the "final" answer because it's backed by actual gold and foreign currency reserves. The Reserve Bank of Zimbabwe (RBZ) has been very vocal about this. They claim there is roughly $900 million in hard assets backing the currency.

But trust is a fragile thing.

When you look at the Zimbabwe USD exchange rate today, you see a massive gap. While the bank says 25.67, the informal market—the "black market"—often pushes closer to 40 or 45 ZiG for a single US dollar, depending on who you're talking to and how much you're changing.

Why the split? It’s basically a supply and demand problem mixed with a "once bitten, twice shy" mentality. Zimbabweans have seen the Zimdollar, the Bond Note, and the RTGS dollar all go to zero. Even though the ZiG has held up better than its predecessors, people still prefer the "Greenback" for big purchases. If you’re buying a car or paying rent, nobody wants ZiG. They want USD.

What the official numbers say

The RBZ daily updates show a very controlled crawl. Here is what the mid-market looked like this week:

- USD/ZWG (Official): 25.67

- GBP/ZWG: 34.50

- ZAR/ZWG: 1.57

Inflation has actually slowed down significantly compared to the nightmare years of 2008 or even 2023. We’re looking at year-on-year inflation around 15% for the local currency. In the world of Zimbabwean economics, that’s practically a miracle. Finance Minister Mthuli Ncube even suggested we might hit single-digit inflation by the end of this year.

🔗 Read more: Parma Auto Body Parma Ohio: Why Your Local Shop Choice Actually Matters After a Crash

It sounds ambitious. Maybe too ambitious.

Why the Zimbabwe USD Exchange Rate Still Matters So Much

Everything is linked to the dollar. Zimbabwe operates on a multi-currency system, which is a fancy way of saying the US dollar is the real boss. About 80% of transactions in the country are done in USD.

If the exchange rate slips, prices in the shops go up instantly. Shopkeepers use "forward pricing." They aren't looking at what the rate is today; they’re guessing what it will be in two weeks when they need to restock their shelves from South Africa or China.

If they think the ZiG will weaken, they raise prices now. This creates a self-fulfilling prophecy.

🔗 Read more: Omaha Skyline King: Why the First National Bank Tower Still Matters in 2026

The Gold Factor

This is the part most people get wrong. They think the ZiG is just another piece of paper. But the RBZ actually has gold coins and digital tokens (GBDT) that are supposed to act as a tether. You can actually see the gold price quoted daily on the RBZ website—it's around $4,843 per ounce in ZiG terms today.

But here is the catch: You can’t easily walk into a bank and swap your ZiG notes for a physical bar of gold. Until that bridge is seamless for the average person, the "gold-backed" claim feels like a theoretical concept rather than a practical reality.

Practical Advice for Navigating the Rates

If you are dealing with money in Zimbabwe right now, you need a strategy. Don't just look at the Google exchange rate; it won't help you when you're standing at a till in OK Zimbabwe or Pick n Pay.

- Always ask for the "Swipe" vs. "Cash" price. Many retailers offer a discount if you pay in USD cash because they're desperate for liquidity.

- Watch the ZAR (South African Rand). In the southern parts of the country, the Rand is king. Sometimes the ZiG-to-Rand rate is more stable than the ZiG-to-USD rate.

- Check the "Street Rate" daily. Use reliable local news sites or community boards. The official rate is for importing fuel and medicines; the street rate is for your groceries.

- Keep minimal ZiG balances. Most experts suggest holding only what you need for immediate expenses (like utilities or government fees, which are often mandated in local currency). Everything else should stay in USD or hard assets.

The economy is currently projected to grow by about 5% in 2026. That’s decent, but it’s tempered by the fact that the country is still navigating a massive debt of $23.4 billion. The IMF is watching closely, but they haven't opened the taps for big loans yet.

Until the world sees sustained stability, the Zimbabwe USD exchange rate will remain a volatile, daily conversation for every Zimbabwean. It’s not just a business metric; it’s a survival guide.

Stay updated by checking the Reserve Bank of Zimbabwe (RBZ) daily bulletins for the official baseline, but always keep your ear to the ground for the "real" rate. Understanding the spread between the two is the only way to keep your purchasing power intact.

Next Steps for You

To manage your finances effectively in this environment, track the weekly variance between the interbank rate and the retail price index. If the gap exceeds 30%, expect a price hike in basic commodities within 72 hours. Prioritize settling government taxes and utility bills in ZiG while the official rate is favorable, but keep your primary savings in USD to hedge against the persistent informal market volatility.