You’re scrolling through your banking app or checking your email in early January, and there it is. A notification from Venmo, PayPal, or maybe eBay. They’re telling you a tax form is ready. Specifically, the 1099-K form. If your first reaction is a mild panic or a confused "what is it?", you aren’t alone. The rules surrounding this specific piece of paper have been a moving target for years. Honestly, it’s been a mess.

The IRS has been playing a game of "will they, won't they" with the reporting thresholds, leaving millions of casual sellers and side-hustlers in a state of constant limbo. One year the limit is $20,000; the next, they threaten to drop it to $600. It’s enough to make anyone want to close their shop and go back to cash under the mattress. But we can’t do that. Digital payments are the lifeblood of the modern economy.

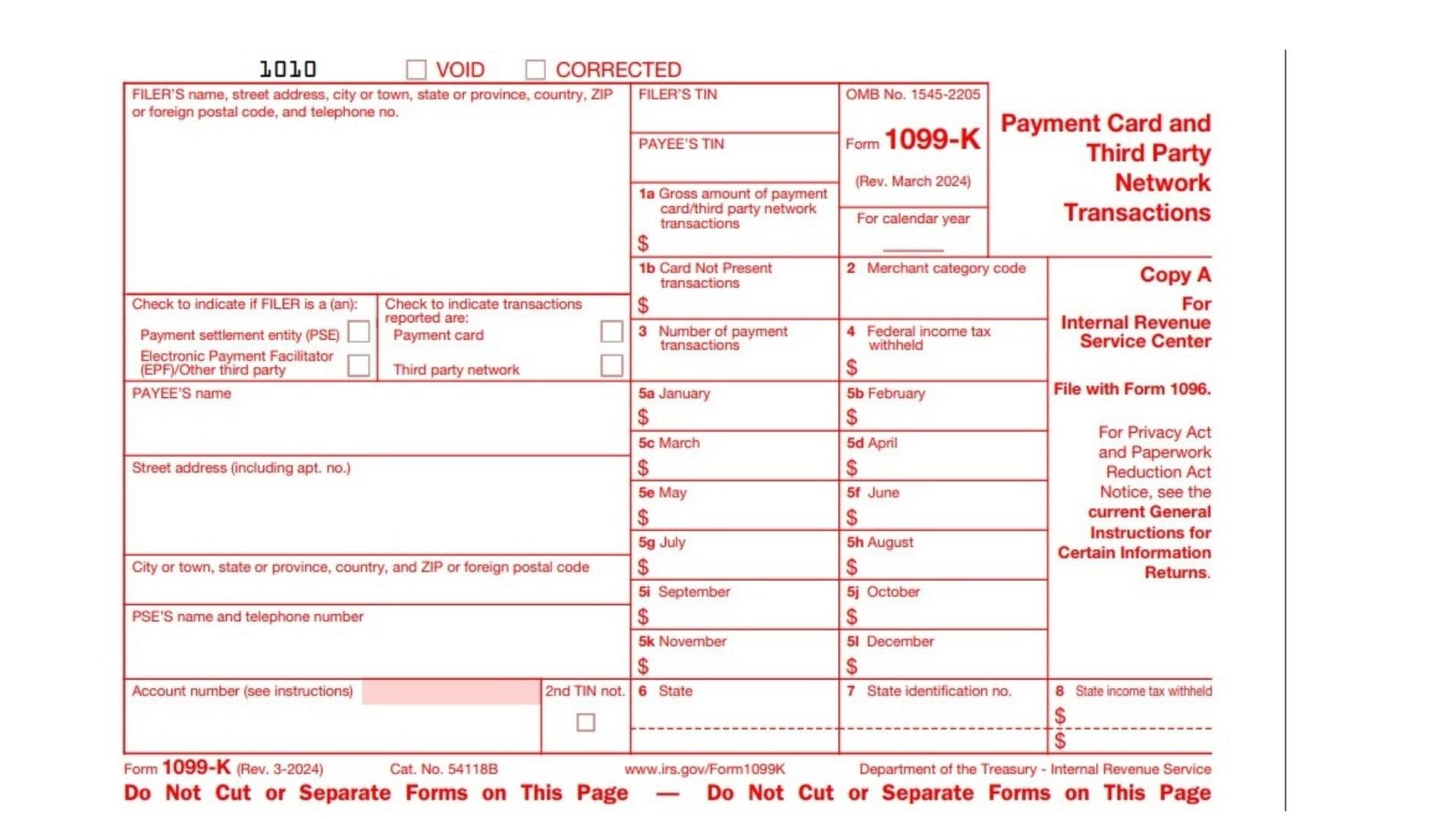

Basically, the 1099-K is an information return. Its job is to tell the IRS how much money you processed through "Payment Settlement Entities." Think credit card processors and third-party apps. It’s not necessarily a bill. It’s a mirror. It shows the government what your digital footprint looks like in terms of dollars and cents.

🔗 Read more: What's The Spot Price For Gold Today: Why the $4,600 Mark is Changing Everything

The Massive Confusion Around the $600 Threshold

For a long time, the rule was simple. You didn't get a 1099-K unless you had over 200 transactions AND $20,000 in gross payments. That’s a high bar. Most people selling an old couch or some used baby clothes never saw one. Then came the American Rescue Plan of 2021. The government decided to slash that threshold to a flat $600 with no transaction minimum.

The backlash was instant.

The IRS realized that sending out millions of new forms to people who just split a dinner bill or got reimbursed for a concert ticket would be a nightmare. So, they blinked. They’ve delayed the full implementation of the $600 rule multiple times. For the 2024 and 2025 tax years, they introduced a "phase-in" approach. For example, for the 2024 tax year, the IRS set a reporting threshold of $5,000 as a transition point.

Why does this matter to you? Because even if the IRS delays the $600 rule again, the platforms might still send you the form. They’re playing it safe. If you get one, you can't just ignore it. The IRS gets a copy too. If the numbers on your tax return don't match the numbers on the 1099-K, a computer in a basement in West Virginia is going to flag your account for an audit or an automated adjustment notice. That is a headache you do not want.

What is the 1099-K Form Actually Tracking?

It tracks "reportable payment transactions." That sounds like boring accounting speak, but the nuance is vital. This includes payments received for goods or services. It does not—and this is a huge point—include personal payments.

If your Aunt Martha sends you $100 for your birthday via Zelle or Venmo, that isn't a reportable transaction. If your roommate sends you $800 for their share of the rent, that isn't supposed to be on a 1099-K. These apps have "Personal" and "Business" tags for a reason. Problems happen when people use the wrong tag or when the algorithm gets greedy and flags everything.

What counts as a "Settlement Entity"?

- Third-party settlement organizations (TPSOs): This is the big one. PayPal, Venmo, CashApp, Stripe.

- Merchant Acquiring Entities: Banks that process credit card payments for your local coffee shop or your Shopify store.

- Online Marketplaces: Etsy, eBay, Ticketmaster, and Poshmark.

If you sold your old Taylor Swift tickets because you couldn't go, and you sold them for a profit, that’s taxable. If you sold them for less than you paid, it’s a loss. But the 1099-K doesn't know your "basis" (what you paid). It only knows the "gross." That is the fundamental flaw of the form that trips people up. It shows the total amount that hit your account before fees, refunds, or the original cost of the item.

The "Gross" vs. "Net" Nightmare

Let’s look at a real-world scenario. You sell a vintage camera on eBay for $1,000.

eBay takes their cut—let’s say 13%.

The shipping cost you $30.

You originally bought the camera for $700.

✨ Don't miss: MXN Peso to GBP: Why the Exchange Rate is Doing Weird Things Right Now

Your 1099-K is going to show $1,000.

The IRS sees $1,000 and thinks, "Hey, that’s $1,000 of income." But you only actually "made" a profit of about $140 after all expenses and the original cost. If you just put $1,000 on your taxes, you are overpaying. If you put nothing, you’re in trouble. You have to use Schedule C or Schedule 1 to explain the math to the IRS. You report the $1,000, then you subtract the $860 in costs to arrive at the taxable $140.

It’s tedious. It’s also why keeping receipts is no longer optional for casual sellers.

Distinguishing Between Business and Hobby

The IRS cares deeply about whether you’re running a business or just have a hobby. If you’re a business, you can deduct losses. If it’s a hobby, you generally can’t deduct expenses to the same extent, but you still have to report the income.

How do they tell the difference? They look at the "9 Factors." This includes things like:

- Do you carry out the activity in a business-like manner?

- Does the time and effort put into the activity indicate an intention to make a profit?

- Do you depend on income from the activity for your livelihood?

If you’re just cleaning out your garage once a year, you’re likely a hobbyist or just a person selling personal effects. If you’re hitting thrift stores every weekend to flip items on Poshmark, you’ve got a business. The 1099-K doesn't distinguish between these. It just barks out a number. You have to be the one to provide the context.

Common Myths That Get People Audited

One big myth is that if you don't get a form, you don't owe taxes. Wrong.

The 1099-K is a reporting tool for the IRS, not a permission slip for you. Even if you only made $400 and didn't receive a form, you are legally required to report that income.

Another myth: "If I use the Friends and Family option on PayPal, I'm safe."

Technically, using "Friends and Family" for business transactions is a violation of the terms of service for most platforms. Beyond that, if the IRS decides to audit you and sees a pattern of "gifts" that look suspiciously like payments for your handmade jewelry, they will reclassify that income and hit you with penalties.

There's also the "Zelle exception." Currently, Zelle is a bit of an outlier because it’s a bank-to-bank transfer service and doesn't technically fall under the same TPSO reporting requirements as Venmo or PayPal. However, don't bank on that lasting forever. The IRS is well aware of the loophole.

What To Do If Your 1099-K Is Wrong

It happens. Maybe you split a vacation with friends and the $3,000 they sent you ended up on a 1099-K because you accidentally had a business profile. Or maybe the platform duplicated a transaction.

First, contact the payer (the platform) and ask for a corrected form.

Second, if they won't fix it, don't panic. You can still file your taxes. You report the amount on the form, then you add an adjustment on your Schedule 1. You essentially list the amount again as a negative value with a note saying "Received in error" or "Personal reimbursement."

The goal is to make the "Total Income" line on your return match the total of all 1099s the IRS has on file for you, even if you’re immediately subtracting those amounts as non-taxable.

✨ Don't miss: Average Social Security Check at Age 70: Why Waiting Often Beats the Math

Practical Steps to Prepare for Tax Season

The 1099-K isn't going away. In fact, the IRS is getting better at tracking digital wealth. Here is how you stay ahead of it:

- Separate your accounts. If you sell anything—even just a few items a month—get a separate PayPal or Venmo account specifically for those transactions. Never mix rent money with business money.

- Digital Paper Trail. Save screenshots of your original purchases. If you bought a laptop for $1,200 two years ago and sold it for $800 today, you don't owe tax because you sold it at a loss. But without the original receipt, you can't prove that $800 isn't pure profit.

- Download your reports monthly. Don't wait until April. Most platforms allow you to export a CSV file. Do this every month so you can categorize "Business" vs "Personal" while your memory is still fresh.

- Watch the "Gross" amount. Remember that the 1099-K includes sales tax collected by the platform and shipping fees paid by the buyer. These are not your income, but they are included in the total. You must deduct them as expenses.

- Check your mail (and your spam). Many platforms have gone entirely paperless. If you don't log in to your dashboard, you might miss the form entirely until the IRS sends you a "Notice of Proposed Adjustment" eighteen months later.

The 1099-K is essentially the government's way of catching up to the digital age. It’s messy, the thresholds are confusing, and the paperwork is annoying. But if you treat it as a gross-receipts tracker rather than a final tax bill, it becomes much less intimidating. Just keep your receipts, categorize your payments correctly, and never assume the IRS isn't watching your digital wallet.