You've probably seen the ticker. Whether it’s listed as AMG on the Euronext Amsterdam or you’re tracking the advanced metallurgical group stock through its broader global operations, there is a weird disconnect happening right now. Most people look at the chart and see a specialty chemicals company or a legacy metals business. They're wrong. Honestly, if you aren’t looking at this through the lens of European lithium sovereignty and "circular economy" metallurgy, you’re missing the entire point of why this stock is a lightning rod for institutional debate.

AMG Critical Materials N.V. isn't a startup. It isn't some speculative junior miner with a PowerPoint presentation and a dream. They’ve been around. They have deep roots in vacuum furnace engineering and high-purity alloy production. But the reason the smart money is obsessed with them lately has nothing to do with their history and everything to do with a refinery in Bitterfeld-Wolfen, Germany.

It’s messy. The lithium market has been a total bloodbath over the last year, and that’s dragged the advanced metallurgical group stock price into the mud. But while the market panics over spot prices, AMG is quietly building the first major lithium hydroxide refinery on European soil. That’s a massive deal.

The Lithium Pivot Nobody Seems to Believe Yet

Let’s get real about the "Lithium Trap." For the last decade, Europe has been talk, talk, talk about "strategic autonomy." They want EVs, but they don't want to rely on China for the battery chemicals. Enter AMG.

The company’s strategy is actually pretty brilliant, if a bit risky. They aren't just digging holes in the ground; they’ve integrated the whole flow. They take spodumene from their Mibra mine in Brazil—which, by the way, is a byproduct of their tantalum operations, making it one of the lowest-cost sources on the planet—and they ship it to Germany. There, they turn it into battery-grade lithium hydroxide.

The first module of that German refinery is a beast. It’s designed to produce 20,000 tons of lithium hydroxide annually. To put that in perspective, that’s enough to power roughly 500,000 EV batteries. Most analysts are still pricing this like a cyclical metals company. They haven't quite figured out how to value a company that is essentially becoming the midstream backbone for the European auto industry.

Volkswagen, BMW, Mercedes—they’re all right there.

💡 You might also like: Warren Buffett on Trump: What Most People Get Wrong

It's Not Just Lithium: The Vanadium Secret

If you only look at lithium, you’re only seeing half the story of this advanced metallurgical group stock. Vanadium is the "boring" part of the portfolio that actually keeps the lights on.

AMG is one of the world's leading recyclers of spent catalysts from oil refineries. They take what is essentially toxic waste, process it at their plants in Ohio, and pull out ferrovanadium and nickel. This isn't just "greenwashing." It’s a high-margin, circular business model that most mining companies would kill for.

Dr. Heinz Schimmelbusch, the CEO (and a guy who has been in the metals game longer than most traders have been alive), has pushed this "circular" narrative hard. He’s not doing it to be trendy. He’s doing it because recycling catalysts is cheaper and more environmentally stable than traditional mining. When the steel industry is booming, vanadium demand spikes. When the steel industry cools, the recycling contracts still provide a steady flow of material. It's a hedge. A really effective one.

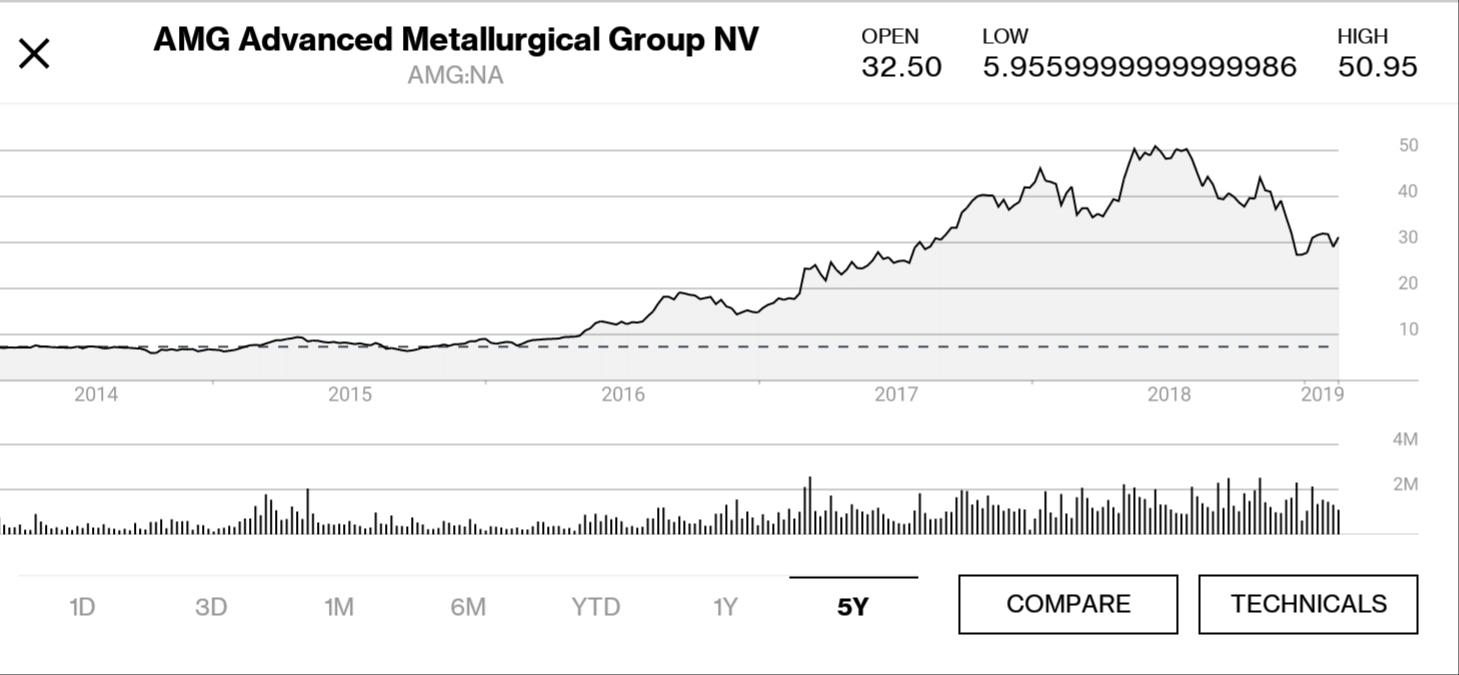

Why the Stock Price Looks Like a Rollercoaster

Value investors love a good "sum of the parts" argument, and AMG is a textbook case. If you look at the market cap of the advanced metallurgical group stock, it often trades at a multiple that suggests the market thinks the lithium project will fail or that vanadium prices will stay low forever.

There’s a clear skepticism.

Investors are scarred. They remember the lithium peak of 2022 and the subsequent crash. They see the delays in EV adoption in the US and Europe and they think, "Why buy a processor now?" But that ignores the regulatory environment. The EU’s Critical Raw Materials Act is practically written for companies like AMG. They are the "local source" that Brussels is desperate for.

The financials are a bit of a jigsaw puzzle. You have the "Clean Energy Materials" segment, the "Critical Minerals" segment, and "Critical Materials Technologies." Honestly, it’s a lot to track. But the core takeaway is that the Engineering wing—where they build vacuum furnaces for the aerospace industry—actually provides a massive safety net. When Boeing or Airbus are ramping up production, they need AMG’s furnaces to make superalloys for jet engines. This helps fund the capex for the lithium expansion. It’s a self-funding growth machine that the market treats like a volatile penny stock.

Managing the Geopolitical Risk

You can't talk about metals without talking about China. Period.

Right now, China dominates the processing of almost everything AMG touches. The bear case for the advanced metallurgical group stock is that China could just dump supply and keep prices low enough to kill off Western competitors before they even get started.

But Schimmelbusch is playing a different game. By focusing on the "circular" side—recycling and byproduct recovery—AMG keeps its cost basis significantly lower than a traditional "pure play" miner. They aren't just fighting for market share; they're fighting for a seat at the table of European industrial policy. If you believe that the West will eventually move toward "friend-shoring" its supply chains, then AMG is sitting on some of the most valuable real estate in the sector.

📖 Related: ARK 21Shares Bitcoin ETF: What Most People Get Wrong

What Most People Get Wrong About the Debt

One of the big knocks on the company is the debt load. Building refineries is expensive. Very expensive.

However, you have to look at the quality of that debt. AMG has been incredibly savvy about tapping into green bonds and low-interest financing tied to their environmental milestones. They aren't just borrowing from high-street banks at predatory rates. They are leveraging their ESG (Environmental, Social, and Governance) credentials to fund their transition into a battery-tech powerhouse.

Is it risky? Sure. Any capital-intensive business is. But comparing AMG's balance sheet to a tech company's is a mistake. This is an industrial play. You have to look at the assets. Between the Mibra mine, the Ohio recycling facilities, and the German refinery, the "brick and mortar" value here is substantial.

The Aerospace Tailwinds

While everyone focuses on EVs, let's talk about the sky. The aerospace sector is currently in a massive replacement cycle. Engines are getting hotter and more efficient, which requires more advanced superalloys.

AMG's Engineering division is the world leader in vacuum induction melting furnaces. If a company wants to melt titanium or specialty steels for a turbine blade, they basically have to call AMG. This part of the business is high-margin and has a huge moat. You don't just "disrupt" a vacuum furnace company with a new app. It takes decades of metallurgical expertise. This provides a "floor" to the advanced metallurgical group stock valuation that pure-play lithium miners simply don't have.

Real Talk: The Risks

It’s not all sunshine and titanium. There are real hurdles:

- Lithium Pricing: If lithium prices stay in the basement for another three years, the German refinery's payback period gets uncomfortably long.

- Operational Execution: Moving from a "metals company" to a "chemical company" (which is what a lithium hydroxide refinery is) is a steep learning curve.

- Energy Costs: Operating in Germany isn't cheap. High energy prices in Europe could eat into the margins of the Bitterfeld plant, regardless of how efficient it is.

The Verdict on AMG's Future

The advanced metallurgical group stock is essentially a bet on the "Dual Transition": the shift to green energy and the return of high-end Western manufacturing. If you think the world is going back to a pre-2020 globalization model where we buy everything from the lowest bidder regardless of geography, AMG is probably overvalued.

💡 You might also like: Qatar Dollar to Peso: What Most People Get Wrong About Exchange Rates

But if you think the future is about secure, local, and recycled supply chains, then the current market cap looks almost silly.

You’ve got a company that is simultaneously a leader in aerospace engineering, a pioneer in vanadium recycling, and the first mover in European lithium refining. That's a lot of hats. But if they can keep them all on, the re-rating of this stock could be one for the history books.

Actionable Next Steps for Investors

If you're looking at this sector, don't just stare at the stock chart. Do these three things instead:

- Monitor the Lithium Hydroxide Spread: Stop looking at spodumene prices and start looking at the "conversion margin." That is the difference between the cost of raw lithium ore and the price of battery-grade hydroxide. This is where AMG's profit lives.

- Track the EU's Subsidy Landscape: Keep an eye on announcements from the European Investment Bank (EIB). Any further grants or low-interest loans for "strategic projects" will directly de-risk AMG's capital structure.

- Watch Aerospace Backlogs: Check the quarterly reports of GE Aviation and Rolls-Royce. Their growth is a leading indicator for AMG's Engineering division, which provides the cash flow needed to fuel the lithium expansion.

The "Advanced Metallurgical Group" name might sound dry and academic, but the actual business is a high-stakes play on the materials that will define the next fifty years. It's not a stock for the faint of heart, but for those who understand the "circular" future of metals, it's easily one of the most interesting stories on the market right now.