You remember 2022. Inflation was screaming at 9%, gas prices were a nightmare, and suddenly everyone—even your cousin who barely knows what a 401(k) is—was talking about Series I Savings Bonds. For a hot minute, they were the coolest thing in finance. They offered a 9.62% yield. Safe. Backed by the government. Basically free money, or so it seemed.

But things change fast.

The frenzy died down as inflation cooled, yet the question remains: Are I bonds a good investment today, or are they just a relic of a weird economic moment? Honestly, it depends on whether you're looking for a place to hide your cash from the taxman or if you're trying to actually get rich. You won't get rich here. That is a fact. But you might save your skin when the next CPI report comes out looking ugly.

How the math actually works (It's weird)

I bonds aren't like a standard savings account where the bank just tells you an interest rate and you say "cool." They have a composite rate. This rate is a Frankenstein’s monster made of two parts: a fixed rate and an inflation rate. The Treasury Department adjusts these every May and November.

💡 You might also like: Converting 1,000,000 HKD to USD: What the Banks Don't Tell You

The fixed rate is the one you really want to watch. It stays the same for the entire thirty years you own the bond. If you bought an I bond in the early 2010s, your fixed rate was likely 0.00%. That’s rough. It means you were only keeping pace with inflation, never actually gaining "real" wealth. Recently, however, fixed rates have hovered around 1.3%. That changes the math significantly because it means you are guaranteed to beat inflation by 1.3% every single year, regardless of what the economy does.

The inflation rate is the wild card. It’s based on the Consumer Price Index for all Urban Consumers (CPI-U). When prices go up, your bond yield goes up. When they go down, your yield drops. But here is the kicker: the rate can never go below zero. Even if the U.S. experiences deflation—where prices actually drop—your I bond won't lose value. It just sits there.

The "Gotchas" that catch everyone off guard

You can't just dump a million dollars into these. The Treasury limits you to $10,000 per person, per calendar year. You can get an extra $5,000 if you use your federal tax refund, but that's a clunky process involving paper bonds that most people find annoying.

Liquidity is the real headache. You are legally forbidden from cashing out an I bond for the first 12 months. Period. If you need that money for an emergency car repair in month six, you are out of luck. It's locked in a digital vault at TreasuryDirect.gov, a website that looks like it was designed in 1998 and never updated.

Then there’s the three-month penalty. If you sell before five years, you lose the last three months of interest. It's not a dealbreaker, but it’s something to factor into your "is this worth it" spreadsheet. If rates plummet, you might want to bail, but you’ll have to time that exit to minimize the hit.

Comparing I bonds to the competition

Right now, High-Yield Savings Accounts (HYSA) and Certificates of Deposit (CDs) are putting up a fight. You can find HYSAs offering 4% or 5% with total liquidity. So why bother with the Treasury?

One word: Taxes.

I bonds are exempt from state and local taxes. If you live in a high-tax state like California or New York, that 4.5% or 5% I bond starts looking a lot better than a 5% CD that gets shredded by state income tax. Furthermore, you can defer federal taxes until you cash out. Most other investments make you pay every year. There is also a massive loophole for education. If you use the proceeds for qualified higher education expenses, you might be able to avoid federal taxes entirely. That’s a huge win for parents.

💡 You might also like: Wipro Share Price: What Most People Get Wrong About This IT Giant

The real risk is "Opportunity Cost"

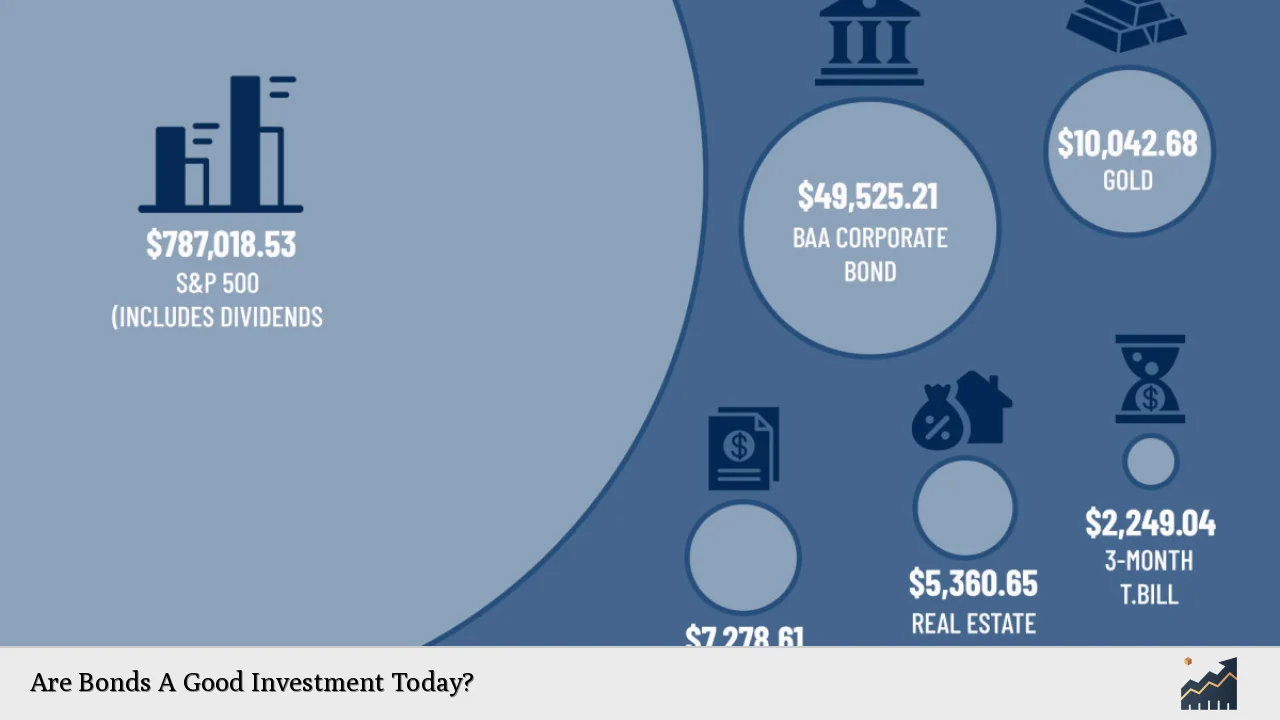

The biggest danger isn't losing money—you literally can't lose your principal with I bonds. The danger is missing out on the stock market. Over long periods, the S&P 500 has historically returned about 10% annually. If you put your $10,000 in I bonds for 20 years, you'll have protected your purchasing power. If you put it in a low-cost index fund, you might have tripled it.

I bonds are for your "sleep well at night" money. They are for the portion of your portfolio that you cannot afford to see drop by 30% in a market crash. They are a hedge. They are boring.

Why some experts are still buying

David Enna, who runs the site Tipswatch, has long argued that the fixed rate is the most important metric. When that fixed rate is high (above 1%), I bonds become a legitimate long-term savings tool rather than just a temporary inflation shield. We are currently in a period where the fixed rate is attractive.

The TreasuryDirect system is still a pain to navigate. You’ll deal with account locks, weird security questions about your favorite childhood pet, and a layout that defies modern UX principles. But for the safety of a sovereign nation’s guarantee, most people suck it up.

Actionable Steps for Your Cash

If you're sitting on a pile of cash and wondering if you should pull the trigger, follow this logic:

- Check your emergency fund. If you don't have three months of expenses in a liquid savings account, do not buy I bonds. That 12-month lock is real and it is unforgiving.

- Look at the current fixed rate. If the fixed rate is 1.0% or higher, it’s a strong "buy" for long-term holders. You are locking in "real" growth above inflation.

- Time your purchase. Buy near the end of the month. You get credit for interest for the full month even if you buy on the 29th.

- Automate the tax move. If you’re expecting a refund, fill out Form 8888 to grab that extra $5,000 in paper bonds. You can later convert them to electronic ones.

- Set a reminder. Check the new rates every May 1 and November 1. If the composite rate drops to something insulting—and you’ve held for over five years—consider moving the money back to a brokerage account.

I bonds are a tool, not a miracle. They won't make you a millionaire by next Tuesday, but they will ensure that $10,000 today still buys $10,000 worth of groceries in 2035. In a world where the dollar's value feels like it's melting, that's not a bad deal at all.