Honestly, trying to time a money transfer between Australia and India feels a bit like trying to catch a falling knife. You look at the AUD currency to INR rate one morning, it's at 60.30, and by the time you've finished your coffee and logged into your bank, it's jumped to 60.82. That’s where we are as of mid-January 2026. The Australian Dollar is showing some serious teeth, and if you’re sending money back to Mumbai or Bangalore, you’re basically playing a high-stakes game of "refresh the page."

The current rate is hovering around 60.83 INR per 1 AUD. Just a week ago, we were seeing numbers closer to 59.60. That is a massive swing for anyone paying for a wedding, a home loan, or just supporting family.

What’s Actually Moving the Needle?

It’s not just random luck. The Reserve Bank of Australia (RBA) is in a tight spot. While they kept the cash rate at 3.60% back in December, the vibe has shifted. Inflation is still being a pain—stubbornly sitting above that 3% target—and everyone is whispering about a rate hike in February. When people think interest rates are going up, they buy the currency. That’s exactly why the Aussie dollar has been climbing against the Rupee lately.

✨ Don't miss: 500 dolares en lempiras: Lo que nadie te dice sobre las comisiones ocultas

India is doing things differently. The RBI, now led by Governor Sanjay Malhotra, just cut their repo rate to 5.25% in December. They’re trying to keep the economic engine humming while inflation in India stays relatively cool, around the 2% to 3% mark.

Think about that gap. Australia might hike; India is cutting. That "interest rate differential" is like a magnet for global investors. They pull money out of lower-yielding INR and park it in AUD. Result? You get more Rupees for your Aussie dollars, but the trend is making things expensive for Indian importers.

📖 Related: Who is the Koch family? The massive influence behind the name you keep hearing

The Commodities Factor

You can't talk about the AUD without talking about what Australia digs out of the ground. Iron ore and coal prices have been surprisingly resilient this month. Since India is a massive buyer of Australian resources, the trade balance between these two giants dictates the daily "pip" movements we see on Google.

What Most People Get Wrong About Exchange Rates

Most people see a rate like 60.80 and think they'll get exactly that. Nope. Unless you're a big-shot hedge fund manager, you’re dealing with "retail rates."

👉 See also: Why Wichita, Kansas is Basically the Industrial Engine of the United States

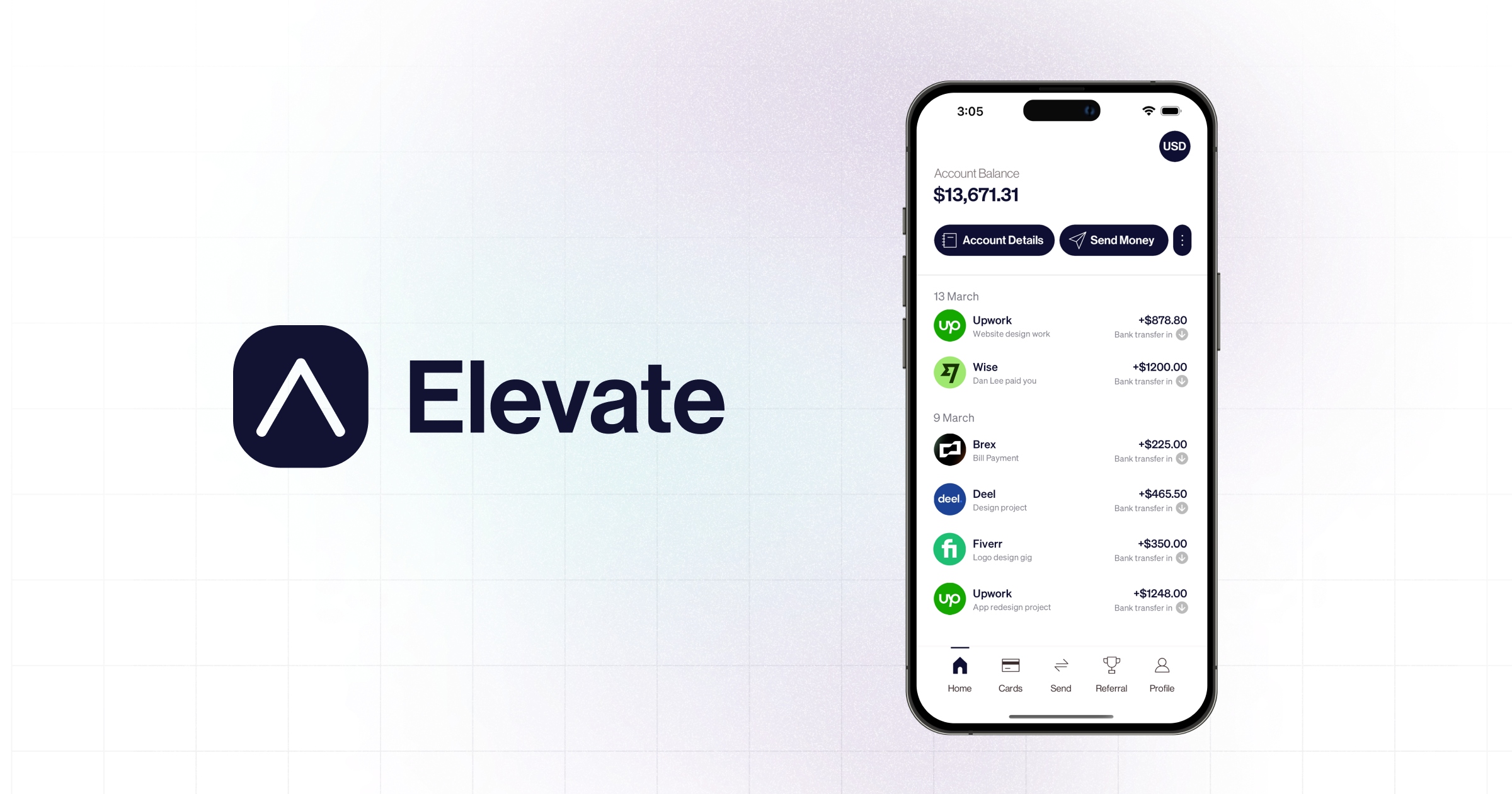

Banks often take a 2% to 4% cut hidden in the spread. If the mid-market rate is 60.83, your local big four bank might only offer you 58.90. It’s kinda daylight robbery if you aren't careful. Digital platforms like Wise or Remitly usually get you closer to that real number, but even then, fees can creep up.

- Mid-market rate: The "real" exchange rate you see on Google.

- Buy/Sell spread: The difference between what the bank pays and what they charge you.

- Transfer Fee: A flat fee that can eat small transfers for breakfast.

The Rupee’s Performance in 2026

The Rupee is actually one of the steadier emerging market currencies right now. India’s foreign exchange reserves are massive—over $680 billion—giving the RBI plenty of ammo to stop the Rupee from crashing. But they don't want it too strong either. A weak Rupee helps Indian exports. It's a delicate dance.

If you're an NRI in Sydney or Melbourne, this 60+ INR level is a "sweet spot." We haven't seen rates this high consistently in a while. In early 2025, the rate was down near 53.25. That’s a 14% increase in your purchasing power in just one year.

Practical Steps for Your Next Transfer

Don't just send money because it's payday. Look at the calendar. The RBA meets on February 3, 2026. If they hike rates, the AUD might spike again. If they hold, it might dip.

- Use a Comparison Tool: Sites like Monito or CurrencyTransfer show you the real-time spread.

- Set a Rate Alert: Most apps let you ping your phone when AUD hits a specific INR target (say, 61.00).

- Forward Contracts: If you're buying a house in India, ask your broker about a forward contract. It lets you lock in today's rate for a transfer you make in three months. It’s basically insurance against a sudden AUD crash.

- Avoid Weekend Transfers: Forex markets close on weekends. Banks often widen their spreads on Saturdays and Sundays to protect themselves from "gap" openings on Monday. You’ll almost always get a worse deal on a Sunday.

The AUD to INR story for 2026 is one of Australian inflation vs. Indian growth. For now, the Aussie dollar is the one with the momentum. Keep an eye on those inflation prints coming out of Canberra in late January; they’ll tell you exactly where the next big move is headed.

Actionable Insight: If you need to send a large sum, consider splitting it. Send half now at 60.80 and wait for the February RBA decision for the rest. This "dollar-cost averaging" for currency is the safest way to avoid the sting of a sudden market reversal.