Ever feel like those government reports about "average pay" are just a bunch of numbers being yelled into a void? You aren't alone. Honestly, looking at the average salary in us is a bit like looking at a blurred photograph—you get the gist, but the details are what actually matter for your bank account.

The latest numbers for 2026 are officially in. Right now, the median annual salary in the US is hovering around $63,795.

That sounds decent. But it's just a starting point.

If you’re a full-time worker, you're likely seeing a median weekly check of about $1,214. That is up roughly 4.2% from where we were a year ago. It's a solid bump, sure. But with the way eggs and rent have been acting lately, that "raise" mostly feels like just keeping your head above water.

🔗 Read more: Finding a Better Synonym for Pick Your Brain: How to Ask for Advice Without Sounding Like a Vampire

Why the average salary in us feels like a lie

Let's get real for a second. The "average" is a math trick. If your neighbor makes $20 million a year and you make $40,000, your average is over $10 million.

Does that help you pay your car note? Nope.

That is why we look at the median. The median is the true middle. Half the country makes more, half makes less. In 2026, that middle-of-the-road figure is the $63,795 we mentioned. If you're hitting that, you’re basically the definition of the American center.

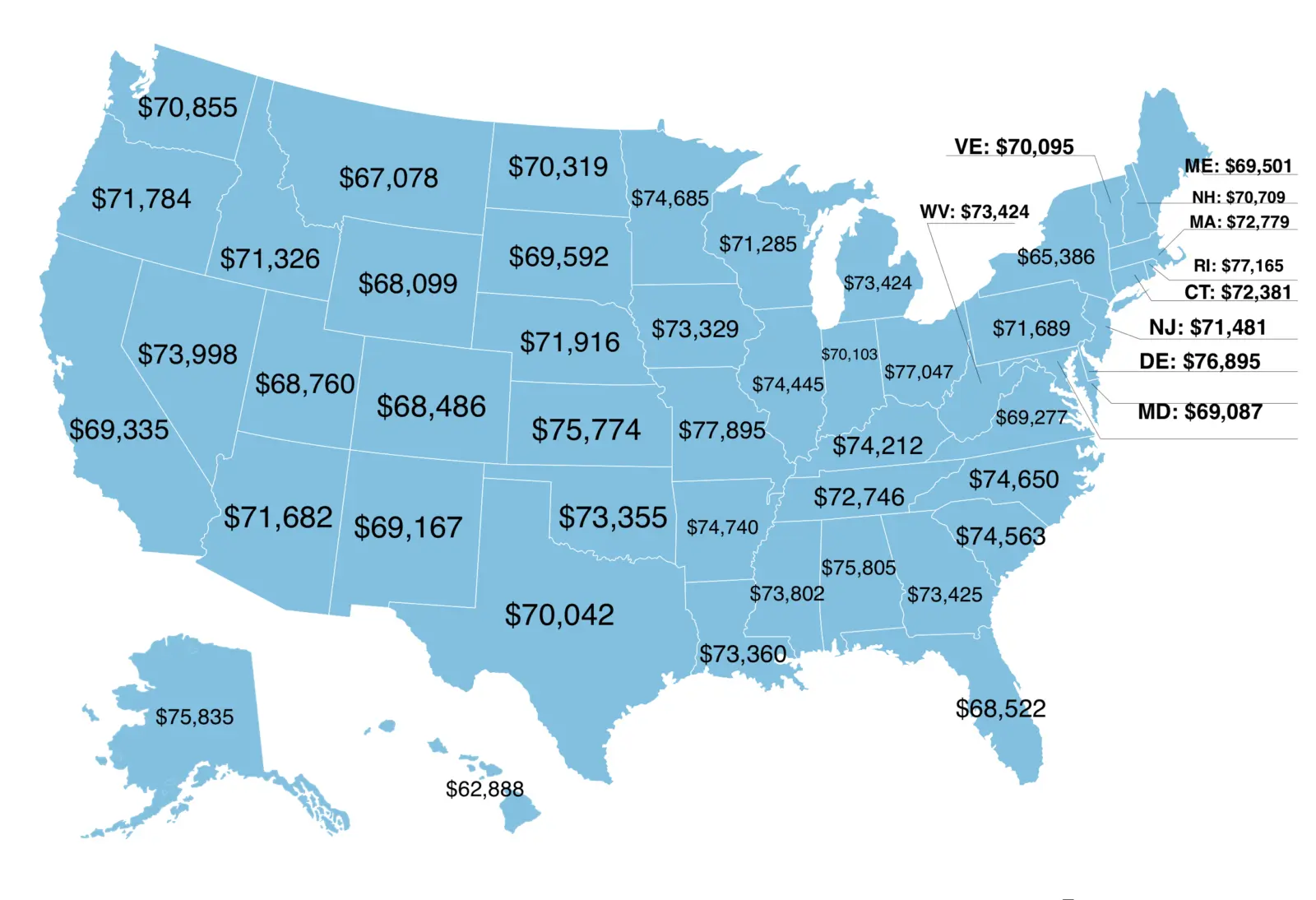

But where you live changes everything.

Take Massachusetts. It’s currently the heavyweight champion of paychecks, with an average annual salary of about $76,600. Then look at Mississippi. The average there drops down to roughly $43,100. That is a massive $33,500 gap just for living in a different zip code.

Of course, a sandwich in Boston costs way more than a sandwich in Biloxi, so it kinda balances out. Sorta.

The age and experience factor

You've probably noticed your pay doesn't move in a straight line. It’s more like a hill.

- The 16-24 Crowd: Basically the entry-level struggle. Median weekly pay is about $771.

- The 35-44 Sweet Spot: This is where you usually peak. Workers in this bracket are pulling in about $1,385 a week.

- The 45-54 Veterans: Still going strong at $1,377 a week.

- The 65+ Finish Line: Earnings start to dip back down as people transition to part-time or retirement roles.

It's interesting to see that men in the 35-44 age range are hitting a median of $1,504, while women in that same age group are at $1,226. That’s a gap that's been closing, but it’s still very much there.

Which jobs are actually paying the bills in 2026?

If you want the big bucks, you go where the tech is. Or the scalpel.

According to the 2026 Salary Guide from Blue Signal, a Cloud Engineer is currently looking at a median pay of $138,000. If you’re a Data Scientist, you're right there with them at the same $138,000 mark. Even "lower-level" tech roles like a QA Engineer are starting around $89,000.

But it isn't just about coding.

📖 Related: Why That Chick Fil A Rain Suit Actually Matters for Fast Food Operations

Healthcare is still a goldmine if you have the stomach for it. A Nurse Practitioner is now averaging about $129,210. On the flip side, people in service occupations are still on the low end of the totem pole, often bringing home around $897 a week for men and $747 for women.

Education pays off, too. There is no getting around that. A worker with a Bachelor’s degree is averaging $1,559 a week. Compare that to someone with just a high school diploma at $960. Over a year, that is a $31,000 difference. Basically a whole extra person's salary just for having that piece of paper.

The 2026 "Real Wage" reality

Here is a bit of good news. For the third year in a row, we are seeing "real wage growth."

What does that mean in plain English? It means your pay is finally growing faster than inflation. ECA International reports that real-terms salaries are forecast to rise by about 1.8% this year. It isn't a lottery win, but it means your money actually buys a little more than it did last January.

✨ Don't miss: S\&P 500 Historical Data: What the Charts Don't Actually Tell You

What you should actually do with this info

Knowing the average salary in us is fine for trivia night, but for your life? You need to benchmark yourself.

First, stop comparing yourself to the national average if you live in a low-cost area. It’ll just make you feel bad for no reason. Instead, look at your specific industry and your specific city. ZipRecruiter and the Bureau of Labor Statistics (BLS) are your best friends here.

If you’re significantly below that median $1,214 weekly mark and you’ve got a degree or five years of experience, it is time to have a very uncomfortable conversation with your boss. Or start polishing the resume.

Next steps for your wallet:

- Check the local floor. 22 states are raising their minimum wage in 2026. Even if you make more than minimum, this "wage floor" lift usually pushes all salaries up eventually.

- Audit your skills. The biggest jumps right now are in AI, Cloud platforms, and Healthcare. If you can add even one "hot" skill to your LinkedIn, your market value jumps.

- Negotiate based on the median. When you ask for a raise, don't say "I want more." Say, "The median for this role in this city is $X, and I am delivering Y value."

The numbers are just a guide. You're the one who has to go get them.