Honestly, if you'd asked most investors a year ago where they thought Boeing would be by now, you probably would’ve gotten a lot of nervous laughs and eye-rolling. It's been a rough ride. But right now, the price of boeing stock is telling a story of recovery that almost nobody saw coming quite this fast. As of mid-January 2026, we're looking at a share price hovering around $247.68.

That is a huge deal.

Why? Because just a few months back, Boeing was still dodging headlines about production glitches and executive shakeups. Now, it’s hitting two-year highs. If you're looking at your portfolio and wondering if you missed the boat or if this is just a temporary "dead cat bounce," you’re not alone. The market is basically split down the middle on whether this $247 level is a peak or just the beginning of a massive breakout.

What is the price of boeing stock doing right now?

So, here’s the breakdown of where we stand. The stock recently tapped $248.75, which is its 52-week high. If you look at the year-to-date performance, it’s already up over 9% in just the first two weeks of 2026.

That’s some serious momentum.

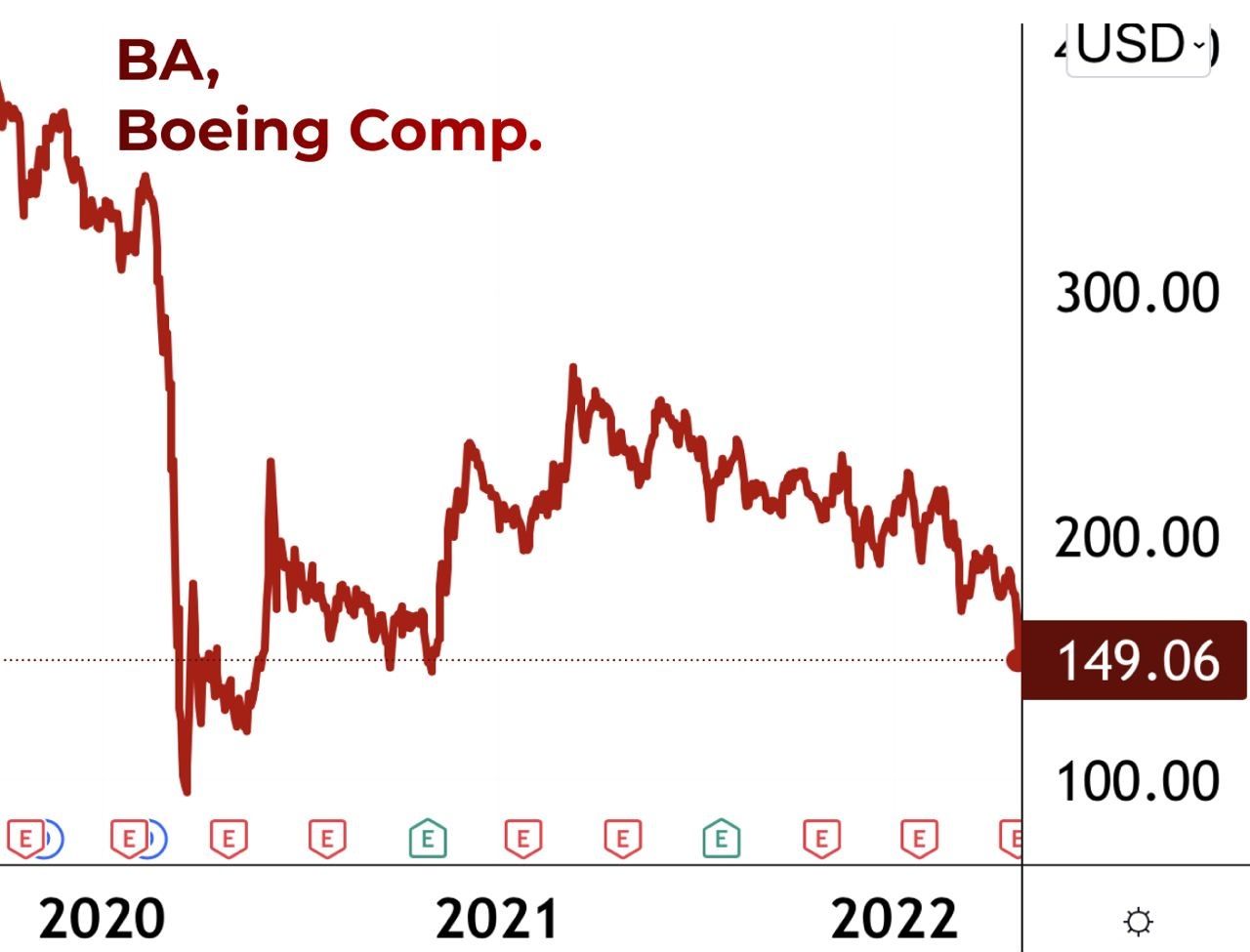

Compare that to where it was a year ago—trading in the $170s—and you start to see why the "turnaround" narrative is finally sticking. People are actually buying the dip. Not just retail traders, either. Big institutional players like Vanguard and Kingstone Capital have been upping their stakes. When the big money moves in, the price of boeing stock tends to find a floor, and right now, that floor feels a lot more solid than it did in 2024.

The Numbers You Need to Know

- Current Price: ~$247.68 (as of Jan 16, 2026)

- 52-Week Range: $128.88 – $248.75

- Market Cap: Roughly $194 Billion

- Recent Momentum: Up about 20% in the last 30 days

Why is it suddenly moving so fast?

A lot of it comes down to "clearing the deck." For years, Boeing felt like it was playing a never-ending game of whack-a-mole with its problems. 737 MAX issues. 787 delivery pauses. Labor strikes. It was exhausting for everyone involved.

But 2026 feels different.

The FAA finally gave the green light to ramp up 737 production to 42 planes a month. That is the magic number analysts were waiting for. When Boeing actually builds and delivers planes, it makes money. It's a simple business model that they just couldn't quite execute for a while. Now that they are, the cash is starting to flow back in. Delta just ordered up to 60 of the 787 Dreamliners, and Alaska Airlines recently dropped a massive order for 105 planes.

📖 Related: Arizona Minimum Wage 2024 Explained (Simply)

Backlog is the keyword here. We're talking about a $636 billion order backlog. That is a staggering amount of guaranteed work, assuming they don't trip over their own feet again.

The Spirit AeroSystems Factor

Don't forget the acquisition of Spirit AeroSystems that closed late last year. By bringing their most critical supplier back in-house, Boeing is trying to fix its quality control issues at the source. It’s expensive, sure. But the market seems to think it’s a price worth paying to stop the constant stream of "part failure" headlines.

Is it actually a good deal at $247?

This is where it gets tricky. If you look at the price of boeing stock through the lens of traditional valuation, it looks... well, weird. The trailing P/E ratio is basically useless because they’ve been losing money. But the forward-looking analysts are getting aggressive.

✨ Don't miss: Johnstown Wire Johnstown PA: Why This Industrial Landmark Still Matters Today

Bernstein recently moved their target to $298. Susquehanna is even bolder, eyeing $300.

They aren't looking at what Boeing did last year. They’re looking at 2027 and 2028. By then, analysts expect free cash flow to explode toward $10 billion annually. If you believe that Boeing will hit its production targets of 50+ planes a month by the end of this year, then $247 actually looks pretty cheap.

On the flip side, you have the bears. They’ll point to the fact that Boeing’s debt is still massive compared to Airbus. They’ll remind you that the 777X delivery got pushed back to 2027. There is zero room for error here. If another "door plug" incident happens, that $247 price tag will evaporate overnight.

How to play it from here

If you're looking to jump in, or if you're already holding and wondering whether to take profits, here’s the move:

- Watch the $242 level. Technical analysts see this as a key "buy point" from a recent cup-and-handle pattern. As long as the price stays above $242, the upward trend is technically healthy.

- Focus on the January 27th earnings call. This is the big one. CEO Kelly Ortberg will need to prove that the production ramp isn't just a fantasy.

- Check the delivery numbers monthly. Don't just look at the stock price. Look at how many planes are actually leaving the factory. If deliveries dip below 35 a month, the stock will likely retreat.

The bottom line? The price of boeing stock is currently riding a wave of massive optimism. It’s a classic "show me" story. The market has priced in a lot of success already, so now Boeing actually has to deliver the goods. Literally.

✨ Don't miss: Finding Your Way: The Royal Bank Branch Finder and What You Need to Know

Actionable Insight: If you're a long-term investor, the valuation gap between Boeing and its intrinsic value (some models suggest it's worth over $350) offers a cushion, but the volatility remains high. Consider using limit orders rather than market orders to manage the intraday swings that are common with BA. Keeping an eye on the debt-to-equity ratio over the next two quarters will tell you more about the company's long-term survival than any single day's price movement.