If you've bought a pair of shoes, a laptop, or even a bag of frozen shrimp lately, you’ve probably felt the phantom sting of a trade war you thought was settled years ago. It wasn't. Honestly, the whole situation with the china tariff to us has become a dizzying game of economic tag. One day we’re hearing about "de-risking," and the next, there’s a fresh executive order hitting your favorite tech gadgets with a 25% surcharge.

It’s messy.

Back in the day—we’re talking 2018—the trade spat felt like a temporary tantrum. Most experts figured it would blow over after a few high-stakes meetings in D.C. or Beijing. Instead, it’s 2026, and the "temporary" measures have basically become the permanent architecture of how the U.S. and China do business. If you’re trying to figure out why your company’s supply chain costs are skyrocketing or why that EV you wanted is suddenly priced like a luxury yacht, you have to look at the specific levers being pulled right now.

💡 You might also like: Is Target an American Company? The Surprising Truth About Where Your Money Goes

The 2026 Reality: Not Just One Tariff, But a "Stack"

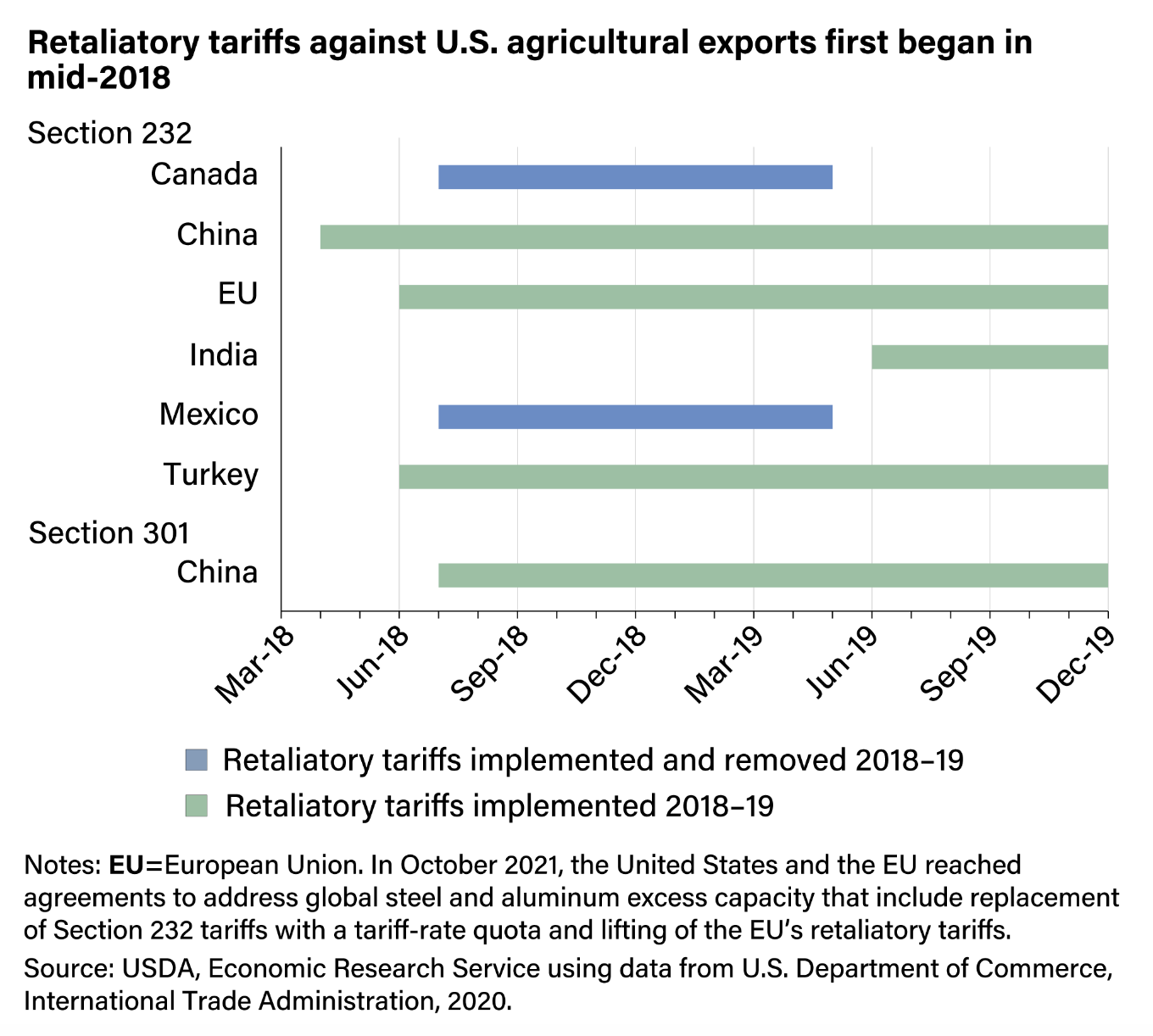

Most people talk about "the tariff" as if it’s one single tax. It’s not. It’s more like a lasagna of taxes. You’ve got the original Section 301 duties from the first Trump administration, which the Biden-Harris team not only kept but expanded. Then you have the 2025 escalations.

As of January 13, 2026, we are seeing a massive shift in how these are applied. Specifically, the U.S. Trade Representative (USTR) has pushed through the second wave of increases on "strategic" sectors. We're talking about 100% duties on Chinese electric vehicles and 50% on semiconductors.

Why the sudden jump?

The U.S. government argues that China hasn't moved the needle on intellectual property theft. They claim "Made in China 2025" is still the blueprint for global dominance, and the only way to level the playing field is to make Chinese goods prohibitively expensive.

What’s Hitting Your Wallet Right Now?

- Medical Supplies: If you’re in healthcare, you’ve noticed. Tariffs on rubber medical and surgical gloves just hit 100% this month. Face masks? Those are up to 50% now.

- Tech and Chips: Semiconductors and solar cells are sitting at a 50% rate. This isn't just about computers; it’s about anything with a "brain," from your dishwasher to your car.

- The "Fentanyl" Tariff: This is a weird one that caught people off guard last year. President Trump invoked the International Emergency Economic Powers Act (IEEPA) to slap a 10% duty on Chinese goods specifically to pressure Beijing on precursor chemicals.

The Supreme Court Cliffhanger

Here is the part nobody is talking about: the legal foundation of these tariffs is currently screaming for help. Just yesterday, President Trump posted on Truth Social that it would be a "complete mess" if the Supreme Court struck down his global trade tariffs.

The Court is looking at whether the President actually has the authority to use "national emergency" laws to tax everyday imports. If they rule against the administration, we could see a chaotic scramble for refunds. Imagine billions of dollars in duties having to be paid back to importers. It would be an accounting nightmare that could take years to untangle.

But for now? The china tariff to us remains in full effect. Customs and Border Protection (CBP) isn't waiting for a court ruling; they’re collecting the cash at the ports every single day.

The "De Minimis" Loophole is Closing

You know those $15 shirts from Temu or Shein? They used to slip in duty-free under the "de minimis" rule, which allowed anything under $800 to enter the U.S. without a cent of tariff.

That’s basically over.

Since August 2025, the exemption has been suspended for many categories. Now, even those small packages are getting hit with a 54% duty or a flat $100 fee in some cases. It’s killed the "cheap direct-to-consumer" model that many people relied on.

Is Anyone Actually Winning?

It depends on who you ask.

✨ Don't miss: Why 2 Marlton Pike West Cherry Hill is the Most Important Intersection in South Jersey

If you’re a domestic steel producer in Ohio, you love this. You’ve got a 25% price advantage over the guy importing from Shanghai. But if you’re a small business owner in Georgia trying to build a new warehouse, your construction costs are up 30% because of those same steel duties.

The Tax Policy Center estimated that these tariffs would impose a burden of roughly $2,100 per household in 2026. That’s a "tax" that doesn't show up on your 1040 form, but it definitely shows up at the grocery store and the car dealership.

The Narrow Windows of Relief

It’s not all doom and gloom. There are "exclusions." The USTR recently extended 178 specific product exclusions until November 10, 2026. These are for things that simply cannot be made anywhere else yet—certain types of manufacturing equipment and specific solar components.

If your business is struggling, you need to check the HTSUS (Harmonized Tariff Schedule of the United States) codes constantly. Sourcing from Vietnam or Mexico is the "meta" move right now, but even that is getting risky. The U.S. is starting to look at "transshipment," where Chinese parts are sent to Mexico just to be bolted together and shipped to the U.S. duty-free. CBP is cracking down on that with massive penalties.

✨ Don't miss: The House of Gucci by Sara Gay Forden: Why This Story Still Haunts Luxury Fashion

Actionable Steps for Navigating 2026

If you're a business owner or a consumer trying to stay ahead of the china tariff to us impact, don't just sit and wait for the news.

Audit Your HTS Codes Immediately

Don't rely on your freight forwarder to get this right. If your product is misclassified, you could be paying 25% when you should be paying 7.5%—or worse, you could be hit with back-taxes and penalties. Use a trade attorney to verify your classifications.

Diversify Your Sourcing (Realistically)

Moving production to Vietnam or India takes 18 to 24 months. If you haven't started, you're already behind. However, don't just look for "not China." Look for countries with active Free Trade Agreements (FTAs) with the U.S. to ensure long-term stability.

Watch the November 10, 2026 Deadline

This is the "cliff" for many current exclusions and the temporary "truce" agreements. Mark your calendar. If those extensions aren't renewed, costs will spike again overnight.

Evaluate "First Sale" Valuation

For high-volume importers, using the "First Sale" rule can legally lower the declared value of goods, which reduces the total tariff paid. It's a complex accounting maneuver, but in a 25%+ tariff environment, it can save millions.

The trade war isn't a headline anymore; it's the climate we live in. Adapt or get soaked.