So, you’re looking at a nine-zero figure. 1,000,000,000 yen. It looks massive on paper, right? In Japan, it basically makes you a "billionaire," but the reality of 1 billion yen to dollars is a moving target that has left a lot of investors and travelers scratching their heads lately. If you had this much cash in 2020, you were looking at nearly $10 million. Today? It’s a completely different story.

The yen has been on a wild, somewhat nauseating rollercoaster.

🔗 Read more: Bulgarian Currency to USD Explained: Why the Lev Just Changed Forever

Basically, the Japanese currency has been hammered by what economists call the "interest rate differential." While the Federal Reserve in the U.S. was cranking up rates to fight inflation, the Bank of Japan (BoJ) stayed stuck in the mud with near-zero or negative rates for years. This created a massive gap. Money flows where it earns interest. Naturally, investors dumped yen to buy dollars, causing the yen's value to crater.

The Current Reality of 1 Billion Yen to Dollars

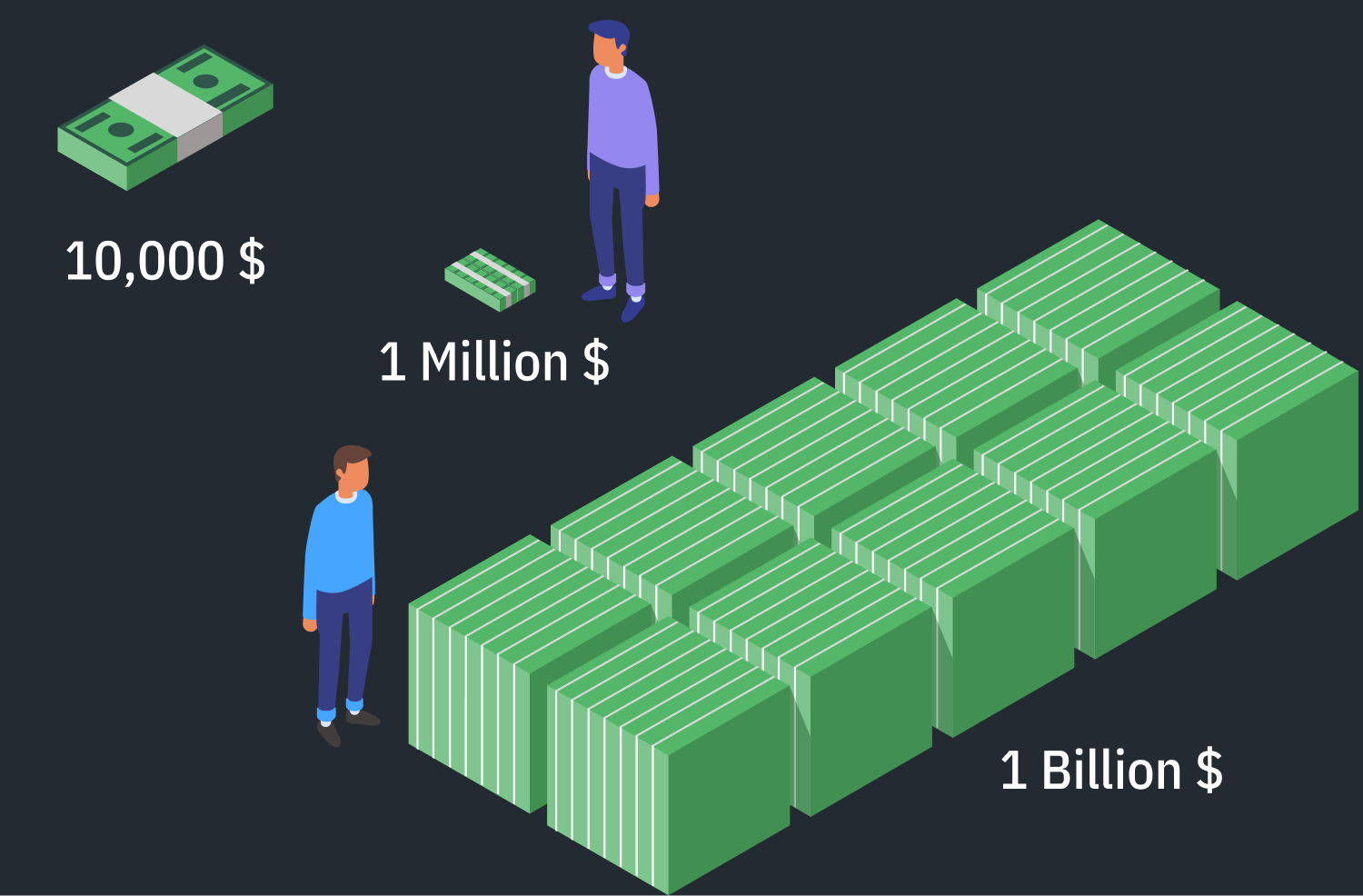

Right now, if you’re sitting on 1 billion yen, you’re looking at roughly $6.5 million to $7 million USD, depending on the specific heartbeat of the market the second you check.

Wait.

Let that sink in. A few years ago, that same billion yen would have bought you a high-rise penthouse in Manhattan. Now, you’re missing about 30% of that purchasing power in dollar terms. It’s a brutal haircut. When people search for the conversion of 1 billion yen to dollars, they often expect a round number. They want it to be $10 million. It isn't. Not anymore.

Why the Math Keeps Changing

Currency markets don't care about your feelings or your budget. They care about the 10-year Treasury yield and the statements coming out of Kazuo Ueda’s mouth—he’s the Governor of the Bank of Japan, by the way.

- The Carry Trade: This is the big one. Institutional investors borrow yen (because it's cheap) and invest it in higher-yielding assets elsewhere. When they do this at scale, it puts downward pressure on the yen.

- Trade Balances: Japan imports a ton of energy. Since oil and gas are priced in dollars, Japan has to sell yen to buy those dollars to keep the lights on. This constant selling pressure keeps the yen weak.

- Speculation: Hedge funds love to short the yen when they see the BoJ hesitating to raise rates.

Honestly, the volatility is the real story here. On a "bad" day for the yen, your 1 billion could lose $100,000 in value in a few hours. That’s enough to buy a Porsche, just gone, because of a press release.

What 1 Billion Yen Actually Buys You

To understand the weight of 1 billion yen to dollars, you have to look at what that money actually does in Tokyo versus Los Angeles or New York. Japan is experiencing a weird phenomenon where the yen is weak globally, but domestically, things haven't gotten that much more expensive for locals compared to the hyper-inflation seen in the States.

In Tokyo’s high-end Minato City district, 1 billion yen will get you a spectacular "mansion" (that’s what they call luxury apartments there). We’re talking 300 square meters of floor-to-ceiling glass overlooking the Tokyo Tower.

If you take that same $6.7 million to San Francisco? You’re getting a nice house, sure. But it’s probably a four-bedroom in a decent neighborhood, not a world-class trophy property. The "weak" yen actually makes Japan a playground for anyone holding USD.

The "Ichibun" Club

In Japan, 1 billion yen is often cited as the "exit" number for tech founders. It's the point where you never have to work again. But if those founders want to retire to Hawaii, they are feeling the pinch. Their "billionaire" status doesn't travel as well as it used to.

Real World Examples: The Impact of the Conversion

Think about SoftBank. Masayoshi Son deals in trillions of yen. When the exchange rate shifts by even one yen, it wipes billions of dollars off their balance sheet in "unrealized losses" or gains. For a smaller company—let's say a mid-sized Japanese exporter—a weak yen is actually a gift. They sell their products abroad for dollars, and when they bring that money back home, it magically turns into more yen than they expected.

But for the individual? It's a headache.

If you are an American expat living in Japan getting paid in yen, your student loans back in the U.S. just became 30% more expensive to pay off. That’s the reality of the 1 billion yen to dollars conversion. It’s not just a number on a currency converter app; it’s a lifestyle shift.

The Intervention Factor

Sometimes the Japanese government gets tired of the yen being a punching bag. They’ve stepped in multiple times, spending billions of dollars from their reserves to buy yen. They literally try to brute-force the exchange rate.

Does it work?

Sorta. It usually provides a temporary floor, but the market is a giant ocean and the BoJ is just a guy with a bucket. Unless the underlying interest rates change, the trend usually holds.

Misconceptions About Large Currency Swaps

One thing people get wrong is thinking they can just go to a bank and swap 1 billion yen for dollars at the "mid-market" rate they see on Google.

Forget it.

The "spread" will eat you alive. If the mid-market rate is 150 yen to the dollar, a retail bank might give you 147. On 1 billion yen, that 3-yen difference is 20,000 dollars. You’re basically handing the bank a luxury sedan just for the privilege of moving your own money.

Professional traders use "limit orders" and specialized FX desks to shave those costs down to almost nothing. If you ever find yourself actually needing to convert this much, please, for the love of your bank account, don't use a standard wire transfer at a local branch.

The Future: Will the Yen Bounce Back?

Predicting the future of the 1 billion yen to dollars rate is a fool’s errand, but we can look at the pressures. If the U.S. economy slows down and the Fed starts cutting rates aggressively, the dollar will weaken. If Japan finally decides to embrace 1% or 2% interest rates (which is "high" for them), the yen will rocket upward.

Most analysts at places like Goldman Sachs or JP Morgan are split. Some think the yen is fundamentally undervalued and should be closer to 120 or 130 per dollar. Others think Japan’s aging population and debt load mean the yen is destined to stay weak forever.

It's a tug-of-war between two giants.

Practical Steps for Handling Large Conversions

If you are looking at large sums, or even just planning a big trip, here is how you should actually think about the math:

- Watch the 10-Year Yield: If U.S. Treasury yields go up, the yen almost always goes down. It’s a very tight correlation.

- Use Multi-Currency Accounts: Services like Wise or Revolut are fine for $10,000, but for "billion yen" territory, you need an ISDA agreement or a prime brokerage account.

- Hedge Your Bets: If you know you need dollars in six months, you don't have to wait. You can use "forward contracts" to lock in today's rate.

- Think in Purchasing Power: Don't just look at the dollar amount. Look at what that money buys in the country where you'll spend it. 1 billion yen goes a lot further in Osaka than $7 million goes in New York City.

The conversion of 1 billion yen to dollars is more than just a math problem. It’s a snapshot of the global economy’s health, a reflection of Japan’s unique monetary policy, and a cautionary tale about how quickly "wealth" can shift when the world’s central banks start moving the levers.

To manage a sum of this size effectively, you need to stop thinking about it as a fixed value and start seeing it as a moving part in a much larger machine. Monitor the Bank of Japan’s quarterly outlook reports and the U.S. Consumer Price Index (CPI) releases. These are the two primary drivers that will determine if your billion yen is worth a fleet of private jets or just a couple of very nice condos. Stay informed on the "yield curve control" policies in Tokyo, as any sudden shifts there often trigger the most violent moves in the exchange rate.