If you’ve got 1.6 million yen sitting in a bank account or you're looking at a price tag in Tokyo, your first instinct is to pull out a phone. You want to know what 1.6m yen to usd looks like in "real money." It sounds like a lot. 1.6 million of anything feels like a fortune, right? But the reality of the Japanese Yen versus the US Dollar is a bit of a roller coaster lately.

Right now, $1.6 \text{ million JPY}$ is hovering somewhere around $10,500 to $11,500 USD.

That’s a massive range. Honestly, it’s frustrating. One week you’re looking at a decent used car price, and the next, you’ve lost enough purchasing power to cover a month's rent just because the Bank of Japan decided to stay the course while the Fed got aggressive.

The Reality of 1.6m Yen to USD Right Now

Exchange rates aren't static. They breathe. They're basically the heartbeat of global trade, and currently, the yen is breathing pretty heavily. When you look at 1.6m yen to usd, you have to account for the "spread." That’s the hidden fee banks charge you. If Google says the rate is 150 yen to the dollar, your bank might give you 154. On a 1.6 million yen transaction, that difference isn't pennies. It's hundreds of dollars.

Why does this matter? Because 1.6 million yen is a specific "sweet spot" in Japanese finance. It’s often the threshold for certain tax implications or the price of a high-end used Toyota Aqua or Honda Fit in the Tokyo suburbs. If you're an expat or a digital nomad, this is a significant chunk of change.

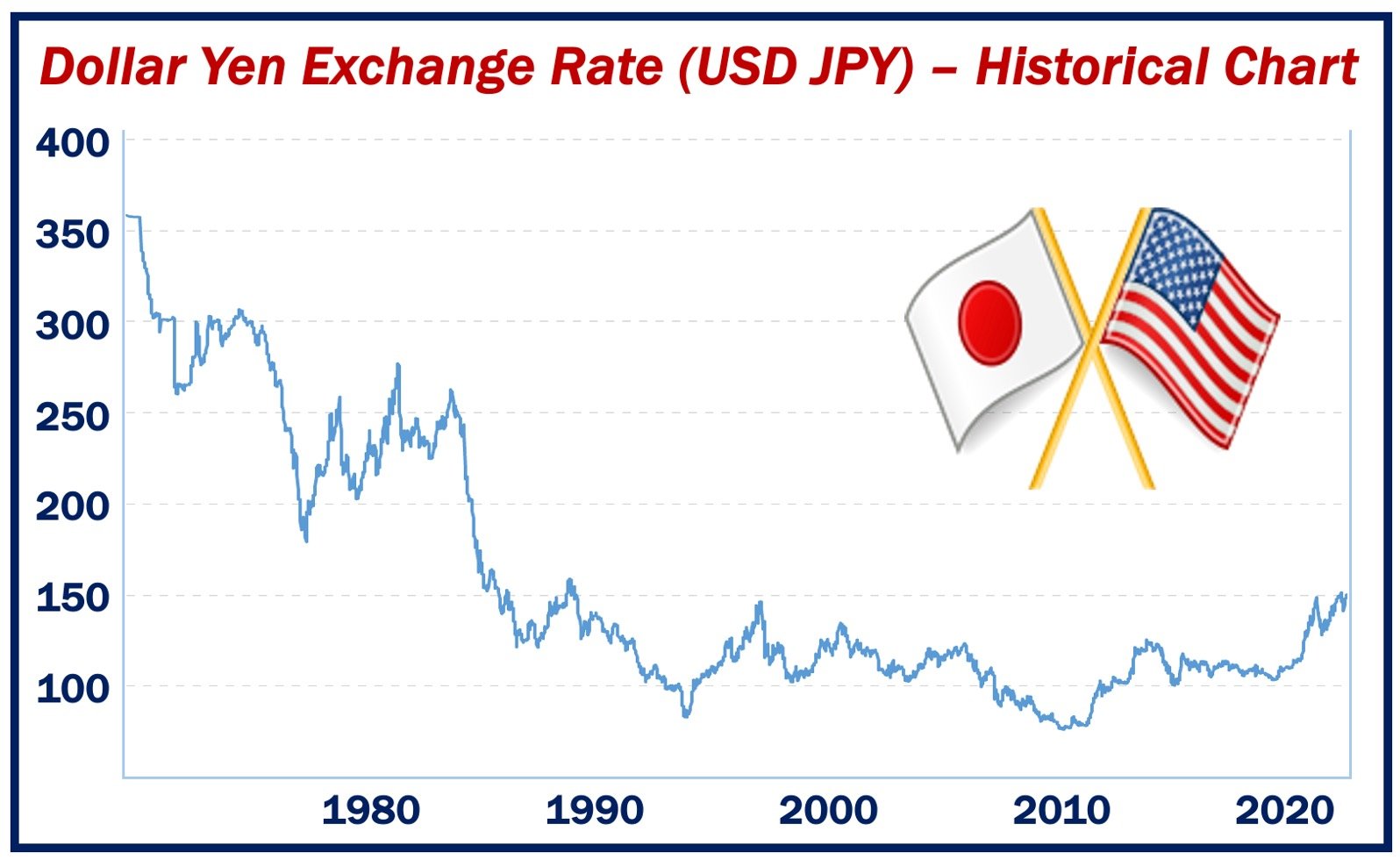

Why the Yen is Acting So Weird

The Bank of Japan (BoJ) has been the odd man out for years. While the rest of the world hiked interest rates to fight inflation, Japan kept theirs near zero or even negative. This is called the "carry trade." Investors borrow yen for cheap and dump it into USD to earn higher interest. This makes the yen drop.

🔗 Read more: Australian Stock Exchange Announcements: What Most People Get Wrong

When the yen drops, your 1.6 million yen buy fewer iPhones and less California wine. It's a tough spot for locals.

Breaking Down the Math (Without the Boredom)

Let's look at how the conversion actually plays out in the real world.

If we assume an exchange rate of $150 \text{ JPY} / 1 \text{ USD}$:

$1,600,000 / 150 = 10,666.67 \text{ USD}$

If the yen strengthens to $140 \text{ JPY} / 1 \text{ USD}$:

$1,600,000 / 140 = 11,428.57 \text{ USD}$

That’s a $760 difference. For the same amount of yen.

Imagine buying a vintage Rolex in Ginza. One day it costs you $10,600. You wait a week, the yen gets stronger, and suddenly you’re out an extra $760. This is why timing is everything when dealing with 1.6m yen to usd conversions. You aren't just trading currency; you're gambling on macroeconomics.

Where You Lose Money

Most people go to an airport kiosk. Don't do that. It’s a trap.

Airport exchanges often take a 5% to 10% cut through terrible rates. On 1.6 million yen, you could be literally handing them $1,000 just for the convenience of standing at a counter. Using services like Wise or Revolut is usually the smarter play because they use the mid-market rate—the one you actually see on Google.

💡 You might also like: The Quickest Way to Get Tax Return Cash Without the Typical IRS Headaches

What 1.6 Million Yen Actually Buys You in 2026

Context is king. Numbers on a screen are just numbers until you see what they do in the wild. In Japan, 1.6 million yen goes surprisingly far compared to $11,000 in the States.

- A Used Car: You can get a very clean, 5-year-old hybrid with low mileage. In the US, $11,000 gets you a 2012 SUV with a suspicious engine light.

- Rent: In a city like Fukuoka or even parts of Osaka, 1.6 million yen could cover your rent for nearly two years. Try doing that in San Francisco or New York.

- Education: This amount covers about two or three semesters of tuition at a decent Japanese university.

The "Purchasing Power Parity" (PPP) is skewed. While 1.6m yen to usd might look "small" in dollars, the local life it buys is substantial. Japan has experienced "deflationary thinking" for decades. Prices stay flat. A bowl of ramen that cost 800 yen five years ago might still be 850 yen today. Meanwhile, your Big Mac in Chicago has doubled in price.

The Psychological Barrier of the Million

There is something psychological about hitting the "million" mark. In Japan, 1 million yen is the "Ikkyu" or a major milestone for savings. When you have 1.6 million, you're officially in the "comfortable" zone for a rainy-day fund.

But when you convert that 1.6m yen to usd, that psychological "millionaire" feeling vanishes. You're back to four figures. It's a humbling experience for many Westerners living in Japan. You feel rich until you look at your US student loan balance.

Factors That Will Move the Needle

- Oil Prices: Japan imports almost all its energy. If oil goes up, the yen usually goes down.

- US Treasury Yields: If the 10-year Treasury note in the US pays more, people want dollars.

- Tourism: Since Japan reopened fully, the influx of tourists buying yen has provided a slight floor for the currency, but it's not enough to fight the big banks.

How to Handle the Conversion Safely

If you actually need to move 1.6 million yen into a US bank account, you need a strategy. Don't just click "transfer" on your local Japanese bank app. Most Japanese "megabanks" like MUFG or SMBC are notoriously clunky and expensive for international wires. They still use fax machines for some of this stuff. I'm not even kidding.

🔗 Read more: Malaysia Currency to Naira: What Most People Get Wrong About the 2026 Exchange Rate

- Check the Mid-Market Rate: Use a site like XE or Reuters to see what the "true" price is.

- Compare Fintech Options: Services like Wise are generally the gold standard for this specific amount.

- Watch the BoJ Meetings: If the Bank of Japan hints at raising interest rates, the yen will spike. That’s when you want to sell your yen for dollars.

- Consider the Tax Implications: If you're a US citizen, moving more than $10,000 across borders triggers an FBAR requirement. 1.6 million yen is right on that line. You need to report it to the IRS.

The Hidden Costs of Small Transfers

People think they should move money in small chunks to "average out" the rate. That’s often a mistake. Each wire transfer usually carries a flat fee of 2,500 to 7,000 yen. If you break 1.6 million yen into five transfers, you’re burning money on fees.

Do it once. Do it right.

The Future of the Yen-Dollar Pair

Predicting currency is a fool's errand, but we can look at the trends. Japan's population is shrinking. Their economy is struggling to find a new identity in the tech age. Conversely, the US dollar remains the world's reserve currency.

Most analysts expect the yen to stay relatively weak. This means that if you're waiting for 1.6m yen to usd to return to the "good old days" of 100 yen per dollar (making it $16,000), you might be waiting a long time.

The 150-160 range seems to be the new "normal."

Actionable Steps for Your 1.6 Million Yen

If you have this money right now, here is exactly what you should do:

- Evaluate your "Need Date": If you don't need the dollars for six months, consider a Japanese Fixed Term Deposit. The interest is low, but it keeps the money safe while you wait for a favorable "dip" in the exchange rate.

- Set a Target Rate: Don't just watch the news. Set an alert on an app for a specific rate, say 142 JPY. When it hits, move the money.

- Consult a Tax Pro: If this 1.6 million yen is an inheritance or a gift, the rules for moving it to the US are different than if it's just your salary.

- Check for Hidden Fees: Before you commit, ask the receiving bank in the US if they charge an "incoming wire fee." Some charge $15 to $30 just to receive your own money.

Converting 1.6m yen to usd is more than a math problem. It’s a timing problem. By staying informed on the Bank of Japan’s moves and avoiding high-fee traditional banks, you can keep more of your hard-earned cash where it belongs—in your pocket.