Money is weird. You look at a screen, see a number, and think that's just what your cash is worth. But if you’re trying to swap 68 GBP to USD right now, you’re probably realizing that the "official" rate and the "actual" rate are two very different beasts.

The British Pound (GBP) and the United States Dollar (USD) are the heavyweights of the currency world. They trade more than almost any other pair. As of early 2026, the global economy is still shaking off the weirdness of the last few years, and that means the pound is dancing around in ways that can make a simple $68$ pound transaction feel like a math test you didn't study for.

Honestly, most people just want to know if their sixty-eight quid will buy a decent dinner in New York or if they're stuck with street cart pretzels.

The Math Behind 68 GBP to USD

Let’s get the raw numbers out of the way first.

If the exchange rate is sitting at roughly $1.25$, then your 68 GBP to USD conversion lands at exactly $85.00$. If the pound strengthens to $1.30$, you’re looking at $88.40$. But here is the kicker: you are almost never going to get that "mid-market" rate. That’s the rate banks use to trade with each other. It’s a wholesale price. You, me, and the guy buying a vintage vinyl record on eBay? We get the retail rate.

Banks like HSBC, Barclays, or Chase usually bake a "spread" into the price. This is a sneaky way of saying they charge you a fee without calling it a fee. They might offer you a rate of $1.21$ when the real rate is $1.25$. On a small amount like $68$ pounds, that might only be a few bucks, but it adds up. It's the difference between a $85$ dollar payout and a $82$ dollar one.

Why does this specific amount matter?

$68$ pounds is a "threshold" amount. It’s often the price point for a mid-tier subscription, a fancy bottle of gin, or a standard video game pre-order in the UK. When that crosses the Atlantic, the psychological barrier of $100$ USD is usually the goal for retailers.

If you are a freelancer in London billing a client in Seattle for a quick consultation, that 68 GBP tag might look like a random number to them. They see the USD equivalent. If the dollar is strong, your 68 pounds feels "cheap" to them. If the dollar weakens, suddenly you’re an expensive hire.

What Drives the Exchange Rate Today?

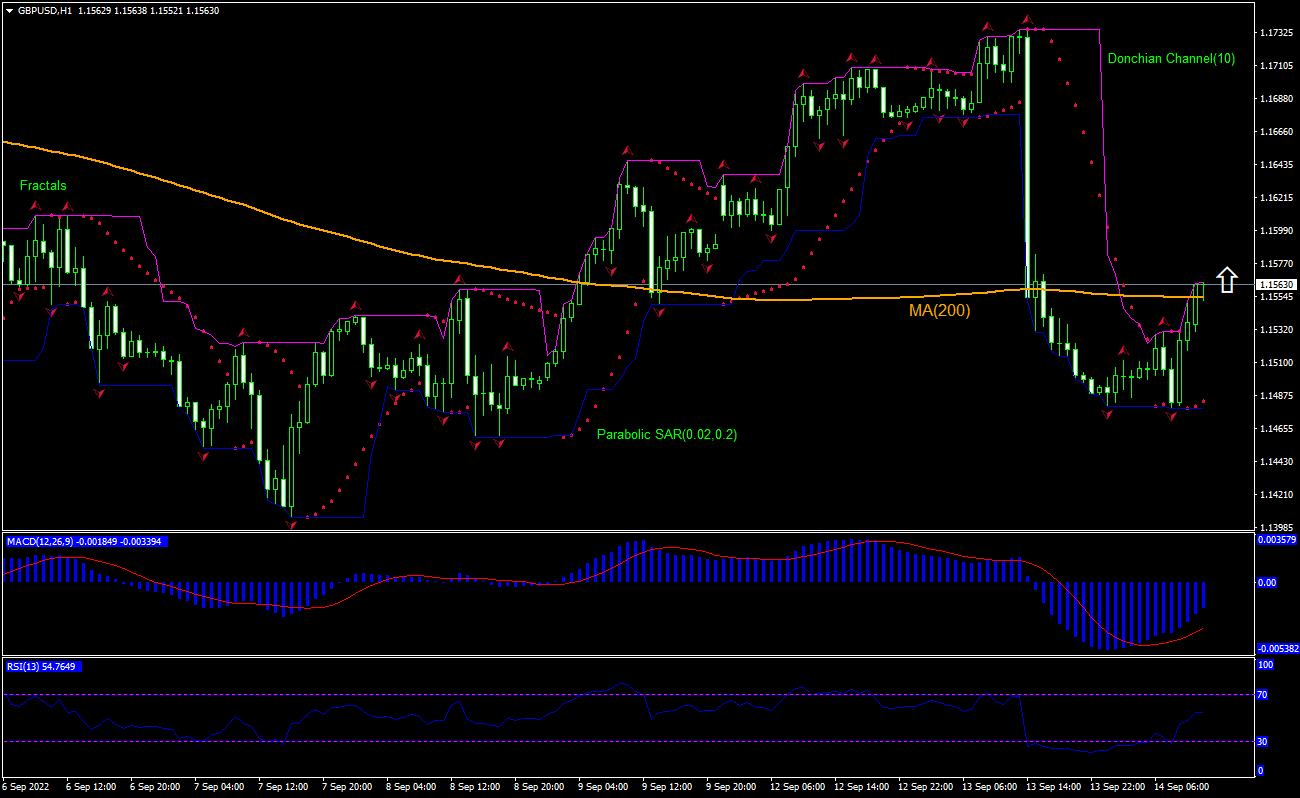

The relationship between the Cable (that’s the nickname for the GBP/USD pair, a throwback to the actual telegraph cables under the Atlantic) is driven by two things: interest rates and vibes.

👉 See also: Jose Menendez Net Worth: Why the Fortune Everyone Talked About Basically Vanished

Specifically, we’re looking at the Bank of England (BoE) versus the Federal Reserve (the Fed). In 2026, the conversation has shifted. We aren't just talking about inflation anymore. We’re talking about growth.

- The Fed's Stance: If the Fed keeps rates high to cool down a spicy US economy, the dollar stays strong. Your 68 pounds buys less.

- The BoE's Move: If Governor Andrew Bailey and the folks in London decide to hike rates to save the pound, your 68 GBP suddenly has more "muscle" when converted to USD.

- Geopolitics: Any time there is drama in Europe, investors run to the dollar like it’s a bunker. It’s the "safe haven" play.

It's a constant tug-of-war. You’ve got traders in the City of London staring at Bloomberg terminals, trying to predict if a random jobs report from Ohio will tank the pound. It’s chaotic.

The "Ghost Fees" of Currency Conversion

You’ve probably seen those "Zero Commission" signs at airport kiosks. Total nonsense. They aren't charities. If they aren't charging a commission, they are giving you a terrible exchange rate.

Let's look at the ways you lose money converting 68 GBP to USD:

- The Spread: The gap between the "buy" and "sell" price.

- Fixed Fees: A flat $5$ dollar or $3$ pound charge just for the privilege of the transaction. On a small amount like $68$ GBP, a $5$ pound fee is a massive percentage. It’s almost $7%$.

- Intermediary Bank Fees: If you’re doing a wire transfer, sometimes a random bank in the middle takes a "nibble" of the money.

If you use a service like Wise (formerly TransferWise) or Revolut, you generally get closer to that "real" rate. They use a peer-to-peer system that skips the ancient plumbing of the traditional banking system. For sixty-eight pounds, using a traditional bank wire is basically lighting money on fire. You’d be better off using a credit card with no foreign transaction fees.

Real-World Impact: What 68 GBP Buys in America

To understand the value of 68 GBP to USD, you have to look at purchasing power parity. This is the "Big Mac Index" logic.

In London, $68$ pounds might get you a decent dinner for two in Soho, including a glass of wine and service. Maybe a bit more if you're hitting a chain like Dishoom.

In the US, once you convert that to roughly $85$ USD, the experience changes depending on where you are.

👉 See also: Why That Holiday Inn Express Commercial Still Lives Rent Free in Our Heads

- In New York City: $85$ USD is gone in a blink. After a $20%$ tip (which is standard now, let's be real) and sales tax, that $85$ dollars covers a couple of cocktails and maybe two appetizers at a trendy spot in Brooklyn.

- In Austin or Nashville: You’re doing better. That’s a solid dinner or a couple of rounds of drinks at a live music venue.

- In the Midwest: You’re living like a king. That $85$ USD might cover a week of groceries for a single person if you’re savvy.

The volatility of the exchange rate means that a British tourist who budgeted $68$ GBP per day for food in 2024 might find themselves significantly hungrier in 2026 if the exchange rate has dipped.

Is the Pound "Undervalued"?

A lot of economists argue that the pound has been fundamentally undervalued since the 2016 Brexit vote. It never quite regained its old swagger. Back in the early 2000s, $1$ pound got you $2$ dollars. $68$ GBP was $136$ USD. Imagine that! You could go to Florida and everything felt like it was half-price.

Today, we are in a "new normal." The parity party is over. We’re hovering in that $1.20$ to $1.30$ range. Some analysts, like those at Goldman Sachs or JP Morgan, occasionally predict a "sterling resurgence," but it usually depends on the US dollar weakening rather than the UK economy actually getting stronger.

How to Get the Best Rate for 68 GBP

If you actually need to move this money, don't just click "convert" on your banking app.

First, check the live rate on Google or XE. That sets your baseline. Then, look at the "hidden" cost. If you're buying something online, check if your credit card does the conversion or if the merchant does. Never let the merchant do the conversion. That’s called Dynamic Currency Conversion (DCC), and it is a total scam. They will charge you a premium of $5%$ to $10%$ just to show you the price in your "home" currency. Always pay in the local currency of the website (USD) and let your bank handle the math.

For a $68$ GBP transaction, the "convenience fee" of letting a site like PayPal handle the conversion can be upwards of $4$ dollars. That’s a sandwich. Don't give them your sandwich.

The Role of Digital Assets

We can't talk about currency in 2026 without mentioning stablecoins or crypto. Some people try to bypass the 68 GBP to USD headache by using USDC or similar digital dollars. While this avoids bank fees, the "on-ramps" and "off-ramps" (getting your actual cash into the digital wallet) often cost more than the bank fee itself for small amounts. Unless you're moving thousands, stick to the fintech apps.

💡 You might also like: Cargill Family Net Worth: What Most People Get Wrong

The Future of the Pound-Dollar Relationship

What happens next?

The UK is trying to find its feet with new trade deals, while the US is dealing with its own internal fiscal drama. If the UK manages to link up more closely with European markets again, the pound might see a "trust bump." If the US stays on its path of high spending and high debt, the dollar might lose its luster.

But for now, the dollar is king. When you convert 68 GBP to USD, you are buying into the world's primary reserve currency. You are paying for the stability and the massive reach of the American economy.

Action Steps for Your Conversion

Stop guessing. If you have $68$ pounds and you need dollars, follow this checklist to make sure you aren't getting fleeced.

- Check the Mid-Market Rate: Use a neutral site to see the "true" value before you look at your bank’s offer.

- Avoid Airport Booths: They are the worst place on earth to exchange money. Period.

- Use Fintech: Apps like Revolut or Wise will almost always beat a high-street bank on the exchange rate for a small amount like $68$ GBP.

- Watch the News: If there is a major announcement from the Federal Reserve tomorrow, wait. Rates often spike or dip right after a "Fed Chair" speech.

- Check Your Card Fees: Many modern travel cards offer $0%$ foreign transaction fees. If yours doesn't, you're losing money twice—once on the rate and once on the fee.

The difference between a "good" conversion and a "bad" one on $68$ GBP is probably about $5$ to $7$ USD. It won't break the bank, but why give it away for free? Be smart about the "Cable" and keep more of your cash in your own pocket.

The volatility of the GBP/USD pair is a feature, not a bug. It’s a reflection of the global pulse. Whether you’re a small business owner, a traveler, or just someone buying a gift from overseas, knowing the "why" behind the numbers makes the "how much" a lot easier to stomach. Always look at the total cost, including the spread, and you'll navigate the 68 GBP to USD conversion like a pro.