You've probably seen the headlines. The stock market is hitting record highs, and everyone is wondering if we're in a bubble. Honestly, looking at the current P/E ratio of S&P 500, it’s easy to get a little spooked. As of mid-January 2026, the trailing twelve-month (TTM) P/E ratio for the S&P 500 is hovering around 31.44.

That is high. Like, "don't look down" high.

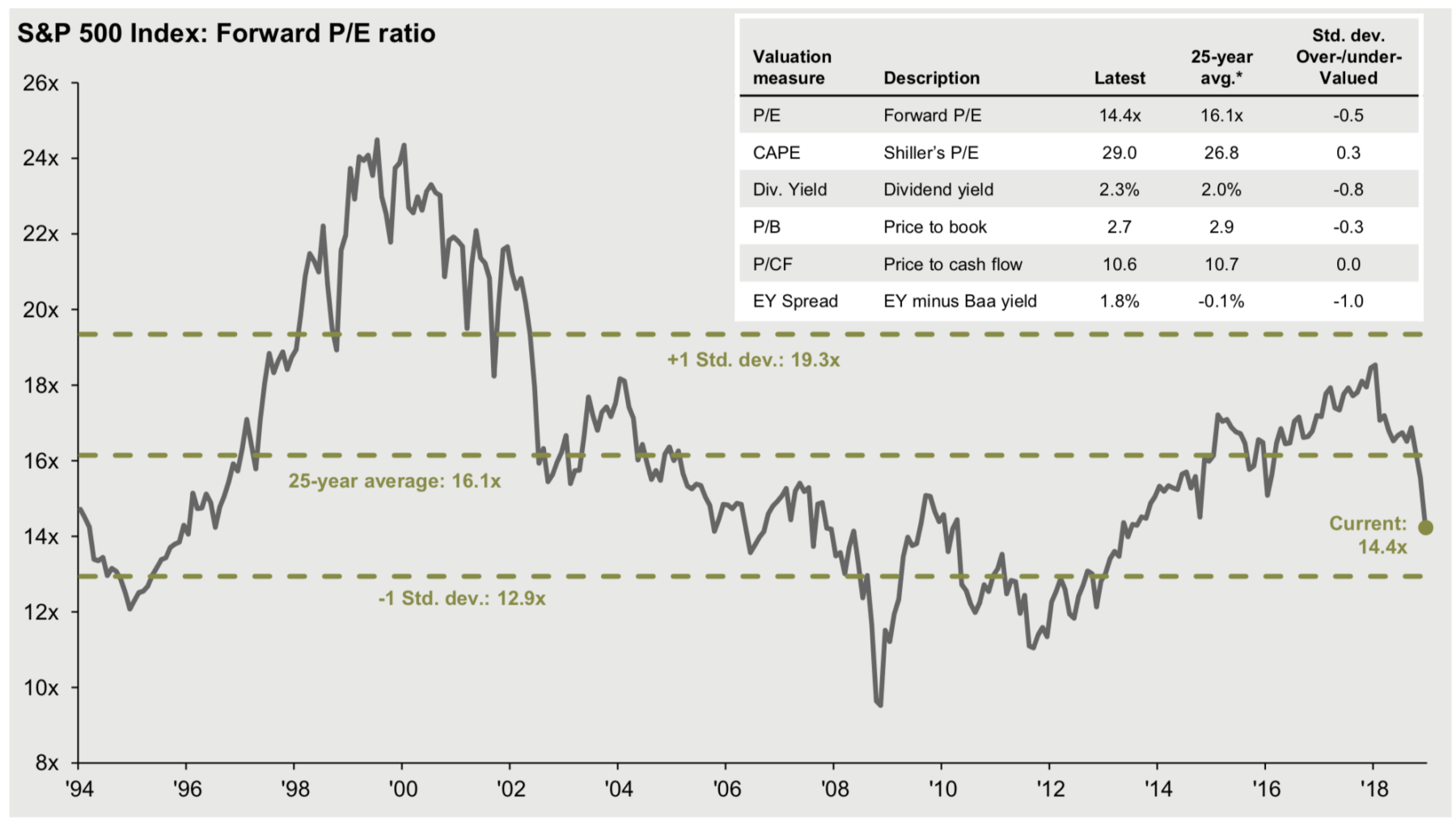

To put that in perspective, the historical average usually sits somewhere between 15 and 20. We are well north of that. But before you go mattress-stuffing your cash, you have to realize that a single number never tells the whole story. The market today isn't the same market your parents traded in the 90s.

What the current P/E ratio of S&P 500 is actually telling us

Right now, investors are paying roughly $31 for every $1 of profit the companies in the index earned over the last year. If you look at the Shiller PE Ratio—which is basically the P/E ratio's more sophisticated cousin that adjusts for inflation over ten years—the number looks even crazier. It's sitting at 40.92.

Only twice in history has it been higher: right before the dot-com crash and briefly during the post-COVID frenzy.

💡 You might also like: Eddie Craven Net Worth: What Most People Get Wrong

So, are we doomed? Not necessarily.

Markets can stay "expensive" for a lot longer than people think. Kinda like that one house in your neighborhood that’s clearly overpriced but still gets five offers in a weekend. The S&P 500 is currently dominated by a handful of tech giants—the so-called "Mag 7"—and these companies have profit margins that would make an oil tycoon blush. When 30% of the index is growing at 40% a year, the math gets weird. The "other 493" stocks in the index actually have much lower valuations, often closer to a P/E of 17 or 19.

Forward P/E vs. Trailing P/E: The "Expectation" Game

Most pros don't even look at the trailing P/E. They look at the Forward P/E ratio, which is currently around 22.46.

This is where it gets interesting.

The forward P/E is based on what analysts think companies will earn over the next year. If earnings grow as fast as Wall Street expects, that 31.44 number "naturally" drops down to 22. It makes the market look more reasonable. But—and this is a big but—if we hit a recession or if AI spending doesn't result in immediate profits, those earnings estimates will get slashed. If earnings drop, the P/E ratio shoots up even if the stock price stays the same.

Why 2026 feels different (and why it might not be)

We're seeing some strange divergence right now. In the first two weeks of January 2026, the S&P 500 has continued its upward crawl, closing near 6,960. People are bullish on tax breaks and the Fed's management of interest rates.

✨ Don't miss: US Stock Market Summary: What Most People Get Wrong About 2026

But history is a mean teacher.

Matt Bartolini from State Street Global Advisors recently pointed out that the concentration in the top 10 stocks of the S&P 500 is near its highest level since 1972, at about 40%. When the index is that top-heavy, the current P/E ratio of S&P 500 becomes less of a "market" metric and more of a "how is Big Tech doing" metric.

A quick look at the sectors

- Technology: Still leading the pack with massive multiples.

- Materials: Trading at a much more modest forward P/E of roughly 19.20.

- Small Caps: Many analysts, including those at Morningstar, are arguing that while the S&P 500 is pricey, small-cap stocks are actually "cheap" compared to their 10-year averages.

Is the market "Strongly Overvalued"?

If you ask the folks at Current Market Valuation, they'll tell you the market is "Strongly Overvalued." They point out that we are currently 2.3 standard deviations above the modern-era average. In plain English: the rubber band is stretched really, really far.

Usually, when the Shiller PE hits 40, it’s followed by a "reversion to the mean." That's a fancy way of saying prices fall or earnings rise until the ratio looks normal again. Since earnings rarely double overnight, the "correction" usually happens on the price side.

However, we have to acknowledge the AI factor. If generative AI actually triples productivity across the S&P 500, then today’s "high" prices might actually be a bargain. It’s the classic "this time is different" argument that has burned investors for decades—but every once in a long while, it actually is different.

Actionable insights for your portfolio

Don't panic, but don't be blind. If you're looking at the current P/E ratio of S&P 500 and feeling uneasy, here is how you can actually handle the current environment:

Check your concentration. If you own an S&P 500 index fund, you basically own a tech fund. You might want to look into "Equal Weighted" S&P 500 ETFs (like RSP). These give the 500th company the same weight as the 1st, which brings your effective P/E ratio down and protects you if the tech giants take a breather.

Stop chasing the "froth." Stocks like Eli Lilly are trading at P/E multiples of 50 or higher. While weight-loss drugs are a massive market, a lot of that "perfect future" is already priced in. If you're buying at these levels, you’re betting on zero mistakes from management.

🔗 Read more: Alaska Property Search by Name: How to Actually Find Who Owns What

Look at the "other" stocks. Energy, Materials, and even some Utilities are trading at much lower multiples. They aren't as sexy as AI, but they provide a safety net if the high-flyers start to revert to their historical averages.

Keep some dry powder. With the Shiller PE above 40, keeping a slightly higher cash balance in a high-yield account isn't "missing out"—it's being ready. If the market does correct by 10% or 15% to bring that P/E ratio back to reality, you'll want the cash to buy the dip.

The market isn't necessarily going to crash tomorrow. High valuations can stay high for years. But the current P/E ratio of S&P 500 is a clear sign that the "easy money" phase of the bull market is probably behind us, and discipline is going to matter a lot more in 2026 than it did in 2024.