If you’ve lived in Durham for more than a minute, you know the vibe here is changing fast. Cranes are everywhere. Old warehouses are becoming tech hubs. But for homeowners, that growth comes with a side of "sticker shock" when the tax bill hits the mailbox. People get really confused about the durham county nc property tax rate because they see one number on a news site and a completely different one on their actual bill.

The math isn't just one flat fee. Honestly, it’s a puzzle of county rates, city rates, and weird little "special districts" that most people don't even know they're in until they look at the fine print.

The Numbers for 2025-2026: What You’re Actually Paying

Let’s get the raw data out of the way first. For the 2025-2026 fiscal year, the Durham Board of County Commissioners set the base countywide tax rate at $0.5542 per $100 of assessed value.

Wait.

If you remember last year’s rate being around $0.7987, you might think, "Oh cool, a massive tax cut!" Not exactly. Durham just finished its 2025 property revaluation. Because property values skyrocketed (some neighborhoods saw 70% or 80% increases), the county lowered the rate to keep things somewhat balanced. It's called the "revenue-neutral" dance, though most people still end up paying more because their home’s "value" on paper exploded.

The "Combined" Rate Headache

Almost nobody pays just the $0.5542. If you live within the Durham city limits—which is most of us—you have to tack on the City of Durham’s rate of **$0.4371**.

When you mash those together, your combined rate is $0.9913.

Basically, for every $100,000 your house is worth, you’re looking at about $991.30 in taxes. A $400,000 home? That’s nearly $4,000 a year. And that’s before we even talk about the "extras."

The Hidden Extras: Fire Districts and BIDs

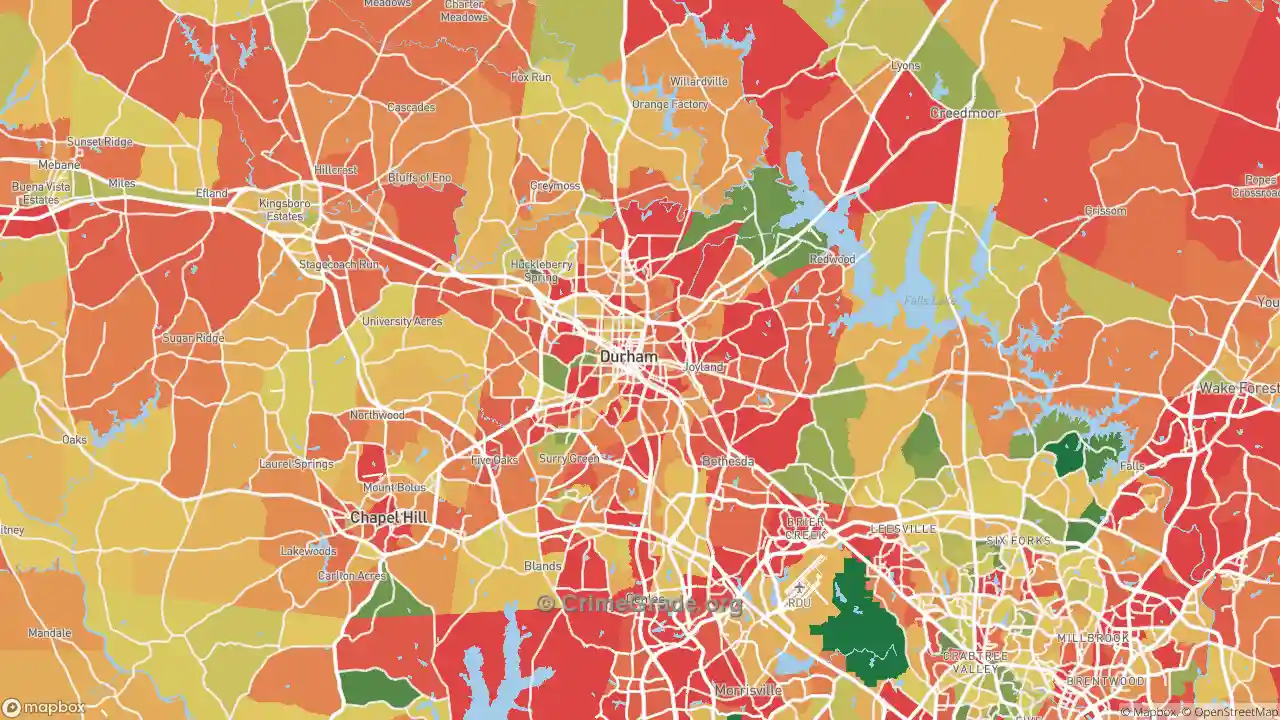

If you live out in the more rural parts of the county, like Bahama or Redwood, you don’t pay the city tax, but you do pay a fire district fee. These range from about $0.04 to $0.09.

✨ Don't miss: Capital One Direct Deposit Issues Today: What Really Happened to Your Paycheck

- Lebanon Fire District: $0.0919

- Redwood Fire District: $0.0907

- Bahama Fire District: $0.0883

- Eno Fire District: $0.0484

Then there's the Downtown Durham Business Improvement District (BID). If you own property in the heart of downtown, you pay an extra $0.07 on top of everything else. It adds up. Fast.

Why the 2025 Revaluation Changed Everything

North Carolina law requires counties to revalue property at least every eight years. Durham, being Durham, does it every four. They want the tax values to stay close to what the market is actually doing.

The 2025 revaluation was a wild one.

Market values in Durham County rose by an average of about 78.4% since the last check-in. If your home was valued at $250,000 in 2021, it might be sitting at $440,000 now. Even with the lower "rate," your bill probably took a jump. It's a weird paradox: you're richer on paper because your equity grew, but you're "poorer" every month because your escrow payment just went up $150.

📖 Related: The P\&G Plant in Box Elder County: Why This Utah Site Is Still Growing

Can you fight it?

Yes. But you have to be fast. When the county sends out those valuation notices (usually in early Spring), you have a small window to appeal. You can’t just say "taxes are too high." You have to prove they got the facts wrong—like saying you have a finished basement when it's actually just a crawlspace with a lightbulb.

Ways to Actually Lower Your Bill

Most people just grumble and pay, but there are three big "outs" that Durham offers. They aren't automatic. You have to go to the Tax Administration office (or their website) and actually ask for them.

- The Homestead Exemption: If you’re 65 or older, or totally disabled, and you make less than $38,800 a year, you can knock off $25,000 or 50% of your home's value from the tax bill.

- The Disabled Veteran Exclusion: This is a big one. It takes $45,000 off your assessed value. There's no income limit for this, but you need the VA to sign off on the paperwork.

- The Circuit Breaker: This is for long-time residents (5+ years) who are seniors or disabled. It caps your taxes at a certain percentage of your income. The catch? It’s a "deferment." If you sell the house or pass away, the last three years of those deferred taxes have to be paid back.

Actionable Steps for Durham Homeowners

Don't just stare at the bill and wonder why your mortgage payment changed. Here is what you should actually do:

- Check your "Primary Residence" status: Ensure you are listed as an owner-occupant. This doesn't change the rate, but it's vital for qualifying for any of the relief programs mentioned above.

- Verify the data: Go to the Durham County Tax Administration portal. Look up your property. Does it say you have 4 bedrooms when you only have 3? Errors happen in mass appraisals. If the data is wrong, your bill is wrong.

- Apply by June 1st: This is the hard deadline for all tax relief programs (Homestead, Veteran, etc.). If you miss it, you're stuck paying the full amount for the year.

- Budget for the "Escrow Gap": If your taxes went up $1,200 a year, your mortgage company will likely raise your monthly payment by $100 plus another $100 for a few months to "catch up" the shortage in your escrow account. It hurts, so plan for it.

The durham county nc property tax rate is a moving target. With the 2025 revaluation now in the books, the $0.5542 (County) and $0.4371 (City) rates are the new normal for this cycle. Keep an eye on the Board of Commissioners meetings every June—that's when they decide if they’re going to tweak these numbers for the following year.

👉 See also: 500 Howard St San Francisco CA: Why This Building Still Anchors the Tech Corridor

For now, the best move is to check your assessment for accuracy and see if you qualify for an exemption before the June deadline.