Ever sat around and listened to your grandparents talk about the "good old days" when they could basically live off the interest from a simple bank account? They aren't exaggerating. If you look back at the timeline of historical cd interest rates, the numbers look like something out of a fever dream compared to the crumbs we've been fighting over for the last decade.

In 1981, you could walk into a local branch, hand over some cash for a 3-month Certificate of Deposit, and walk away with an 18.65% interest rate.

Seriously.

Eighteen percent.

But there is a catch that most people—even the savvy ones—usually miss. While those double-digit yields look incredible on paper, the world was a very different place. Inflation was a monster. Paul Volcker, the Fed Chair at the time, was essentially burning down the house to save the village, hiking rates to levels that would cause a national revolt today just to stop prices from spiraling out of control.

The Wild Ride of the 1980s

If you want to understand historical cd interest rates, you have to start with the Reagan era. It was the peak. The Mount Everest of savings.

✨ Don't miss: Why the Treasury Yield 10 Years Moves Everything You Own

By the summer of 1984, the average yield on a six-month CD was still hovering just under 11%. Banks were desperate for your cash because they could turn around and lend it out at even higher rates. But here’s the reality check: inflation in 1980 hit a staggering 14.6%.

If your CD paid you 15% but the price of milk and gas went up 14%, you weren't actually getting rich. You were barely treading water.

Honestly, the "real" winners were the people who locked in those high rates just as inflation started to cool in the mid-80s. By 1985, inflation had dropped to about 3.5%, but you could still find CDs paying 8% or 9%. That’s where the real wealth was made—in the gap between the interest rate and the cost of living.

When 5% Was "Low"

Moving into the 1990s, things started to stabilize. We shifted away from the panic-inducing highs of the Volcker years into a more "normal" environment under Alan Greenspan.

For most of the 90s, a 5% or 6% return was just... standard.

- 1990: Rates were still hanging out above 8%.

- 1993: A recession hit, and rates tumbled to about 3.10%.

- 1997: Things bounced back, and you could easily snag a 5.5% APY.

It’s funny to think about now, but people back then complained that 5% was too low. If only they knew what was coming in the 2010s.

The Great Yield Desert

Then came the 2000s. It started strong. In June 2000, a 3-month CD yield was sitting at a comfy 6.73%.

Then the dot-com bubble burst. Then 9/11 happened. The Fed slashed rates to keep the economy from flatlining, and by 2003, CD rates fell below 2% for the first time in most people's adult lives.

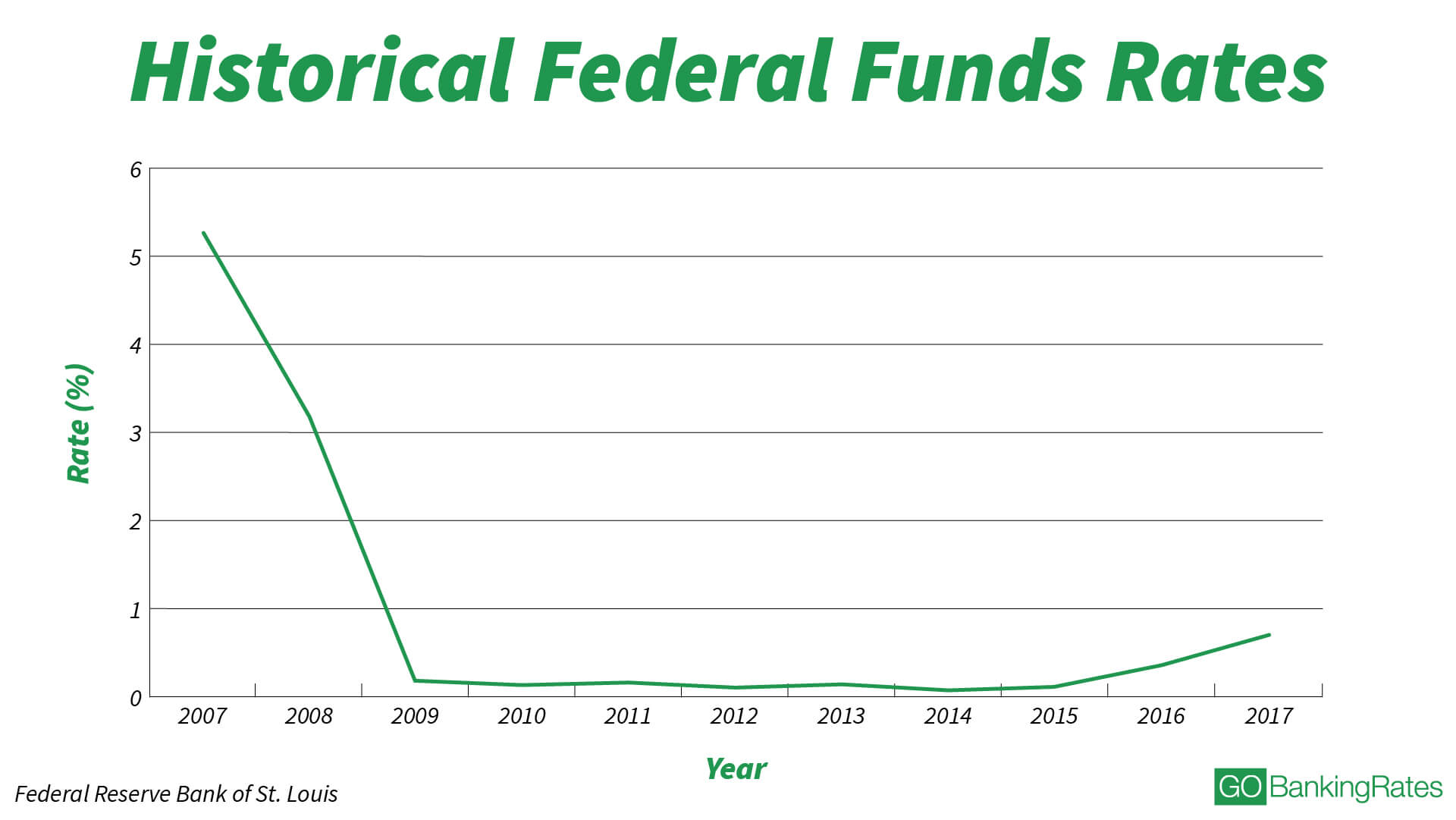

We saw a brief "return to glory" between 2006 and 2007, where you could get 5.20% on a six-month CD. It felt like the good times were back. But the housing market was a ticking time bomb. When it exploded in 2008, the Federal Reserve dropped the hammer. They took the benchmark rate to zero.

And they left it there. For a long, long time.

From 2009 to roughly 2017, historical cd interest rates entered a period I call the Great Yield Desert. If you were getting 0.50% on a 1-year CD, you were lucky. Most people just gave up on CDs entirely and threw their money into the S&P 500 or just left it in a checking account. Why lock your money away for 12 months for the price of a ham sandwich?

The 2023 Spike and the 2026 Reality

Everything changed when the world reopened after the pandemic. Inflation came back with a vengeance—not quite 1980s levels, but enough to scare the Fed into the fastest rate-hiking cycle in modern history.

In late 2023 and early 2024, we saw something we hadn't seen in nearly 20 years: 5.5% and 6.0% CD rates.

But as of January 2026, that window is closing.

📖 Related: What Is The Home Loan Interest Rate Today: Why Waiting Might Cost You

The Fed issued three significant rate cuts at the tail end of 2025. Right now, as we sit in the first month of 2026, the national average for a one-year CD has slipped to around 1.9%, though competitive online-only banks are still dangling offers near 4.00% to 4.25% to keep their deposit bases steady.

Why History Matters for Your Wallet Right Now

Looking at the broad arc of historical cd interest rates, you see a clear pattern: rates go up by the stairs and down by the elevator.

When the Fed decides to cut, they usually move fast. If you've been sitting on the sidelines waiting for rates to hit 6% again, you might be waiting another decade. Or two. History shows that those 5% plus environments are the exception, not the rule, in the post-2008 world.

Here is what you actually need to do with this information:

Laddering is your best friend. Don't dump everything into a single 5-year CD. If rates have started to drop—which they have—you want to lock in the best of what's left. By "laddering," you buy CDs that mature at different times (e.g., a 6-month, a 12-month, and an 18-month). This gives you cash flow if you need it but protects you if rates keep sliding.

Watch the "Real" Rate. If a bank offers you 4% in 2026 and inflation is at 2.5%, you are making a 1.5% real profit. That is actually a better deal than getting 12% in 1980 when inflation was 13%. Don't get blinded by the big numbers; look at the "spread."

Check the online-only outliers. The "National Average" is a trap. It's dragged down by the massive brick-and-mortar banks that pay 0.01% because they don't need your money. In the 2020s, the best historical cd interest rates are almost always found at digital banks like Ally, Marcus, or Synchrony.

Right now, the smart move is to stop waiting for a "peak" that has already passed. If you can find a rate above 4% today, lock it in for at least a year. The trendline for 2026 is pointing downward, and by this time next year, a 3% CD might look like a total bargain.