Debt is a heavy weight. For most of us, that weight is a thirty-year mortgage that feels like a life sentence. But here is the thing: the bank expects you to take the full thirty years. They’re counting on it. In fact, their entire profit model is built on the slow, agonizing crawl of interest accumulating over decades. If you actually use a mortgage payment calculator extra payments feature, you start to see the cracks in their plan. You see how a few hundred bucks here and there can shave years—literal years—off your debt.

It's kinda wild.

Most people just set up autopay and forget it. They look at the monthly bill, sigh, and move on. But if you're looking at the math, you realize that the first fifteen years of a standard mortgage are basically just you handing the bank pure profit. Your actual loan balance? It barely moves. It’s frustrating.

The Math the Bank Doesn't Want to Highlight

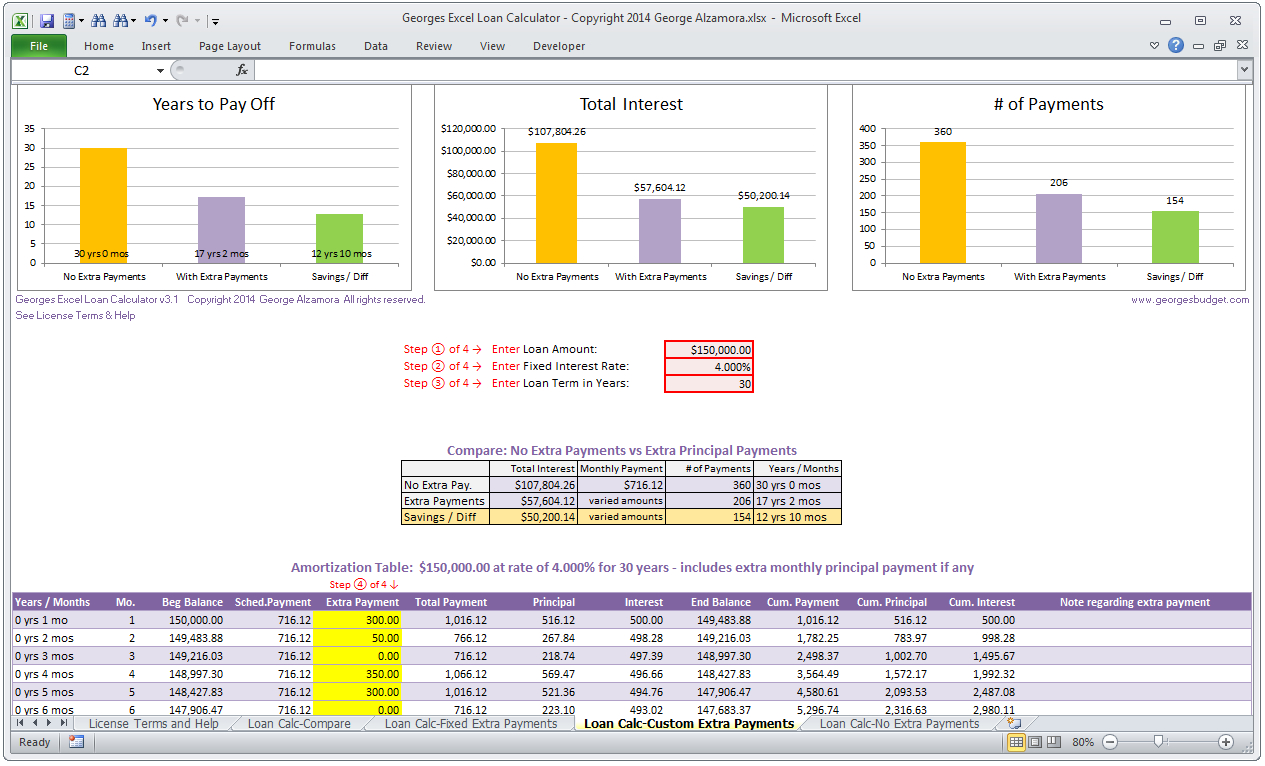

Let’s get real about amortization. When you sign those closing papers, the lender gives you a massive stack of documents. Hidden in there is the amortization schedule. It shows that on a $400,000 loan at 6.5%, your first payment is mostly interest. We’re talking maybe $300 going to your principal and over $2,100 going to interest. It feels like a scam, even though it's perfectly legal.

This is where the mortgage payment calculator extra payments tool becomes your best friend.

📖 Related: Monsey Shoes Monsey NY: What Most People Get Wrong About This Local Staple

When you add even $100 a month to that principal payment, you aren't just paying $100. You are "buying back" the interest that $100 would have accrued over the next twenty years. Because that $100 is no longer part of the balance, the bank can't charge you interest on it next month. Or the month after. Or in 2045.

It compounds. But in your favor this time.

Why One Extra Payment a Year is the "Magic" Number

You’ve probably heard the old advice about making one extra payment per year. It sounds like a drop in the bucket. How could one payment change a thirty-year trajectory? Honestly, it’s because of how front-loaded interest is. By making thirteen payments in a twelve-month period, you usually knock about four to six years off a thirty-year mortgage.

Think about that.

Six years of your life where you don't have a housing payment. That is money for retirement, travel, or just the peace of mind of owning your dirt outright. You can do this by dividing your monthly principal and interest by twelve and adding that amount to every single monthly check. Or, if you get a tax refund or a year-end bonus, just chuck it at the mortgage in one go.

Using a Mortgage Payment Calculator Extra Payments to Strategize

Not all calculators are the same. A basic one just tells you the monthly cost. A good one lets you toggle "monthly extra," "yearly extra," or "one-time lump sum."

Let's look at a scenario. Imagine a $350,000 loan.

If you decide to skip the fancy coffee or the extra streaming services and put $200 extra toward the principal every month, you don't just finish early. You save roughly $100,000 in interest over the life of the loan. That is a staggering amount of money. It’s the cost of a college education or a very nice inheritance for your kids.

But you have to be careful with how you communicate this to your servicer.

Some banks are... let's call them "clumsy." If you just send an extra check without instructions, they might apply it to the next month's payment instead of the principal. This is a huge mistake. Applying it to the next month just pays the interest early. You want it applied specifically to the principal balance. Most online portals have a specific box for "Principal Only." Use it. Always.

The Opportunity Cost Debate

Now, I’d be remiss if I didn't mention the other side of the coin. Financial experts like Ric Edelman have famously argued against paying off a mortgage early, especially if your interest rate is locked in at those 2020-2021 lows of 3%.

The logic is simple: if your mortgage costs you 3%, but the S&P 500 is averaging 8-10% over the long haul, you are technically "losing" money by paying down the debt. You should invest that extra cash instead.

But math isn't the only factor here.

Emotions matter. Risk matters. There is a psychological freedom in a paid-for home that a brokerage account balance can't always match. If you lose your job, the bank doesn't care how much you have in your 401(k); they want their check. If the house is paid off, your "burn rate" for survival drops significantly. You have to decide if you want to optimize for the highest possible net worth or the lowest possible stress.

Common Pitfalls and "Gotchas"

Before you go crazy with the mortgage payment calculator extra payments strategy, check for a prepayment penalty. These are rare on standard conventional loans these days, thanks to the Dodd-Frank Act, but they still exist in some subprime or specialized private lending products.

A prepayment penalty is basically the bank throwing a tantrum because they’re losing out on your interest. They might charge you a percentage of the remaining balance if you pay it off too fast.

Also, don't forget your "boring" financial foundation.

- Do you have an emergency fund? (At least 3-6 months of expenses).

- Are you getting your full employer match on your 401(k)?

- Is your high-interest credit card debt gone?

If you're paying 22% on a Visa card, putting extra money toward a 6% mortgage is, frankly, a bad move. Kill the credit cards first. They are the forest fire; the mortgage is just a slow-moving glacier.

The "Lump Sum" Psychology

Sometimes you get a windfall. An inheritance, a house sale, or maybe you just had a killer year in sales. Dropping $50,000 onto a mortgage principal feels amazing, but it won't lower your monthly payment.

This is a point of confusion for a lot of people.

Your payment is "re-amortized" only if you do something called a mortgage recast. Most lenders (like Chase or Wells Fargo) will do this for a small fee, usually around $250 to $500. They take your new, lower balance and calculate a new monthly payment based on the remaining years of the loan. This gives you the best of both worlds: a lower monthly obligation and a faster path to freedom.

Real World Example: The "Every Little Bit" Method

I knew a couple who didn't have an extra $500 a month. They were tight. But they decided to round up every payment. If the mortgage was $1,842, they paid $1,900. That extra $58 didn't feel like much. They barely noticed it in their budget.

By the end of the year, they had put nearly $700 extra toward the principal. Over thirty years, that tiny habit would have saved them over $20,000 in interest. They eventually increased it as they got raises. It’s about the habit of aggression toward the debt.

How to Audit Your Progress

Don't just trust the bank's website. Keep your own spreadsheet or use a dedicated mortgage payment calculator extra payments app to track your "Effective Term."

Every time you make an extra payment, look at how your payoff date moves. It’s incredibly motivating to see your "Freedom Date" jump from November 2054 to August 2051 just because of one extra payment. It becomes a game. You start looking for ways to "win" more months back from the bank.

Actionable Steps to Take Right Now

If you are ready to stop being a "renter" from the bank and start being an owner, follow this sequence:

- Log into your mortgage portal and find the current principal balance. Don't look at the total "payoff quote" yet, just the balance.

- Run the numbers. Use a calculator to input your current interest rate and remaining years. Add $50 to the "monthly extra" field and see what happens. Then try $100. The jump is usually shocking.

- Check for the "Principal Only" toggle. Ensure your servicer allows you to direct extra funds specifically to the balance. If they don't have an online option, you might have to write a physical check and write "APPLY TO PRINCIPAL" in the memo line in big, bold letters.

- Automate the aggression. If you can afford $100 extra, don't make it a manual choice every month. You'll eventually talk yourself out of it. Build it into your autopay.

- Re-evaluate during tax season. When that refund hits, decide then and there: half to savings, half to the house.

The reality is that most people will sell their home or refinance before the thirty years are up. But by paying extra now, you are building equity much faster. That means when you do sell, the check you get back from the title company will be significantly fatter. You’re essentially using your house as a high-yield savings account with the added benefit of having a roof over your head.

Stop looking at your mortgage as a fixed cost. It’s a variable one. You have the remote control; you just have to start pressing the buttons. Move that payoff date. Reclaim your future income. It starts with one extra payment.

Just one. And then another. Underestimate the bank, but never underestimate the power of compound interest working in reverse. It is the most boring, yet most effective way to build genuine wealth in this country. Period.