So, you’ve hit that stage where the government finally wants its cut. Honestly, it’s a bit of a shock for most people. You spend decades stuffing money into a Traditional IRA, watching it grow, and then—bam—the IRS knocks on your door. They want you to start taking it out. This is the world of Required Minimum Distributions, or RMDs.

If you're looking for an ira rmd age calculator, you're probably already sensing that the rules have changed. They have. In fact, if you’re using a calculator from 2022, it’s basically a paperweight.

The SECURE Act 2.0 threw a giant wrench into the old timelines. It used to be age 70½. Then it was 72. Now? It’s 73. And if you’re younger, it’s eventually going to be 75. It’s enough to give anyone a headache.

The Moving Target: When Do You Actually Start?

Here is the deal. For the year 2026, the age that matters is 73. But "age 73" doesn't mean the same thing to the IRS as it does to your birthday cake.

If you turn 73 in 2025, you have a weird choice to make. You can take your first RMD by December 31, 2025. Or, you can wait until April 1, 2026. This is known as your Required Beginning Date.

Waiting sounds great, right? Keep the money in the account longer? Sure. But there’s a trap. If you wait until April 1, 2026, to take your 2025 RMD, you still have to take your 2026 RMD by December 31, 2026.

That’s two massive withdrawals in one tax year.

You’ve basically just invited a tax bomb to your front door. For many retirees, doubling up on distributions like that can push them into a much higher tax bracket. It can also trigger the "tax torpedo," where your Social Security benefits suddenly become more taxable because your provisional income spiked. Kinda nasty, isn't it?

Who needs to worry about this in 2026?

Let’s look at the actual birth years. The IRS doesn't care about your "vibes"; they care about the calendar.

- Born between 1951 and 1959: Your RMD age is 73.

- Born in 1960 or later: Your RMD age is 75.

Wait. There was actually a weird glitch in the original law for people born in 1959. Because of how the bill was written, they technically fell into both the 73 and 75 age buckets. Congress eventually had to clear that up—anyone born in '59 is currently on the hook starting at age 73.

How the Calculation Actually Works

Most people think an ira rmd age calculator just tells them when to start. But the real heavy lifting is figuring out how much to take.

The formula is actually pretty simple prose, even if the math feels heavy: Prior Year-End Balance / Distribution Period.

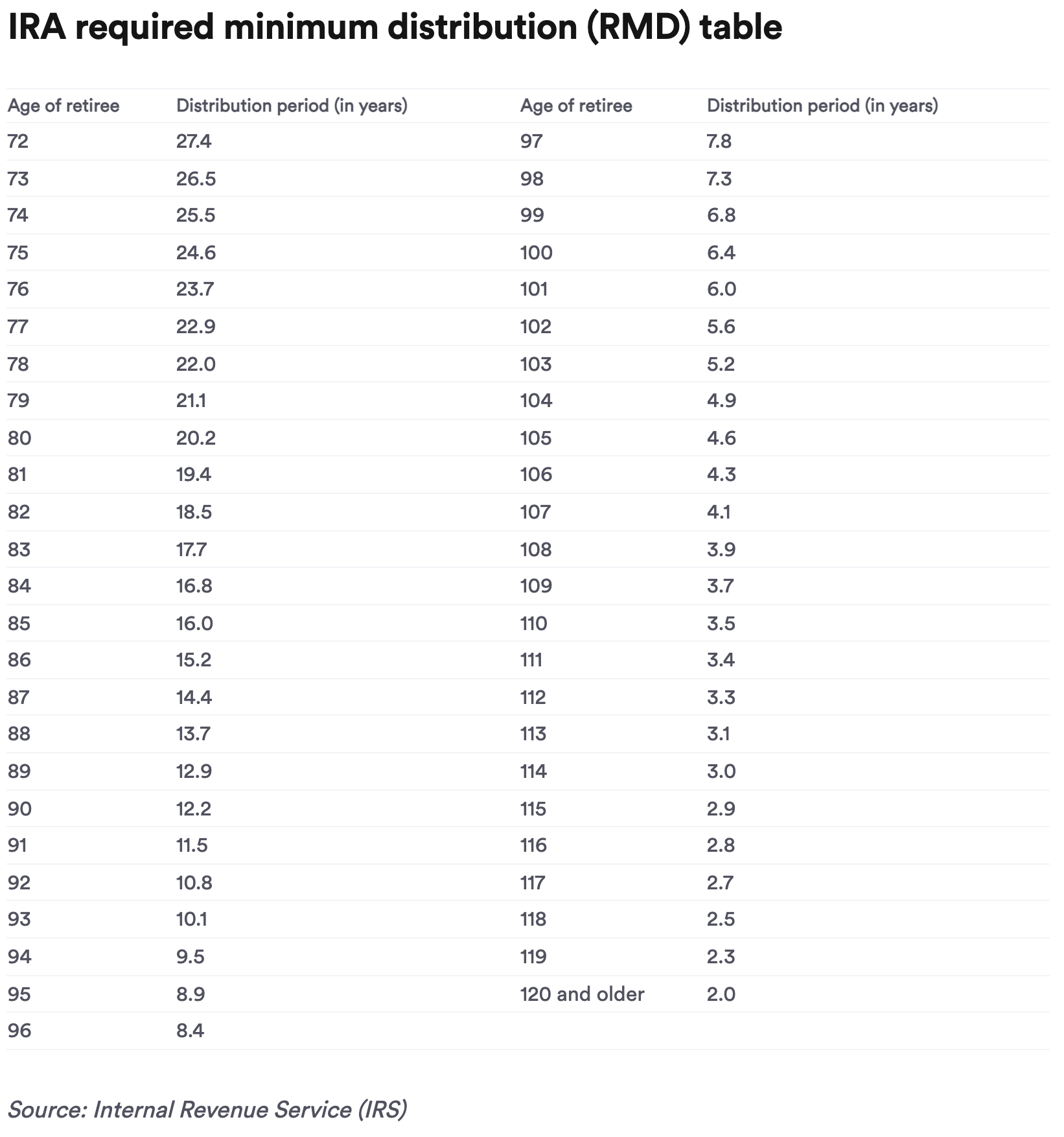

Basically, you take the balance of your IRA on December 31 of the year before the distribution. If you’re figuring out your 2026 RMD, you look at your statement from December 31, 2025. Then, you find your "distribution period" (which is just a fancy way of saying life expectancy) from the IRS Uniform Lifetime Table.

For example, if you are 73, your distribution period is 26.5.

If you have $500,000 in your IRA, you divide that by 26.5. That gives you roughly $18,868. That’s your minimum. You can always take more, but you can’t take less.

The "Spouse Exception" You Shouldn't Ignore

There is one big exception to the Uniform Lifetime Table. If your spouse is more than 10 years younger than you and is your sole beneficiary, you get to use a different table: the Joint and Last Survivor Table.

Why? Because the IRS assumes the money needs to last longer for that younger spouse. This results in a smaller RMD. If you're 75 and your spouse is 50, your RMD will be significantly lower than if you were single or married to someone your own age. Don't let your calculator default to the wrong table; it’s a mistake that costs you unnecessary taxes.

Common Mistakes People Make with RMD Age Calculators

I've seen people get this wrong constantly. They treat their RMDs like a suggestion. They aren't.

1. Forgetting about Multiple IRAs

If you have three Traditional IRAs, you have to calculate the RMD for each one. However, you can aggregate the total and pull it all from just one account. This does not apply to 401(k)s. If you have two different 401(k)s from old jobs, you must take a separate RMD from each individual plan. Mixing those up is a fast track to a penalty.

2. The 25% Penalty Gut-Punch

It used to be a 50% penalty for missing an RMD. That was brutal. SECURE 2.0 lowered it to 25%. If you fix the mistake quickly (usually within two years), it drops to 10%. Still, paying 10% to 25% of your money to the government for a math error is a bad day.

3. Thinking Roth IRAs Have RMDs

Original owners of Roth IRAs never have to take RMDs. Never. You can be 105 years old and let that money sit. However—and this is a big however—inherited Roth IRAs do have RMD rules for most beneficiaries.

4. Ignoring QCDs

If you’re 70½ or older, you can do a Qualified Charitable Distribution (QCD). You can send up to $105,000 (adjusted for inflation) directly from your IRA to a charity. The cool part? This counts toward your RMD but doesn't count as taxable income. It’s the closest thing to a "cheat code" in the tax law.

✨ Don't miss: 2024 Tax Tables 1040: What Most People Get Wrong

Nuance Matters: The "Still Working" Rule

Some people think that just because they hit 73, they must start withdrawals. Not always.

If you have a 401(k) or 403(b) at your current job and you don't own more than 5% of the company, you can usually delay RMDs for that specific account until you actually retire. But this doesn't apply to your IRAs. You could be 80 years old, still working as a CEO, and you'd still have to take RMDs from your Traditional IRA while delaying them for your current 401(k).

Actionable Next Steps for 2026

If you’re approaching that "magic" age, don't just wait for your brokerage to send you a letter. They make mistakes too.

- Audit your accounts. List every Traditional, SEP, and SIMPLE IRA you own.

- Check your birthdays. If you turn 73 in 2026, your first RMD isn't technically "due" until April 1, 2027. But seriously, talk to a CPA about whether you should take it in late 2026 instead to avoid the "double-up" tax hike in 2027.

- Update your beneficiaries. If your spouse is much younger, make sure they are listed as the sole beneficiary so you can use the more favorable Joint Life Expectancy Table.

- Automate the withdrawal. Most big firms like Fidelity, Vanguard, or Schwab allow you to set up an "automatic RMD" service. They do the math based on the year-end balance and send you the cash. Use it. It's the best way to avoid that 25% penalty.

Managing your IRA isn't just about the growth anymore; it's about the exit strategy. The government helped you save it, but they're very specific about how you spend it. Keep your eye on the calendar.