You try to e-file your taxes. You’ve got your coffee, your W-2s are organized, and you’re ready for that refund. Then, the screen flashes red. Rejected. The reason? Someone already filed using your Social Security number. It's a gut punch. Honestly, it’s one of the most violating feelings in the modern financial world.

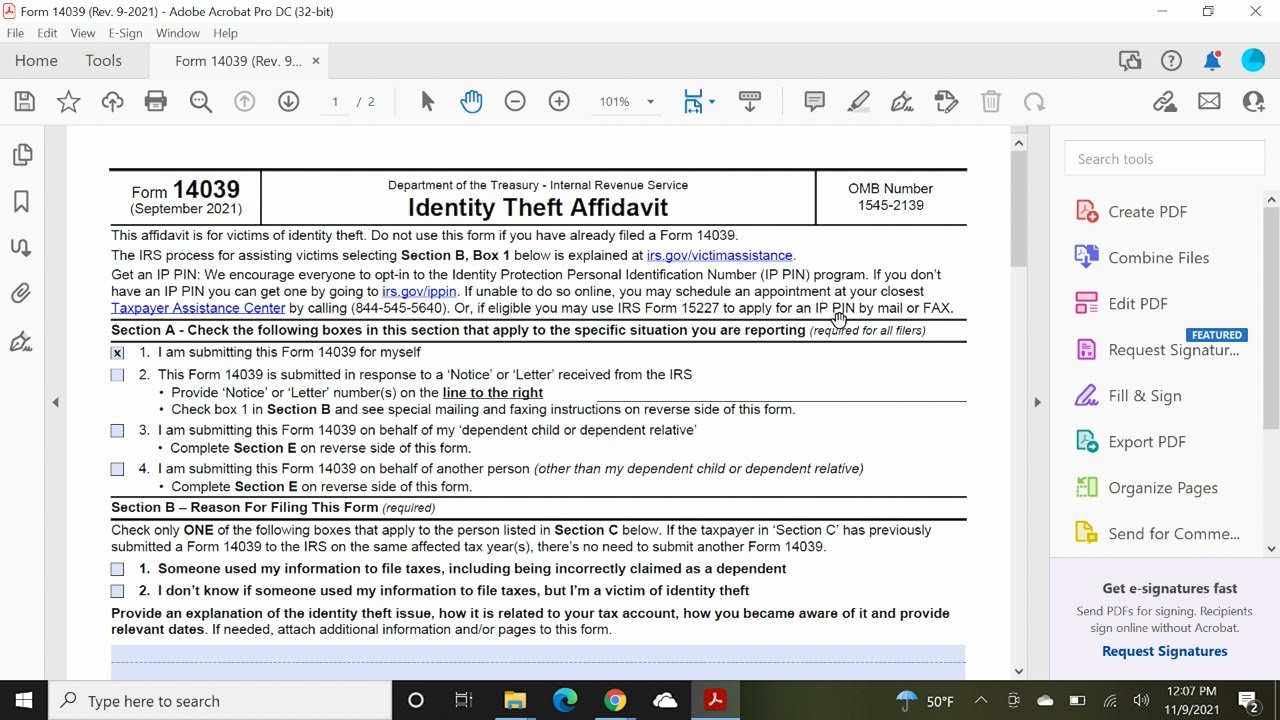

This is exactly why IRS Form 14039 Identity Theft Affidavit exists.

It’s the official way you tell the federal government, "Hey, that wasn't me." But filling it out isn't just a box-ticking exercise. If you mess it up, or if you send it when you don't actually need to, you might just bury your tax account in a mountain of bureaucratic red tape that takes eighteen months to clear. Seriously. The IRS is backed up, and adding unnecessary paperwork to your file is like pouring molasses into a jet engine.

Why You Actually Need IRS Form 14039 Identity Theft Affidavit

Most people think they should file this form the second they lose their wallet. Stop. Don't do that.

🔗 Read more: MTAR Tech Share Price: What Most People Get Wrong About This High-Tech Play

If your wallet was stolen but there's no evidence someone tried to mess with your taxes, you don't necessarily need this form yet. You should definitely put a freeze on your credit with Experian, Equifax, and TransUnion. You should call your bank. But the IRS Form 14039 Identity Theft Affidavit is specifically for tax-related identity theft.

The biggest red flag is that "duplicate Social Security number" rejection. Another common sign is getting a transcript in the mail you didn't request or receiving a notice about an employer you've never worked for. Basically, if the IRS thinks you're living a double life, that's when you pull this lever.

The IRS isn't playing around with this. In recent years, the IRS has flagged millions of returns for potential fraud. According to the National Taxpayer Advocate's reports, identity theft cases are a primary driver of the massive delays in processing amended returns and refunds. When you submit this affidavit, you are essentially asking the IRS to lock down your account and start a manual investigation. It is a slow process.

The Nitty-Gritty of Filling It Out Right

Section A is where you explain why you're writing. You have two choices. Either you are a victim of a tax-related event, or you are a victim of a non-tax event (like a data breach) and you're worried about future tax issues.

Choose carefully.

If you pick the "actual victim" box, you better have proof. This usually means a copy of a police report or a Federal Trade Commission (FTC) Identity Theft Report. If you choose the "potential victim" box, the IRS might not do much other than keep a closer eye on your account.

What most people get wrong about the paperwork

You have to be precise.

If you're filing this because of a rejected e-file, you usually have to submit a paper tax return along with the IRS Form 14039 Identity Theft Affidavit. You can't just mail the affidavit by itself and hope they figure it out. You attach the form to the front of your complete paper return and mail it to the processing center for your area.

Think about the physical paper. A human being at an IRS service center in Austin or Ogden has to open your envelope, see Form 14039 on top, and realize this isn't just a normal late return. If you hide it in the middle of your 1040, it might get scanned as a regular return, get rejected again for a duplicate SSN, and you're back at square one. It's a mess.

Life After Filing: The IP PIN

Once the IRS processes your IRS Form 14039 Identity Theft Affidavit, you’re likely going to become part of the Identity Protection PIN (IP PIN) program.

This is a six-digit number the IRS assigns you every year. You need it to file. If you don't have it, your e-file gets rejected instantly. No exceptions. It's a great security measure, but it's a huge hassle if you lose the letter they mail you in December or January.

Back in the day, the IP PIN program was only for confirmed victims. Now, the IRS has opened it up to anyone who wants to opt-in voluntarily. Honestly, even if you haven't been hacked, opting into the IP PIN program is a smart move. It's like putting a deadbolt on your tax return before the burglar even shows up at your house.

Real-World Nuance: The "Secondary Victim" Problem

What if it's your kid?

Identity thieves love stealing kids' Social Security numbers because those numbers stay "clean" for eighteen years. No one is checking a five-year-old’s credit score. If you try to claim your child as a dependent and get a rejection because their SSN was already used, you have to file the IRS Form 14039 Identity Theft Affidavit on their behalf.

📖 Related: Why CVS CEO Tom Ryan Still Matters: The Architect of Modern Healthcare

In Section C of the form, you’ll fill out the information for the person whose identity was stolen (your child), and in Section E, you sign as the parent or legal guardian. You’ll need to provide proof of your relationship, like a birth certificate, to prove you’re not the one trying to scam the system.

The Timeline of Pain

Let's be real: the IRS is not fast.

Once you mail that packet, don't expect a resolution in two weeks. It's more like 120 to 180 days. In some complex cases, people have waited over a year to get their identity theft case closed and their refund issued.

During this time, the "Where's My Refund?" tool on the IRS website might show nothing. It might look like your return vanished into a black hole. This is where you have to be persistent. If 180 days pass and you haven't heard a peep, that's when you call the Identity Protection Specialized Unit at 800-908-4490.

Don't call every week. You'll just get frustrated sitting on hold for three hours. But do keep a log of every document you sent and the date you mailed it. Use Certified Mail with a Return Receipt. It costs a few extra bucks, but having that green postcard showing someone at the IRS signed for your mail is the only way to prove you actually sent it.

💡 You might also like: Tax Return Estimator 2025: Why Your Refund Might Look Different This Year

Scams and Misinformation

Watch out for people telling you that you need to pay for a "special service" to file this form. You don't.

The IRS Form 14039 Identity Theft Affidavit is free. You can download it directly from IRS.gov. If a website asks for your credit card to help you file an identity theft report with the IRS, close the tab immediately.

Also, the IRS will never call you to ask for your IP PIN. If someone calls claiming to be from the IRS and says they need your six-digit PIN to "verify your identity," hang up. They're trying to steal your identity... again. The irony is thick, but it happens all the time.

Practical Steps to Move Forward

If you're sitting there looking at a rejected tax return right now, here is exactly what you need to do:

- Get the form. Go to IRS.gov and search for Form 14039. Download the latest version.

- Collect your evidence. Get a copy of your driver's license or passport. If you have an FTC identity theft report or a police report, get that ready too.

- Paper file your return. Print out your entire tax return. Sign it in blue or black ink.

- Assemble the packet. Put the IRS Form 14039 Identity Theft Affidavit on the very top. Place your ID copy behind it. Then put your tax return behind that.

- Mail it certified. Take it to the Post Office. Do not just drop it in a blue mailbox. Get a tracking number and a return receipt.

- Notify others. Identity theft is rarely "just" about taxes. Check your credit reports at annualcreditreport.com. Place a fraud alert on your accounts.

- Wait and verify. Set a calendar reminder for 120 days from today. If you haven't received a letter from the IRS by then, call the Identity Protection Specialized Unit.

- Watch for the PIN. Expect a CP01A Notice in the mail late in the year or early next year. This contains your IP PIN for the next filing season. Do not throw this away; it is your golden ticket to filing your taxes safely in the future.

Managing a tax identity theft case is a marathon, not a sprint. It's annoying, it's slow, and it's bureaucratic. But by filing the affidavit correctly the first time, you prevent the IRS from ignoring your case or marking it as incomplete. Keep your records organized and stay patient while the system works through the backlog.