Honestly, the holidays are chaotic enough without having to guess if your limit orders are actually going to execute or if the New York Stock Exchange (NYSE) has already packed up for the year. You’ve probably seen conflicting info online. Some people say the market is always closed on Christmas Eve, while others swear they’ve traded right up until the dinner rolls were coming out of the oven.

The short answer? Yes, the stock market is open on December 24th, but it's not a normal day at the office.

If December 24th falls on a weekday, the NYSE and Nasdaq typically open at their usual 9:30 a.m. ET, but they pull the plug way earlier than usual. You aren't getting that 4:00 p.m. closing bell. Instead, the market closes at 1:00 p.m. ET.

✨ Don't miss: Current Price of Gold Per Gram USD: Why the $149 Milestone Changes Everything

The 2026 Schedule: December 24th Specifics

In 2026, December 24th lands on a Thursday. Because it's a weekday, the standard "early bird" rules apply. If you're planning to make moves before the year-end, you have a very narrow window to get things done.

Here is how the timing breaks down for the major US exchanges:

- Pre-Market Trading: Starts as early as 4:00 a.m. ET (for the early risers or the caffeine-addicted).

- Regular Market Open: 9:30 a.m. ET.

- The Big Close: 1:00 p.m. ET sharp.

- After-Hours Trading: Usually continues but with significantly thinned-out liquidity until around 5:00 p.m. ET.

Why does the bond market play by different rules?

If you trade bonds or follow fixed-income closely, you're dealing with a different beast. SIFMA (the Securities Industry and Financial Markets Association) generally recommends that the bond market closes even earlier or follows its own unique guidance. For December 24th, 2026, the recommendation is a 2:00 p.m. ET close for bonds.

It’s sorta weird, right? You’d think they would all just leave at the same time. But the bond market is often less "retail-heavy" and more driven by institutional recommendations that don't always lock step with the equity side.

What happens if December 24th falls on a weekend?

This is where the confusion usually starts. If December 24th is a Saturday, the market is closed. Period. But that doesn't mean you get an early close on Friday. If Christmas Day (Dec 25) falls on a Sunday, the market is closed on Monday, December 26th, in "observation" of the holiday.

In those specific calendar years, December 24th essentially disappears from the trading calendar entirely. You won't see any "early close" magic because the lights are already off.

Liquidity and the "Ghost Town" Effect

Just because the market is open doesn't mean it's active.

Most institutional traders—the "big money" at hedge funds and investment banks—are already off in Aspen or drinking eggnog by the 24th. This leads to what we call low liquidity.

When liquidity is low, there aren't many buyers and sellers. This can cause "slippage," where the price you see on your screen isn't exactly the price you get when you hit the buy button. Spreads between the bid and the ask price can widen significantly. Basically, it’s a risky time to be doing high-volume trading or trying to play a volatile stock.

Small trades on the 24th can move the needle more than they would on a random Tuesday in October. If a big sell order comes through and there aren't many people there to buy the dip, the price can drop much faster than usual.

International Markets: A Global Mixed Bag

Don't assume the rest of the world follows the US lead.

The London Stock Exchange (LSE) usually has an early close as well, often around 12:30 p.m. local time.

The Tokyo Stock Exchange (TSE), however, might be business as usual depending on how their local holidays align.

If you’re trading global ADRs or foreign stocks, you basically have to check each specific exchange's calendar because they definitely aren't checking yours.

Don't Forget About Crypto and Forex

If you’re a crypto enthusiast, the concept of a "market holiday" is basically a joke. Bitcoin, Ethereum, and the rest of the digital asset world trade 24/7, 365 days a year. Christmas Eve, Christmas Day, 3 a.m. on a Tuesday—it doesn't matter.

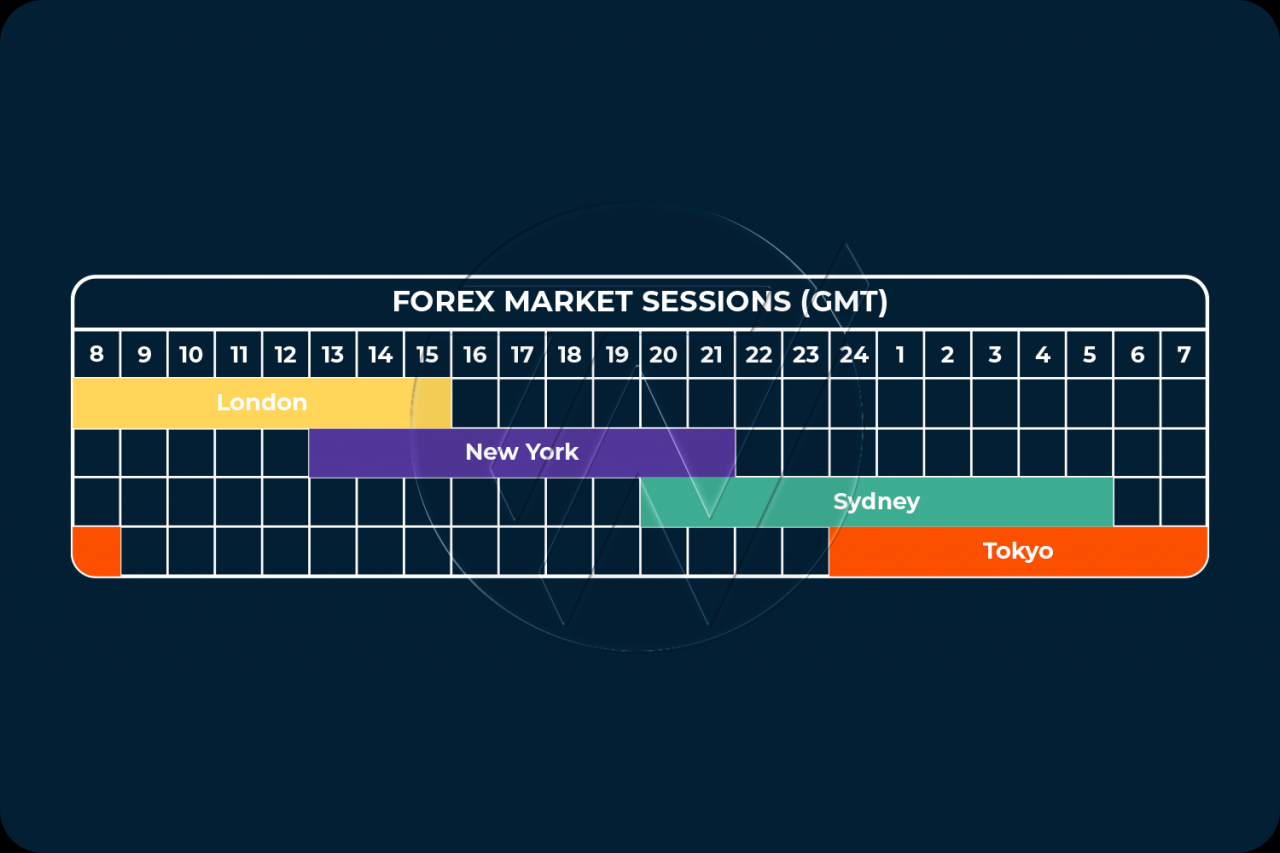

Forex is slightly different. While it's a 24-hour market, it does shut down on weekends. On December 24th, it remains "open," but like the stock market, the volume is often so low that it’s barely worth watching unless there’s some massive geopolitical shock.

Actionable Tips for Trading on December 24th

Since you’ve only got a half-day, you need to be surgical.

First, check your standing orders. If you have "Good 'Til Canceled" (GTC) orders sitting out there, a low-liquidity environment can trigger them unexpectedly if there’s a weird price spike. It might be worth pausing them if you aren't going to be at your desk.

Second, use limit orders. Never, and I mean never, use market orders on a day like December 24th. You want to control the exact price you pay or receive. Market orders in a thin market are an invitation for the "market makers" to take a bigger slice of your money.

Third, watch the clock. If you try to place a trade at 12:55 p.m. ET, you’re cutting it way too close. Systems start winding down, and your order might not get filled, leaving you holding a position over a long holiday weekend when you didn't intend to.

Lastly, just take the day off. Seriously. The statistical likelihood of you finding the "trade of the century" in a three-and-a-half-hour window on Christmas Eve is slim. Most of the time, the market just drifts sideways on low volume. Enjoy the break. The markets will still be there on the 26th.

Double-check your specific brokerage's hours, as some smaller platforms or international-focused brokers might have slightly different internal cut-off times for processing wires or customer service requests.

Keep your eye on the 1:00 p.m. ET bell for stocks and the 2:00 p.m. ET recommendation for bonds. Anything after that is just noise.