Let’s be honest for a second. The phrase "unrealized capital gains tax" sounds like something dreamed up in a windowless room by people who have never actually had to balance a checkbook or run a business. It’s a mouthful. It’s confusing. And if you’ve been scrolling through social media lately, you’ve probably seen some pretty wild takes on it.

Basically, the idea is that the government wants a piece of the pie before the pie is even out of the oven.

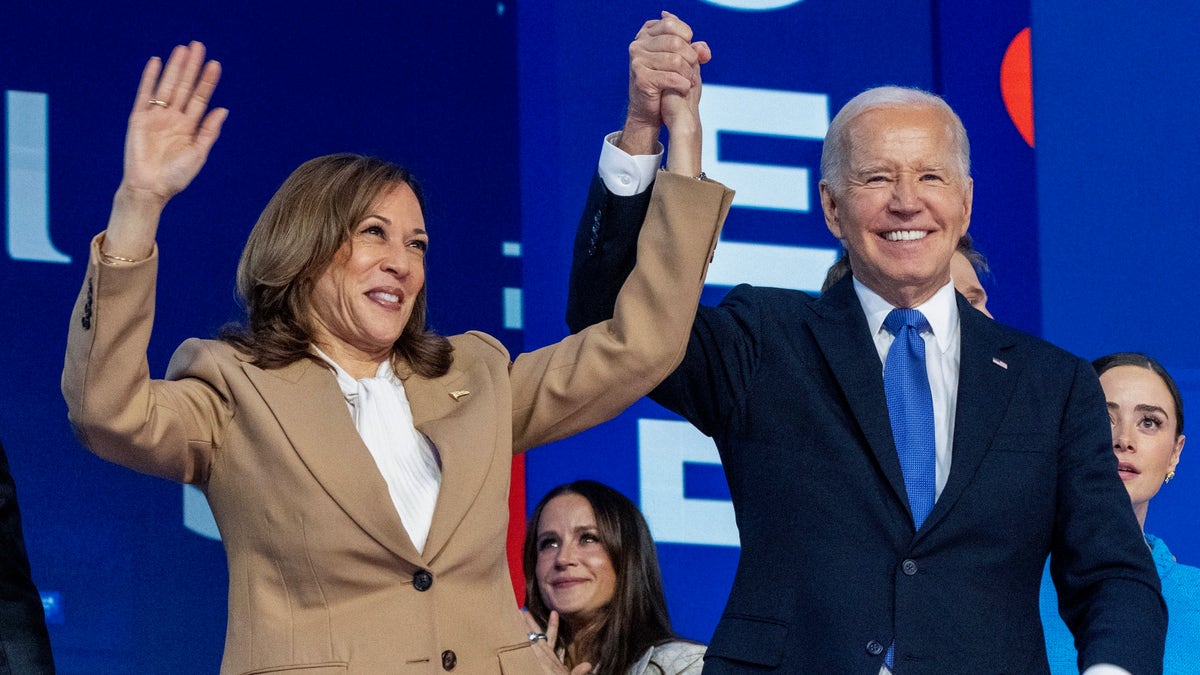

The proposal, which Vice President Kamala Harris has signaled support for as part of the broader Biden-Harris economic framework, suggests that if your assets go up in value, you owe taxes on that increase—even if you haven’t sold a single share or square foot of property.

Is it "ridiculous"? Well, that depends on who you ask, but from a purely logistical and economic standpoint, it’s certainly one of the most controversial shifts in American tax history.

💡 You might also like: Why Every Map of the Permian Basin Looks Different (and Why That Matters)

The $100 Million Threshold: Are You Actually on the Hook?

Before we get into the weeds of why this is making people lose their minds, let's clear up the biggest misconception: who this actually hits.

Most people aren't going to be writing a check for their Zillow estimate going up. The Kamala Harris unrealized capital gains tax proposal—technically the "Billionaire Minimum Income Tax"—specifically targets individuals with a net worth over $100 million.

We're talking about the top 0.01% of the country. About 10,000 people.

If you’re a teacher with a 401(k) or a homeowner in the suburbs, this isn't coming for you. At least, not yet. Critics often argue that once a tax like this is on the books, the threshold eventually creeps down. Think about the federal income tax in 1913; it started as a tiny tax on the ultra-rich, and look at us now.

How the Math Supposedly Works

Under the current system, if you buy a stock for $10 and it grows to $100, you don't owe anything until you sell it. That’s a "realized" gain. Under the new proposal:

- The 25% Rule: If your net worth is over $100 million, you’d be required to pay a minimum tax of 25% on your total income, including those paper gains.

- The Valuation Nightmare: Every year, you’d have to figure out what everything you own is worth. This is easy for Apple stock, but what about a private tech startup or a rare painting?

- Payment Over Time: To be fair, the proposal does allow taxpayers to spread out the initial tax payment over nine years, and subsequent annual payments over five years.

Why Critics Call It "Ridiculous"

Honestly, the pushback isn't just coming from billionaires who want to keep their money. Economists and venture capitalists are genuinely worried about the "flywheel" effect.

Imagine you’re a founder of a tech company. Your company is "worth" $200 million on paper because of a recent funding round, but you only have $100,000 in your bank account. You’re "asset rich" but "cash poor."

Under this plan, you might be forced to sell off pieces of your company just to pay the tax on wealth that might disappear tomorrow if the market dips.

The Problem with "Ghost" Wealth

The most glaring issue is that unrealized gains aren't real money. They are projections.

If Elon Musk’s net worth drops by $20 billion in a week (which has happened), does the government send him a refund check for the taxes he paid on that "gain" the year before? The proposal mentions "credits" for future years if values drop, but that doesn't help a business owner who had to liquidate their life's work just to cover a tax bill on a peak valuation.

"A tax on unrealized gains is a tax on optimism. It assumes the market only goes up and that paper wealth is the same as spending power. It’s not." — Common critique from Silicon Valley circles.

👉 See also: Open Grounds Farm NC: The Massive Row Crop Operation You Can Actually See From Space

The Defense: Closing the "Buy, Borrow, Die" Loophole

To understand why Kamala Harris and other proponents support this, you have to look at how the ultra-wealthy actually live. They don’t usually take a "salary" like we do.

Instead, they use a strategy called "Buy, Borrow, Die."

- Buy assets that appreciate (stocks, real estate).

- Borrow against those assets at low interest rates to fund a lifestyle. Since loans aren't "income," they aren't taxed.

- Die and pass the assets to heirs, often with a "stepped-up basis" that wipes out the capital gains tax entirely.

Supporters like economist Gabriel Zucman argue that this creates a system where the middle class pays 25-30% in income tax while the person with $500 million pays virtually nothing because they never "realize" their gains. The Kamala Harris unrealized capital gains tax is designed to break that cycle.

Real-World Consequences for Innovation

If this goes through, it could fundamentally change how startups work.

Currently, Silicon Valley thrives because founders and early employees take massive risks for "equity"—the promise of future wealth. If that equity becomes a tax liability before it’s even tradeable on a public exchange, the incentive to start a company in the U.S. might evaporate.

We’ve already seen hints of this. In 2026, the conversation around the "wealth exodus" is louder than ever. Some founders are looking at places like Singapore or certain European jurisdictions that, surprisingly, have more traditional tax structures despite being "socially" focused.

Complexity for the IRS

Can we talk about the paperwork for a second?

The IRS is already backlogged. Now, imagine they have to audit the "estimated value" of every private business, vineyard, and art collection owned by 10,000 of the world’s most litigious people. It would be a legal and administrative quagmire that could cost nearly as much to enforce as it brings in.

✨ Don't miss: Russian Rouble to USD: What Most People Get Wrong

What Really Happens Next?

Is it going to pass? Honestly, probably not in its current "unfiltered" form. The U.S. Constitution's 16th Amendment gives Congress the power to tax income, and there is a huge legal debate over whether a "paper gain" actually counts as income. This would almost certainly end up in front of the Supreme Court.

Even if it doesn't pass, the conversation is shifting. We are seeing a move toward higher corporate rates (the proposal also suggests moving the corporate rate from 21% to 28%) and a higher top rate on realized gains (moving from 20% to 28% for those making over $1 million).

Actionable Steps for Investors

While you might not be a centi-millionaire, these shifts in tax policy almost always change market behavior. Here’s what you should keep an eye on:

- Watch the "Stepped-Up Basis": Even if the unrealized tax fails, the government is looking at taxing gains at death. Talk to an estate planner about how your assets are titled.

- Liquidity is King: If taxes on investment income rise, the value of liquid assets versus "locked" assets changes. Ensure your portfolio isn't 100% tied up in illiquid real estate or private equity.

- Tax-Loss Harvesting: It’s more important than ever. If the top rates go up, your ability to offset gains with losses becomes more valuable.

The Kamala Harris unrealized capital gains tax remains a theoretical lightning rod for now. Whether you think it’s a necessary step toward fairness or a "ridiculous" economic suicide note, it has successfully started a conversation about what "wealth" actually means in the 21st century.

Next Steps for You

Review your current investment portfolio for any large "built-in" gains. Even if you aren't in the $100 million club, any future tax changes to the long-term capital gains rate (which is also part of the Harris proposal) could affect your net proceeds if you decide to sell in the next few years. Consider consulting a tax professional to model how a 28% realized gains rate would impact your retirement exit strategy.