You’re applying for a mortgage. Or maybe a new apartment in a city where the rental market is basically a blood sport. Suddenly, someone asks for a "letter of employment." It sounds simple, right? You ask HR, they click a button, and you’re done. But honestly, if the document doesn't hit specific notes, it's going to get kicked back. That's a headache nobody needs.

A letter of employment example isn't just a piece of paper saying you work somewhere. It's a legal verification of your financial stability. Lenders and landlords look at these with a magnifying glass. If the tone is too casual or the details are fuzzy, it raises red flags. I’ve seen people lose out on houses because their boss wrote a "nice" letter that forgot to mention if the position was permanent.

Let's get into what actually makes a verification letter work.

Why a Generic Letter of Employment Example Often Fails

Most people grab the first template they see on Google. Bad move. Banks, especially, have very rigid requirements. They aren't looking for a character reference. They don't care if you're the "life of the office" or if you make great coffee. They want cold, hard data points.

If your letter is missing the company’s official letterhead, it’s basically junk. Seriously. I've talked to mortgage underwriters who say they reject dozens of these a week because they look like they were typed up in a basement. It has to look official. That means a logo, a physical address, and a professional header.

The Essential Data Points

You need the basics. Your name. Your job title. Your start date. But here’s the kicker: the "status" of your employment.

Is it full-time? Part-time? Contract? If you’re a freelancer or a 1099 contractor, a standard letter of employment example won't even work for you. You’d need something more akin to an independent contractor verification. Lenders want to know the "likelihood of continued employment." While an employer can't strictly promise you'll have a job in five years, they usually state that you are in "good standing."

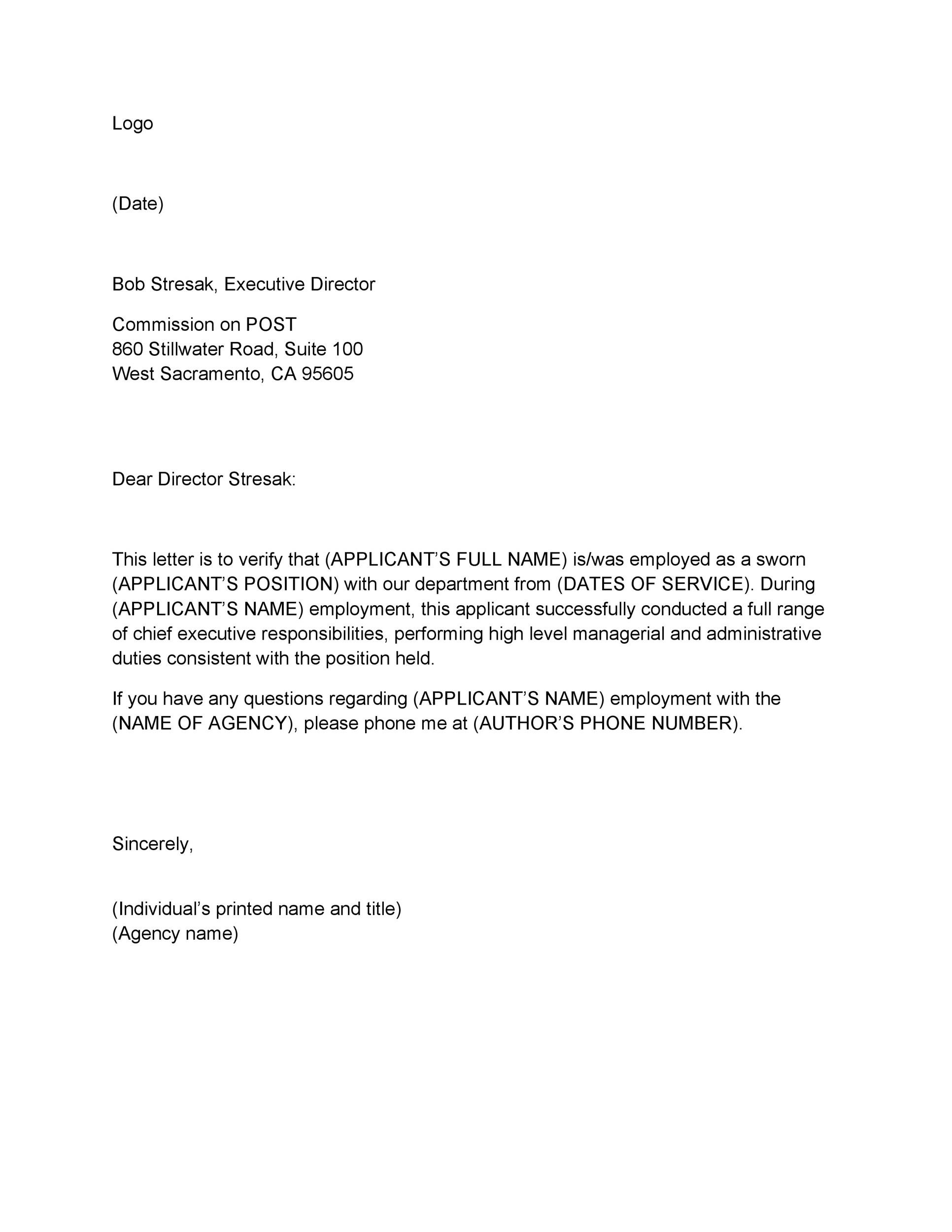

An Illustrative Example of a Standard Professional Letter

Below is a breakdown of what a standard, effective letter looks like. Don't just copy-paste it; make sure your HR department uses their actual voice and branding.

Company Letterhead

(Logo, Address, Phone Number)

Date: January 13, 2026

To: To Whom It May Concern (or a specific name like "Fairview Mortgage Services")

Subject: Employment Verification for [Your Name]

Dear [Name/Department],

Please accept this letter as formal verification of employment for [Your Name]. [Your Name] has been employed with [Company Name] since [Start Date].

Currently, [Your Name] holds the position of [Job Title] and works on a full-time basis. Their current gross annual salary is [Amount], plus eligibility for [Bonuses/Commissions, if applicable].

If you require any further information or have specific questions regarding this verification, please feel free to reach out to the Human Resources department at [Phone Number] or via email at [Email].

Sincerely,

📖 Related: Federal Reserve Interest Rates by Year: What the History Books Actually Tell Us

(Signature)

Jane Doe

Director of Human Resources

[Company Name]

See how dry that is? It’s supposed to be. This isn't a place for flair. It’s a place for facts.

The Salary Question: To Include or Not?

This is where it gets tricky. Sometimes you don't want your landlord knowing exactly how much you make. You just want them to know you can afford the rent. However, if you’re using a letter of employment example for a loan, the salary is non-negotiable.

Some companies have a policy where they won't include salary unless you give written permission. If you're the one requesting the letter, be explicit. Tell HR: "I need my base salary and my average overtime from the last six months included." If you don't tell them, they'll likely leave it out to be safe, and you'll end up playing email tag for three days.

Different Strokes for Different Folks

- For Landlords: Focus on the "Permanent" status and length of tenure. They want to know you won't vanish in two months.

- For Mortgages: They need the breakdown. Base pay, bonuses, and any raises you’ve received recently.

- For Work Visas: This is a whole different beast. Usually, you need to include your specific job duties to prove you meet the "specialized knowledge" criteria.

Common Mistakes That Kill Your Credibility

Don't let your boss sign it with a digital "scribble" that looks like a font. In 2026, many institutions still prefer a "wet" signature (scanned) or a verified digital signature like DocuSign. A typed name in a fancy font? Forget about it.

Another big one is the date. A letter of employment has a shelf life. Most banks won't accept one that is older than 30 to 60 days. If you got a letter in October and you're finally closing on a house in January, you’re going to need a fresh one. It’s annoying, but it’s the reality of risk management.

Watch out for "forward-looking statements." No smart HR person will ever write, "John will definitely work here forever." If a lender asks for that, they are asking for the impossible. A good letter stays in the present and the past. It says what you do and what you have done.

✨ Don't miss: Procter and Gamble Test: How to Actually Pass the P\&G Assessment Without Overthinking It

What About Small Businesses?

If you work for a tiny startup or a mom-and-pop shop, you might be the one writing the letter for your boss to sign. It feels weird. It feels like you’re "faking" it. You’re not. Just keep it professional. Use a clean layout. Ensure the contact person listed is actually someone who answers the phone.

Lenders often call to "verify the verification." If they call the number on your letter of employment example and it goes to a Google Voice number that hasn't been set up, you're in trouble. Make sure the person signing is reachable.

Nuances of the "Current Standing" Clause

The phrase "in good standing" is corporate-speak for "we aren't planning on firing this person tomorrow." It’s a layer of protection for the lender. If an employer refuses to put that in, it might be a policy thing, or it might be a signal. Most of the time, it's just policy.

If your company uses a third-party service like The Work Number, you might not even get a letter. You’ll get a code. You give that code to the bank, and they pull the data themselves. It's efficient but feels a bit cold. If you're in that boat, don't panic—just explain to the person requesting the letter that your company uses an automated verification system.

Actionable Steps for Your Next Request

Getting this right the first time saves so much stress. Here is how you should handle it:

- Check the requirements first. Ask the person requesting the letter exactly what they need. Do they need salary? Do they need your manager’s direct line?

- Give HR a template. Don't make them do the work. Send them a letter of employment example and ask them to put it on letterhead.

- Check for "The Big Three." Before you send it off, verify your name is spelled correctly (it happens!), the date is current, and the salary matches your paystubs.

- Get a PDF. Never send a Word document. It looks unprofessional and can be edited. Always send a flattened PDF.

- Follow up. If you haven't heard back from HR in 48 hours, nudge them. These letters are usually low priority for them but high priority for your life.

If you’re self-employed, your "letter" is usually replaced by an Enrolled Agent or CPA letter. That’s a different document entirely, focusing on your Year-to-Date (YTD) earnings and tax filings.

The bottom line is that a letter of employment is a bridge. It connects your work life to your personal goals. Treat it like the legal document it is, and you’ll skip the back-and-forth drama that usually comes with financial applications.