Inheriting money is usually a blessing, but inheriting an IRA? That is more like receiving a high-stakes homework assignment from the IRS. If you’ve just found out you're the beneficiary of a retirement account, you've likely already started hunting for an rmd beneficiary ira calculator. You want a simple number. You want to know how much you have to take out so the government doesn’t swoop in and grab a 25% penalty.

Honestly, it’s a mess. Between the SECURE Act of 2019 and the follow-up SECURE 2.0, the old rules were basically tossed out the window and replaced with a labyrinth.

If you’re looking at a calculator and it just asks for your age and the account balance, close the tab. It is probably wrong. A real calculation in 2026 requires you to know more than just the math; you need to know the "status" of the person who passed away and your exact legal category as a beneficiary.

The 10-Year Rule is the New Normal (Sorta)

Most people who aren't spouses now fall under the 10-year rule. This basically means the IRS wants their tax money, and they want it fast. You generally have to empty the entire account by December 31st of the 10th year following the year of the original owner's death.

But here is where the "calculator" part gets tricky.

For a few years, everyone thought you could just wait until year 10 and take one giant lump sum. The IRS eventually cleared their throat and said, "Not so fast." If the person you inherited the IRA from had already started taking their own RMDs (meaning they were past their "Required Beginning Date"), you can’t just wait. You have to take annual distributions in years one through nine, and then empty the rest in year ten.

If they died before they were required to take RMDs, you might actually be able to sit on the cash for a decade. See the difference? A simple rmd beneficiary ira calculator can't tell you what to do unless you know if the original owner was 73 or older when they passed.

Why Your "Category" Changes the Math

The IRS divides human beings into three buckets when it comes to inherited IRAs. Your bucket determines which life expectancy table you use—or if you use one at all.

1. Eligible Designated Beneficiaries (The VIPs)

This group still gets the "stretch" IRA. They can take money out slowly over their own lifetime, which is a massive tax win. You are in this club if you are:

- The surviving spouse.

- A minor child of the owner (but only until you hit 21).

- Chronically ill or disabled.

- Not more than 10 years younger than the deceased (think siblings or partners).

2. Designated Beneficiaries

This is most adult children and grandchildren. You’re stuck with the 10-year rule. If you use an rmd beneficiary ira calculator, it needs to account for whether you’re forced into annual "mini-RMDs" during that decade or if you have total flexibility.

3. Non-Designated Beneficiaries

This is for estates, charities, or "non-see-through" trusts. If the owner died before their RMD age, you might have to empty the thing in just five years.

The Math Behind the "Single Life Table"

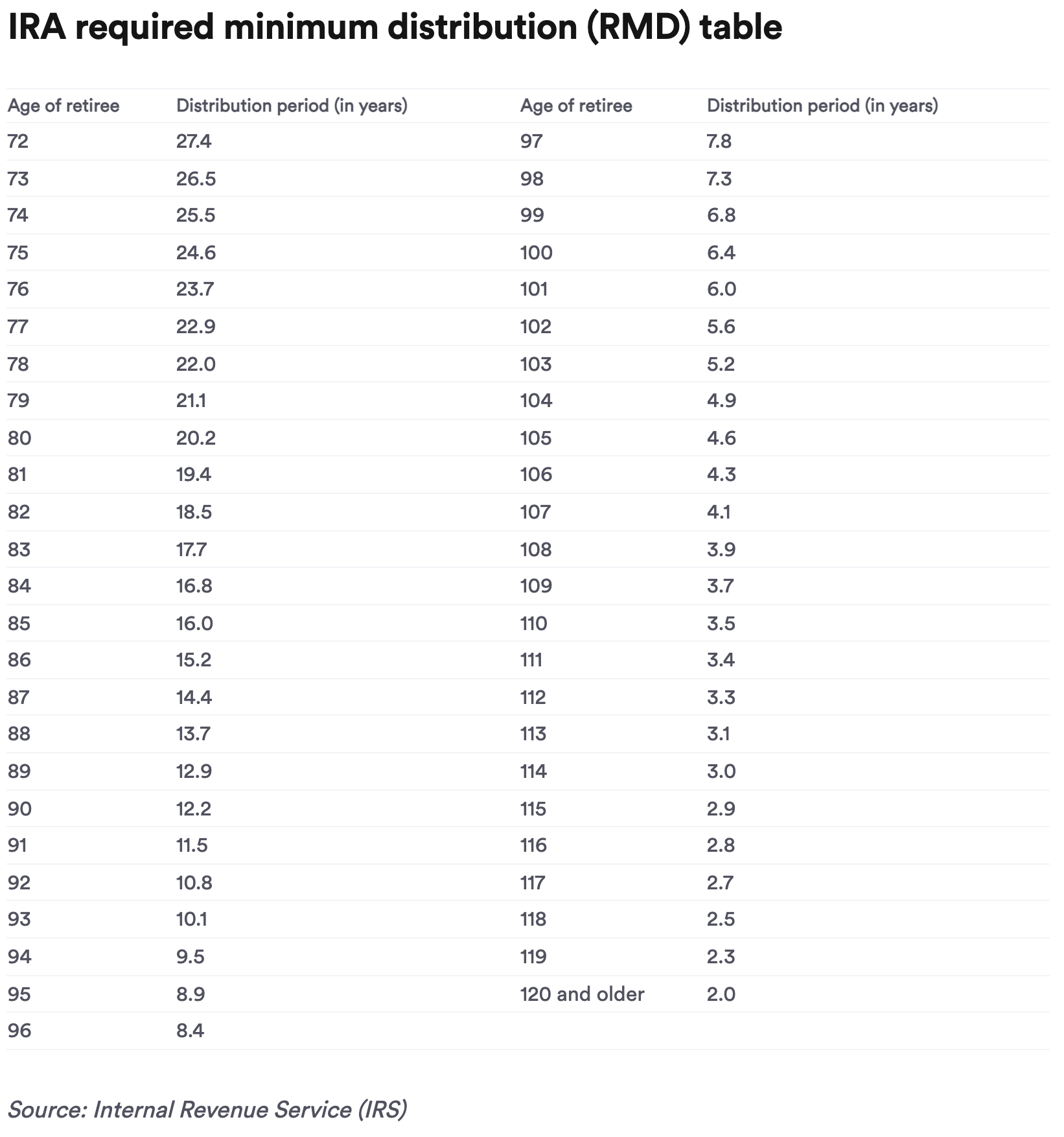

When you actually sit down to use an rmd beneficiary ira calculator, it’s pulling numbers from the IRS Single Life Expectancy Table (Table I).

Let’s say you’re a 45-year-old who inherited an IRA from a sibling. Because you’re within 10 years of their age, you’re an Eligible Designated Beneficiary. You don't use the 10-year rule; you use the "stretch."

For your first RMD, you look up the life expectancy factor for a 46-year-old (your age in the year after the death). Let's say that factor is 40.6. You take the account balance from December 31st of the previous year and divide it by 40.6.

🔗 Read more: Jefferies Downgrades Apple to Underperform: What Most People Get Wrong About the iPhone 17 Cycle

The Formula:

$$\text{RMD} = \frac{\text{Prior Year Year-End Balance}}{\text{IRS Life Expectancy Factor}}$$

Next year, you don't look at the table again. You just subtract 1.0 from your previous factor. So, $40.6 - 1.0 = 39.6$. This "fixed term" countdown is where people often trip up and over-calculate or under-calculate their liability.

The "Year of Death" Trap

One thing a lot of automated tools miss is the RMD for the year the owner actually died. If the deceased person was supposed to take an RMD in 2025 but died in July before they did it, you have to take that RMD by December 31st. It doesn't matter if you didn't even have the paperwork processed yet. That money belongs to the IRS, and they don't care that you're grieving.

If there are multiple beneficiaries, you guys can split that "year of death" RMD however you want, as long as the total amount is covered. You don't have to split it 50/50 if one sibling needs the cash more and is willing to take the tax hit.

Actionable Steps for Beneficiaries

Stop guessing.

First, get the exact date of birth of the person who passed and find out if they had already started taking RMDs. This is the "on/off" switch for whether you have annual requirements.

Second, check your own status. If you are a spouse, you almost always want to "assume" the IRA as your own, but if you’re under 59½ and need the money now, keeping it as an "inherited IRA" might be smarter to avoid the 10% early withdrawal penalty.

🔗 Read more: Calculadora de horas trabajadas: Por qué sigues perdiendo dinero (y tiempo) al fichar

Third, calculate your factor using IRS Publication 590-B. Do not rely on a generic website that hasn't been updated since 2022. The life expectancy tables actually changed recently to reflect that people are living longer, which means RMDs are slightly smaller than they used to be.

Finally, if you inherited the account between 2020 and 2024, the IRS was fairly lenient about missed RMDs because the rules were so confusing. That "grace period" has ended. Starting in 2025 and 2026, the 25% penalty for a missed RMD is back in full force. Use your rmd beneficiary ira calculator results to set up an automatic distribution with your brokerage so you never have to think about this again.

Confirm your specific beneficiary type with a tax professional before you make a final withdrawal, especially if the account is large enough to push you into a new tax bracket.