Saving for retirement is usually a "set it and forget it" situation, but the Roth IRA contribution guidelines don't play that way. One year you're fine. The next, you get a small raise or a holiday bonus, and suddenly the IRS is looking at you like you've committed a minor white-collar crime. It’s annoying. It’s confusing. Honestly, it’s one of the most misunderstood parts of the tax code because the rules change almost every single year.

If you’re staring at your brokerage account wondering if you can still squeeze a few grand into your Roth for the 2024 or 2025 tax year, you need to look at the numbers—not just the ones on your paycheck, but your Modified Adjusted Gross Income (MAGI). That’s the magic number. It's the gatekeeper.

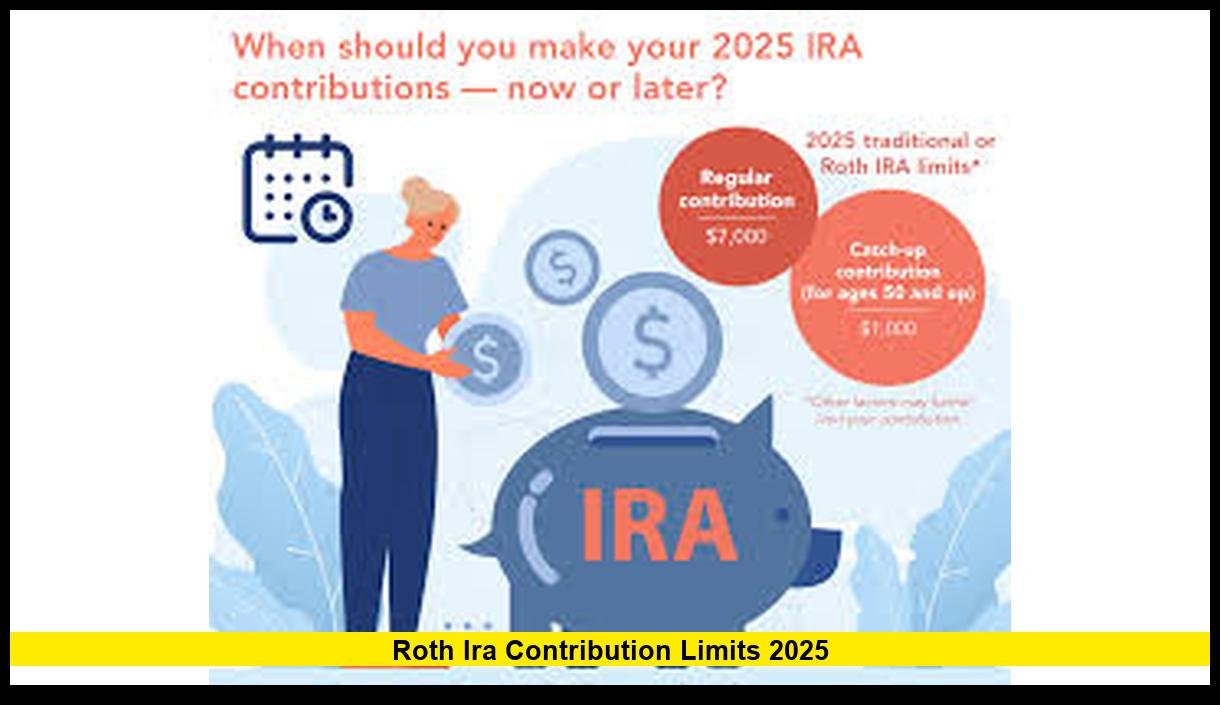

The Raw Numbers You Actually Need

Most people just want to know the "how much." For 2024, the limit is $7,000. If you’re 50 or older, you get a "catch-up" contribution, bringing your total to $8,000. For 2025, the IRS held the line on the base limit at $7,000, but they bumped the catch-up for those aged 60 to 63 due to the SECURE 2.0 Act. It's a bit of a moving target.

But here is the kicker: you can’t contribute more than you earned. If you only made $3,000 working a part-time gig all year, your contribution limit isn't $7,000. It’s $3,000. Simple as that. The IRS calls this "taxable compensation." If it's not from a job—like if it's just interest from a savings account or child support—it doesn't count toward your ability to fund a Roth.

The Income Trap

You can make too much money for a Roth. It sounds like a high-class problem, but it’s a real headache for people hovering near the phase-out range. For 2024, if you’re filing single, you start losing the ability to contribute once your MAGI hits $146,000. By $161,000, you’re completely locked out. Married filing jointly? Your range is $230,000 to $240,000.

Fast forward to 2025. The IRS adjusted these for inflation. Single filers see the phase-out move to $150,000–$165,000. For married couples, it’s $236,000–$246,000. If you fall in that middle "phase-out" zone, you can't just dump the full $7,000 in. You have to do some math that basically feels like a middle school algebra quiz to find your reduced limit.

What Happens When You Break the Rules?

People mess this up all the time. Maybe you set up an auto-deposit in January, got a big promotion in June, and suddenly your MAGI is way over the limit. You’ve now got "excess contributions."

The IRS hates this. They’ll hit you with a 6% excise tax on the excess amount for every single year it stays in the account. To fix it, you generally have to withdraw the extra money plus any earnings it made. And yeah, those earnings are usually taxed as ordinary income.

The Backdoor Loophole (Is it still legal?)

You might have heard about the "Backdoor Roth." It sounds shady. It’s not.

Basically, if you make $500,000 a year, you can't put money directly into a Roth. But there is no income limit on contributing to a Traditional IRA. So, you put the money in a Traditional IRA (without taking a tax deduction) and then immediately convert it to a Roth. Since there are no income limits on conversions, you’re in. This has been a point of contention in Congress for years, but as of right now, it’s still a perfectly valid strategy used by high earners across the country.

Spousal IRAs: The Stay-at-Home Advantage

One of the coolest nuances in the Roth IRA contribution guidelines is the Spousal IRA. Usually, you need earned income to contribute. But if one spouse works and the other doesn't, the working spouse can fund a Roth for the non-working spouse.

Think about a stay-at-home parent. They aren't "earning" a paycheck in the eyes of the IRS, but they can still have a Roth IRA fully funded by their partner's salary. This is huge for long-term wealth building in single-income households. The only catch is that you must file a joint tax return to pull this off.

🔗 Read more: 1 cad to chinese yuan: Why the Looneys Slump Might Not Be What You Think

Common Myths That Just Won't Die

- "I can't contribute because I have a 401k." False. You can do both. In fact, you should probably do both if you can afford it.

- "I'm too old to start a Roth." Wrong. Unlike the old rules for Traditional IRAs, there is no age limit for contributing to a Roth as long as you have earned income.

- "I can take my money out whenever I want." Sorta. You can always withdraw your contributions tax-free and penalty-free. It’s the earnings (the growth) that are locked behind the age 59½ and five-year rule.

The Five-Year Rule is the Sneaky Part

Even if you’re 65, you can't necessarily pull all your Roth money out tax-free tomorrow. You have to have held a Roth IRA for at least five years before you can touch the earnings without a potential tax hit. This "clock" starts on January 1st of the year you made your first contribution. If you opened your first Roth in December 2023, the IRS considers the clock to have started on January 1, 2023.

Nuance for the Self-Employed

If you're a freelancer or a small business owner, your "earned income" is your net profit minus half of your self-employment tax. This gets tricky. If you have a bad year and your business shows a loss, you can't contribute to a Roth IRA, even if you have $100,000 sitting in a savings account. You need profit. You need a paper trail of "work."

Actionable Steps to Stay Compliant

Don't wait until April 15th to figure this out. The deadline to contribute for a tax year is the tax filing deadline (usually April 15th of the following year), but waiting creates stress.

Check your MAGI mid-year. If you’re getting close to the $146,000 (single) or $230,000 (joint) marks for 2024, stop the auto-contributions. It's much easier to add money later than it is to claw it back out after a mistake.

💡 You might also like: Payroll Software for Small Business: What Most People Get Wrong

Automate with caution. Set up your contributions to hit a high-yield savings account first, then move them to the Roth once you’re 100% sure where your year-end income will land.

Document everything. If you do a Backdoor Roth conversion, make sure your CPA knows. You’ll need to file Form 8606 with your tax return to prove that the money you put in was already taxed, so you don't get taxed again on the conversion.

Review your beneficiaries. This isn't strictly a contribution guideline, but a Roth is a powerful inheritance tool. Unlike a Traditional IRA, your heirs won't pay income tax on the distributions they take from a Roth they inherit, though they generally have to empty the account within ten years.

Prioritize the match. If your employer offers a 401k match, do that first. It’s a 100% return on your money. Once you’ve captured the match, then look at the Roth IRA contribution guidelines to see if you can stack more tax-free growth on top of your retirement strategy.