You’ve probably seen the grainy photos. Men in flat caps standing in soup lines that stretch around city blocks, or dust-covered families piling their entire lives onto a rusted-out Ford Model T. It feels like ancient history, right? But if you’re asking about the Great Depression what year it started, you’re usually looking for a single date—and history is rarely that clean.

Most people point to 1929. Specifically, October 29, 1929. Black Tuesday.

That was the day the floor fell out of the New York Stock Exchange. Billions of dollars vanished into thin air. But here’s the thing: the Depression wasn't just a "1929 thing." It was a decade-long grind. It was a slow-motion car crash that didn't truly bottom out until 1933 and didn't fully let go of the world's throat until the drums of World War II started beating in 1939. Honestly, if you only look at 1929, you miss the actual tragedy of how the world's economy fundamentally broke.

When the Party Stopped: 1929 and the Great Crash

The 1920s were loud. People called them "Roaring" for a reason.

🔗 Read more: Finding Your Way Underground: The Kansas City SubTropolis Map and Why It's So Confusing

Everyone was buying radios and cars on credit. People who had never even seen a stock certificate were mortgaging their homes to bet on the market. It was a bubble. And bubbles always pop. When the crash hit in the Great Depression what year of inception, it wasn't just a bad day at the office for bankers. It was a systemic heart attack.

Between October 24 and October 29, the market lost about $30 billion. To put that in perspective, that was more than the United States had spent on World War I. But the crash didn't cause the Depression by itself. It was just the trigger. The real "Depression" part—the years of grinding poverty—happened because the banks started failing.

Imagine waking up, walking to your bank, and finding the doors locked. Your savings? Gone. Forever. No FDIC insurance existed back then to bail you out. By 1933, nearly half of all U.S. banks had failed. That is where the "Great" in Great Depression really comes from. It was the total evaporation of trust in the financial system.

The Long Dark: 1930 to 1933

If 1929 was the shock, 1932 was the misery.

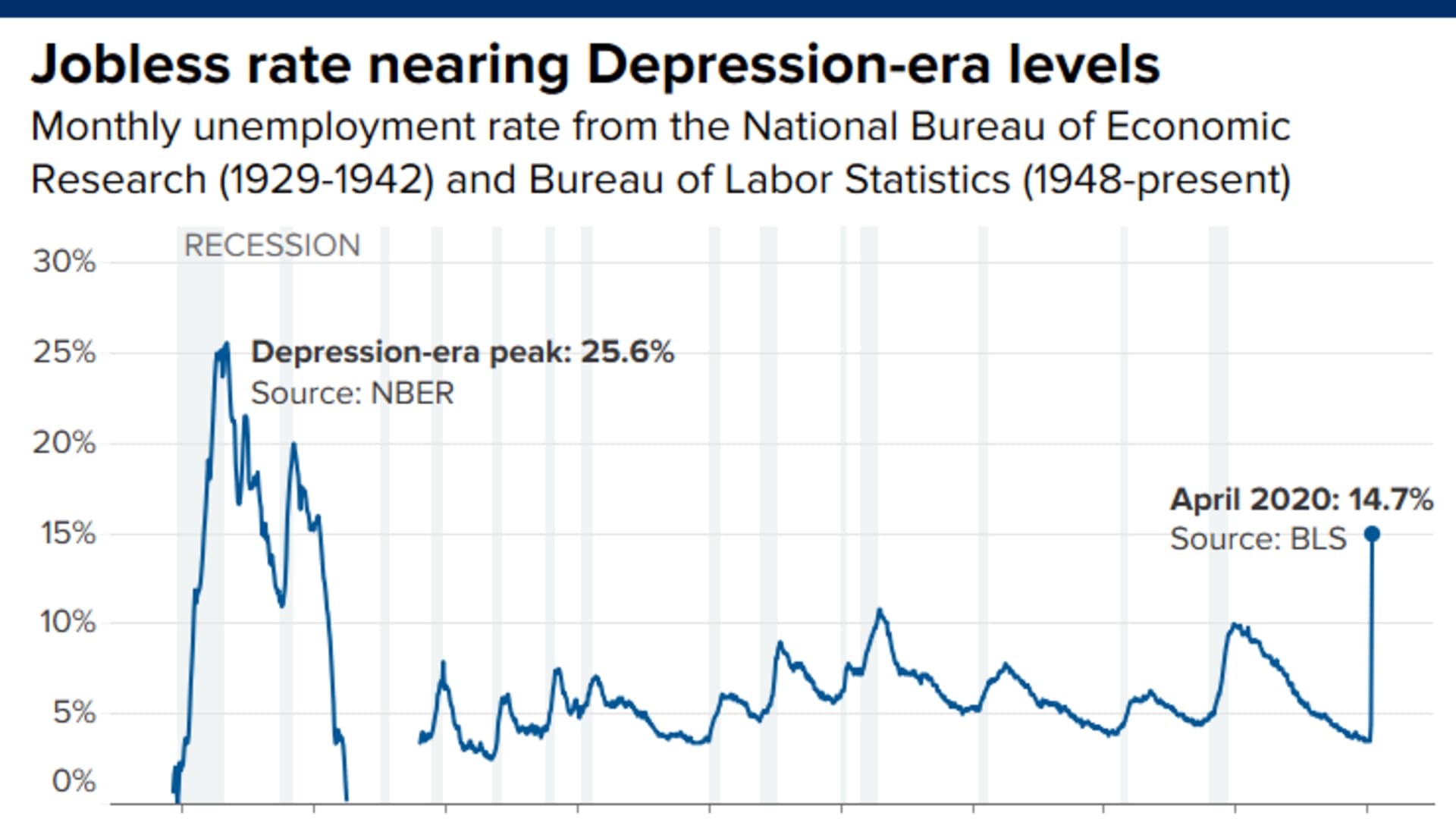

By the time 1932 rolled around, unemployment in the U.S. had soared to a staggering 25%. One in four people had no income. In some industrial cities like Toledo, Ohio, that number was closer to 80%. This wasn't just a "bad economy." It was a total societal collapse.

- The Dust Bowl: While the banks were failing, the weather turned. A massive drought hit the Great Plains. The topsoil literally blew away in "Black Blizzards," turning the breadbasket of America into a wasteland.

- Hoovervilles: People who lost their homes built shantytowns out of cardboard and scrap metal. They named them after President Herbert Hoover because they felt he wasn't doing enough to help.

- Deflation: This is a term economists love, but for regular people, it meant prices dropped so low that farmers couldn't afford to harvest their crops. They'd let oranges rot on the ground while people in the cities starved because shipping them cost more than the fruit was worth.

It’s kinda wild to think about. We usually worry about things getting too expensive (inflation). During the Great Depression, the problem was that everything was too cheap, and nobody had a single nickel to buy it anyway.

The New Deal and the Turning Point of 1933

When Franklin D. Roosevelt took office in 1933, things shifted. This is the "what year" where the government finally stepped in with a sledgehammer.

He closed all the banks for a "holiday" to stop the bleeding. Then came the alphabet soup of agencies: the CCC, the WPA, the TVA. They hired millions of people to build trails in national parks, pave roads, and string electrical wires to rural farms that had never seen a lightbulb.

Did the New Deal end the Depression? Not really. It was more like a bandage. It kept people from starving and stopped the rioting, but the economy didn't actually return to its 1929 levels of health for a long time. There was even a "recession within the depression" in 1937 that wiped out a lot of the gains Roosevelt had made. It was a frustrating, two-steps-forward, one-step-back kind of decade.

💡 You might also like: Why 700 East Patapsco Avenue Baltimore MD Still Matters for Local Business

Why 1939 Was the Real End Date

There is a huge debate among historians about when the Great Depression actually ended.

Some say it ended with the New Deal's peak. Others, like Milton Friedman, focused on the monetary policy shifts of the mid-30s. But most experts agree that the true exit ramp was 1939.

Why? Because that’s when Europe went to war.

Suddenly, the world needed tanks, planes, guns, and canned food. American factories that had been silent for ten years suddenly had more orders than they could handle. Unemployment plummeted—not because of a clever economic policy, but because the world was gearing up for the most destructive conflict in human history. By the time the U.S. entered the war in 1941, the Great Depression was officially a memory, replaced by the wartime boom.

Lessons We Still Haven't Quite Learned

Looking back at the Great Depression what year by year analysis shows us, it’s clear that our modern world is built on the scars of that era.

We have Social Security because of the Depression. We have the SEC to watch the stock market because of the Depression. We have bank insurance (FDIC) because people got tired of losing their life savings overnight.

But it also reminds us how fragile things are. In 2008, we almost went back there. In 2020, during the pandemic, we saw echoes of those long lines. The difference is that now we have "stabilizers" in place to keep the floor from dropping out completely.

The Great Depression wasn't just a year on a calendar. It was a fundamental shift in how humans relate to money, government, and each other. It taught us that "too big to fail" is a myth and that when the bottom falls out, it takes a long, long time to climb back up.

How to Protect Yourself from History Repeating

You can’t control the global economy, but you can learn from the people who survived the 1930s. They were the original "preppers," but in a practical way.

- Diversify your "trust." Don't keep all your assets in one basket. The people who survived the best in the 30s had some cash, some land, and actual skills that people were willing to barter for.

- Understand the "Debt Trap." The Depression was fueled by people buying things they couldn't afford on credit. In a downturn, debt is an anchor that will pull you under.

- Emergency Funds are Non-Negotiable. The Depression taught a generation to save everything. While you don't need to hoard tin foil, having six months of liquid cash is the only real barrier between you and a "Hooverville" scenario if the gears of the world grind to a halt again.

- Watch the indicators. Keep an eye on the "yield curve" and consumer debt levels. These are the modern versions of the red flags people ignored in 1928.

History doesn't always repeat, but it definitely rhymes. Knowing the Great Depression what year it happened and how it unfolded is the first step in making sure you aren't caught off guard when the next cycle turns.

Study the bank failures of 1931. Look at the unemployment spikes of 1932. The more you see the patterns, the less scary the future becomes. The goal isn't to live in fear; it's to live with the kind of pragmatism that kept our great-grandparents alive when the world seemed to be ending.